The movie theater industry has been one of the hardest hit sectors following the COVID-19 pandemic; however, cinemas are showing signs of rebounding in recent months as more and more blockbuster movies are released. That being said, the recovery has been slow and erratic and could continue over the foreseeable future.

It is no secret AMC Entertainment (AMC) has become one of the most popular ways to play the sector following its fascinating run from under $2 per share to a 52-week peak of $72.62. The action has been volatile, but AMC remains one of the more popular meme stocks, with a current market cap north of $20 billion.

It is important to note that AMC has used this popularity to issue more shares and raise cash to survive over the near-term. The company continues to lose money and is expected to post losses well into 2022.

Perhaps the best way to play a possible recovery of the global movie industry is through Imax (IMAX). The company, which focuses on premium experiences and blockbusters, has been relatively less affected by structural issues affecting the movie industry overall: although the company has also posted losses over the past four-quarters, IMAX is expected to be profitable in 2022. Analysts, on average, expect fiscal-year earnings could come in at $0.72 per share on revenue of roughly $350 million.

In its most recent quarter, IMAX beat expectations after reporting a loss of $0.12 per share, versus forecasts for a loss of $0.27. Second-quarter revenue of $51 million was well above consensus of just over $40 million, following a faster pace of the reopening of movie theaters and higher-than-expected box office receipts.

Another aspect that separates IIMAX from AMC is that its China business is focusing more on local language movies. This means any possible delays in the release of Hollywood blockbusters is less of a concern for its Chinese operations.

Fourteen analysts currently follow IMAX, with four issuing strong buy ratings and seven with a buy. Two have a hold rating, and there is one sell recommendation.

One analyst recently raised his firm’s price target on Imax to $30 from $28, keeping a Buy rating on the stock. The bump higher in the share price came after the analyst said he is “increasingly confident” in a pre-pandemic box office return in 2022.

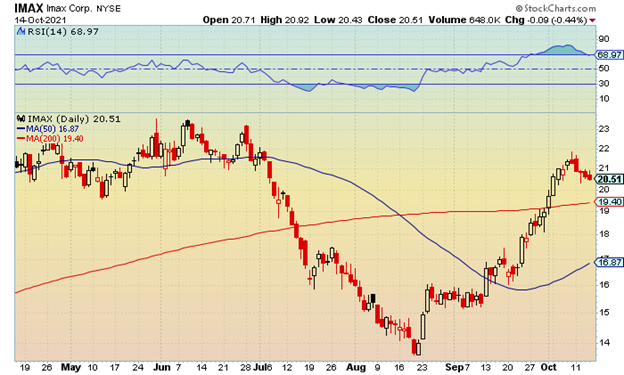

As far as the technical outlook, shares have been in a strong uptrend since forming a “double bottom” in mid-August after testing a low of $13.60 and $13.62 in back-to-back sessions. Current resistance is at $21.75-$22 with a close above the latter signaling a possible trip towards $23-$23.25 and levels from May and June.

The relative strength index (RSI) shows shares are slightly overbought after testing the 80 level earlier this month and remains near 70. A pullback towards $20-$19 and the 200-day moving average would represent a better buying opportunity.

Given the ongoing risks of possible new covid strains, there is still risk when it comes to investing in the movie theater industry. However, Imax appears to be a better way to bet on the recovery the global movie industry than AMC.