New Tariffs. Rising Volatility. Here’s What to Do Now.

Jay and Tim just dropped their urgent market briefing and revealed a powerful strategy designed for the exact kind of market chaos we are living now. Catch the replay before it’s taken down.

April 23, 2025 - 1:56 pm

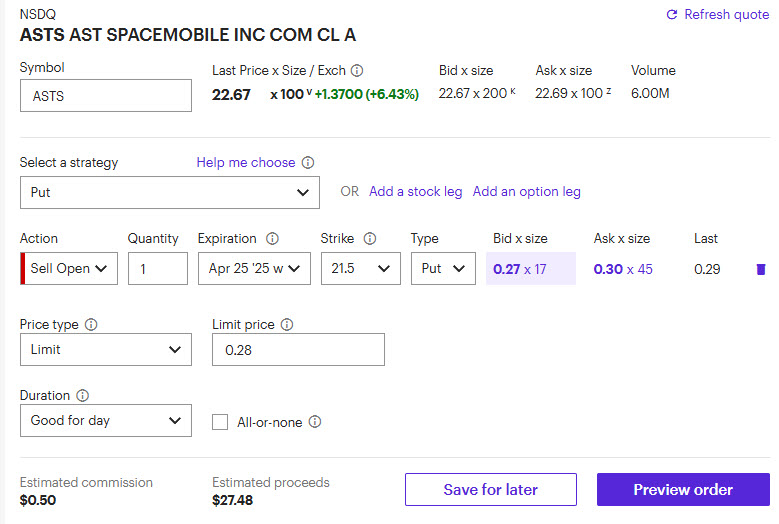

In the live session today we sold the ASTS 4/25 21.5 put for around 28 cents. You’ll need 2,150 per put sold in a cash account to make the trade. I’ll send out closing info on Friday.

April 17, 2025 - 1:57 pm

We should be in the clear on our SEI puts with the stock up 5% today. No action needed, and you can let the puts expire for zero.

April 16, 2025 - 1:53 pm

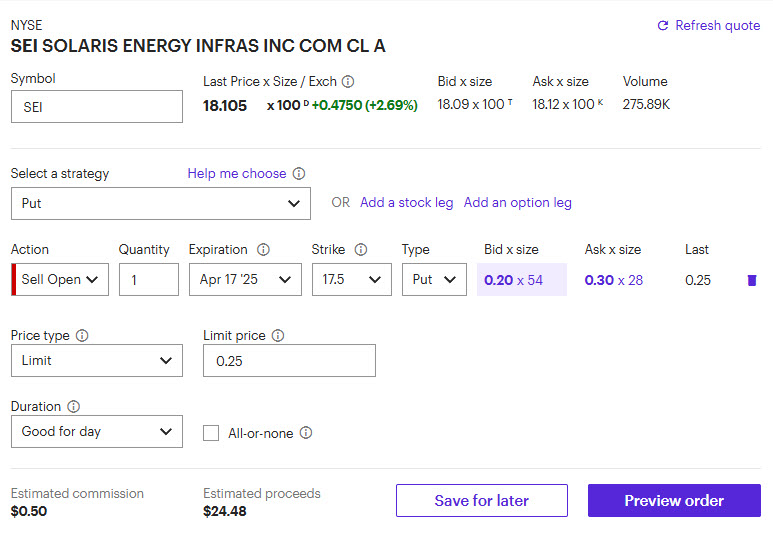

In the live session today we sold the SEI April 17th 17.5 put for 25 cents. Expiration is tomorrow because the market is closed on Friday, so this is effectively a one-day trade. You’ll need 1,750 per put sold in a cash account to make the trade. I’ll send out closing info tomorrow.

April 11, 2025 - 2:19 pm

Despite the market volatility, the ASTS put we sold has been an easy winner. We can let it expire for zero with no action needed. It’s nice to have a non-stressful winning trade given how crazy things have been this week.

April 9, 2025 - 1:53 pm

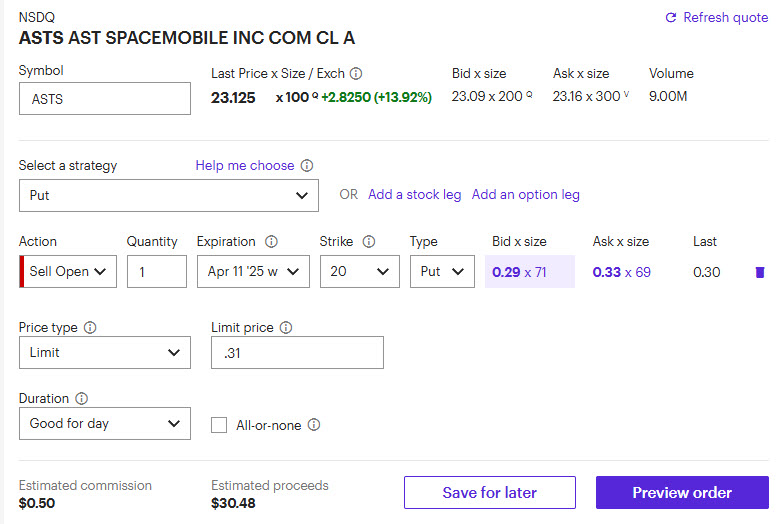

Despite the market insanity, we dipped our toes back into ASTS in the live session today. We sold to open the April 11th 20 puts in ASTS for around 31 cents. You’ll need 2,000 per put sold in a cash account to make the trade. I’ll send out closing instructions on Friday.

