It’s no secret that investors are always looking for the next big thing in the stock market. New tech and renewable energy ideas are particularly popular… which is why you’ll often see companies with little or no revenue trading at high valuations. It’s all about the potential.

Of course, that doesn’t mean a company is necessarily going to reach its potential. Stock prices can fluctuate dramatically for these types of companies, precisely because their prospects are always in flux. Every time new information is made available, investors have to reassess a company’s potential.

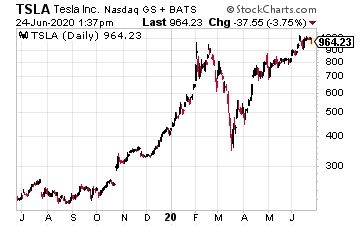

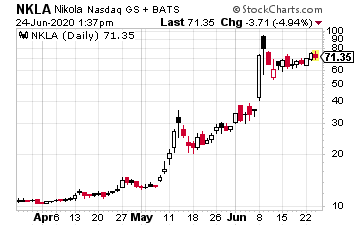

In recent months, the investment crowd has been very focused on alternative-fuel vehicles, such as electric and hydrogen-powered cars and trucks. The leader in this category is Tesla (TSLA), which always seems to be in the news. More recently, Tesla competitor Nikola (NKLA) has been grabbing headlines with its hydrogen/electric trucks.

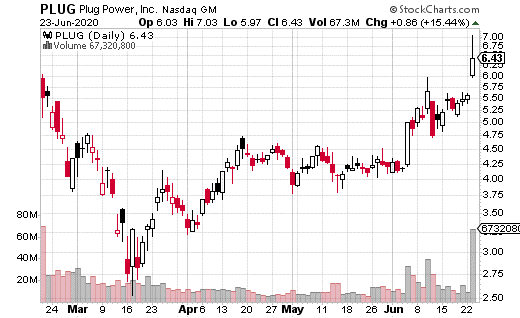

However, just this week, a long-time player in this industry stole the spotlight with better-than-expected projections. Plug Power (PLUG) has been around since 1997. The company is known for its hydrogen fuel cells for vehicles, but, those fuel cells had always been based on hydrogen from natural gas—not the greenest of energy types.

That’s why it was big news when Plug announced the acquisitions of United Hydrogen and Giner ELX. These additions will allegedly allow the company to get 50% of its hydrogen from green sources by 2024. The company also raised its 2024 revenue target to $1.2 billion.

After this news, Plug’s share price jumped to $7 (up over 25%) before settling at $6.43 (up around 15%). Options traders took notice, with options volume over 150,000 on the day—well over the 23,500 average daily options volume.

<div style=”background-color: #ffffcc; padding: 30px; font-family: Helvetica; border-radius: 25px”><h2 align=”center”><a href=”https://www.investorsalley.com/landing/oft-extra-cash-masterclass/?a=1094&utm_campaign=extracash2&utm_source=oft&utm_medium=article&t=oftlandjoextra2oft”>”I love you, Jay! I went from a $7,000 portfolio to $50,000 literally OVERNIGHT!”</a></h2><p>I woke up to this message in my inbox on Feb 20th when our E*Trade option skyrocketed 1,420% in 9 days. One member profited $43,000 literally overnight. We then closed on WMT for a quick 178% gain and then XLB for 222%. I’m sending out these opportunities every month. <b><a href=”https://www.investorsalley.com/landing/oft-extra-cash-masterclass/?a=1094&utm_campaign=extracash2&utm_source=oft&utm_medium=article&t=oftlandjoextra2oft”>Click here to see what to do to get my next trade.</a></b></p></div><p> </p>

Sentiment on Plug appears strongly positive, with roughly 90% of options activity seemingly positive in nature. Still, looking at the biggest orders, there seem to be mixed opinions on the company’s upside potential.

One trader was clearly bullish on the stock, grabbing nearly 1,500 of the September 7 calls for $1.00, with the stock at $6.78. The stock price would need to be $8 or higher by September expiration for the trade to make money.

On the other hand, the largest single trade of the day was moderately bullish at best (and could even be considered bearish depending on your point of view). A trader sold just below 3,000 July 17th 7 calls with the stock at $6.79. These calls were sold for 57 cents, which means break-even for the trade is at $7.57. Anything below $7 at July expiration means the trader keeps all 57 cents ($57 per option) in premium.

The July call sale suggests there is a cap on how far Plug will climb, at least over the next few weeks. On the other hand, the September trade is predicting a move above $8, but it has a longer time frame. Of course, with the different time frames, both traders could be right. That’s just one more advantage of options: traders can have very different viewpoints, and everyone can still make money in certain situations.