When Stanley Black & Decker (SWK) reported earnings last week, CEO Jame M. Loree chose an unusual way to begin his earnings call remarks. Mr. Loree read a quote from the company’s recent shareholder letter, about a military college’s description of the atmosphere at the beginning of the post-Cold War era.

As Mr. Loree said, “VUCA stands for volatility, uncertainty, complexity and ambiguity. And while back in that period, VUCA described the backdrop for the formation of a new world order, this time, I believe it describes what leaders of all institutions will have to consider as we devise strategies and tactics to thrive in what can now be called the new world disorder of the 2020s.”

The focus of the earnings call, as with many companies at present, was on how the company is ensuring the health of SWK workers. Then, talk quickly turned to what the company is doing to shore-up its balance sheet, followed by growth prospects.

SWK was able to tout a very solid health record in the face of the pandemic. The company encountered COVID-19 first in its large China operations, and was able to bring safety measures it began in China, to its global workforce. The company has had less than 100 employees, out of 58,000, test positive for the virus.

To ensure the company remains financially stable, Loree said SWK would be unveiling a “comprehensive cost reduction and efficiency program.” The goal of the program is to provide $500 million in savings in 2020, and $1 billion in savings over the next 12 months.

In the first quarter, the company’s revenue was $3.1 billion, down 6% year-over-year, with a 7% decline in organic growth. Earnings per share came in at $1.20. Loree said January and February actually came in at projected growth numbers, but the falloff in demand in March drove the shortfall from projections.

Donald Allan, Stanley Black & Decker CFO, said the quarterly numbers for various geographical regions matched the impact of the virus. He said, “Emerging markets declined 13%. Asia was hardest hit down 25%, with Latin America down 12%.”

On the bright side, in referring to the current quarter, Allan informed investors, “As we watch the trends in the quarter, e-commerce globally and DIY in many developed markets, showed signs of acceleration.”

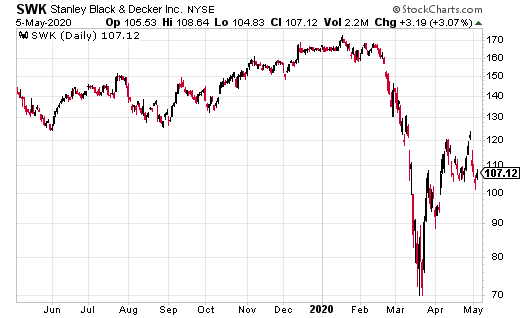

The company’s stock has declined from a high of just over $170 in January to trade at approximately $108 currently. Stanley Black & Decker has a PE of 17, and is yielding 2.66%.

Steven Adams’s personal position in Stanley Black & Decker: none.