April 4, 2025 - 2:50 pm

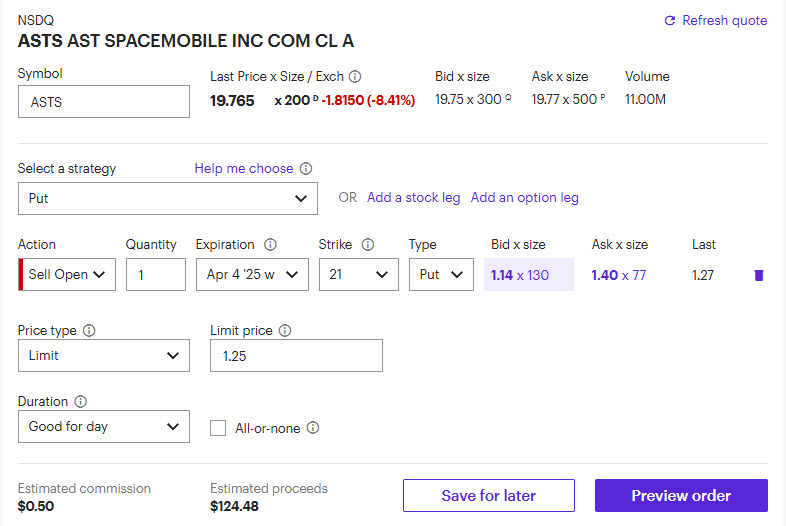

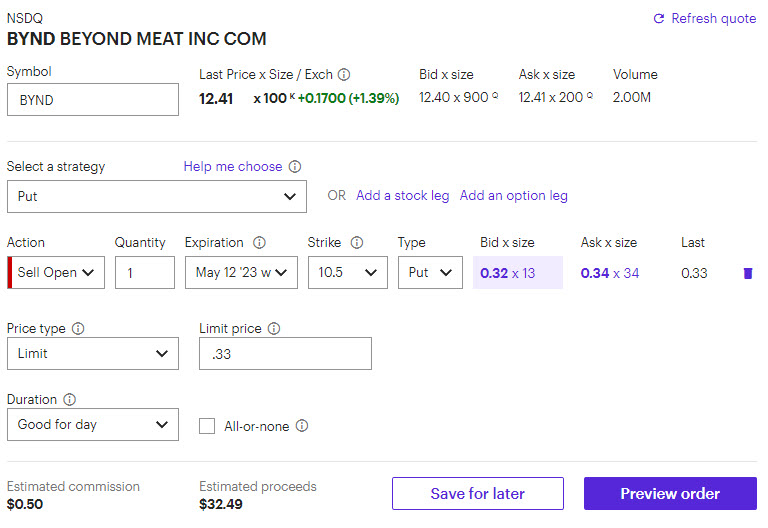

Our ASTS puts help up really well during yesterday’s huge selloff, but they eventually succumbed to today’s carnage. Buying to close the 21 puts here will cost us about 1 to 1.25 (it’s fluctuating a lot as I write this), which is considerably better than it could have been given the massive drop other share prices have seen. We don’t know what the weekend will bring so closing is the safest thing to do. For those who like to wheel, there’s definitely downside risk, but the calls should have plenty of premium.

Our recommendation is to buy to close the 21 puts as seen below:

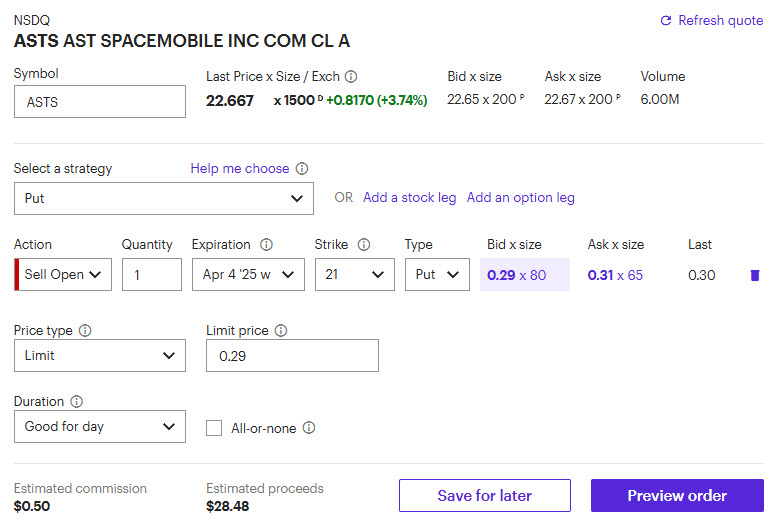

April 2, 2025 - 1:58 pm

In the live session today, we sold to open the ASTS April 4th 21 put for around 29 cents. You’ll need 2,100 per put sold in a cash account to make the trade. I’ll send out closing info on Friday.

March 26, 2025 - 1:49 pm

There’s no trade this week in 48 Hour Income. We couldn’t find anything worth doing. We’ll get back to it next week!

March 21, 2025 - 2:36 pm

We look to be in the clear on our CAL trade. The share price is well above our short put strike of 15. No action needed as we can get let the put expire for zero and collect the full premium.

