Anyone remember the commercials for “Friendly Bob Adams” of Household Finance? They advertised “debt consolidation loans”. Bring all your payment booklets, pay off your debts and consolidate them into one loan with a lower monthly payment. Theoretically it took the pressure off those living from paycheck to paycheck, up to their eyeballs in debt.

A friend worked there and often joked about the TV store next door. People would leave his office, go next door, walk out with a new color TV and payment booklet. Soon they would be back in his office “consolidating” once again.

A lot of high earning professionals were regular customers. Many lived at the country club, drove fancy cars, had expensive toys and their payments were sky high. They had lots of cool toys, but when you subtracted what they owed, their net worth was very low. They created the illusion of wealth.

I recall reading that 90% of the top of the line Mercedes and Lexus were leased or financed; meaning the lender really owned the vehicle.

Many are on a debt treadmill, spending most of their income to meet their monthly obligations, while paying exorbitant interest on credit card debt. Pundits call these folks “Debt Slaves”. They are locked into a lifestyle of debt that could take years to get out from under.

| The money you bring in each month is not as important as the money you have left over at the end of the month. |

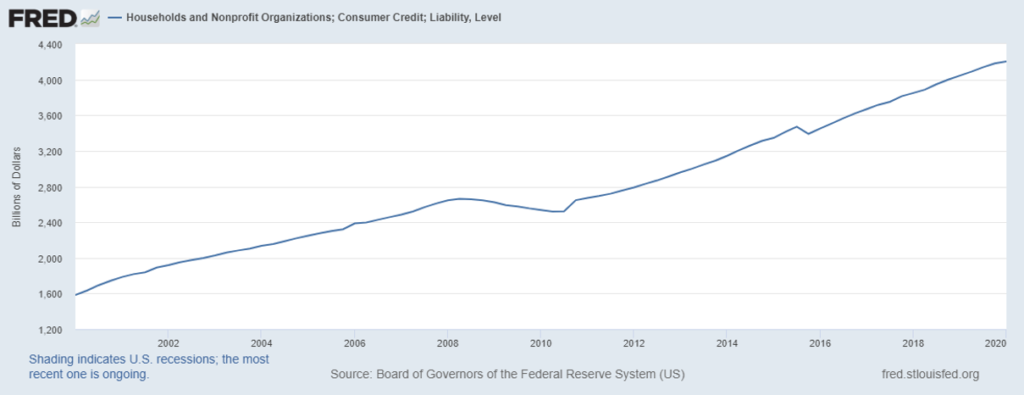

Low interest rates have encouraged people to borrow and spend to historic levels. Consumer debt has more than doubled since 2000.

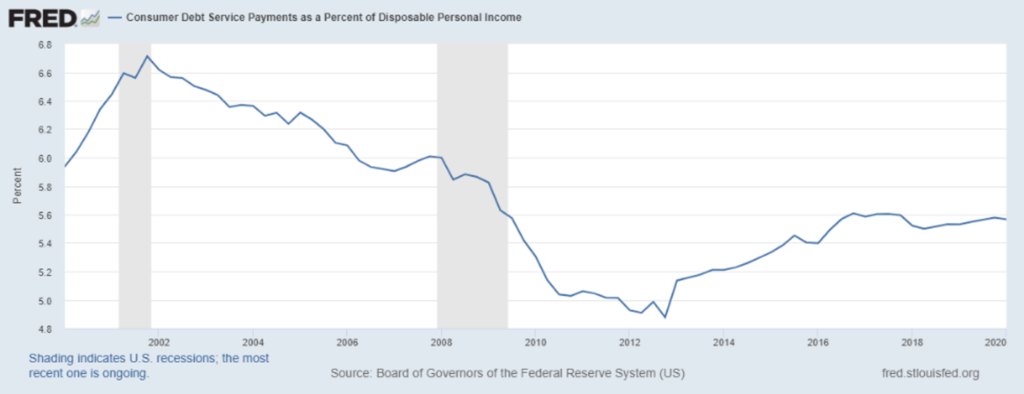

During the same time period, consumer debt as a percentage of income has decreased.

Note the increased decline during recessionary times. A debt slave on the treadmill can go on for years – until their income stops or is curtailed significantly. The current recession has a lot of people scared; particularly if they work for a small business. Another recession wake-up call.

My unscientific guess is the past declines were caused by two major factors. During the recessions people lost their jobs and may have defaulted on their loans. In addition, baby boomers began retiring and their anticipated retirement income fell woefully short of expectations. Many downsized, and decided they needed to change how they live.

Take control of your finances and your life

It generally requires a behavioral change. Two factors come into play; motivation and intelligence. There are millions of intelligent debt slaves who understand personal finance that go happily through life borrowing, making payments and making lenders rich. Much like a diet, they know what they should do to get healthy, but their will power is lacking.

A significant loss of income (or a threat) should serve as a wake-up call – real motivation.

