The European Economy is a hot mess.

There is no growth. Inflation is still a problem; it has been over a year since we have seen anything that resembles good news from Europe about the economy.

After decades of the economic dominance of the region, Germany has proven that following moronic energy and monetary policies can cripple even the most vibrant economy. They relied on Russia for natural gas.

They gave in to the Greens and reduced their use of reliable, safe nuclear energy.

I could go on running down the list of mistakes made by Germany, but that would be boring.

Suffice it to say that losing the economic powerhouse has not helped the region get back on track.

The wars in Ukraine and the Middle East are also having direct negative consequences for the Eurozone.

The European Central Bank is hoping to be able to lower interest rates this year and hopefully spur some growth in the area.

Energy prices will be the biggest obstacle to that objective.

As a long-term, patient, aggressive investor, there is only one possible course of action that I can consider.

It is time to go shopping for companies that trade at a steep discount on the value of their assets and are in solid financial condition.

MPC Container Ships ASA (MPZZF) fits the bill nicely.

The Norway-based container ship company is currently trading at just 80% of tangible book value.

Using my credit scoring system, the company is in no danger of facing critical financial distress anytime soon.

MPC Container Ships has 62 small to mid-sized container ships, and its fleet is 98.7% leased right now.

The company is well-capitalized and has far less leverage than many of its competitors.

MPC Container Ships recently upgraded its revenue and cash flow estimates for 2023.

The current revenue backlog is $1 billion, with an average of 1.7 years left on its existing contracts.

Management intends to pay out 75% of net profits after capital expenditures and other expenses are paid.

The company may also pay extra dividends if it sells ships at a profit or has other extraordinary gains.

MPC Container Ships is a dividend machine.

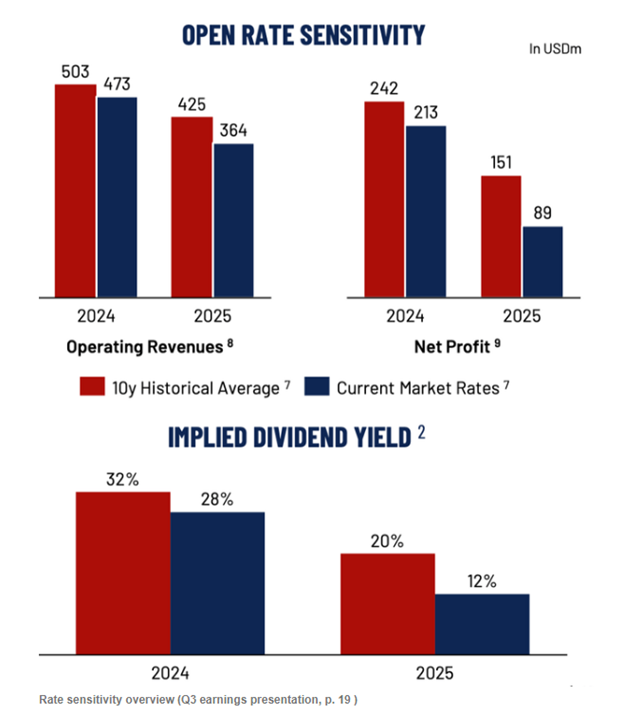

Look at the estimated payout for 204 and 2025 from its most recent investor presentation:

MPC Container Ships has low leverage and can easily pay its bills.

The expected dividend payouts are enormous.

The current valuation is a discount to the fleet net of debt scrap value.

Patient-aggressive investors should see massive profits from huge dividends and appreciation over the next several years.

I have been told that it is a cardinal sin in the newsletter game to talk about foreign stocks, especially those traded over the counter with an extra letter in the symbol. The more I hear that, the more interested I am in talking about and investing in them.

Investing at the bottom of a recession in a developed economy has historically led to enormous gains.

That should be the case with judicious investments in deeply undervalued European companies and assets during the current pessimistic climate.