Let’s dream for a moment.

It’s November 2021. A coronavirus vaccine for was found in late December 2020. Due to pre-ramping of production facilities, 100% of the U.S. population has been vaccinated. COVID-19 is no more.

Given this possible reality, where are you going to do your holiday shopping? Are you geared up for Black Friday and headed to the mall? Maybe a big box retailer?

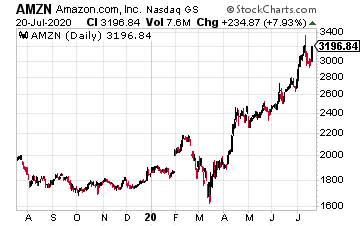

Or, are you going to try your best to get everything you can online, with a big chunk of your gifts, party supplies, etc. coming from Amazon (AMZN)?

The pandemic has had a major impact on just about everyone. The ways we shop, work, and communicate have all changed. As time passes and we get more accustomed to these changes, I believe in many ways there will be no going back.

Amazon is one of the companies that has taken advantage of this new normal to capture market share from both brick-and-mortar stores and less technologically able online retailers. And I don’t believe for one minute that Mr. Bezos is going to let that market share slip away post pandemic.

Other large technology stocks have also thrived during the pandemic, due to the forced shift of how we do things. As the country reopens, and then shuts down, and then reopens again, these companies will continue to benefit both immediately and once COVID-19 is a bad memory.

Companies like Amazon also continue to innovate and expand in new business areas, even as they expand their core businesses.

Amazon just announced it will be using a contactless checkout system in its already automated grocery stores. Amazon Go stores will be testing the new Dash Carts, which are equipped with cameras and essentially an onboard checkout station.

The carts allow shoppers to place items directly into bags in the cart. When shoppers are done, they simply pick their bags out of the cart and walk out the door. Everything is then charged to their Amazon account; there’s no need to touch a checkout screen or interact face-to-face with a cashier.

While Amazon is definitely benefitting from the population’s move online, it is also allocating its substantial resources in a bid to continue to innovate, and make further inroads in areas like groceries. Its purchase of Whole Foods was just an opening salvo in what could become a major presence in the grocery sector.

The company spent basically all of its Q1 profits addressing COVID-19, approximately $4 billion. Amazon reported revenue of $75.45 billion, and earnings per share of $5.01.

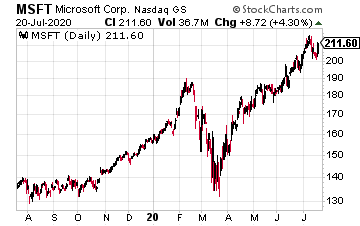

Microsoft (MSFT) is another company that has been in the right place at the right time when it came to the coronavirus pandemic. As business has moved online, the company’s Microsoft Office products are being used by large and small companies alike.

Microsoft also has a video product, Teams, which has increasingly become the standard for large businesses that require more security than products like Zoom (ZM) currently provide.

“Mr. Softee” trounced earnings estimates last quarter, earning $1.40 per share on sales of $35 billion. This was up from $30.57 billion year-over-year. Analysts had expected $1.27 and revenue of $33.75 billion.

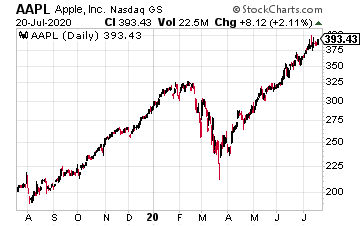

And finally, Apple (AAPL) has become the closest thing to a business in your hand as exists today. Small companies, run by solo entrepreneurs, can literally run their entire businesses from their iPhones.

With the near rollout of 5G, and a new phone possible in September, Apple could get additional winds in its sails if the company adheres to recent launch patterns. Various tech sources are expecting a possible redesign in the iPhone 12, and possibly additional product offerings, such as a “Max” version of the phone.

Whatever the eventual release of the new iPhone brings, I have little doubt it will continue to be the preferred tool of communication in both business and in the social media world.

In its most recent quarter, Apple posted revenue of $58.3 billion, with services revenue coming in at an all-time-high of $13.3 billion. Earnings per share were $2.55, up 4% year-over-year.