One of the more exciting stocks for options traders to trade on is Tesla (TSLA). The electric car and battery company has been volatile basically since its inception. That makes for excellent opportunities for options traders, but also a fair amount of risk.

TSLA is essentially a cult stock. There are some investors who love it, no matter its price. There are also plenty of investors and traders who hate it, and will short it at any price. Because of the extreme, bimodal nature of TSLA investors, there tends to be a lot of price swings in the stock.

Of course, Elon Musk’s unpredictable behavior only adds to the high volatility of the share price. But despite Musk’s antics, TSLA does have a popular product. Electric vehicles (and the batteries that support them) are the future of transportation. As such, there is some reason to believe that TSLA’s massive valuation is based on future potential.

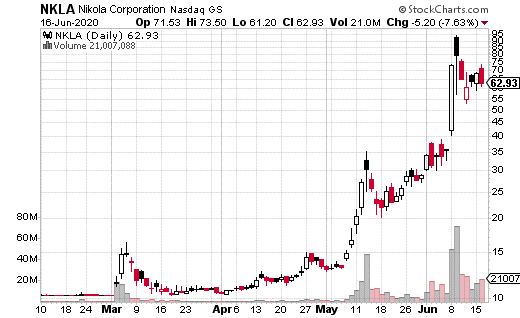

Recently, however, Tesla has taken a “back seat” to another alternative vehicle company, Nikola (NKLA). Nikola (also named after famous inventor Nikola Tesla) designs trucks and other vehicles that run on fuel-cell and electric batteries. NKLA wants to be the “Tesla of trucking”—a tall order for any company (even Tesla itself).

One thing that Nikola has been adept at doing is marketing itself. The stock went public through a reverse merger on June 4 and has skyrocketed since. It’s now worth more than $21 billion in market cap… on essentially zero dollars of revenue.

A New Way To Try Out Options Trading on NKLA and TSLA Without Risking a Penny [ad]

Tesla, for all its faults, has $26 billion of revenue. Nikola is worth $21 billion (a current stock price of around $61) on hype alone. The company supposedly has $10 billion worth of orders for its trucks, but no money has been deposited. It hasn’t stopped the stock from surging over 500% year-to-date. It also hasn’t stopped short-sellers from taking huge positions in the stock.

Typically, when a stock becomes as volatile as NKLA has been in recent days, I like to look at the options market for clues about what to expect next. Roughly 60% of the action in NKLA options has been bullish, and 40% has been bearish. It seems like bullish traders have a slightly louder voice, probably due to the hype (and how much the stock has gone up).

Looking at the larger orders, though, they don’t necessarily tend to be directional. Most of the institutionally-sized trades seem to be taking advantage of mispriced volatility between months. This sort of complex trading is generally referred to as relative volatility trading, a very capital-intensive strategy that isn’t accessible to the more casual trader.

There’s nothing wrong with trading options in a super volatile stock like NKLA, but be aware: your costs will be extremely high if you want to make directional bets. On the other hand, attempting to sell volatility (or sell options) will be extremely risky. If you can’t stomach high risk or high premiums on directional strategies, it’s probably best to sit this one out.