– Tim Plaehn, Editor, The Dividend Hunter

![]()

Hi there! Thank you for downloading this brand-new research report on one of my favorite high-yield income stocks! It’s my goal with this report to inspire you to rethink how you invest for retirement by investing for income instead of growth.

Hi there! Thank you for downloading this brand-new research report on one of my favorite high-yield income stocks! It’s my goal with this report to inspire you to rethink how you invest for retirement by investing for income instead of growth.

It may sound counter-intuitive at first, but I’ll show you why investing in high-yield dividend stocks like the one I feature in this report can be the difference between retiring comfy, knowing you have plenty of cash to spend, save, and live, and running out of money, having to rely on the charity of family and friends to live.

First, let me introduce myself. My name is Tim Plaehn, and I am a former F-16 Air Force pilot, mathematician, and certified financial planner. That’s me on the right in my Air Force days.

Fast forward to today and I now lead a community of thousands of like-minded income investors. Together we are building investments that pay us cash every single month that we then use to live off of. And let me tell you, the results are astounding.

I get messages like these all the time from my readers, and they get these results because they have started to invest in the type of stocks (high-yield dividend stocks) like the one I feature below.

Why Dividend Stocks?

It is very difficult, if not impossible, to predict the direction of share prices. Most market direction forecasts are only useful for the short to intermediate term. That’s why I have developed stock buying, selling, and tracking strategies that help me towards the goal of a large and growing dividend income stream.

I never worry about the day to day movements of the stock market because I have developed tools and systems (which I am happy to share with you) that allow me to know exactly how much I earn every month from my income stocks and how much I will earn in the next 12 months, 24 months, and even 36 months. I call this system the 36 Month Accelerated Income Plan, and I’ll explain more on that later (it’s a foolproof way to rapidly compound your dividend income)

I like dividends because they give you returns in the form of cash payments into your brokerage account. To think of it one way, it’s like having a friendly neighbor that comes to your house every couple of months and puts a couple crisp hundred dollar bills right into your pocket. My goal is to fill my neighborhood with fine ladies and gentleman like that, who bring me payments every month.

Dividends are always paid in cash and you can decide to do whatever you want with that money. With other types of stocks, it might feel great to have the price go up 20% in a year, but you won’t see any of that money unless you sell the shares. With dividend stocks, you earn cash returns like clockwork. This gives a consistency to your stock returns that cannot be matched by investments that do not pay dividends.

However, there can be a lot of misleading information out there on the internet. I for one am not a huge fan of the huge “investortainment” media sites and cable news shows as they tend to spread opinions as if they were facts. I prefer to stick to facts. That’s why I’ve released this report for free to the public (I usually charge $49 for this specific information). I want you to have information and analysis that actually packs a punch so you can make confident investing decisions.

Two Strategies for Earning High-Yield Dividend Income

Reading this report won’t make you an expert income investor overnight (A subscription to my Dividend Hunter newsletter might!), but it will lay a foundation that you will be able to build off.

With that in mind, here are a few strategies I use that may be out of step with what you have learned from the entertainment-focused financial news outlets and my the dividend stock that pays an 18% yield like clockwork.

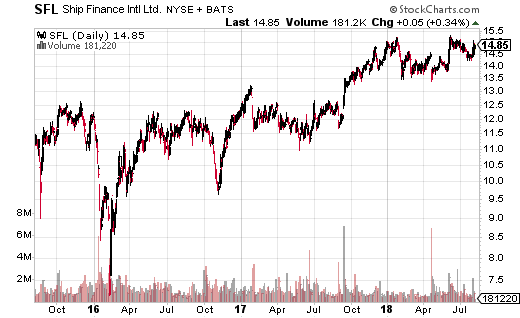

Track your dividend earnings on a monthly or quarterly basis. The online brokerage account systems do a terrible job of tracking stock returns including dividends. For example, I have accumulated shares of Ship Finance International Limited (NYSE: SFL) in one of my accounts. The brokerage account summary page shows the shares are up about 2.5%.

Yet with dividends included, the SFL shares have earned a 17% total return since I started buying into the stock. To know that information, I have kept a spreadsheet that lists each dividend stock I own, and the individual listings are updated with each share purchase and dividend earned.

Be willing to buy more shares of your income stock investments when the share price drops. This is a hard one for investors to do, but it will make a huge difference over years of investing. Again, using SFL as an example, my first purchase was at $16.07 per share. The current share price is below that point, yet I am in a positive share value position in the stock.

