Over the last two decades, the investment landscape has been dramatically altered by two trends. The first is the shift from single stock and mutual fund investing into exchange-traded products (primarily ETFs). The second is the emergence of volatility as an asset class.

First off, ETFs opened the door for the average investor to trade assets that were previously only within reach of the institutional or high-net wealth client. What started with a simple way to actively trade a basket of S&P 500 stocks has since morphed into diverse products and strategies. ETFs are used to gain exposure to everything from soybean futures and emerging market government bonds to merger and acquisition arbitrage and physical palladium.

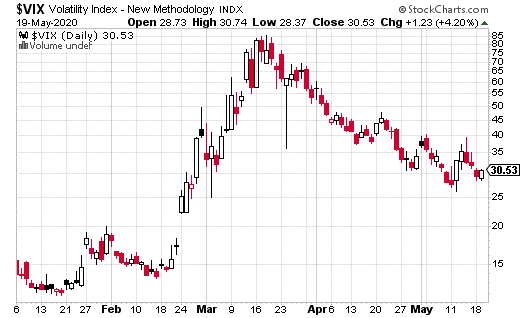

Market volatility has been widely followed and traded since the ’80s. The primary method of tracking (measuring) volatility has been through the Cboe’s S&P 500 Implied Volatility Index, referred to as the VIX. But it wasn’t until 2004 that VIX-based products became tradable.

The Cboe launched VIX futures and options on those futures soon after. While the casual trader isn’t likely to trade futures or options, what the launch did was allow tradable VIX products to be packaged into exchange-traded products. It’s these products that opened volatility trading to the broad audience it has today and firmly established volatility as its own asset class.

Volatility products are popular trading vehicles for a few reasons. The long side (buying volatility) is an extremely effective method for hedging market risk. That is, volatility tends to go up when stocks go down. On the short side (selling volatility), the strategy has historically provided a predictable income stream.

However, trading volatility is not without risks. The yield from selling volatility has, at times, been overcrowded. The widespread popularity of the trade is, in part, what caused the “Volmageddon” selloff in February of 2018, which resulted in the implosion of the XIV short volatility fund (and caused heavy losses for those short volatility).

On the flip side, buying volatility can be very expensive. While being long volatility is an excellent hedge in the event of a downturn in stocks, waiting for it to happen will cost you money. That makes the timing of a volatility purchase vital. Nevertheless, knowing when to buy volatility remains a significant challenge for most investors.

Trading volatility through ETFs (or their cousins, ETNs) is still quite common, the risks on both the short and long side of the trade have slowed the introduction of volatility-related products to a crawl. That means there has been very little innovation in the space.

That is, until now.

A one-of-a-kind volatility-based ETF just launched, and it could very well change the way investors gain access to volatility in their portfolio. The new product is called the LHA Market State Alpha Seeker ETF (MSVX). I believe it’s precisely the type of product investors have sorely needed.

The ETF is run by Thompson Capital Management (with Little Harbor Advisors serving as the Investment Adviser). Thompson Capital has been managing the Alpha Seeker fund strategy since 2015, but the ETF version just launched in May. What truly makes the ETF stand out is it’s the only long/short volatility strategy on the market.

Being a long/short volatility strategy means the portfolio managers can choose to buy (go long) volatility when they see fit, sell volatility (go short) when it makes sense, or remain in cash. In other words, Thompson Capital will make the timing decisions on volatility trading, so you don’t have to.

For volatility traders/investors, it’s the best of both worlds. MSVX can buy volatility ahead of a market downturn or sell volatility when markets are calm. Thompson Capital has a rules-based, tactical approach to making long/short decisions. They have a series of time-tested quantitative measures, which allows them to actively manage the portfolio based on market conditions.

For instance, from the Prospectus for MSVX, it can be seen that the Alpha Seeker fund posted a roughly 23% return in 2017, a year when volatility was extremely low (and the S&P 500 was up about 22%). Yet, in March of 2020, while stocks crashed 30%, the fund earned over 11% for the month.

Trading volatility has been a massive boon for investors, but timing the trades isn’t easy. With MSVX, investors can now get exposure to the volatility asset class without having to be concerned about the prevailing market conditions. The ETF is designed to provide portfolio diversification regardless of market conditions. Frankly, it’s the sort of strategy that every investor should consider for their portfolio.