Options Profit Engine

2/21/18

This Week’s Trade Recommendation:

(FROM Thursday, February 15th) SELL TO OPEN the March 16th Russell 2000 Index (RUT) 1405-1410-1610-1615 iron condor for a $0.75 CREDIT.

(FROM Thursday, February 15th) SELL TO OPEN the March 16th Chipotle Mexican Grill (NYSE: CMG) 260-265 put spread for a $0.77 CREDIT.

Here’s the link to the live videos of me making the trade: http://content.jwplatform.com/videos/OgUG7n29-bK67iJnL.mp4

Trade Analysis:

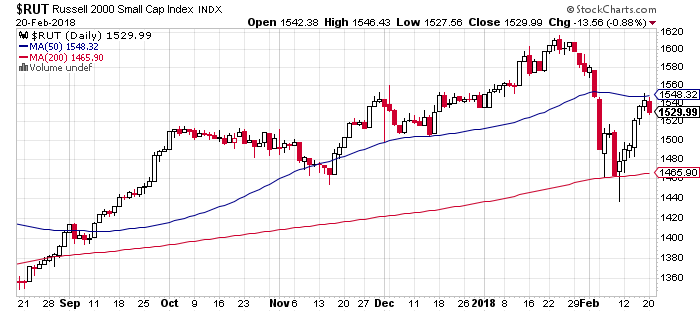

We continue to take advantage of elevated volatility by placing credit trades. The RUT trade is a straightforward way to capitalize on overall market volatility. We have a roughly 200 point range to work with and had the opportunity to use 5-wide gaps, something not normally possible with index options.

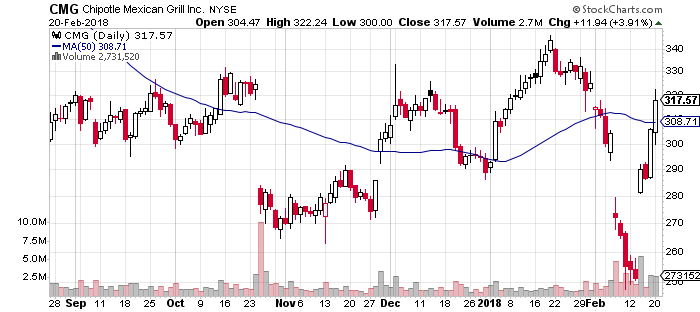

CMG was a bit of a different trade, although still for a credit. It definitely had jacked up volatility after the stock dropped sharply during the market selloff. However, I liked this trade even more because of the new CEO hire, which sent the stock considerably higher. The trade is already a big winner, and we should be able to close it soon.

Open Position Update:

Portfolio Commentary:

Portfolio Commentary:

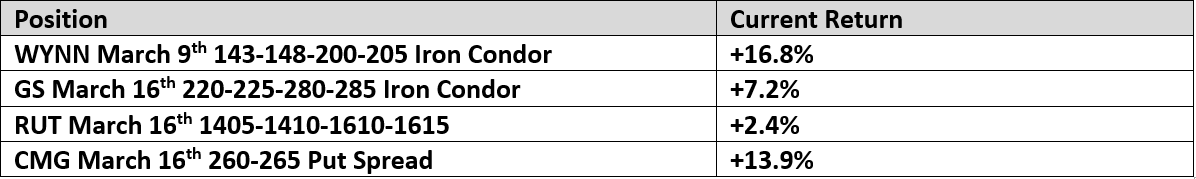

We have four open positions this week. Results are based on close of trading prices for Tuesday February 20th.

WYNN March 9th 143-148-200-205 Iron Condor – WYNN is looking great and has solid returns. We can close it soon.

GS March 16th 220-225-280-285 Iron Condor – GS is a decent winner so far but is sitting a little close to the upper short strike of 280. We may close it for a bit smaller profit this week rather than take a chance on a market rally sending the stock soaring.

RUT March 16th 1405-1410-1610-1615 – So far so good with this recent trade.

CMG March 16th 260-265 Put Spread – Should be ready to close this week!

