While stock prices have recovered some from the March lows…

The U.S. economy is in a recession.

There is no doubt of that fact. First quarter GDP came in negative.

But the U.S. stock market is forward-looking. Investors value stocks based on their view of future business results.

However, the price discovery process is chaotic.

Current news and opinions influence investor beliefs. Outside factors drive short-term trends. Fear and greed are always present.

2020 introduced a new element: An economic shutdown driven by a pandemic.

Predicting future results has become impossible for many companies and sectors of the economy. The result is a stock market with record-breaking volatility.

Economy opening…not opening…vaccine…no vaccine…recession…no recession. Every week we are walking into uncertainty.

So how do we create certainty in the most uncertain market we’ve had since 2008?

With…

The Safest Dividend Stocks on the Planet

These aren’t your normal dividend stocks…

These stocks pay you first…and can act as a safe haven getting you away from volatility.

However, this time, these dividend stocks have crashed as well…but they should be the first to recover.

They’re called Preferred Stocks.

Preferred shareholders receive no voting rights. However, they’re entitled to profits first before common shareholders.

Did you know as a common shareholder, you’re paid out after preferred AND debtors?

Equity (stock) holders are always last in line.

You don’t want to be last when there’s a possible storm coming.

Here’s another safety net from preferred shares…

If the company wants to pay common stock dividends, it cannot reduce or suspend preferred share dividends by a penny.

Meaning, your dividend is much safer and can’t be cut as long as common shareholders receive their dividend.

For example, on March 18, hotel REIT RLJ Lodging Trust (RLJ) announced it had reduced its common stock dividend from $0.33 per share down to $0.01 per share. A penny per share per quarter.

By keeping the common stock dividend at a penny, RLJ’s preferred share dividends must continue at their regular rate. No cuts allowed!

That would keep your income stream secure as others saw theirs drop 97%.

There is one more difference.

Price and Yield: Preferred stock shares are issued at a $25.00 price (its “par value”) with a set yield—for example, the NRZ.PFA shares have a 7.5% yield. Multiply the yield times the share price to get the annual dividend rate. In this case, 7.5% times $25 gives an annual dividend of $1.875 per share or $0.46875 per quarter.

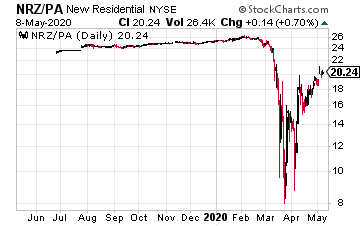

In normal times, most preferred stocks will trade around the par value with yields close to the coupon rates. Prices fluctuate to reflect changes in market interest rates for similar securities. Again, using NRZ.PFA, this preferred stock was issued in June 2019, and the share price stayed in a tight range of $25 to $27.

During times of panic, preferred shares get sold right along with common stocks. In March, the markets went through a liquidity event, where closed-end funds and exchange traded notes (ETNs) that owned leveraged portfolios of different high-yield securities were forced to dump investments, including preferred stocks.

As I write this, NRZ.PFA is trading for about $20 per share, with an 9% yield. When it becomes apparent that the company will not go bankrupt and will continue to pay common and preferred share dividends, I expect preferred stock share prices to climb back up closer to their par values

I believe that preferred stock investments will lead the share price recovery when investors again start to believe in a positive future for American companies and stock market values.

Here are 3 Preferred Dividend Stocks to Consider Right Now

If you’re interested in dipping your toes into preferred shares, take a look at a few recommendations.

Arbor Realty Trust Cumulative Preferred C (ABR.PC) Arbor Realty Trust is a finance REIT serving multi-family property developers and owners. The ABR Preferred C shares have an 8.5% coupon rate. At the current $24 share price, the yield is 8.95%.

Brookfield Property REIT Preferred A (BPYUP) Brookfield Property REIT shares are mirror shares of Brookfield Property Partners L.P. The Preferred A shares have a 6.375% coupon. The current yield is 10.59%. Buy up to $20 per share.

Chimera Investment Corp. Preferred B (CIM.PB) Chimera Investment Corp. is a finance REIT that invests in residential mortgage loans, asset securitization, and mortgage-related securities. While I am not interested in the CIM common shares, the Preferred B shares are now attractive after the high-yield selloff. The CIM.PB has an 8% coupon and is priced to yield 11.4%. Buy up to $20.

If you want to see the 6 best preferred stocks I’m investing in to diversify your portfolio… You’ll want to see my “Emergency Dividend Plan” that could protect and grow your portfolio over the next 36 months. Click here to see the plan.