The outbreak of the coronavirus pandemic and spread of COVID-19 infections pushed federal and state leaders to the unprecedented actions of shutting down a wide swath of the economy and telling citizens to stay at home to avoid being exposed to, or spreading, the virus. A primary victim of the shutdown was the dine-in restaurant industry.

With restaurants closed, those who don’t want to cook—or who won’t cook—scrambled to find new ways to get food prepared by someone else. To mix metaphors, stay-at-hoe orders created a perfect storm for the benefit of pizza companies.

Everyone loves pizza. It’s inexpensive, tasty, comfort food. And the industry was already doing plenty of delivery and curbside pick-up business.

During the pandemic, pizza companies quickly ramped up production and sales. When they report their 2020 second-quarter results, the numbers will be very positive for the stock prices. Here are three dividend-paying companies that will deliver both pizza and quarterly dividend checks.

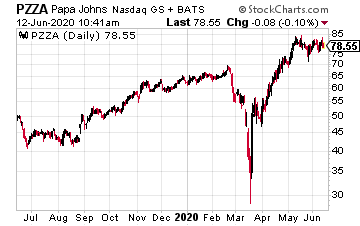

Papa John’s International (PZZA) has 5,200 stores, of which 4,400 are franchised restaurants, in the U.S. and 44 countries. The other stores are either company-owned or joint ventures. There are about 3,000 Papa John’s locations in the U.S.

For the 2020 first quarter, PZZA reported net income of $0.15 per share, up from a loss of 12 cents per share in the 2019 first quarter. North American comparable sales increased by 5.3%, and international sales were up 2.3%.

On May 27, the company put out a business update on its response to the pandemic. Rob Lynch, President & CEO, said, “In May, for the second straight month, Papa John’s team members and franchisees delivered the best sales period in the company’s history.” North American sales were up 26.9% from March 30 to April 26 and up 33.5% for the period from April 27 to May 24.

PZZA currently pays a $0.225 quarterly dividend, giving a current yield of 1.2%. The dividend was last increased in July 2017.

Even with last Thursday’s market rout the PZZA stock price is within 7% of its 52-week high.

[TRENDING NOW]: This 36-Month Accelerated Income Plan Pays Your Bills For Life…

Even In Downturns Like Now

One simple plan takes minutes to set up, yet could pay all your bills for life. No longer will your mailbox be stuffed with ‘payment due’ envelopes.

This is our most powerful plan we’ve ever put together… and over 10,000 retirement investors have already used its recommendations.

There is still time to start generating $4,084 per month for life… but the window is closing. Click here for complete details.

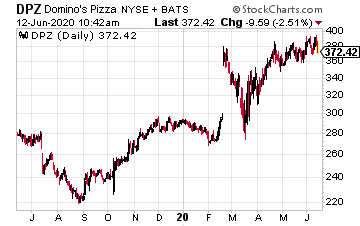

Domino’s Pizza (DPZ) operates more than 17,000 stores in 90 countries. Of those, 6,156 are in the U.S. The next three largest regions in terms of DPZ’s locations are India (1,332), the U.K. and Ireland (1,187), and Australia/New Zealand (834). Mexico and Canada have a total of 1,324 Domino’s stores. More than 94% of Domino’s stores in the U.S. are franchise-owned.

For the first quarter, DPZ reported net income of $121.6 million, up 32.2% compared to a year earlier.

Net income of $3.07 per share was up from $2.20 per share. Domino’s also released a pandemic-related business update on May 26.

Here are the same store results from U.S. stores during the period:

- March 23 to April 19: Up 7.1%

- April 20 to May 17: Up 20.9%

- March 23 to May 17: Up 14.0%

International store sales were up 1.0% for the period. Including all stores, total sales growth for the period was 5.7%.

Domino’s currently pays a $0.78 per share quarterly dividend. The dividend has increased for seven consecutive years, with a 20% annual compound growth rate.

The current yield is 0.80%.

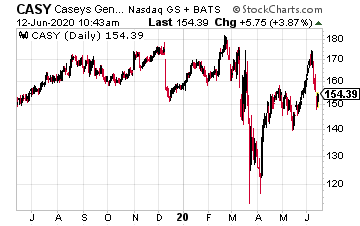

Casey’s General Stores (CASY) operates more than 2,000 convenience stores in 16 Midwestern states. Approximately 57% of Casey’s stores in areas with populations of 5,000 or less. In contrast, roughly 17% of Casey’s are located in areas with populations of 20,000 or more. Casey’s has a strong balance sheet and owns nearly all of its assets, which allows the company to take advantage of growth opportunities consistently.

CASY offers self-service gasoline, a wide selection of grocery items, and an array of freshly prepared food items. Among the most popular of Casey’s prepared foods are their made-from-scratch pizzas, donuts, subs, and sandwiches.

CASY reported fiscal fourth-quarter earnings on June 8, for the three-month period that ended on April 30. Earnings of $1.67 per share were up 146% compared to a year earlier. Much of the profit gain came from fuel sales, where the average margin of $0.408 per gallon, compared to $0.186, resulted in a 96% increase in fuel profits, even though gallons sold dropped by10.7%. Casey’s is well known for its pizza, with both pickup and delivery service. Pizza sales were up by double digits in the quarter.

Casey’s pays a $0.32 quarterly dividend. The dividend has grown for 20 straight years, with a 10% annual compound growth rate.

The current yield is 0.82%.