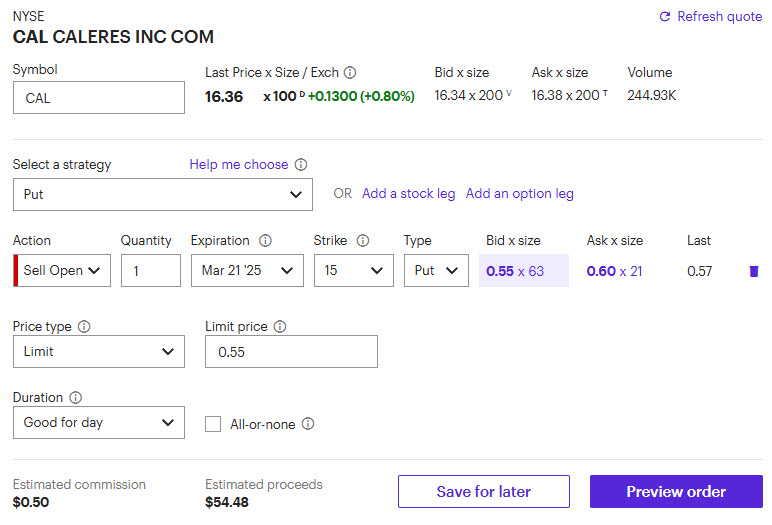

March 19, 2025 - 1:58 pm

In the live session today we sold the CAL March 21st 15 put for around 55 cents. Earnings are tomorrow. You’ll need 1,500 per put sold in a cash account to make the trade. I’ll send out closing instructions on Friday.

March 14, 2025 - 2:24 pm

We look to be in good shape with our PATH 10 puts. The stock is over 10.60, so we appear to be in the clear to let our puts expire for zero. No action is needed. However, if the market sells off in the next hour, I may send out a closing alert. If you don’t hear from me, it means we are good to let the trade expire.

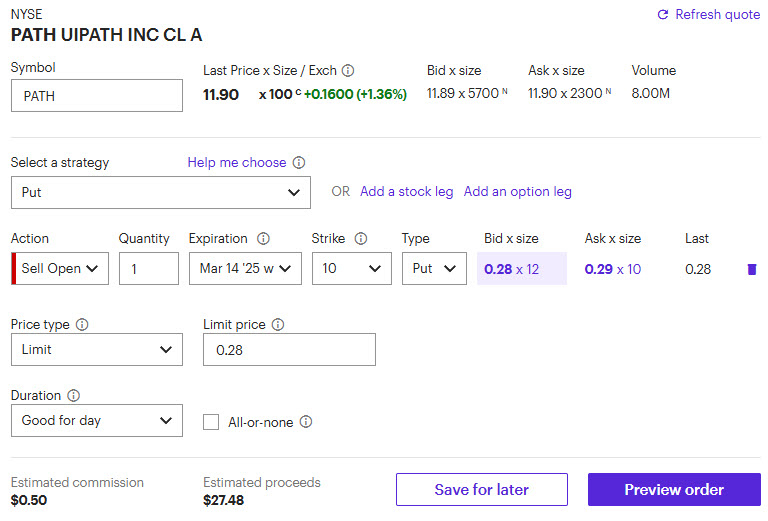

March 12, 2025 - 1:56 pm

In the live session today, we sold to open the PATH 3/14 10 put for around 28 cents. Earnings are today after close. You’ll need 1,000 per put sold in a cash account to make the trade. I’ll send out closing instructions on Friday.

March 7, 2025 - 2:18 pm

GAP shot higher after earnings so we are well clear of our short put strike. No action needed as we can let the puts expire for zero and collect the full premium.

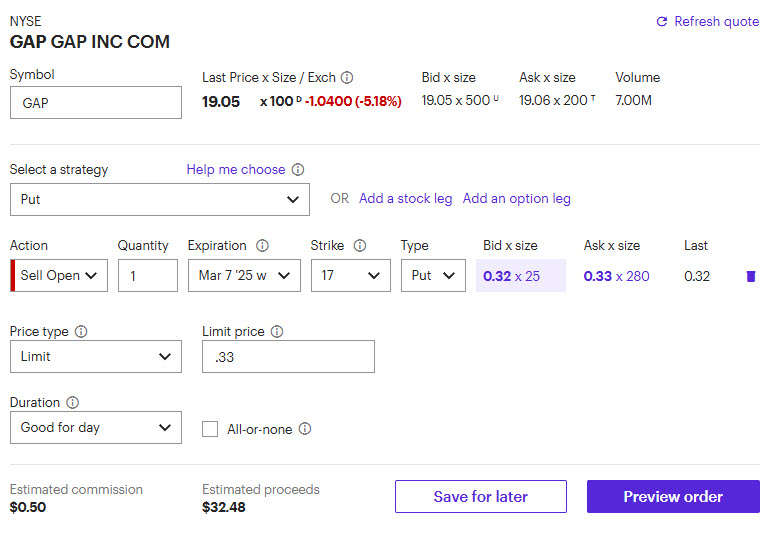

March 5, 2025 - 1:45 pm

In the 48 Hour Income live session, we sold to open the March 7th 17 put on GAP for around 33 cents. You’ll need 1,700 in cash account per put sold to make the trade. Earnings are tomorrow after close. I’ll send out closing instructions on Friday.

March 5, 2025 - 12:45 pm

Please ignore that last alert. That was meant for a different service. We’ll have our 48 Hour Income live session in 45 minutes.

February 28, 2025 - 2:28 pm

Our PCT puts are well out of the money. No action necessary as the puts will expire for zero and we’ll collect the full premium.

