If Vice President Joe Biden is elected President, his tax plan to increase federal government revenue by $3.0 trillion relies heavily on higher corporate income tax collections. If the plan goes into effect, the higher corporate taxes could give a lift to the stocks of companies that, by law, do not pay corporate income taxes.

The real estate investment trust (REIT) business structure allows companies not to pay corporate income taxes. In an era with much higher corporate income taxes, REITs could be winners for investors’ portfolios.

Here is the breakdown of Biden’s corporate income tax proposals, as outlined by the Tax Foundation.

- Increases the corporate income tax rate from 21 percent to 28 percent: Understand that what looks like a 7% increase is actually a 33% increase when you calculate how much more a corporation will pay.

- Creates a minimum tax on corporations with book profits of $100 million or higher: The minimum tax is structured as an alternative minimum tax—corporations will pay the greater of their regular corporate income tax or the 15 percent minimum tax while still allowing for net operating loss (NOL) and foreign tax credits. This proposed new tax means that corporations that are profitable but under the current tax law do not pay income tax will be required to pay some tax. My reading indicates this alternate minimum tax will offset companies’ ability to deduct the costs of capital improvements.

Looking at these potential corporate tax increases brings us to the investment potential of REIT stocks. REITs are a type of “pass-through” business structure. By law, an REIT does not have to pay corporate income tax as long as it pays at least 90% of net income as dividends to shareholders.

Related: How To Profit From a Possible Higher Corporate Income Tax Rate if Joe Biden Wins

Also, because REITs—as the name implies—typically own commercial real estate, much of the free cash flow generated is sheltered by depreciation. Typically an REIT will have free cash flow much higher than reported income and can easily pay more than 100% of net income as dividends to investors.

For investors, REIT dividends are not tax-qualified, so REIT shares may be best owned in tax-qualified retirement accounts. That decision depends on your personal marginal tax bracket.

Individual REITs specialize in specific types of commercial property. The diverse range of REIT categories lets you, as an investor, put together an REIT portfolio that covers a large portion of the different business sectors. Here are three examples:

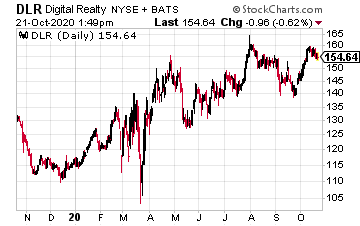

Digital Realty Trust, Inc. (DLR) is a data center REIT. The company provides essential data storage to interconnected businesses and entities around the world.

Currently, DLR owns 280 data centers located in 22 countries on six continents. The company bills itself as the “Heart of the Internet.” Digital Realty has increased its dividend for 15 straight years.

The shares currently yield 2.9%.

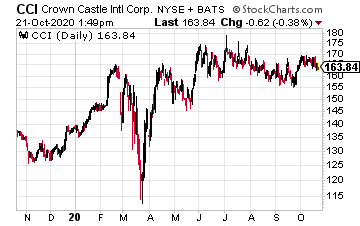

This recent headline: “Cell Tower REITs: 5G Is Here.” It illustrates that you can use REITs to invest in the growth of service.

Crown Castle International Corp. (CCI) owns over 40,000 cell towers, 80,000 route miles of fiber cable, and 70,000 small cells on air.

The Crown Castle dividend is growing at a 6% annual growth rate, and the current yield is 2.8%.

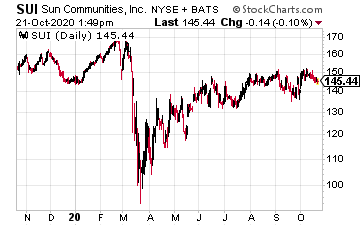

Finally, manufactured home communities benefit from retirees looking to downsize into affordable housing in warmer climates.

Sun Communities, Inc. (SUI) owns and operates or has an ownership interest in 426 manufactured housing and recreational vehicle communities located in 33 states.

Most of the communities are restricted to residents age 55 and up. The Sun Communities dividends have increased for four straight years.

The current yield is 2.2%.