A recent Wall Street Journal article titled “Your Fancy, New ETF Might Be a Little Too Fancy” highlights the value investors receive from my newish ETF Income Edge newsletter service.

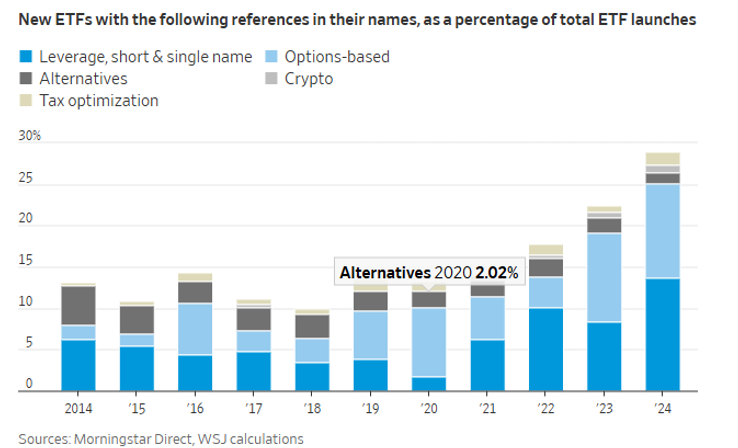

The article discusses how ETF companies are packaging more complex investment strategies into the ETF form. About 30% of new ETFs in 2024 indicated they would use more complex investment strategies.

For the ETF Income Edge newsletter service, I focus on ETFs that use options strategies, such as covered calls, to pay high distribution yields. The Journal has a point. My database of this type of ETFs now includes 92 funds, of which 38 launched in the last 12 months. That is a lot of ETFs, each with a designated underlying asset and its own options strategy.

As with everything in the investing world, returns have ranged from not-so-good to really good. Plus, with new funds coming out nearly every week, we look through the documentation to determine how a new fund will attempt to make money for investors. It’s a lot of fun, and some new funds are exciting. Here are a couple of strategies or features that have taken hold in recent months.

Weekly Dividends: Why wait a whole quarter or even a month to receive a dividend? More and more of these high yield ETFs are moving to weekly dividend payments. It’s fun to see dividends land in your brokerage account every Friday.

Zero Days to Expiration (0DTE) options strategies. ETFs employing 0DTE go short options or spreads in the morning for contracts that expire at the end of the day. This strategy needs an underlying asset, such as SPY or QQQ, that trades daily options. Some 0DTE ETFs are performing well, while others have struggled with overly aggressive options strategies.

With the ETF Income Edge service, we provide a portfolio of suggested ETFs that have and should continue to provide superior returns. Many of these funds have eye-popping yields of 20%, 30%, or higher.

To give you an example, the Simplify Bitcoin Strategy PLUS Income ETF (MAXI) has a current distribution rate of 78% (it has ranged from 30% to 78%, with variable monthly dividends) and posted a total return of 92% for 2024.

Trump's "Day 1 Dollar Surge" Has Already Started (Are You Ready?)

While most investors chase overvalued tech stocks, a massive currency shift is building. Research shows certain overlooked stocks could soar when the dollar hits all-time highs. Join this urgent briefing on January 15th to get positioned before January 20th changes everything.