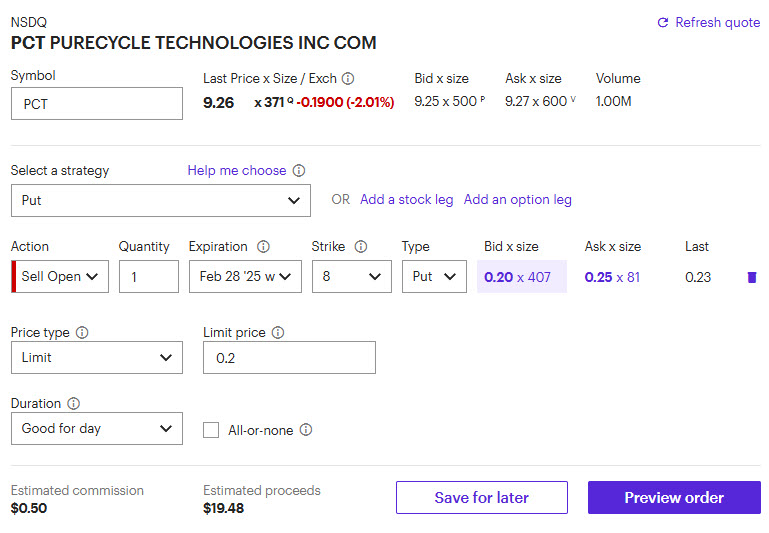

February 26, 2025 - 1:57 pm

In the live session today we sold to open the PCT February 28th 8 put for around 20 cents. Earnings come out tomorrow morning. You’ll need 800 in a cash account per put sold to make the trade. I’ll send closing instructions out on Friday.

February 14, 2025 - 3:07 pm

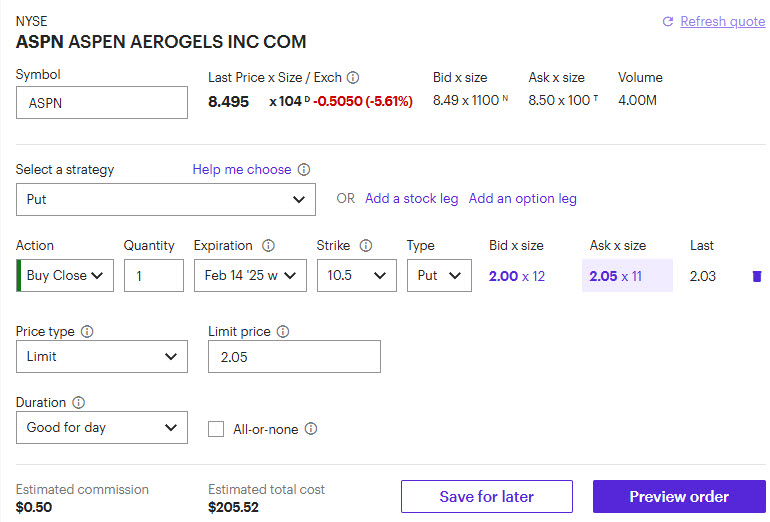

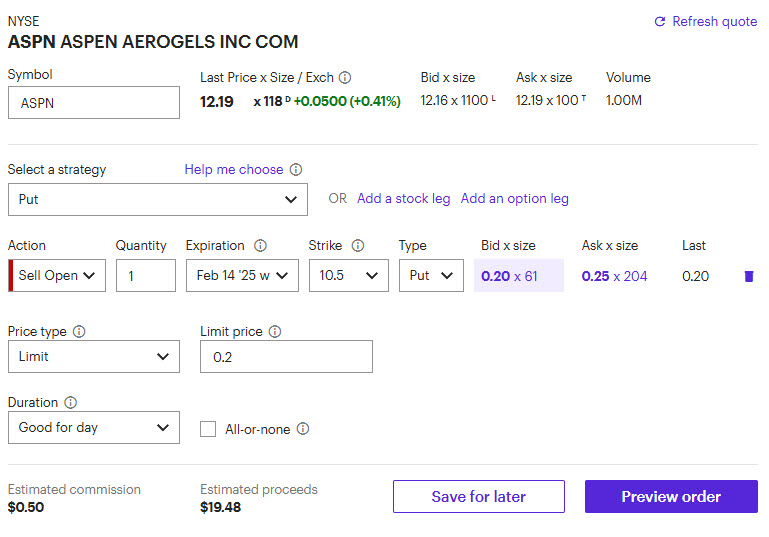

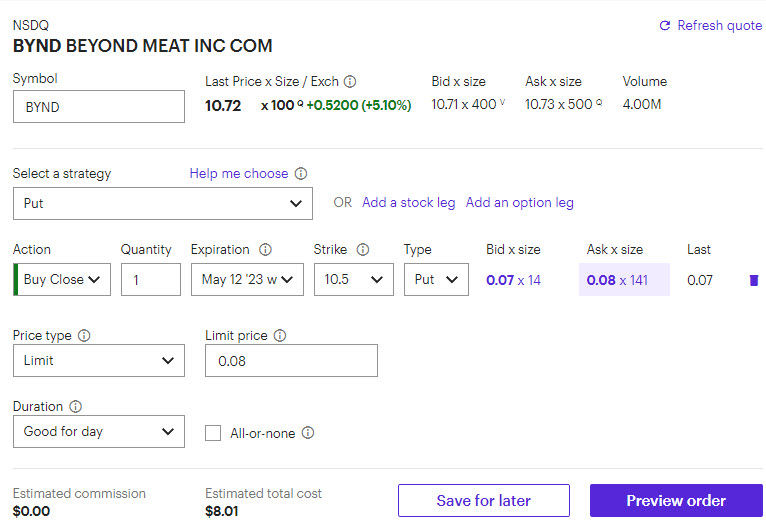

ASPN is likely oversold, but it’s also probably not going to bounce back quickly. We’re going to close it here and take the loss. For those who like to wheel the shares, it may take a while to recover, but the call premiums are reasonable. (I won’t be tracking the wheel trade as it’s beyond the scope of this service). Just remember when closing, you will be buying to close. See trade details below.

