Cisco Systems (CSCO) has struggled throughout 2020 after shares came in at $48 and are down 7% despite the strong gains observed throughout the tech sector and on the Nasdaq this year.

CSCO was once considered one of the “four horseman” of the tech sector throughout the 1990s—along with Dell, Microsoft, and Intel—and one of the best ways to invest in the internet.

While Microsoft has remained a steady force, Cisco Systems and the others have been replaced by the likes of Apple (AAPL), Facebook (FB), and Google (GOOGL) the leaders of the continued internet boom.

While valuations of all the aforementioned stocks can be debated, Cisco Systems trades at a current price-to-earnings of 18 and pays an annual dividend north of 3%, or $1.44. The yield may not look too great, but the company’s relatively long payment history is pretty reliable, with dividends typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable, but that’s not something current CSCO shareholders need to worry about.

Cisco paid out 40% of the free cash flow it generated in 2020 as dividends, suggesting the dividend is affordable. The company’s dividend is covered by both profits and cash flow, a sign the dividend is sustainable.

Of course, with its 52-week low at $32.40, there is risk in owning shares of CSCO at current levels. The nearly 50% rebound off the March low, to $48 in early August, was impressive… at least until the company announced its fourth-quarter earnings.

At that time, CSCO topped Wall Street’s estimates by $0.06 per share, along with a revenue beat; however, the company said first-quarter revenue was expected to decline 9%–11% from the prior year, with forecasts at $12.25 billion.

Fast forward to November, with Cisco Systems reporting first-quarter earnings of $0.76 per share, versus expectations of 70 cents—another six-cent disappointment. Revenue came in at $11.9 billion, but that was actually ahead of lowered forecasts at $11.85 billion.

For the coming second quarter, Cisco sees adjusted earnings per share coming in at $0.74–$0.76, above estimates of $0.73, but revenue growth between 0% and -2% year-over-year with forecasts at $11.63 billion.

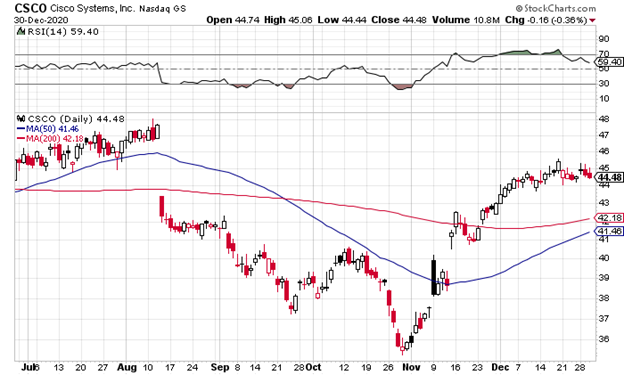

With the company’s next earnings release scheduled for early February, the headline risk is of less importance than the current technical setup. The chart below shows a consolidation pattern between $44–$45 throughout December, with the latter getting stretched and the December peak at $45.57.

If shares can clear and hold the $45.50 level, there a run towards $48–$50 could be in the mix. With January options expiring mid-month, the February call options look like a better bet to give this trade more time to play out.

The CSCO February 46 calls are currently trading for $1.05 and would allow six weeks for shares to make a run towards the aforementioned price targets. If shares can trade to $48.10 by mid-February, these call options would double from current levels as they would be $2 in the money.

Both the 50-day and 200-day moving averages are curling higher, another positive technical development. However, a close below the $43.50–$44 area would be a slightly bearish development if this were to occur at some point in January. It would also likely signal a further pullback towards the moving averages with traders cutting losses to save the remaining premium.