Investors have panicked, and the stock market has quickly tumbled into bear market territory. Panic leads to poor decision making. The reactions to the coronavirus outbreak, such as canceling sporting events and sending employees home, will end up causing more damage than from the virus itself. If you stay logical and you don’t panic, the current stock market crash will soon be viewed as the investment opportunity of the new decade even as painful as it is at the current moment

With the stock market down 25%, plus and many great income stocks down even further, it’s time to get into dividend stocks. I recommend and orderly investment plan, buying shares over a period of time, and over that same period, reinvest all dividends earned to compound your income stream growth. I call this “trickle charge growth.” Your dividend income stream will be like an electric current that you build by the steady addition of high-yield dividend income stock shares.

My Dividend Hunter readers are earning steady dividend income right through this stock market crash. By putting their portfolios on the income trickle charger, they will average down their per-share cost and quickly grow their income streams.

Online brokerage accounts allow you to set individual securities for automatic dividend reinvestment. Or you can choose to manually reinvest dividends, picking the stocks that look most attractive as the dividends land in your brokerage account. In my Dividend Hunter account, I have some investments on automatic reinvest and others where the dividends go to cash. They don’t stay in the cash holdings for very long!

There is no way to predict where the bear market will bottom. I do know that we are in one, which means its time to make sure you are adding to your income stocks through any remaining decline and into the subsequent stock market recovery. For reference, out of the 2008-2009 bear market, the S&P 500 returned 84% over the two years following the market bottom.

Here are three good ideas in the income stock universe to get you started:

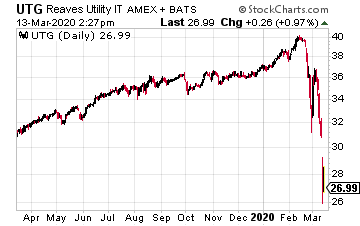

The Reaves Utility Income Fund (UTG) is a closed-end fund with a portfolio of utility and dividend-paying infrastructure companies.

UTG pays monthly dividends and has paid a stable and growing dividend for 16 years. Every month since the fund’s Spring 2004 IPO.

A month ago, the market priced the fund shares to yield 5.25%. Now the yield is up to 7%.

Buy some UTG shares, put the investment on automatic reinvest, and three years from now, you will be bragging to your friends about your investment genius!

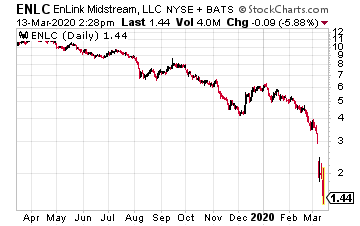

EnLink Midstream Corp. (ENLC) is an energy midstream company that provides a broad range of gathering, processing, transport, and storage services for crude oil and natural gas producers.

Since the start of 2020, the ENLC share price has fallen from $6.00 to $1.70. The company has a market cap of $900 million and will generate $700 million in distributable cash flow in 2020.

The current annual dividend of $0.75 per share, is 2.0 times covered by DCF and gives a current yield of 44%.

I don’t care if the dividend gets cut; this company is worth $10 per share in any regular market.

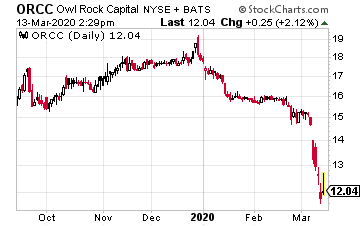

Owl Rock Capital Corporation (ORCC) is a new business development company (BDC) that launched with a July 2020 IPO. Compared to other BDC’s, ORCC has a very low debt to equity leverage.

That is a good thing in a volatile market. The federal government is talking about loan help for small businesses.

That type of program should be a benefit for BDC’s.

ORCC yields 10% on its regular dividend, and the board of directors has approved bonus dividends for every quarter in 2020. Buy some!