February 14, 2025 - 2:07 pm

Just a heads up that we’ll be closing ASPN in the next hour or so. For those of you that like to wheel the shares we get assigned on, it should be a reasonable strategy for ASPN. In terms of 48 Hour Income’s recommendation, we’ll be closing the position and moving on.

February 12, 2025 - 1:57 pm

In the live session today we sold to open the February 14th 10.5 put in ASPN for around 20-25 cents. You’ll need 1,050 per put sold in a cash account to make the trade. Earnings are today after close. I’ll send out closing instructions on Friday.

February 7, 2025 - 3:22 pm

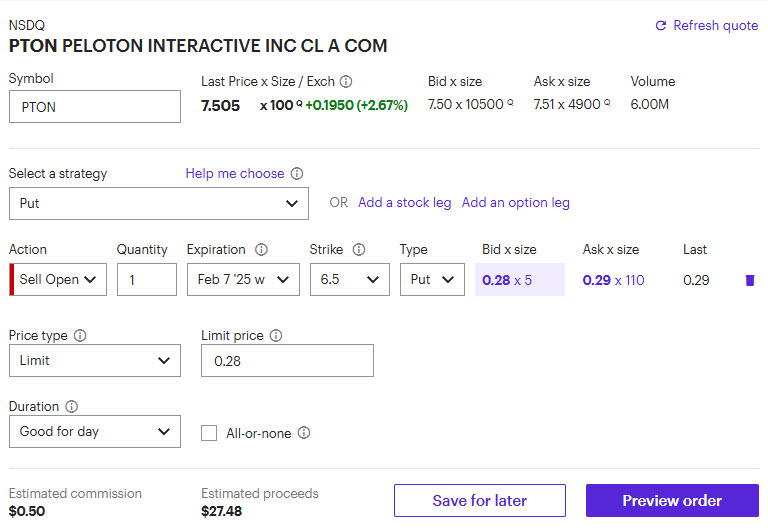

No action needed in PTON as the stock price is well above our strike. We will collect the full premium on the trade as the put expires for zero.

February 5, 2025 - 1:58 pm

In the live session today, we sold to open the PTON February 7th 6.5 put for around 28 cents. Earnings are tomorrow. You’ll need 650 in a cash account per put sold. I’ll send out closing instruction on Friday.

January 31, 2025 - 4:40 pm

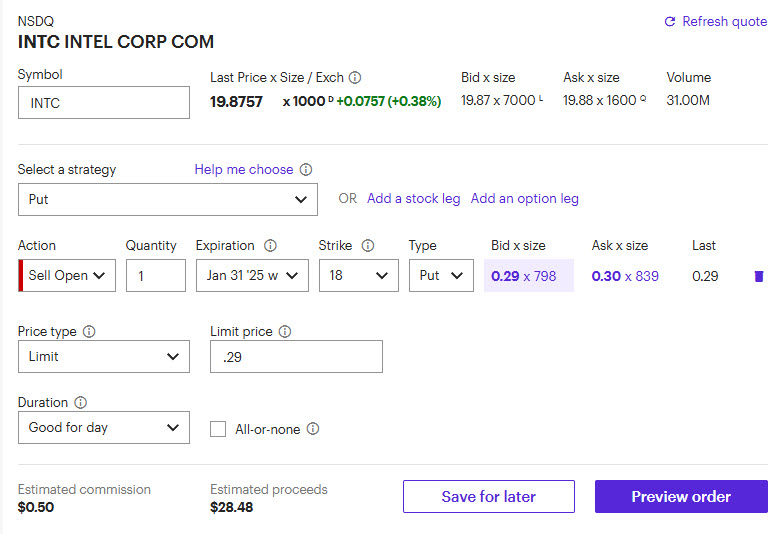

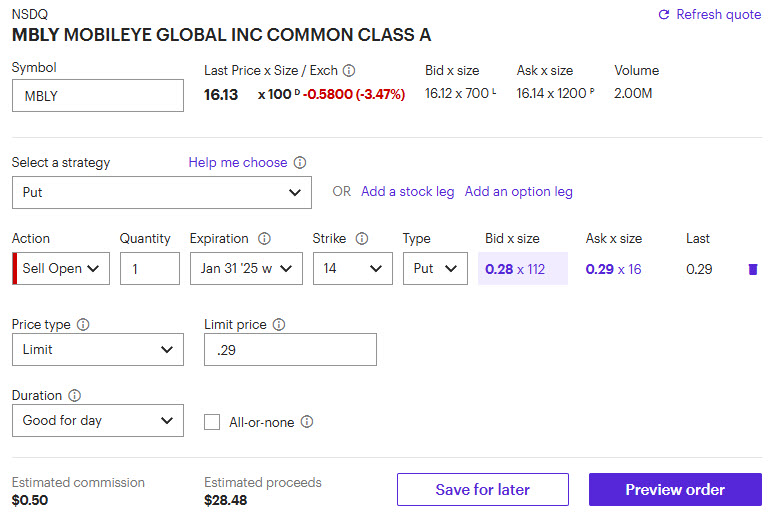

Sorry for the delay – for both of our trades (INTC and MBLY) no action was necessary as we let both options expire for zero and collect full premiums on both. It was so un-stressful that I forgot to send out a message that no action was needed!

