This can be a frustrating time of year for investors in the types of stocks I follow and recommend. With little to no news about smaller companies, share price movement can be very random, and a random down will make investors ask: “why?”

The real news is scarce for stocks that aren’t in the news every day, like the small to medium-sized income-focused stocks I recommend. I often say the quarterly earnings reports are the only real news we receive. As a result, the reality is that investors can go three to four months without any news about a stock.

Yet when investors see one of their stocks going down, they want to know the reasons, and they fear losing money. A falling stock price leads investors to believe there is something wrong with the company. As a result, they sell their shares, which pushes the share price down even further.

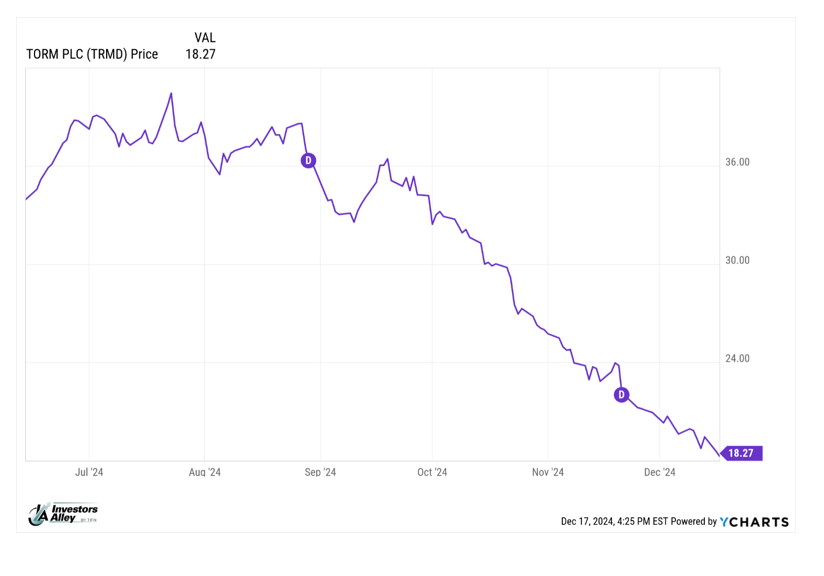

When a stock enters a downtrend, a positive catalyst is often needed to stop the decline and raise the share price. Until there is some positive news, it can be challenging for a declining stock price to reverse itself.

All of this comes with the assumption or belief that there isn’t some piece of bad news out in the unseeable future. The idea is to not assume there will be bad news based strictly on the evidence of a falling share price.

TORM is a shipping company that focuses on vessels that transport refined energy products. The company pays variable quarterly dividends. The most recent two were $1.80 and $1.20 per share, respectively. Over the last few years, the payout has averaged about $1.50 per share per quarter.

I point out several facts to investors with questions about TRMD.

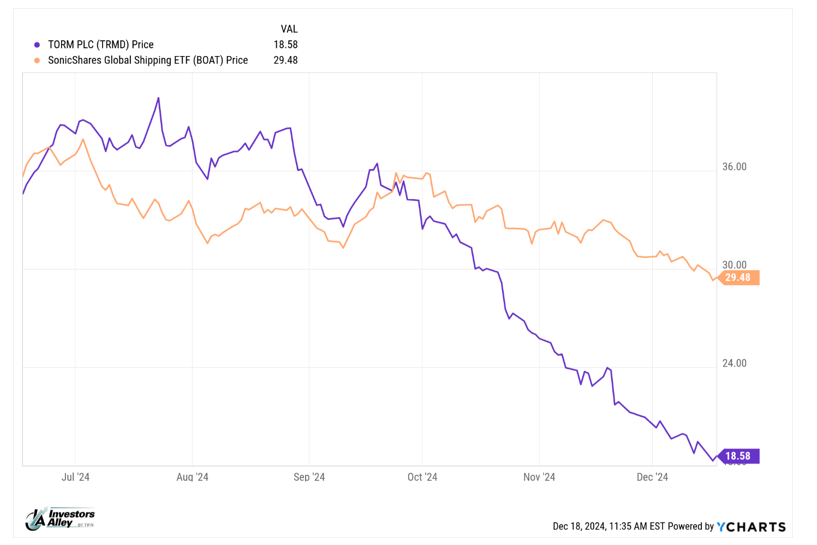

TORM, plc (TRMD) is a stock I have recommended to subscribers that is in just such a steep price decline. The TRMD stock chart is truly amazing in its steadiness and steepness of decline. Here is the six-month price chart. I have included the SonicShares Global Shipping ETF (BOAT) for comparison.

As you can see, the shipping sector is experiencing a seasonal decline. Combine that with the “no news” period we are going through with TORM, and there just are no buyers for the shares. Current owners become increasingly fearful and continue to sell into a stock with no buying support.

TORM will announce its next dividend in March, which is a few months out. If the dividend is as I expect, similar to the payouts of the last couple of years, TRMD will again be a $30-plus stock.

This Bitcoin ETF Sports a 91% Distribution Rate and Pays Out on Friday the 28th

Imagine waking up at the end of each month to find an extra $492.25 deposited directly into your account. That's $5,907 per year in pure passive income. Enough to cover half the average American's annual grocery bill or a dream vacation. That's how much you could be looking at by the end of the week if you act by Wednesday.

Imagine waking up at the end of each month to find an extra $492.25 deposited directly into your account. That's $5,907 per year in pure passive income. Enough to cover half the average American's annual grocery bill or a dream vacation. That's how much you could be looking at by the end of the week if you act by Wednesday.

Click here for how to get the name and ticker of this bitcoin winner.