That is because over the last two years I have made nine additional purchases at share prices ranging from $12.96 to $15.20. When there is a significant short-term drop in the stock price, I look to buy more. I also think about buying after a stock goes ex-dividend. Typically, the share price will drop by several percentage points as the “dividend capture” crowd rushes to sell after locking in the receipt of the dividend payment.

When you have cash available to invest, there is probably a stock or two in your portfolio, or on your stock wish list, that has dropped from recent highs. These are the shares you want to think about buying and then consider which one fits into your overall portfolio strategy.

I have one or two stocks that I think of as “junk drawer” stocks. These are the very high-yield stocks that I can buy shares in when I find some extra cash in my brokerage account. Think of these stocks as a place where you can put some cash to work after you sell shares of one of your income stocks that have run up to a high price.

Yes, I like to take profits (usually a partial sale) if one of my income stocks is showing big gains compared to what I paid for the shares. Your junk drawer stock is also a place to put the proceeds back to work after one of your stocks unexpectedly cuts its dividend and you have to close out the position at a loss. It can happen to any of us.

The Dividend Stock that Pays Monthly Dividends and a Double-Digit Yield

Your junk drawer stock needs to be one that pays a high yield and one where you have confidence in the underlying company value. In practice, this stock can turn extra cash into significant extra dividend income. Here is an 18% yielder from my newsletter, The Dividend Hunter, recommendations list that I use as a stock to put extra cash to work to earn big dividends over time.

Ultra-high-yield ETF, InfraCap MLP ETF (NYSE:AMZA) has been a great income investment for my Dividend Hunter newsletter subscribers.

The InfraCap MLP ETF (NYSE: AMZA) was the first actively managed ETF covering the MLP sector.

The fund owns the same MLPs as the ones tracked by the Alerian MLP Infrastructure Index (AMZI), with the following possible enhancements to the index: The fund manager can weight individual MLPs holdings different than the index.

The AMZI is strictly market cap weighted, tracking the 26 largest midstream MLPs. AMZA will weight these same MLPs based on the return potential from the management team’s proprietary algorithm. The fund can own the publicly traded general partner companies of the index component MLPs. The GP companies have potential to produce extra capital gains for the fund and a faster growing distribution cash flow stream.

The fund can sell call options (covered call strategy) to generate extra cash income from the portfolio. Fund managers can use a moderate amount of leverage (currently 20% of the portfolio).

I added AMZA to the recommendations list in April 2015. At that time the energy sector bear market still had a long way to fall. For 2016 and 2017 the MLP sector attempted a rally which fell short, leading to a second bear market in 2017. The fund sustained its very large dividend payments through the end of 2017. During that period the yield was often above 20%.

I encouraged Dividend Hunter subscribers to reinvest the dividends, building the number of shares owned while the share price was down. In January 2018 the fund managers adjusted their dividend policy.

The annual rate was reduced to ensure sustainability of the payouts and the schedule was changed from quarterly to monthly. AMZA remains a super yield investment, paying investors a 17% annual cash yield.

Why I continue to like AMZA: This is the highest yielding investment in The Dividend Hunter recommendations list. The 17% current yield provides a lot of flexibility. A share owner can take a 10% income and have almost that much left over to reinvest. It has taken longer for the energy infrastructure sector and MLPs to start a sustained recovery after the 2015 energy sector crash.

Now in 2018 industry fundamentals are very strong. 62% of the AMZI constituents increased their distributions over the last year. All the factors point to a sustained recovery for MLPs and the AMZA share price.

This should be a very good year for MLP investments. Both distribution rates and share prices should rise over the course of the year. As MLPs on average increase the distributions paid to investors, it will become easier for the AMZA management to make sure the dividend is covered.

I do strongly recommend that investors who own AMZA reinvest at least a portion of those large dividend payments back into more shares. Taking just one-quarter of the dividend payment to buy additional AMZA shares would leave an investor with 13.5% in fee cash flow and also grow future dividend payments by about one percent each quarter. That’s a win-win scenario that is very hard to beat!

In 6 Months or Less You Can Build a Portfolio Paying You $36,000 a Year

Recently a rather new subscriber wrote in to tell me how well my system works for him. His name is Brad and he’s an educator in the Mid-West. He wrote:

“I just wanted to thank you for the excellent advisory service that you provide. In 3 months I have collected $8,284 in dividends from my investments.

In less than 6 months, I have put together a portfolio that will generate $36,000 per year for the rest of my life.

Your system really does work and once I had demonstrated that to myself, I purchased your service for life!

It is nice to actually come across something that really does work and perhaps more importantly, doesn’t make outrageous promises that can’t be kept! Thanks again!

Click here to discover how you can get your retirement income plan on track just like Brad did.