Remember the saying, “Everything comes to those who wait?” Investment gurus lectured us about patience and compounding. They blared, “Save $100/month, invest at 6% and you will be a millionaire when you retire.”

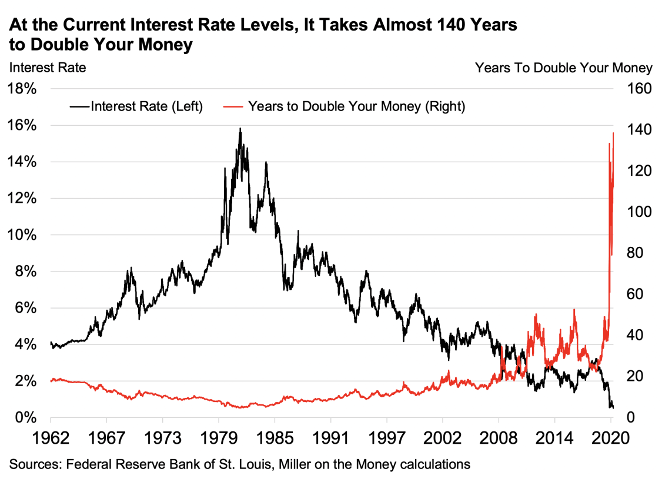

Current interest rates make that impossible. 25 years ago, if you bought US treasuries, the compound interest doubled your money in 12 years. Using today’s interest rates, it takes well over a century.

Holding bonds and CDs was considered “passive” investing. When they matured you bought another, collecting money along the way. A few hours a year managing your money was all it took.

| Today, passive investors will eventually go broke! |

My wife Jo inherited a portion of the family farm. We set up a trust so it would be passed down to her daughter. The farm was sold. We bought CDs; we didn’t want to lose any of that money and we accepted what little income they provided.

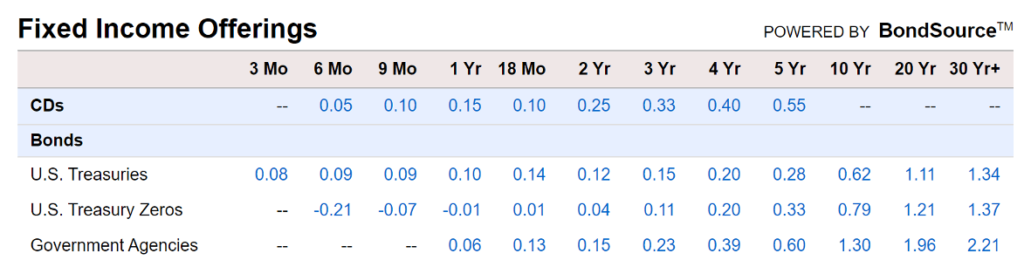

Recently Jo had several 2% CDs mature. I looked at the offerings and got angry. With such small yield, we will eventually have to tap into principal to help pay the bills.

I grabbed the current issue of The Dividend Hunter. We discussed alternatives, risks and potential returns. Electric utilities are unlikely to go out of business. I searched my online broker looking for those with the top ratings.

I used $100,000 to keep the math simple. If Jo bought a 5-year CD she would earn $45.83/month in interest …. whoopee!

Dividend Hunter recommended a fund paying 6.85%. I found two other top-rated utilities paying 3.18% and 4.89%. One quarterly dividend from the lowest yielding utility ($795) is more than the annual interest from a CD.

Utility stock prices fluctuate and could go down. Was the additional income enough to offset the risk?

We did two things. We bought a small portion of all three, and I contacted Tim Plaehn, editor of The Dividend Hunter. Tim is a member of our panel of experts, specializing in income-producing investments.

We need to reconsider the investment landscape, both risks and rewards.

DENNIS: Tim, thank you for your time. I’ve preached about low interest rates for some time. I’ll admit that graph was a real wakeup call.

Safe, fixed income investors are pretty well screwed. Junk bond yields are not worth the risk. If they want to grow their wealth, they can’t do it safely.

Am I missing something? What do you say to people like Jo who are really afraid of losing money?

TIM: Thanks for inviting me. Dennis, your observations are spot on.

I was curious about the yield on the Fidelity Government Money Market Fund. It’s the default sweep account for Fidelity brokerage accounts. Chances are many of your readers have an account with Fidelity.

I was shocked to see the yield at 0.01%. Yes, one-one-hundredth of a percent. Put in dollar terms, $1 million in this money market fund will earn $100 in interest per year… that’s per year. I’m old enough to remember when it paid 5% ($50,000).

The current investment world does provide opportunities to earn great yields. The primary trade-off is to understand and be willing to accept price volatility.