January 29, 2025 - 1:56 pm

We made two trades in the live session today. Both puts we sold are in stocks with earnings coming up this week. For INTC, we sold to open the January 31st 18 puts for around 29 cents. You’ll need 1,800 per put sold in a cash account to make this trade. In MBLY, we sold to open the January 31st 14 put for around 29 cents. You’ll need 1,400 per put sold in a cash account to make the trade. I’ll send out closing instructions on Friday.

January 23, 2025 - 11:51 am

There was no trade in 48 Hour Income this week. Sorry for the late notice!

January 17, 2025 - 2:28 pm

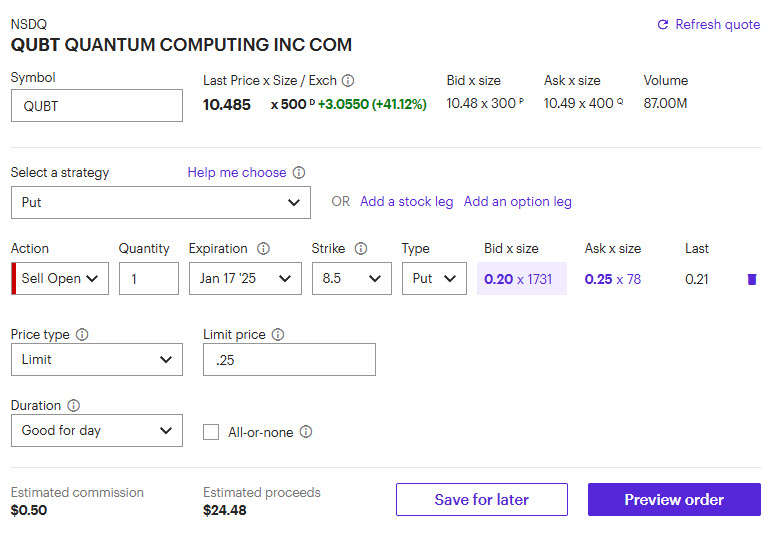

QUBT share price is well above our short strike price. You can let the put expire for zero. No action needed.

January 15, 2025 - 1:56 pm

In the live session today we sold to open the QUBT January 17th 8.5 puts for around 25 cents. You’ll need 850 dollars per put sold in a cash account to make the trade. I’ll send out closing instructions on Friday.

January 10, 2025 - 1:58 pm

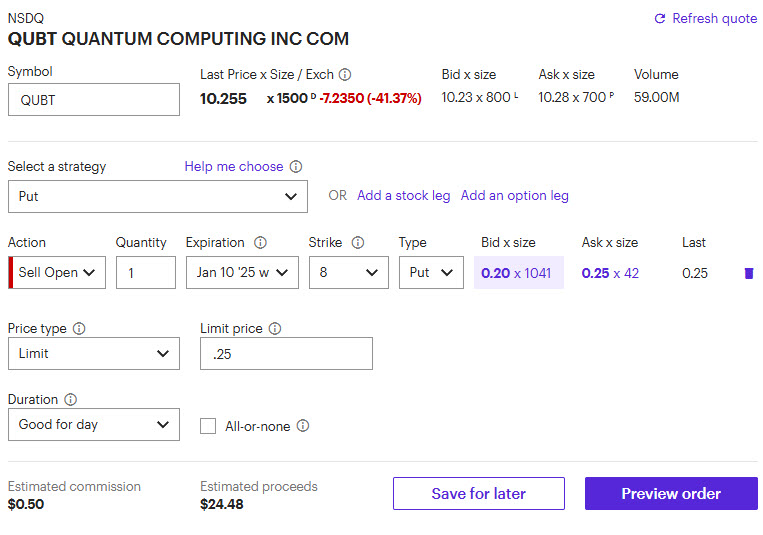

We should be in the clear on the QUBT trade. The stock price is still well above our put strike. No action needed as we can let our puts expire for zero.

January 8, 2025 - 1:55 pm

In the live session today, we sold to open the January 10th 8 puts in QUBT for around 25 cents. You’ll need 800 per put sold in a cash account to make the trade. The market is closed on Thursday, but I’ll send out closing instructions as usual on Friday.

December 20, 2024 - 2:43 pm

We’re in good shape on FCEL. We can let the puts expire for zero. No action needed.

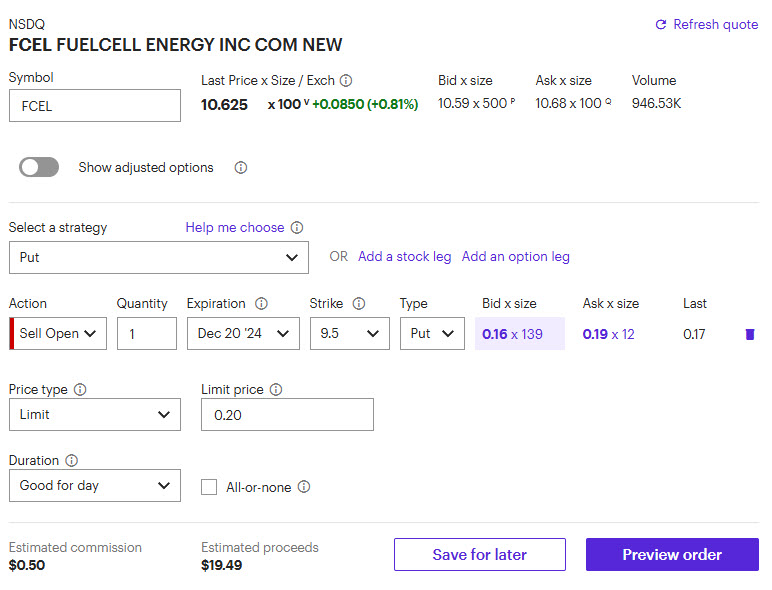

December 18, 2024 - 1:56 pm

In the live session today, we sold to open the December 20th 9.5 put on FCEL. We’re looking to get at least 20 cents on the trade (you may need to wait a bit to get filled). You’ll need 950 per put sold in a cash account to make the trade. Earnings are tomorrow before open. I’ll send out closing instructions on Friday.

