Last Monday, July 19, 2021, the U.S. stock market dropped almost 950 points, or 2.7%, on the Dow Jones Industrial Average. While 2.7% doesn’t sound like a lot, the negative dollar figure was eye-opening when applied to a sizeable brokerage account. I received many subscriber emails asking what to buy, what to sell, what to do.

With my dividend-focused strategies, I often discuss with my subscribers how taking advantage of stock market declines, whether a full-blown correction or a one-day mini-crash, creates an opportunity to build our wealth.

I don’t attempt to time the market. I am not smart enough to predict the future, and every strategy I have seen (with 40 years in the market) fails when you need it the most.

With an income-focused approach, however, money can be invested at any time, and your income stream will grow. The goal of my Dividend Hunter strategy is to build a stable and growing income stream. Share prices are what they are when you have money to invest. If you buy shares at any price, you will still boost your future income.

With this mindset, when the stock market declines, lower share prices are a buying opportunity. You will grow your income stream at a higher yield, and also build your wealth as share prices recover. History shows that after the stock market drops, shallow or deep, short term or extended time, share prices of quality investments always recover the losses.

So what should you buy when days like last Monday happen? Here are a couple of criteria to consider:

First, always work to have balance in your portfolio. If you have an underweight position on some great investments, that’s the first place to look for “stocks on sale.”

Look at those stocks you own or would like to own that have fallen the furthest. Earlier this week, I noted that Simon Property Group (SPG) dropped by $10 per share during the Monday sell-off, but then gained $14 over the next two days. This would have been a good pickup. Another good pickup would have been EnLink Midstream (ENLC), which dropped 19% over the previous week by the bottom on Monday.

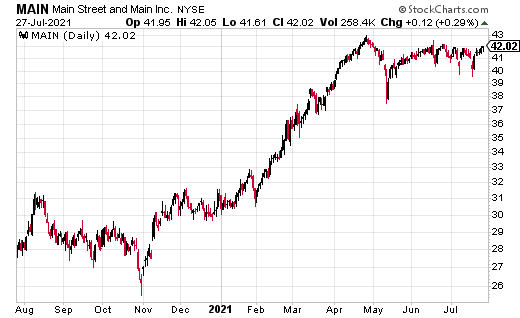

You should also aim to pick up shares of stocks that typically trade at a premium to similar stocks. Business development company Main Street Capital (MAIN) is a great example. It can be hard to add shares of Main Street when the current yield is below 6%. During the Monday drop, the yield climbed back above that 6% target.

If you don’t want to keep that close of a watch on your income-focused investment portfolio, consider my Dividend Hunter service, where I send out a Stock of the Week every week, outlining one of the better values out of the Dividend Hunter recommendations list.