Matterport (MTTR) is one of the purest plays in the new market being referred to as the metaverse, and it has started to gain traction after Facebook officially changed its name to Meta Platforms (FB) last November.

At the time, Facebook’s CEO and founder, Mark Zuckerbrrg, said: “The metaverse is the next frontier in connecting people, just like social networking was when Facebook got started.”

In lay terms, the metaverse is simply an online virtual world that incorporates augmented and virtual reality, 3D holographic avatars, video, and animation, along with other forms of communication. As the metaverse expands, the goal will be to offer you a surreal alternative world in which to coexist.

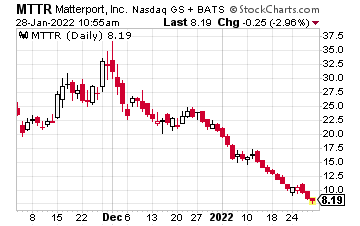

This is where MTTR comes into the picture, as it is believed to be one of the key companies helping Meta Platforms build its version of the metaverse. Shares certainly responded following the transformation news of Facebook, with the high hitting $37.60 at the start of December.

Since then, shares of MTTR have tumbled 70% and recently tested a low of $9.36, with its 52-week low at $9. The company become publicly traded following its reverse merger with Gores Holdings VI, a SPAC (special purpose acquisition company), in last July, at a price of $14.

Matterport provides a 3D data platform that enables users to design, construct and operate metaverse communities. It currently has 6.2 million spaces under management and 439,000 subscribers with a presence in 170 countries, according to its website.

Investors love the growth rate as these numbers represent a 116% third-quarter increase in subscribers, year-over-year. The company is expected to announce fourth-quarter numbers during the second week of March.

Analysts expect Matterport to report a loss of $0.09 per share on revenue just north of $25 million. Looking forward to 2022, Wall Street has penciled in a full-year loss of $0.21 on revenue of $160 million.

There are currently only five analysts who cover the stock, with one strong buy rating and four buy ratings. With other players popping up in the metaverse sector, such as Microsoft (MSFT) and Alphabet (GOOG), more coverage could come on board if Matterport gains additional traction.

Given the steep selloff, shares seem to be at an attractive entry point for starting to build a small position, with the opportunity to add at lower levels on a continued selloff. With the stock in the single-digits, long-term investors might do well once the company becomes profitable, or if a takeover candidate emerges.

As for an option trade, the MTTR 2023 January 10 calls are going for $3.75 and do not expire until January 20th, 2023. This would give a savvy trader nearly 12 months for shares to clear $13.75 and the breakeven point at current levels.

If shares trade above $17.50, these call options would be $7.50 in-the-money for a 100% return. However, the position would lose money if shares are below $13.75 by next January, and the calls would expire worthless if shares are below $10 by then.

Given this risk/reward setup, MTTR stock seems like a safer bet, as you would make 100% if shares recover the $19 level over the next year or two. The options would require less capital as $375 would allow you to control 100 shares into next January by buying one contract of the aforementioned calls. A hundred shares of the stock would cost around $9.50, but you’ll own them as long as the company remains in business.