December 13, 2024 - 3:51 pm

We are safely above our 18 put in OKLO as the close approaches. No action necessary as we can let the put expire for zero.

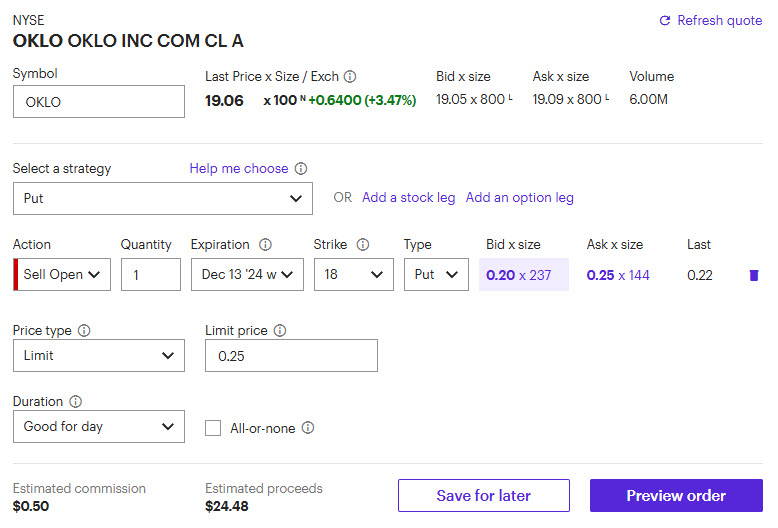

December 11, 2024 - 2:04 pm

In the live session today, we sold to open the December 13th 18 put on OKLO for around 25 cents. You’ll need 1,800 per put in a cash account to make the trade. I’ll send out closing instructions on Friday.

December 6, 2024 - 3:08 pm

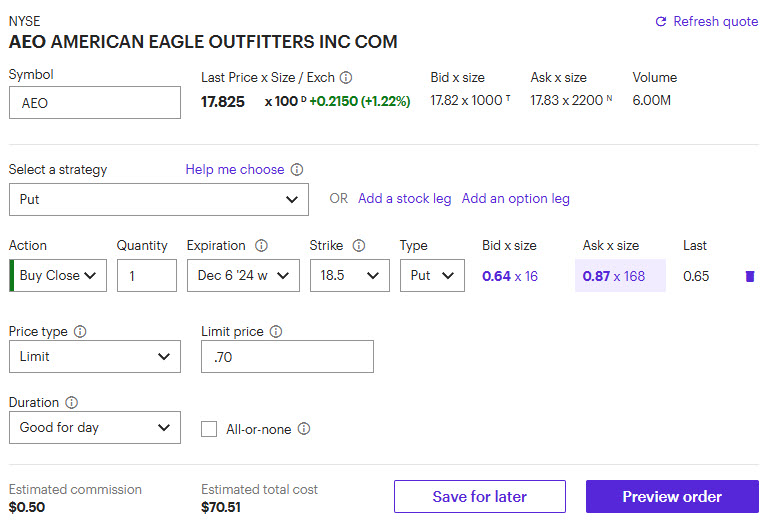

AEO is still below our short strike so my plan is to close the trade for about a 40-45 cent loss. However, rolling out the put or taking assignment (and then selling calls next week) are both viable choices. For the purposes of 48 Hour Income, we are going to close the trade for a small loss. You’ll need to buy back (buy to close) the 18.5 put for around 70 cents. Make sure you close the trade if you don’t want to take assignment of the shares.

December 6, 2024 - 1:35 pm

AEO got close to our strike this morning but has pulled back a bit. We’re going to give it another hour or so and then close. For those of you that are comfortable with the wheel trade (and want to take assignment of the shares), the near strike calls are moderately attractive to sell. My recommendation is going to be to close in any case, but it will make for an okay wheel trade.

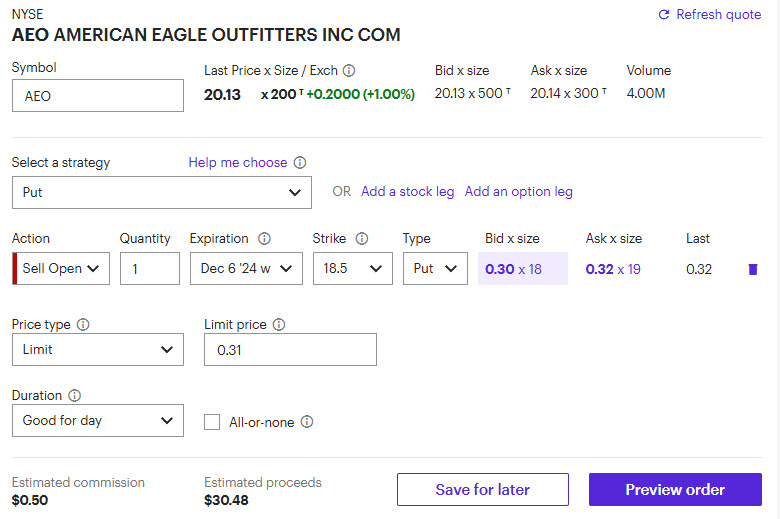

December 4, 2024 - 2:00 pm

In the live session today, we sold to open the AEO 18.5 put for around 31 cents. Earnings are after close today. You’ll need 1,850 per put in your cash account to make the trade. I’ll send out closing instructions on Friday.

