Sound the alarm on these three stocks because one more bad piece of news could send their shares tumbling. Even in this bull market not every stock will continue to go up. Sell these three stocks now before they fall.

No matter what’s occurring today, whether it’s turmoil in local politics, geopolitics or even terrorist attacks, the bull market around the world continues on.

The current U.S. bull market is now the second longest in history, having run from March 2009. The only longer one was the great bull market from the 1987 market crash to 2000.

But that doesn’t mean you as an investor can just buy anything and it will go up.

There are still both sectors and specific stocks to avoid.

Here are just three that I would give a wide berth.

Oil Service Sector Still Hurting

Oil Service Sector Still Hurting

One sector, in my view, to avoid is the oil services group.

The renewed boom in the U.S. shale industry is masking to U.S. investors what is going on in the rest of the world when it comes to oil.

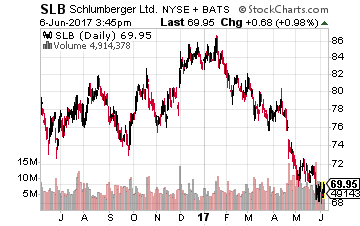

Almost all of the growth reported in the latest quarter by Schlumberger (NYSE: SLB) and Halliburton (NYSE: HAL) and others came from the United States shale industry.

The rest of the global oil industry – especially the offshore segment – is moribund and still mired in recession.

That can be seen in the number of drilling rigs. Here in the U.S., the rig count has more than doubled from its low point about a year ago. Meanwhile, in the rest of the world, the number of rigs has continued on its downward path.

Barclays analysts forecast that U.S. exploration and production companies will raise spending by 25% this year. But spending is forecasted to decline 10% in the rest of the world.

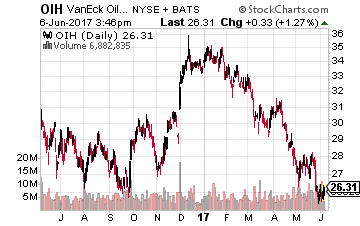

The continuing terrible conditions for oil service companies can be seen by the poor performance of the oil services ETFs, as of this writing, and seen below:

The continuing terrible conditions for oil service companies can be seen by the poor performance of the oil services ETFs, as of this writing, and seen below:

- Van Eck Vectors Oil Services ETF (NYSE: OIH) – down 22.43% year-to-date.

- SPDR S&P Oil & Gas Equipment & Services ETF (NYSE: XES) – down 27.89% YTD.

- iShares U.S. Oil Equipment & Services ETF (NYSE: IEZ) – down 22.49% YTD.

- Powershares Dynamic Oil & Gas Services Portfolio ETF (NYSE: PXJ) – down 24.04% year-to-date.

Not pretty, is it?

Auto Loans Market in Trouble

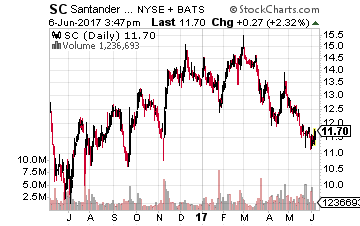

Another sector I’m avoiding is the niche market of auto loans.

There are similarities between it and the subprime housing crisis.

[FREE REPORT] $500 to $2,000 per week trading options

As with mortgages, the growth in the car loan business have been explosive.

According to the New York Federal Reserve, total auto loans outstanding at the end of the first quarter of 2017 was $1.17 trillion. That is up 70% from the trough in 2010. This has pushed total household debt to $12.7 trillion, surpassing the peak set in 2008.

According to the New York Federal Reserve, total auto loans outstanding at the end of the first quarter of 2017 was $1.17 trillion. That is up 70% from the trough in 2010. This has pushed total household debt to $12.7 trillion, surpassing the peak set in 2008.

And as with some housing loans, some people who took out auto loans are finding that they owe more than the vehicle is worth.

The share of auto-related debt more than 90 days overdue rose to 2.3% in the first quarter, said the New York Fed. That is the highest level in six years.

Not surprising considering the number of deep subprime (FICO score below 550) auto loans rose from just 5.1% of total subprime loans in 2010 to 32.5% in 2016.

The specialist companies with the higher car loan concentrations include: Capital One Financial (NYSE: COF), Ally Financial (NYSE: ALLY) and Huntington Bancshares (Nasdaq: HBAN).

The poster child for subprime car loans and definitely one to avoid is Santander Consumer USA Holdings (NYSE: SC).The stock is down 15.26% year-to-date and I’m sure more pain is to come.

Snap Still Iffy

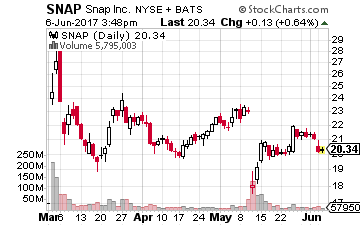

Finally, a list of stocks to avoid would not be complete without mentioning Snap (NYSE: SNAP).

Finally, a list of stocks to avoid would not be complete without mentioning Snap (NYSE: SNAP).

The company already had to worry about Facebook (Nasdaq: FB) and its Instagram product stealing away market share form Snap.

Now, it looks inevitable that a similar feature to Stories will be coming to Apple’s (Nasdaq: AAPL) iMessage. We may see that as soon as this week’s Apple Worldwide Developers Conference.

Snap too still thinks it’s a ‘camera’ company, instead of a social media company.

It began selling its ‘Spectacles’ in five European countries last week. Thanks to its relatively high price, the European media noticed how the kiosks selling the sunglasses had few millennials lining up to buy.

Not good for a company whose core base is millennials.

And Let’s not forget that Snap in the first quarter reported lower revenues, bigger losses and slowing user growth.

Many were disappointed too that, during the earnings conference call, the company’s management – led by Evan Spiegel – seemed to have no long-term vision.

Until there is more of a clear path of where Snap wants to go, I would sit on the sidelines.

While I highlighted the bear cases I believe in for the stocks above, I think it only fair to share with you one other stock that I am bullish on. I’m recommending a new advanced robotics stock that can lead you to massive long-term profits as manufacturing and business become more automated. This stock has figured out a way to help robots “see” what is around them.

This is a critical feature that has always been lacking from even the most advanced robots and gives this one stock huge advantages as it penetrates new markets and manufacturing becomes automated by these machines.

This growth trend is still in its infancy so investors who hop on today could see decades of profits from just this one stock. You can find out the ticker and my bull case all in the June issue of my Growth Stock Advisor newsletter which you can access today for ZERO dollars down.