One of the most well-known names in finance is Visa (V). The company operates the world’s largest electronic payments network, providing processing services and payment product

platforms, including credit, debit, prepaid, and commercial payments.

Visa traces its roots back to the issuance of the first Bank of America credit cards in the late 1950s. Visa as a brand was formed in 1976. In the decades since, the company has been one of the largest beneficiaries of the shift toward electronic payments.

Visa, along with Mastercard (MA), is enjoying what is essentially a payment duopoly, due to their strong network effects. The more consumers plugged into its payment network, the more attractive the payment network becomes for merchants… which in turn makes the network more convenient for consumers, and so on.

Both companies have long-established relationships with the world’s major banks. This means retailers need to accept their cards or otherwise they will miss out on a huge amount of business.

In the 2020 fiscal year, Visa processed almost $9 trillion in purchase transactions. The company has almost 16,000 financial institution partners, 3.4 billion cards in circulation, and more than 50 million merchants accepting their cards. According to the Nilson Report, Visa holds more than 50% market share (by purchase volume) in the U.S., Europe, Latin America, and the Middle East/Africa.

I like that type of dominance, so now let’s take a closer look at the company.

Visa’s Dominance

In its latest earnings report, Visa reported earnings per share of $1.62 for its fiscal fourth quarter of 2021. That was up from $1.12 the prior year and above the $1.54 consensus estimate. Payment volume growth was strong (up 39%), while cross-border volume rebounded by 41%, as some international travel restrictions were eased.

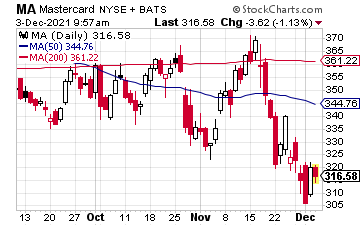

Visa shares trade at about 28 times fiscal 2022 earnings per share estimates, below the 31 multiple for peer MasterCard. So, Visa needs to play catch-up—and it will. After all, Visa has higher operating margins than MasterCard. And the company also processes roughly twice as many transactions as MasterCard.

Visa is a large-cap growth name with consistent and enviable mid- to upper-teens earnings growth prospects. Between 2009 and 2019, it sported a 21% compound annual earnings per share growth. Visa has also translated its dominant position into an enviable level of profitability. Operating margins (using net revenue) in fiscal 2020 were 66%, and margins have generally trended upward because of the scalability of Visa’s business.

What the Future Holds for Visa

Visa’s strong growth trend is likely to continue. Its management offered fiscal year 2022 guidance that included revenue growth at the high end of the mid-teens.

Simply put, Visa’s position in the world of electronic payments is unparalleled. It is very doubtful that a company building a new network with comparable size and reach would be realistic any time in the foreseeable future. The company’s position within the current global electronic payment infrastructure is essentially unassailable.

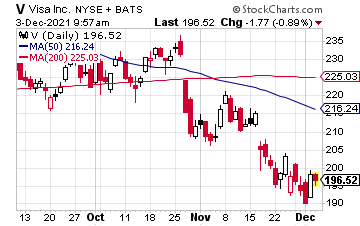

However, Visa’s stock came under selling pressure recently, thanks to a dispute with Amazon (AMZN).

Amazon has announced that from January 19, 2022, forward it will no longer accept Visa credit cards issued in the U.K. due to the high fees Visa charges for processing credit card transactions. However, keep in mind that MasterCard is Amazon’s credit card issuing partner in the U.K.

This move by Amazon is the latest in a list of attempts made by large retailers to bring down these fees. In 2014, Walmart (WMT) sued Visa for $5 billion for charging ‘unreasonably high’ fees, and earlier this year, Amazon introduced a surcharge on Visa transactions in both Australia and Singapore.

Amazon still has a partnership with Visa in the U.S… but that may also be about to change. The ecommerce giant is reportedly considering dropping the partnership, according to a Reuters article that noted Amazon is currently in talks with Mastercard and American Express.

Amazon also signed a deal earlier this year with buy-now-pay-later service Affirm (AFRM) and signed a partnership with third-party payment platform Venmo, which is owned by PayPal (PYPL).

But that’s just a lot of noise. Visa’s operating margin of 66% is the fourth highest in the S&P 500, which translates to its earnings not being very sensitive to a fall in sales.

Ken Suchoski, a payments analyst at research firm Autonomous, told the media recently that “If the Amazon co-brand portfolio flipped to Mastercard, we believe the earnings impact to Visa would be less than 1%.” I agree, which makes Visa a buy after the recent selloff that dropped the stock about 20% from its most recent peak in October. Any price under $200 a share is a bargain.