Many investors buy hot or well-known stocks in the hope that share prices will continue to rise. However, as I was advised many years ago, hope is not a plan. The plan I share with my subscribers derives from conversations I had over several decades with investors who have actually become wealthy by investing in the stock market.

While you may find investors who got lucky and bought a stock that turned into serious wealth, you will discover even more who invested on a guess or hunch and lost their shirts. To confidently build wealth in the stock market, you need a strategy that doesn’t depend on luck or timing.

Dividend growth investing is the one strategy that will, based on my experience and decades of conversations with investors, provide a certainty to grow your wealth over time. Dividend growth involves investing in stocks that will grow their dividends over time.

The Dividend Aristocrats are companies that have increased dividends for at least 25 years. The 66 stocks on the list, such as 3M (MMM), at 56 years of dividend growth; Coca Cola (KO), at 56 years; and Johnson & Johnson (JNJ), at 58 years, have made many long-term investors wealthy.

The math of dividend growth investing is that the average annual total return will end up close to the average dividend yield, plus the average annual dividend growth rate. This average works out through the full bull and bear market cycle of the markets.

14.9% Payouts Up For Grabs! [ad]

The challenge of dividend growth investing is that popular stocks like the Dividend Aristocrats typically have low current yields, combined with moderate dividend growth rates. For example, PepsiCo Inc. (PEP) yields 3.0% and has averaged 7.9% dividend growth for the last decade. A stock like Pepsi will be a great wealth builder if you have 30 years to let the growth compound. But if you are like me and your 30s happened before the cell phone was invented, you might like to get wealthier faster, say in 10 years.

Here are the four portfolio-building steps to put together a wealth-building dividend growth portfolio.

- Search out stocks with a dividend growth total return number that meets your wealth-building goals. For example, my target is a 15% annual total return, so I look for current yield, plus recent dividend growth that total to 15%. I like higher yields, so a stock with a 5% yield and 10% dividend growth would make the cut.

- Learn how a prospective company makes money and evaluate the business for continued dividend growth. Nothing is more aggravating and bad for this strategy than buying a stock just as the company reduces or stops the dividend growth rate.

- Put together a diversified portfolio. This means across different economic sectors. S&P divides the stock market into 11 sectors: Communication Services, Consumer Discretionary, Consumer Staples, Energy, Financials, Health Care, Industrials, Materials, Real Estate, Technology, and Utilities. Your dividend growth portfolio should include stocks from each sector.

- Maintain a watchlist of other dividend growth stocks, usually companies with high dividend growth rates, but unacceptably low yields. These are the stocks you want to buy when the market crashes, and the yields come up.

Dividend growth investing is a simple strategy. Like anything simple that works, the challenge is in the details. The good news is that dividend growth investing is a proven way to build wealth and fund a future retirement.

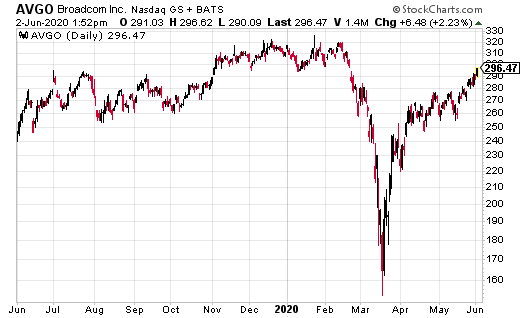

Broadcom Inc. (AVGO) is a good candidate for dividend growth investing. The current yield of 4.46% is more than double, the stodgy blue-chip stocks listed above.

Yet, the AVGO dividend growth has been outstanding, increasing by an average of 50% per year for the last five years.

Broadcom manufactures computer chips, making it a dividend-growth, tech sector investment.