Coronavirus fear became palpable.

Panicked investors sent major indices down thousands of points, reducing former high-flying stocks to penny stock status.

All thanks to an invisible virus that’s making its way around the world.

But what we have to remember is that the virus will pass – and that markets will bounce back.

Granted, we may see further chaos in the next few months.

But to make money in this market, it may pay to buy the excessive pessimism, as Sir John Templeton used to advise. Or as Baron Rothschild would say, “The time to buy is when there’s blood in the streets, even if the blood is your own.”

Related: It’s Hard to Be a Contrarian Investor, Here Are Some Tips to Make it A Little Easier

Here are some of the top former high-flying stocks now trading for less than S1 that exhibit signs of excessive pessimism.

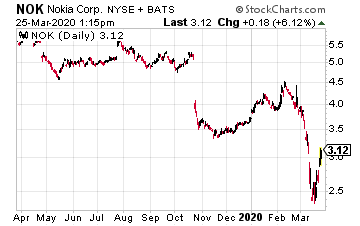

Nokia (NOK)

Since peaking at $4.53 in Feb. 2020, shares of Nokia plummeted to a low of $2.38 a share. However, the stock is starting to signs of life, rebounding well off its lows. Better, U.S. Attorney General William Barr suggested the U.S. take a controlling stake in the company for access to secure 5G equipment. All in an effort to stop the rise of China and HH

Huawei in the space.

“There are only two companies that can compete with Huawei right now as 5G infrastructure suppliers: Nokia and Ericsson. They have quality, reliable products that can guarantee performance. They have proven successful in managing customers’ migration from 4G to 5G. The main concern about these suppliers is that they have neither Huawei’s scale nor the backing of a powerful country with a large market, like China,” as quoted by Light Reading.

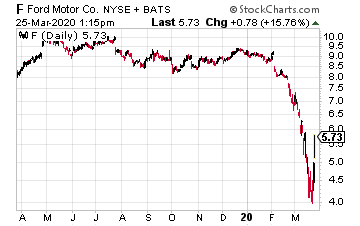

Ford (F)

Ford plunged from a Feb. 2020 high of $9.24 to a low of $4.00. However, it’s. also showing signs of life, as it begins to rebound. While the company is under pressure, the board’s recent decision to suspend its dividend on coronavirus concerns shows its commitment to stay afloat. It has also closed its North American facilities.

“Like we did in the Great Recession, Ford is managing through the coronavirus crisis in a way that safeguards our business, our workforce, our customers and our dealers during this vital period,” Ford CEO Jim Hackett said, as quoted by Barron’s Plus, as highlighted by Morgan Stanley, Executive Chairman Bill Ford, “will do whatever it takes for Ford to survive.”

More Reading: Ford Using Stock Car Parts to Upgrade Ventilators

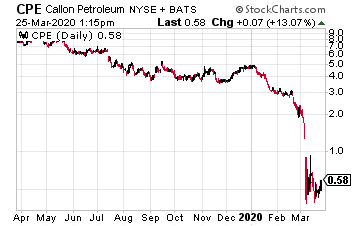

Callon Petroleum (CPE)

Callon Petroleum plummeted from a high of $5.00 to just 50 cents. All thanks to coronavirus fears, falling energy demand, and an OPEC price war. On the pullback, CPE trades with a low PEG multiple of 0.20, a price/sales ratio of 0.63, and a price/book ratio of just 0.22. Once we begin to see a recovery in energy prices, and the coronavirus story becomes a distant memory, Callon Petroleum could recover to $1.25, near-term.

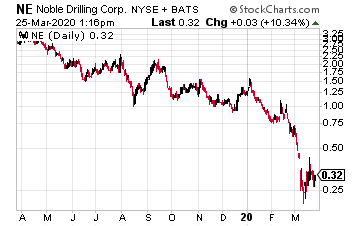

Noble Drilling (NE)

Noble Drilling is another energy name that dropped on coronavirus and OPEC concerns. In recent weeks, the NE stock plummeted from $1.00 to just 28 cents.

However, the company has seen good news in recent weeks. It signed a deal with Exxon Mobil to drill for oil and gas off the coast of South America. Evercore analyst James West called the announcement “a strong vote of confidence” and estimated that Noble’s day rates will rise under the deal, as highlighted by Barron’s.

Once the chaos of the coronavirus and OPEC are behind us, we could see a recovery here.

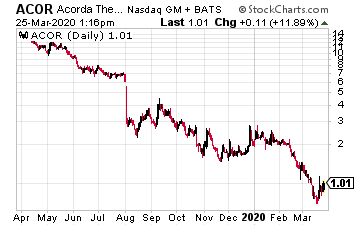

Acorda Therapeutics (ACOR)

Since peaking at $2.80 in early 2020, Acorda hasn’t been able to catch a break either. In fact, on virus concerns, it just plummeted to penny stock status at less than $1.00.

However, it’s worth watching.

“In 2020, our focus will be on increasing awareness of and driving demand for INBRIJA among people with Parkinson’s,” said Ron Cohen, M.D., Acorda’s President and Chief Executive Officer.

“Another top priority for 2020 is continuing to strengthen our capital structure and balance sheet. In December 2019 we successfully restructured the great majority of our convertible debt, and we have also reduced expenses significantly. We are working to identify additional opportunities to manage costs. These actions have helped position Acorda to deliver long-term value for our shareholders,” he added.

As of this writing, Ian Cooper does not have a position in shares of NOK, F, NE, CPE, or ACOR.