Western Gas Partners LP (NYSE:WES)

Investment Synopsis:

Western Gas Partners is a high-growth gathering and processing MLP. The company’s fortunes are closely tied to the North American drilling and production operations of Anadarko Petroleum. Whether Western Gas can continue its growth trajectory is questionable in the current low energy price environment. Potential investors should wait for clearer 2016 capital spending guidance from Anadarko.

• IPO Date: May 9, 2008

• Market Cap: $14.0 billion

• Annual adjusted EBITDA: $750 million (midpoint of 2015 guidance)

• GP/Sponsor: Western Gas Equity Partners LP (NYSE:WGP)

Distribution Facts

• Current yield: 5.75%

• TTM distribution growth: 15.4%

• Forecast annual distribution growth rate: 12%-14%

Business Operations

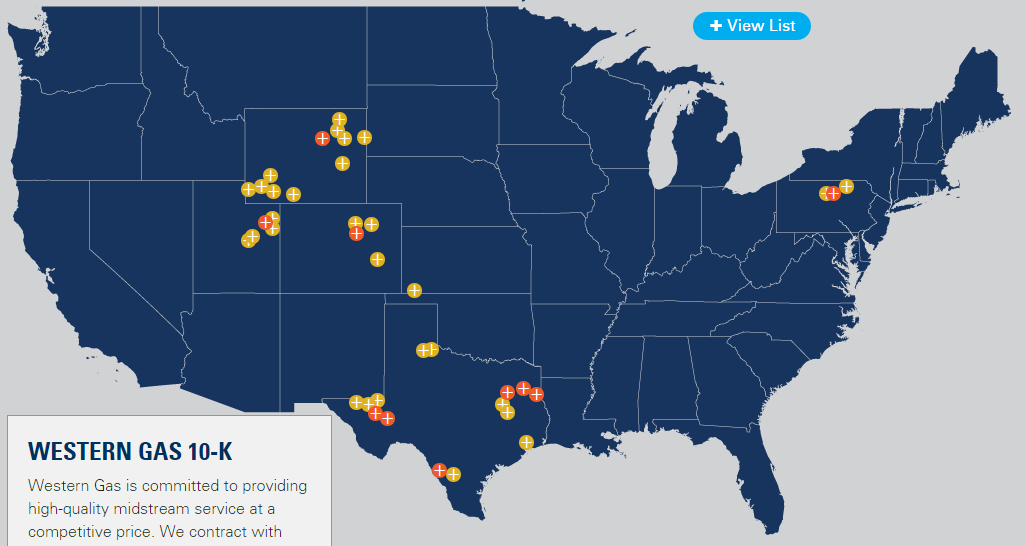

Western Gas Partners is a pure play natural gas, NGLs, and crude oil gathering and processing midstream company. Through the general partner, Western Gas Equity Partners, WES is controlled by Anadarko Petroleum Corp. (NYSE:APC) and the MLP does the majority of its gathering services for Anadarko. From the 2014 Western Gas annual report, the company owned and operated 14 natural gas gathering systems, 14,000 miles of pipeline including four natural gas pipelines, three NGL pipelines and one crude oil pipeline, eight natural gas treating facilities, and 13 natural gas processing facilities. The company’s areas of operation closely align with Anadarko’s onshore North American exploration and production operations. This map shows the locations for assets owned by Western Gas in gold and those owned by Anadarko, in red.

The Western Gas revenues are 98% fee based and fixed price. Only 2% are subject to energy commodity price fluctuations. This MLP has been a high distribution growth investment, with steady mid-teens annual distribution growth resulting in distributions that are 150% higher than the rate at the time of the company’s 2008 IPO. The growth model has been fueled by midstream assets developed by Anadarko and then transferred via the typical MLP drop down process to Western Gas. According to recent information from Western Gas, $3 billion in assets have dropped from Anadarko to the MLP. Currently Anadarko directly owns 8.3% of the WES LP units and 83.7% of the general partner, publicly traded Western Gas Equity Partners.

Investment Prospects

Western Gas Partners and Western Gas Equity Partners have been stars in the high distribution growth MLP space. The APC, WGP, WES interrelationships have produced very steady minimum of 15% annual distribution at WES and 35% annual distribution growth at WGP, which went public with a December 2012 IPO.

The big drop in energy commodity prices has produced a bear market in the MLP space and the Western gas duo have not been immune. The trailing twelve months total return for WES has been a 27% loss. During that time, the yield has climbed from 3.5% to the current 5.75%. WGP has posted an 18% total return loss.

Going forward, the Western Gas growth prospects are tied to the drilling activity of Anadarko. With energy prices staying lower for longer, I expect Anadarko to significantly moderate its E&P activity until there is more visibility on when crude and natural gas prices will recover. 2016 could be a year where distribution growth from Western Gas Partners drops into the single digits. Until there is more guidance out of Anadarko concerning its North American capital spending and drilling plans, I am not inclined to put WES or WGP on the Buy list. These MLPs deserve a re-visit after Anadarko provides its 2016 production plans.

Recommendation: Current investors should continue to hold WES and/or WGP. For others, it is not yet time to start a position in either MLP.