Silver linings. We’ve all been looking for them. I have to stay home… but I get to walk the dog (or play with the cat) more, reconnect with family, catch up on reading (or Netflix (NFLX)), and finally try out meditation or journaling.

One of the silver linings emerging from the global situation, not only by individuals enjoying the fresh air, but by fund managers allocating investment dollars, is that reduced business activity has led to cleaner air and water.

As the world emerges from the COVID-19 crisis, there will be many competing interests. Even now we are seeing the tension between re-opening businesses and continued health concerns. One tension, which was already in full conflict prior to the health crisis, is the reliance on fossil fuels versus green energy.

I think there’s a good chance green energy advocates come out of this crisis with renewed energy and focus. The clean skies, with clear proof from NASA satellites that even a brief pause in industrial activity can have a very substantial impact on pollution, gives them a perfect case study no one could have anticipated.

And many of the stocks recognized as good investments for ESG, or environmental, social, and governance, investors, are weathering the current crisis quite well. Here are three companies that fit this theme, ranging from established businesses to a very early, but potentially very profitable, investment.

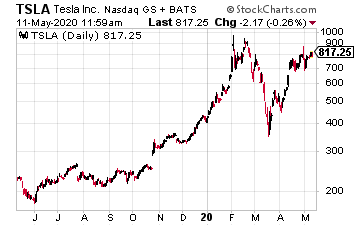

Despite the sometimes-controversial antics of its iconic founder, Elon Musk, Tesla (TSLA) has been on a rocket ride that started in late 2019 and has so far continued into 2020. TSLA captured the imagination of a number of constituencies with its eclectic (and highly rated) cars. Everyone from green energy advocates to technology geeks love the vehicles.

Did you know Tesla actually borrowed money from the U.S. Energy Department as a startup? The company was almost denied the loan because no one believed an expensive luxury electric car was viable in a time when the Prius was the top selling rechargeable vehicle.

But, through a combination of style and performance, TSLA essentially became the iPhone of electric cars: stylish, and with both actual and perceived, quality over its competition. Like Apple (AAPL), Tesla has thus far built what Warren Buffet describes as a moat around its luxury electric car business.

TSLA has moved from $250 in October of 2019, to over $950, before pulling back to the recent $700 to $800 range. In its latest quarter, just reported, the company had earnings per share (EPS) of $0.08 on revenue of $6 billion. Importantly, the new Model Y was profitable in its first quarter, which was the first time Tesla had been able to do this with a new model. This could be a sign the company is getting even better at managing its products.

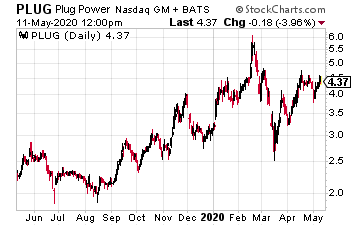

Plug Power (PLUG) is another green energy play, with a leading position in the hydrogen and fuel cell markets. The company has a wide range of products that offer energy solutions for both stationary and mobile applications.

PLUG’s power solutions can replace electric batteries in forklifts and other warehouse-type vehicles. And, its stationary batteries can replace basically anything that runs on a generator. Plug Power says customers should receive a 5% to 6% savings in productivity versus other battery solutions.

In its latest earnings release, the company reported revenue of $40.8 million, and EPS came in at -$0.12. The company’s stock, which traded down to just under $2.60 at the coronavirus lows, has rebounded to over $4.

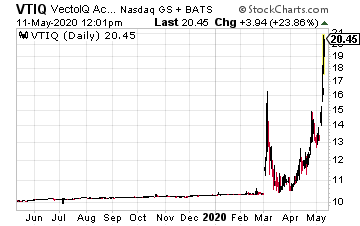

Finally, I have an unusual play in VectoIQ Acquisition Corporation (VTIQ). The company is a SPAC, or special purpose acquisition company—also commonly called a blank-check company. These were rather shady instruments several years ago, but have come to represent a large part of the annual IPO market, and are now most often run by experienced and reputable management teams.

VTIQ recently announced it would be purchasing Nikola Motors. Nikola is in the process of building electric and hydrogen fuel cell semi-trucks. Unlike Tesla, which went the electric car route alone, Nikola has teamed with a number of other truck manufacturers to develop drivetrains and other components for its vehicles…so they’re not starting from scratch.

Another Potential Takeover Target For VTIQ [ad]

This one is a little more speculative, as Nikola is still taking orders, and not yet in the production stage. But it appears to be ahead of others in electric semi-truck production. This is one to keep an eye on as the acquisition likely closes in the next few months, and the new company begins trading as Nikola Motors.