For 2020, energy has been at the bottom of the list of S&P sectors. Year-to-date, energy as a market sector remains down by over 50%, and the investing public continues to avoid energy company stocks. However, the business of energy has held up well through the pandemic—especially the midstream energy companies.

Energy midstream services connect upstream producers to downstream buyers and users. Midstream assets include pipelines, gathering systems, processing plants, storage facilities, and terminals.

During the 2020 first quarter pandemic-triggered stock market crash, the high-yield midstream stocks and MLPs sold off by as much as 90%. Investors expected big dividends to be slashed. But despite market expectations, many midstream companies have sustained their distribution rates. The result—with share prices staying low—is tremendous yields with dividends that should be sustained. I’ll show you a few later on.

For comparison, the Alerian MLP Infrastructure Index (AMZA) has a five-year average yield of 8.5%. Currently, the index components’ yield averages a whopping 13.5%. Simultaneously, cash flow coverage of the dividends payments is as strong as it has ever been. Getting back to the average yield means share values must climb by more than 50%.

Buy The #1 Stock to Turn $25k Into Tens of Thousands of Dollars For Life [ad]

Here are three energy midstream master limited partnerships with yields that look unbelievable. These companies continue to confound the naysayers and pay big dividends.

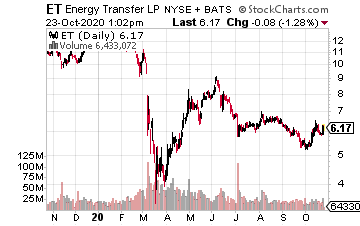

Energy Transfer LP (ET) is a $15 billion market cap company that provides a broad range of midstream services in all major energy production basins.

The company owns 90,000 miles of pipelines.

It transports 25% of all the natural gas and 35% of the crude oil produced in the U.S. Energy Transfer has paid its current quarterly dividend since it was last increased in late 2017.

Expect the payout to continue and enjoy the 21% current yield.

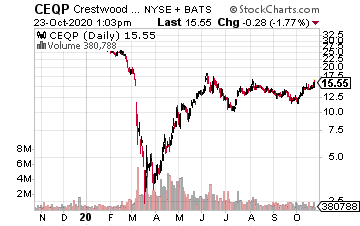

Crestwood Equity Partners LP (CEQP) is a billion-dollar MLP that owns and operates midstream assets located primarily in the Bakken Shale, Delaware Basin, Powder River Basin, Marcellus Shale, Barnett Shale, and Fayetteville Shale.

Following a significant restructuring five years ago, Crestwood has paid the same quarterly dividend since the 2016 second quarter.

You can count on the dividend rate and enjoy the current 17% yield.

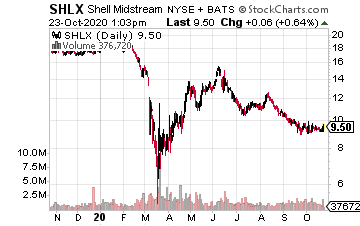

Shell Midstream Partners, LP (SHLX), was spun-off by Royal Dutch Shell (RDS.A) in late 2014. The Shell Midstream dividend has increased by 162% since the IPO.

Through the pandemic-marred 2020, Shell Midstream has sustained a level distribution, with the November 13 payment declared last week. Shell Midstream yields a very attractive 20%.

These three highlighted midstream companies are MLPs that report tax information on IRS Schedule K-1. In my Dividend Hunter service, I show subscribers how to earn similar yields without going through the K-1 hassles.