You have likely seen the news that the S&P 500 has recovered 100% of the losses from the COVID crash. What you won’t see in the press is the broad range of returns from the different industrial sectors used by S&P Global Ratings (formerly Standard & Poor’s).

The 500 S&P stocks are subdivided into 11 sectors. These include healthcare, materials, consumer staples and consumer discretionary, industrials, utilities, real estate, and financials. Year-to-date through August 20, information technology has been the top sector, up 25.2%. At the other end of the sector resides Energy, which is down 39.3% for the year. That is an extreme disparity in returns, and shows how differently the investing public thinks about the effect of COVID-19 on different types of business.

The energy sector further divides into three subsectors. Upstream covers drilling for oil and natural gas. Midstream covers the gathering, transportation, and storage of these fuels. (Midstream is often viewed as just pipeline companies, but the fact is midstream companies perform a wide range of services.) Downstream energy companies are the refiners and retailers.

Fear Running Out of Money in Retirement? Do This Right Now [ad]

A recent survey found that 60% of folks at or near retirement age…

Fear running out of money in retirement…

…MORE than death!

If that’s you — please pay close attention to what I say next…

Because collecting extra, automatic income in retirement is EASY.

Here’s how…

Absolute beginners are collecting upwards of $75,000 or more…

Year-after-year… month-after-month… day-after-day…

Their first move was to just follow these three simple steps.

For steady income, investors have purchased energy midstream stocks for high yields and usually regular dividends. Here are some key points from a recent Alerian article:

- Forward EBITDA estimate revisions for midstream have been resilient in contrast to other sectors of energy because of their fee-based business models and contract protections such as minimum volume commitments.

- Though EBITDA guidance revisions were not universally positive in the second quarter, the defensiveness of the midstream business model is apparent in that companies maintaining or raising guidance significantly outnumber those lowering expectations.

- The stability in the outlook for midstream EBITDA in 2020 and 2021 contrasts starkly with the volatility and weakness in midstream equities this year. This disconnect between performance and fundamentals suggests potential room for improvement if midstream companies can remain financially disciplined and execute consistently.

Question 1: Does the business generate cash flow to support the dividend? Energy midstream uses the metric of distributable cash flow (DCF) to show the money available to pay dividends.

Question 2: What has company management done and said concerning future dividends? This question can have a couple of positive answers. One is that management has a stated commitment to continue the dividend that was paid before the pandemic. Another favorable situation comes from a company that cut its dividend early in the crisis but continues to show adequate DCF to cover the new dividend rate.

Here are three energy midstream stocks with exceptional yields that deserve further research.

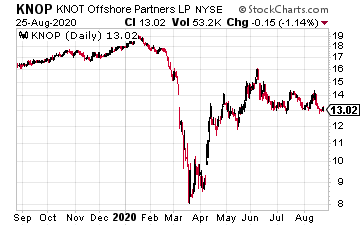

KNOT Offshore Partners LP (KNOP) has sustained its dividend through the crisis, with the most recent $0.52 dividend declared on July 15. The company owns 16 shuttle tankers that bring crude oil and natural gas to shore from the offshore production areas.

For the 2020 first quarter, KNOT reported 1.3 times DCF coverage of the dividend. The July dividend announcement gives confidence the payout is secure.

The shares currently yield 15.9%.

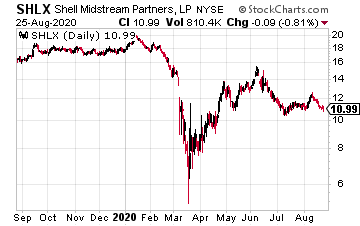

Shell Midstream Partners, LP (SHLX) was formed by Royal Dutch Shell and launched with a 2014 IPO. The company sustained its dividend and reported DCF coverage of 1.0 times for the troubled 2020 second quarter.

In the earnings report, the company confirmed it would maintain the dividend for the next quarter.

SHLX shares now yield 16.2%.

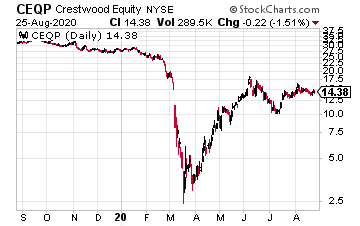

Crestwood Equity Partners LP (CEQP) cut its dividend by 50% four years ago. At the start of 2020, the CEQP payout was increased by 4%.

For the 2020 second quarter, Crestwood reported 15% year-over-year DCF growth.

The coverage ratio for the dividend was 1.6 times. Crestwood operates a very solid business with a steady cash flow to cover the dividends; amazingly, the shares are priced to yield 17.8%.