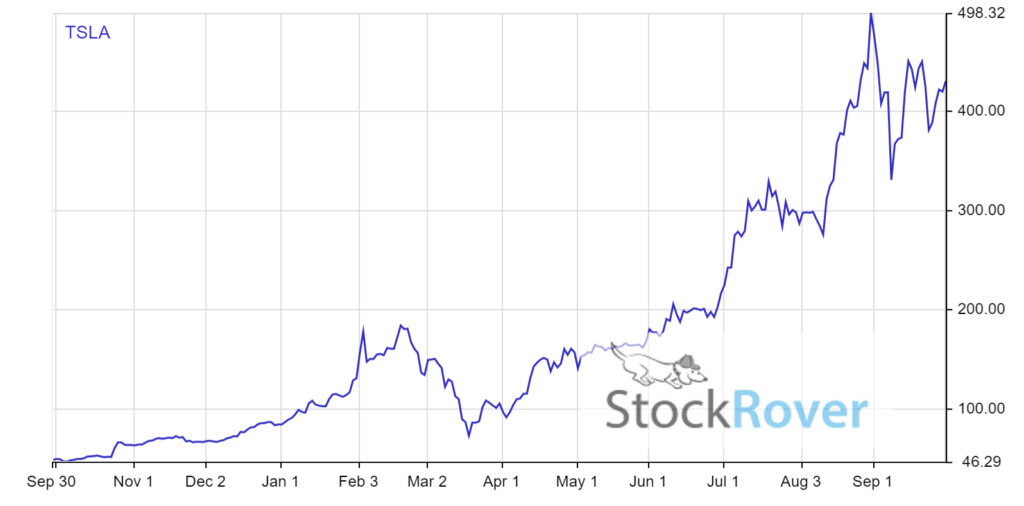

One look at Tesla’s (TSLA) stock in 2020 tells you that Wall Street loves electric vehicles (EVs).

However, Tesla is not the entire EV market. There are other companies in the space that are just as exciting.

A great way to invest in these other opportunities is through the use of a couple of special purpose acquisition vehicles, or SPACs.

So what exactly are SPACs?

In simple terms, SPACs are blank check or shell companies that go public with the idea that its managers will go out and find a company to buy. If a suitable target is not found within a specified time (usually two years), investors’ money is returned.

In a typical SPAC listing, the shell company sells a “unit” in its IPO for $10 dollars each. The unit includes one common share and a warrant to purchase another share later, typically at a strike price of $11.50.

If the SPAC does find an operating business to purchase within the two-year time limit, shareholders get to vote to approve the deal. If they decide to vote “no” and redeem their shares, they can get their $10 back in cash, plus interest.

SPACs have transformed from a niche part of the stock market to an extremely popular alternative route to the public market for some very exciting companies.

And that includes two companies in the electric vehicle space that are going public soon, as mergers with SPACs.

Buy And Hold This Dividend Stock Forever and Leave It For Your Grandchildren [ad]

QuantumScape

The first company is QuantumScape, a battery start-up company backed by auto powerhouse Volkswagen, Silicon Valley’s Kleiner Perkins, as well as Bill Gates’ Breakthrough Energy Ventures.

Volkswagen is its largest shareholder, having invested $300 million into the company.

The company seeks to commercialize a technology it says will nearly double the range of an electric car. QuantumScape adds that its technology offers a significant improvement to the energy storage of a regular lithium-ion battery, while also being safer and cheaper. The company also claims its solid-state batteries can reach 80% of capacity in 15 minutes.

QuantumScape’s battery cells use a solid ceramic electrolyte rather than the liquid one seen in most conventional lithium-ion batteries. The battery also contains a lithium metal anode rather than a graphite one, which allows the battery to store more energy.

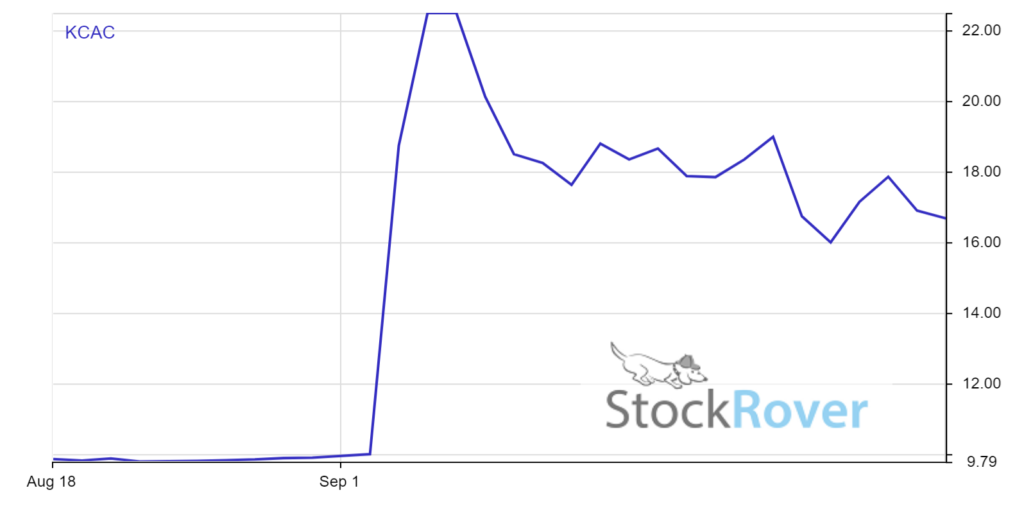

QuantumScape, which was spun out from Stanford University in 2010, is merging with Kensington Capital Acquisition Corp (KCAC) in a deal valuing it at $3.3 billion. Its goal by 2028 is to make enough batteries for 910,000 vehicles a year. That’s about the time by which industry experts believe solid-state lithium metal batteries will become commonplace.

The company says its batteries will actually not hit the market until 2024. If you want a company that has a business here and now, look at this:

ChargePoint

The world’s largest electric vehicle charging business—ChargePoint—will list its shares through a reverse-merger with another SPAC.

ChargePoint’s existing investors include auto giants Daimler and BMW, the engineering firm Siemens as well as the U.K. investment trust Baillie Gifford, which has large holdings in technology companies including Tesla.

The company’s CEO, Pasquale Romano, told the Financial Times: “We are in a breathtakingly large market”—and he is correct. Demand for electric cars has risen across the world despite the pandemic.

ChargePoint was founded in 2007 and installed its first recharging stations a decade ago, generating revenues, so it is a legitimate business. To date, the company has partnerships with 4,000 businesses including retailers, Target and Ikea, and it has already installed more than 100,000 charging points across the U.S. and Europe, with an additional 130,000 available through roaming agreements with other providers. That said, many more stations are needed—especially with some of the leading developed countries phasing out sales of new internal combustion engine models within the next 15 years.

With ChargePoint still in expansion mode, the company did report a 2019 net loss of $133 million on revenues of $147 million.

ChargePoint will merge with Switchback Energy Acquisition (SBE) in a $2.4 billion deal.

Both QuantumScape and ChargePoint look to be interesting ways to play the move toward electric vehicles globally.