DENNIS: Do you have a “conservative” corner in your letter? I would imagine a lot of subscribers are very risk-averse.

TIM: Human nature is a funny thing. I am constantly surprised how aggressive new subscribers often are when picking their first high-yield investments to buy.

I divide my recommendations list into different risk categories. One is quite conservative, while still offering investors very attractive yields. Over the last few months, I’ve increased the number of preferred stocks on the recommendations list, in addition to a preferred stock ETF we’ve held for a number of years now.

My readers have a whole report on just the preferred stocks in our portfolio. Preferreds pay safe and secure dividends. They are called preferred because this type of share gets preference over common stock shares when dividends are paid.

DENNIS: The idea of “set it and forget it” just won’t work. Like it or not, investors must “manage” their investments to earn decent, safe income. Most people don’t have the skills or want to invest the time to do so.

How do you deal with these concerns with your subscribers?

TIM: I spend as much time talking to subscribers about portfolio management as I do about the specific investment recommendations. Just to let you know, in October I’m running a four-part live Master Class on portfolio management for dividend investors.

Just like you and Jo, many investors have moved into stocks out of necessity rather than desire. The yield for passive investors in fixed income products is terrible. Savers and retirees start looking for other ways to make their money grow. That usually means the stock market, which for some can feel complicated and confusing.

Income stocks will do the job with great yields. However, new to stocks investors often need some guidance on how many for how much investments to buy. The yields also don’t always indicate the level of risk. I really enjoy educating my subscribers on how to allocate their money.

DENNIS: You believe in a balanced portfolio, advising readers to hold cash (or short-term CDs), income-producing investments and holding precious metals and stocks to offset inflation.

When silver dropped below $13/oz. I bought WPM, a silver royalty stock. Even with some recent purchases over $50/share, my average cost is $33.46. They pay a $0.40/share dividend, for a yield a little over 1% at my cost.

That isn’t much of a dividend, but gold and silver don’t pay anything.

Is this something you recommend to your subscribers?

TIM: While my focus is on investing for income, I do share ideas outside of that arena. I also own gold and silver. For me, spreads and transaction costs have always been a big negative for precious metals.

Investors need to compare prices when buying metals. Online shopping makes it a bit easier, and it’s worth the time.

DENNIS: One final question. I want to go to the other end of the spectrum. I wrote two covered calls on part of my WPM stock. The strike prices were $52.50 and $55.00. The first garnered $1.25/share and the second $1.80. If they get called, I make even more profit.

Some consider writing covered calls risky. Isn’t it a win if the stock gets called and a win if it doesn’t?

If it’s not called, I’ll sell another one. The covered call income is 3-4 times the dividend. Double digit returns are certainly possible.

Tim, I’m not a stock picker, I leave that to experts like you that have all the proper tools and experience. This is not something for passive investors, but looks like it has some real potential.

Is this something people should take another look at?

TIM: Thank you for the opportunity to talk to your readers.

I do view covered call writing as the third strategy for the income focused investors, after high-yield investments and dividend growth stocks.

Covered call trading takes more education and work, but the returns can be very attractive. A lot of investors feel options are risky, but covered calls are the safest way to go. You can do well, but it requires staying on top of things.

However, let’s not get ahead of ourselves.

Conservative investors like Jo are dipping their toes into the water and understandably cautious. Accredited investors, like yourself with plenty of experience see things differently. I’d suggest we defer the covered call discussion for down the road.

Personally, I’d recommend you and Jo watch the four-part Master Class together. It’s designed for conservative investors who feel they really need to learn about stocks and dividends before they invest a lot of their money.

DENNIS: On behalf of our readers, thanks again for your time.

TIM: My pleasure, Dennis.

| People are creatures of habit, and persist in unprofitable behaviors long after they become a liability. – Subscriber Bernard D. |

Dennis here. A friend recently remarked, “It used to be that working and saving was the hard part in building wealth. Now it’s easy compared to today’s investment challenges. Managing our life savings is now my job, whether I like it or not.”

Passive investing won’t work anymore. Good yield from safe, fixed income CDs or bonds no longer exists, probably gone for our lifetime. It’s time to get on with the job and make our money grow safely!

That means we need to take measured risk in the stock market. That’s something Tim’s an expert at with his newsletter. I’ve been a subscriber to his Dividend Hunter for several years now.

I suggest you investigate how his service works to make growing and managing your savings a whole lot easier. Tim has offered our readers a terrific discount.

Tim has recently shown his subscribers how his portfolio works to deliver an 8%+ yield. It’s so easy to get started and he explains everything in plain English. Click HERE to check out the details.

I’m excited Tim is going to be offering a new Master Class on managing your portfolio for new dividend investors. I’ll keep readers posted on when it is available. Jo and I will be watching.