Today is the day before one of the most contentious presidential elections in memory—at least my memories, which go back to JFK. I figure discussing detailed investment strategy will get lost in the noise, so today, I will use this platform to express my thoughts on broader aspects of life in the financial world. They may even still mean something the day after tomorrow.

I have discussed with others how much I want to see the end of 2020 and to start fresh with a new year. Our lives have been tremendously disrupted in one or many forms. People I talk to are very ready to get back to lives that include the usual things they enjoy, such as going to movies, dining out, live sports, or even just getting the kids out of the house by sending them to school.

This year, I followed up on a long-term dream and bought a small, but upscale, travel trailer. I bought it in part with the income generated from my portfolio following my own Dividend Hunter system. Being able to get away during the warmer months helped me stay level-headed and focused.

With the trailer I traveled through much of the West and Midwest. I found it interesting to see how different areas took seriously, or not so much, the wearing of masks and social distancing. In Wyoming, it was hard to find anyone wearing a mask. However, the Jackson Hole area had numerous restrictions, including closed showers in the RV park.

I don’t think more lockdowns are the solution. I am confident far fewer people would follow lockdown orders. I believe the release of coronavirus vaccines expected in December, with widespread availability in the new year, will be the turning point.

Have you noticed there are “experts” on both sides of every argument? When a politician says: “follow the science,” he or she means: “follow the scientists on my side of the argument.”

On the investment front, I am surprised by how the stock markets diverged into two distinct sectors. On one side, the part that gets the financial news coverage, is what I deem a bubble in tech or tech-related stocks.

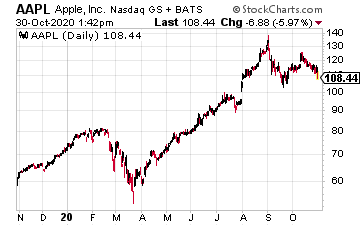

Stock prices in the high-flying sectors have lost touch with business fundamentals. Apple, Inc. (AAPL) is a great company, but 15% to 20% annual revenue and profit growth does not justify 100% stock appreciation over the last year.

The explosion in new SPAC (Special Purpose Acquisition Companies) truly indicates bubble-level pricing for certain types of stocks. As of October 29, 166 new SPAC IPOs have hit the market in 2020, with proceeds totaling $61.5 billion. That compares to 59 SPAC offerings for $13.6 billion in 2019 and an average of 11 new SPACs per year for 2009 through 2016.

A SPAC is a blank check company, giving the sponsor hundreds of millions of dollars ($370 million per IPO this year) with which to buy a company that becomes the publicly traded business of the SPAC. Using the SPAC route allows the sponsor to skip the scrutiny of a traditional IPO. The sponsor also pockets the money happily supplied by eager investors, with no obligation to put a viable company into the SPAC shell.

The final bubble clue to watch for is money managers providing ever more outrageous justification on why stocks that have climbed by multiples of 100% will continue to appreciate. I like watching the financial news just to listen to these far-fetched stories.

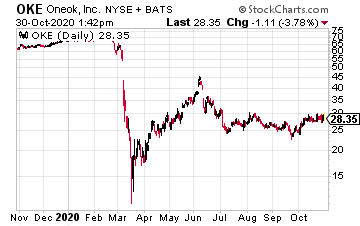

Value stocks sit at the other end of investor interest and stock market returns. Stocks classified as value investments crashed in the spring and have not recovered. The entire energy sector provides an obvious example.

The S&P 500 energy sector is down 54% year-to-date. Yet there are energy companies, especially midstream service providers, that posted 2020 third-quarter results that surpassed their results from the same quarter in 2019.

For example, ONEOK, Inc. (OKE), which gathers, processes, and transports natural gas and natural gas liquids (NGLs), just reported mid-teen increases in EBITDA and operating income compared to a year ago.

OKE is a major holding in my Dividend Hunter portfolio and currently yields 12.8%. The next payment is on the 13th. There are two more energy stocks in the portofolio paying even more. Here’s how to get access to them.

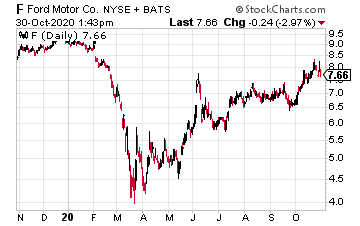

Third-quarter results from Ford Motor Company (F) reported revenue of $34.7 billion and $6.3 billion in adjusted free cash flow. The Ford share price is down 17% for 2020. Ford has a $30 billion market cap and trades at less than 25% of revenue.

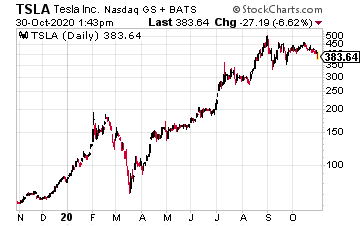

In contrast to the Ford valuation, Tesla (TSLA) reported free cash flow of $1.4 billion on $8.7 billion of revenue. Tesla has a market cap of $380 billion, and the stock is up 385% year-to-date. In what rational world does the market justify pricing Tesla at 40 times the more profitable Ford, based on market cap to revenue?

I confess to being a frustrated value investor. However, history shows that stock market bubbles eventually pop, usually dramatically. History also shows that over the long term, value outperforms growth, especially if you start from a period when the valuation ratios are far out of whack. Maybe once we get past the election, logic will begin to return to stock valuations.

Mean while my Dividend Hunter readers and I will continue collecting our dividend payments every week with an average yield of 9.9%.