Dear Investor,

On Monday, I showed you my pick for the conservative dividend stock to buy for the New Year.

Today, it’s time for my more speculative pick – higher stock and income upside, but with a tad more risk.

Let’s get to it…

On May 20, Blue Owl Capital, Inc. (OWL) started trading on the New York Stock Exchange. The company was formed with the combination of Owl Rock Capital Group, Dyal Capital Partners, and Altimar Acquisition Corporation.

Altimar was a special purpose acquisition corporation (SPAC) that provided the shell company under which Owl Rock Capital and Dyal Capital combined to become a publicly traded corporation quickly.

The name Owl Rock may be familiar. Owl Rock Capital Group manages a publicly traded business development company (BDC), Owl Rock Capital Corp (ORCC). I like the name change to reduce the confusion between the money management company and the BDC. Besides managing publicly traded ORCC, Owl Rock Capital Group operates several more private BDCs.

Dyal Capital invests in minority stakes in private equity companies. Here is how Forbes describes the new, merged company:

…the motivations behind the deal are relatively simple: To create a one-stop shop for private equity firms in need of financing. If a firm wants to add capital to its balance sheet to pursue new strategies or deal with succession planning, it can turn to Dyal. If a portfolio company needs a loan, it can turn to Owl Rock. Blue Owl might never actually conduct a buyout of its own. But the firm is positioned to be a fulcrum of the larger buyout ecosystem, operating as a key part of the infrastructure that helps deals get done.

The combined company sports an approximate $12 billion market cap. A recent presentation shows a total of $70 billion of assets under management.

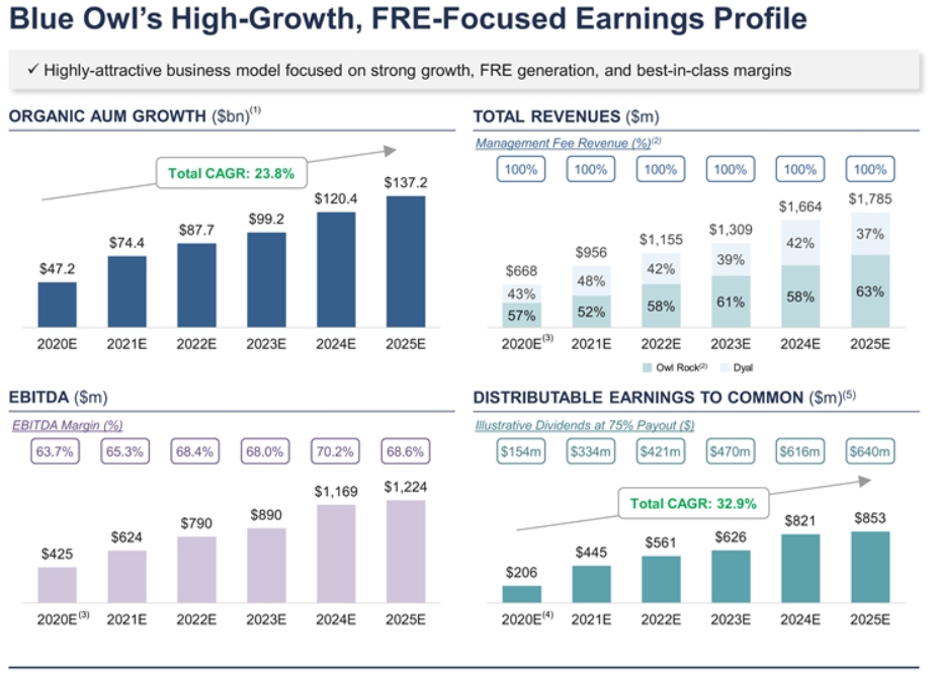

I’m excited by the company’s growth projections. These tables are from an SEC-filed presentation. Note: FRE = fee-related earnings.

The third-quarter earnings presentation highlighted the company’s forecast of 46% annualized earnings growth for 2021 through 2023.

More excitement ensued when I read about Blue Owl’s dividend plans. The company expects to have a 60% to 90% payout ratio. From the post-merger presentations, management stated that they seek to grow earnings and dividends by more than 18% compounded annually through 2023. It appears that by the end of the third quarter, those projections had more than doubled.

The company declared a third-quarter dividend of $0.09 per share, which gives a current yield of 2.4%.

Investment Considerations

The OWL share price has been very volatile since the May 2021 SPAC merger. The shares now trade near the midpoint of the $12 to $18 trading range for the last seven months.

The big question is whether the newly combined company can live up to its earnings and dividend growth projections. Blue Owl is a brand-new investment management company with only one quarter as a publicly traded stock under its belt.

As of the end of 2021, Blue Owl appears on pace to meet those growth goals. In October, the company agreed to purchase Chicago-based Oak Street Real Estate Capital and its investment advisory business for a purchase price of $950 million. In December, the company acquired Ascentium Group Limited to establish its physical presence in Hong Kong, strengthening its presence in the Asia-Pacific region.

The investing public has not yet become aware of Blue Owl Capital, which is on its way to becoming a powerhouse asset manager. I will not be surprised if this stock posts a 100% total return in 2022.And remember, that’s just one of many fast-growing dividend stocks in my Monthly Dividend Multiplier portfolio. To learn more about how this portfolio could help you grow your income and your stock portfolio at the same time, click here.