For income investors, the last 11 months have been, to paraphrase Dickens, “the best of times, the worst of times.” The February-March 2020 market crash was especially brutal on the high-yield investment sectors.

Without a lot of information, I had to analyze my Dividend Hunter recommendations and decide which were best to sell and which to hold. Fortunately, we kept the majority of our portfolio stocks and proceeded to acquire shares at great prices, making my subscribers look really smart now more.

Last April through June, my subscribers followed the advice and bought or added shares when the rest of the investing world was selling in fear. Investments made then are now up 60% to over 300%.

Preferred stocks are one high yield category that went deeply “on-sale” last Spring, allowing us to pick up safe, high-yield dividends at great prices. I added preferred stocks to the Dividend Hunter recommendations list, and from now on, they will stay on the list. Preferreds provide an extra level of safety, the value of which became very clear during last year’s market gyrations.

For subscribers, I provide a list of recommended individual preferred stocks. I keep the list updated and change out stocks as prices and yields fluctuate. Owning individual preferreds provides stability since most preferred stocks trade close to the typical $25 par value.

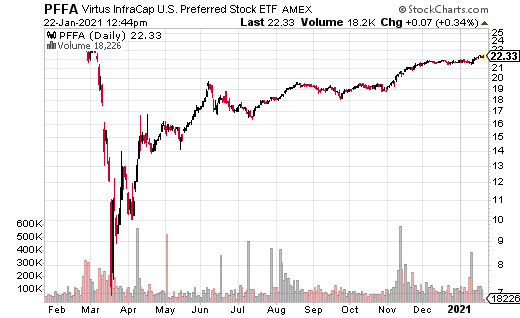

For packaged product preferred stock investing, I recommend the Virtus InfraCap U.S. Preferred Stock ETF (PFFA). While it will be more volatile than individual preferred stocks, the PFFA share price is more stable than most high-yield investments.

PFFA is an actively managed preferred stock ETF. The fund uses a moderate amount of leverage to boost income for dividends. Dividends are paid monthly. To start 2021, in January, the monthly dividend increased by a penny to $0.16 per share. That gives a current yield of 8.6%.

The events of 2020 taught me, and by association, my Dividend Hunter subscribers, the value of preferred stocks investments in an income-focused portfolio. I also firmly believe and recommend that preferred stock exposure comes from a combination of a selected ETF and selected individual preferred stocks. This approach provides a safe income stream, combined with a very attractive 8% average yield.