Step one is for you (and your family) to want to stop the debt insanity and change your behavior when it comes to money. You can choose to get off the treadmill and the stress associated with it.

A good retirement plan allows people to enjoy a comfortable lifestyle, without having to constantly worry about money. I’ve seen many people, up to their eyeballs in debt, commit themselves to change, build and execute a plan, and make it happen. Without exception, they say they are happier and healthier as a result.

Real world tips

Commit to being committed. I remember the day Jo and I decided enough was enough. We didn’t like all the stress and made the commitment to change things, once and for all.

|

“If you’re married, agree on the budget

with your spouse. …. The bottom line is this: if you aren’t working together,

it is almost impossible to win. Once the budget is agreed on and is in writing, pinky-swear and spit-shake that you will never do anything with money that is not on that paper. The paper is the boss of the money, and you are the boss of what goes on the paper, but you have to stick to the budget, or it’s just an elaborate theory.” – Dave Ramsey |

Prepare a budget. We tracked our expenses for the previous two years. Where had we been spending our money? Determining needs versus wants was essential. What does it cost to live?

We were careful not to go overboard. Jo’s personal grooming was very important, and I was not going to push too hard there. She found other ways to cut back where she was comfortable. We cut back on eating out several nights a week. We realized our favorite family style, local restaurants were excellent, and much less expensive than the big chain restaurants.

Don’t try to micromanage your spouse. It will turn into a giant game of gotcha. A dear friend’s wife loves to shop. She confessed that when her friends were buying clothes, she felt compelled to buy something, despite a full closet at home. They set a realistic budget for clothes and it worked. If she felt pressure from her friends, she simply said, “I’m over budget, maybe next time.”

As we look back, we realized a very important life lesson. Cutting back a little bit (living below your means to get out of debt) when you are young, means not having to make major changes when you are older.

| Change “buy now pay later” to “save now, more later!” |

Elimination of debt. We listed all our debts. How much did we owe, what are the monthly payments, and the current interest rate? Interest is rent for using other people’s money.

Our inclination was to pay off the high interest debts first; however, we also focused on the lower amounts or debt with high monthly payments to free up cash. We took the scissors, cut up all but one credit card and started our journey.

Be sure to celebrate when something is paid off, and immediately start applying that amount to reduce other debts. With each payment eliminated, it reinforces your commitment; you know you are on the right track.

We’ve seen friends, with little to no savings, make difficult, radical life changes and take years to get out of debt. Without exception, today they say it wasn’t as tough as they feared and making the changes was one of the best decisions of their lives.

Don’t let low interest rates tempt you to buy things you don’t need or can’t afford.

Begin a savings plan. While that sounds counter to a good plan, it really isn’t. Part of your budget should be a commitment to save a specified amount each month. If you get a 10% raise, increase the savings 10% or more. Ideally, you would like enough money to live for six months (then a year) if you have to.

There are always unexpected, unavoidable expenses that are not in the budget; a car repair, unexpected medical expenses etc. It’s demoralizing to put a new charge on your credit card when you are just about to pay it off.

How many times have we seen people trying to lose weight, gain a couple of pounds, throw their hands up in despair and just give up? Don’t get emotional and abandon your plan because of a temporary setback. You will get there.

Your initial goal is to get out of debt, stop being a debt slave, and accumulate wealth.

Investment education is a continuous process. Even though you may not be debt free, start your investing education now! Learn about safe investments, a balanced portfolio, and inflation protection.

The financial services industry is full of predators who want to charge high fees. They may encourage you to take unnecessary risks to earn income to justify those fees.

Be an educated, cautious investor, you don’t want to lose money and take a step backward.

Keep working as long as you can. When your accumulated wealth does not earn enough to keep up with inflation, you are losing buying power.

No debt, and money in the bank, changes your entire outlook on life; particularly your job. If you hate your job, you have options, choose to do something else.

A few years ago, I wrote about seniors who began “encore careers.” One couple were both pilots and took a job delivering airplanes. They would pick the trips they wanted, deliver the plane, book into a hotel, have a nice vacation and then fly home, with their return air fares paid for.

Another couple delivered motor homes. They towed their car behind, delivered the motor home, took the money for return air fare and enjoyed a leisurely vacation as they motored back.

What are your passions? What do you enjoy? Once you are debt free, living a reasonable lifestyle, with some money in the bank, you have many choices. If you don’t like the stress of your current job, screw it; find something you enjoy.

Remaining productive not only helps financially, it also is good for your health. You have the benefit of experience and don’t have to run on the treadmill to stay physically and emotionally healthy. Find a pace that is comfortable for you.

Enjoy life each and every day. MarketWatch reported about a sad survey; older people fear running out of money more than death. Wealth accumulation is more challenging than ever before, but removing the bondage of being a debt slave is the same as it has always been. Keep your money fears at bay and enjoy life.

Heed the current wake-up call. You can take your life back! A little self-discipline today makes a HUGE difference tomorrow.