Chip shortages could last well into 2023, at least according to Intel CEO Pat Gelsinger.

In an October interview with CNBC, Gelsinger said: “We’re in the worst of it now, every quarter, next year we’ll get incrementally better, but they’re not going to have supply-demand balance until 2023.”

While the shortage continues to be bad news for companies that make automobiles, electronics, medical devices, phones, and millions of other products, it’s great news for chip-related exchange traded funds (ETFs) like the Invesco Dynamic Semiconductors ETF (PSI), which is comprised of 30 U.S. semiconductor manufacturing stocks. With an expense ratio of 0.56%, some of PSI’s top holdings include Advanced Micro Devices (AMD), NVIDIA Corp. (NVDA), Broadcom Inc. (AVGO), Applied Materials (AMAT), Qualcomm Inc. (QCOM), Intel Corp. (INTC), and Analog Devices (ADI).

Since the beginning of 2021, PSI ran from a low of about $105 to a current high of $152. If the ETF can break above double-top resistance around $152.38, it could potentially test $160.

Aside from PSI, other top semiconductor ETFs to watch include:

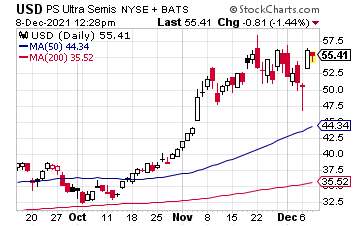

ProShares Ultra Semiconductor (USD): With an expense ratio of 0.95%, USD seeks returns twice that of the Dow Jones U.S. Semiconductors index.

Some of the fund’s top holdings include NVIDIA Corp. (NVDA), Intel Corp. (INTC), Broadcom Inc. (AVGO), Applied Materials (AMAT), Micron Technology (MU), and Lam Research (LCRX).

Since the start of 2021, USD ran from a low of about $26 to a current high of $54.76. From here, it could see higher highs until the semiconductor supply-demand issue begins to balance out.

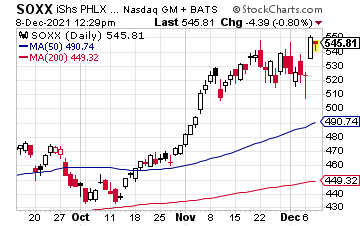

iShares Semiconductor ETF (SOXX): With an expense ratio of 0.43%, SOXX invests in U.S. semiconductor stocks, such as NVIDIA Corp., Broadcom Inc., Intel, Qualcomm, Advanced Micro Devices, Xilinx (XLNX), Marvell Technology (MRVL), and KLA Corp. (KLAC).

Since January, SOXX ran from a low of about $373, all the way up to $538. This ETF could see higher highs, near-term on the semiconductor story, too.

While you can always buy individual semiconductor stocks, an ETF can provide better diversification among many semiconductor names, at far less cost.