Volatility Review:

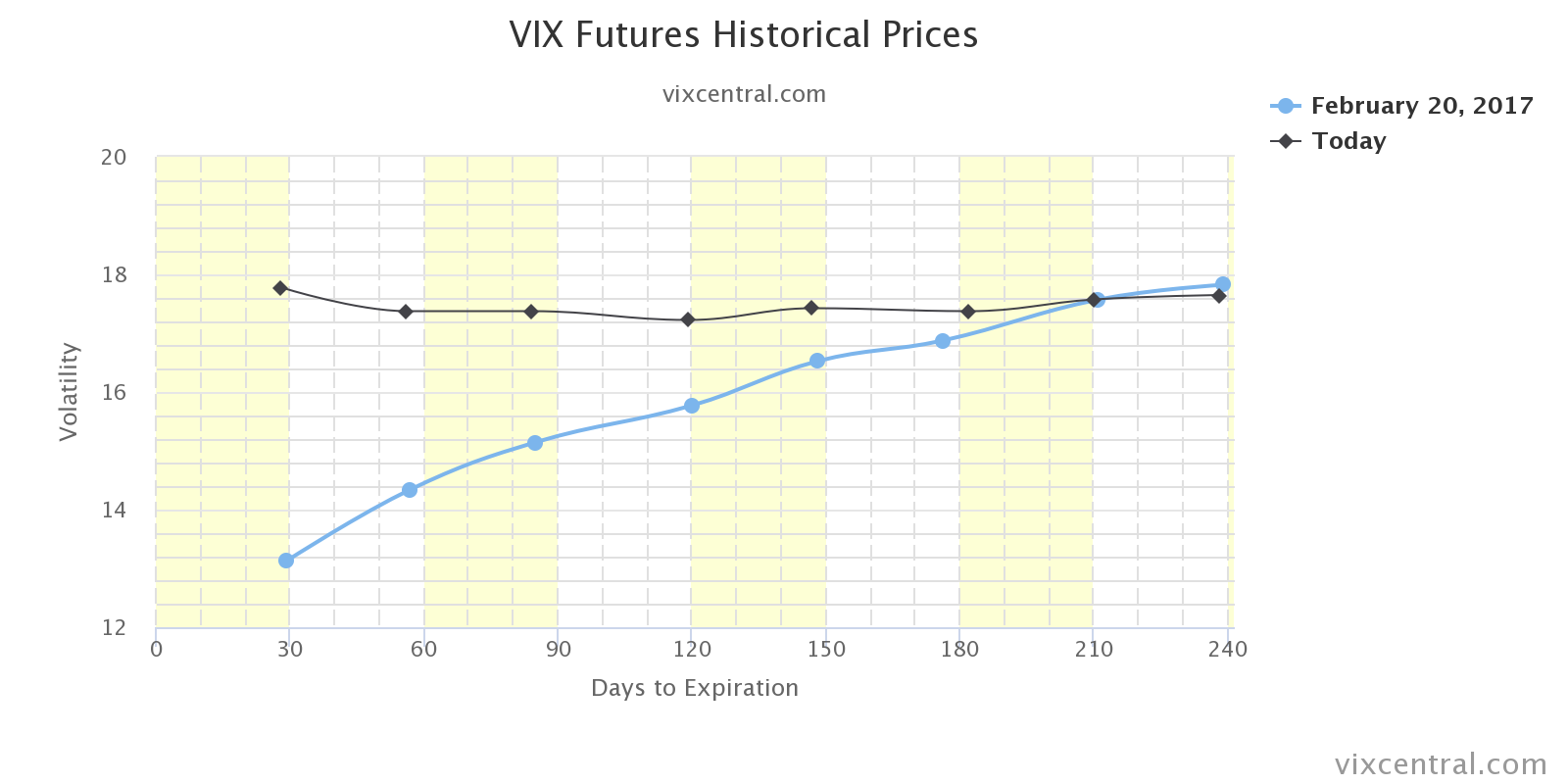

Instead of the normal VIX histogram, let’s look at the current VIX futures curve (in black) compared to the VIX futures at the same time last year (blue). As you can see, we are in backwardation currently (with front month futures more expensive than back months) while last year we were in steep contango (back months are more expensive).

VIX futures are normally in contango as the future is usually more uncertain than the present. At the moment, the market believes we have more risk now than in the future, hence the backwardation. Until the curve shifts to contango, we still need to be somewhat cautious of the market.

Basically, it means we’ll do credit spreads if we can get really wide condors ranges (like RUT) or really juicy OTM put spreads (CMG). Given the state of volatility, it may make sense for us to place some kind of debit spread that makes money if we plunge again. If so, it will be something relatively cheap. We’ll see how things shake out as this week progresses.

Our Next Live Strategy Session:

Live strategy sessions are held on the first Thursday of each month. This means the next strategy session is NEXT Thursday, March 1 at 9:00 p.m. eastern. Participation in the session is free but you must be registered since this is a subscribers-only event. Use the link below right now to register.

https://attendee.gotowebinar.com/register/3901895576529434369