November 27, 2024 - 1:48 pm

There isn’t going to be a 48 Hour Income trade this week as we were not able to find anything worth doing with the market closed tomorrow. Enjoy your Thanksgiving break and we’ll be back at it next week!

November 22, 2024 - 1:30 pm

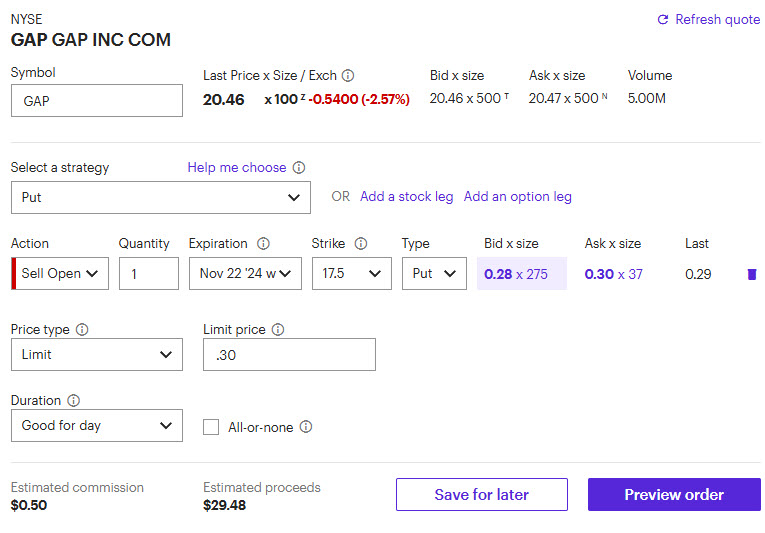

The GAP trade is an easy winner this week. No action needed as our puts will expire well out of the money and we’ll collect the full premium.

November 20, 2024 - 1:58 pm

In the live session today we sold to open the GAP November 22nd 17.5 puts for around 30 cents. You’ll need 1,750 per put in a cash account to make the trade. I’ll send out closing instructions on Friday.

November 15, 2024 - 2:49 pm

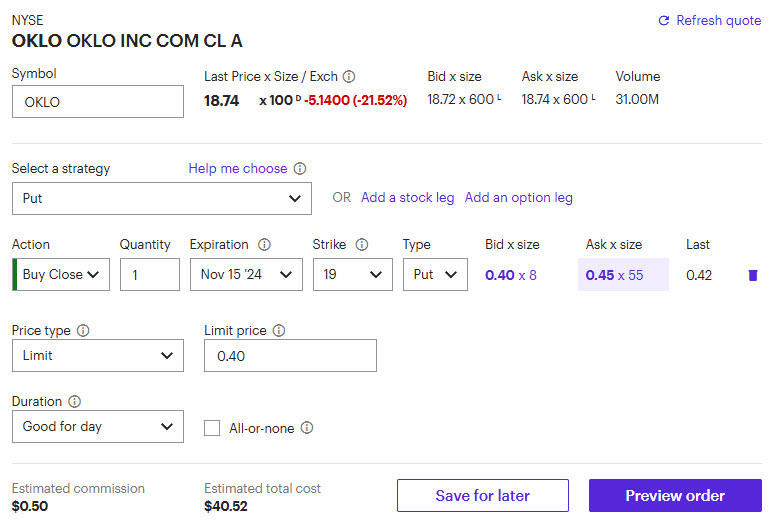

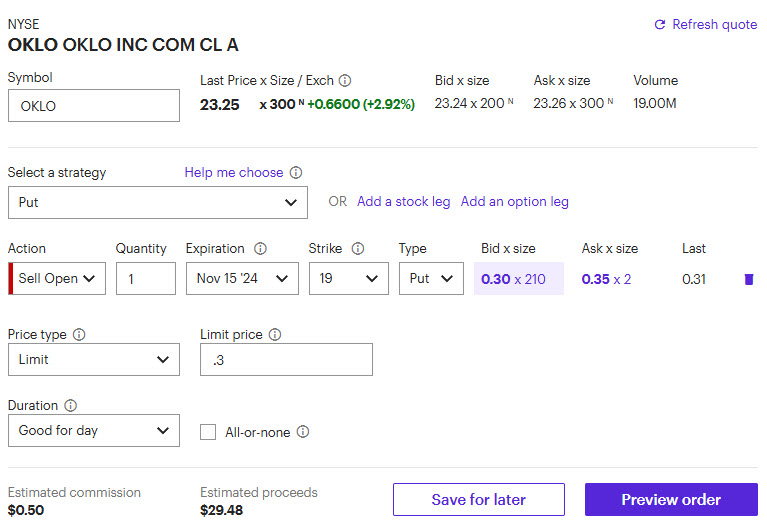

The big down move in tech today has exacerbated what would have been a manageable drop in OKLO after earnings. We are a little below our short strike of 19 as I write this. It makes sense to play it safe and buy back our short put for a small loss to around breakeven. We don’t want to get assigned on the shares, so let’s close it here. Remember, we are buying to close the put.

November 13, 2024 - 2:42 pm

In the live session today we sold to open the November 15th 19 put for around 30 cents. You’ll need 1,900 per put sold in a cash account to make the trade. I’ll send out closing instructions on Friday.

November 8, 2024 - 2:18 pm

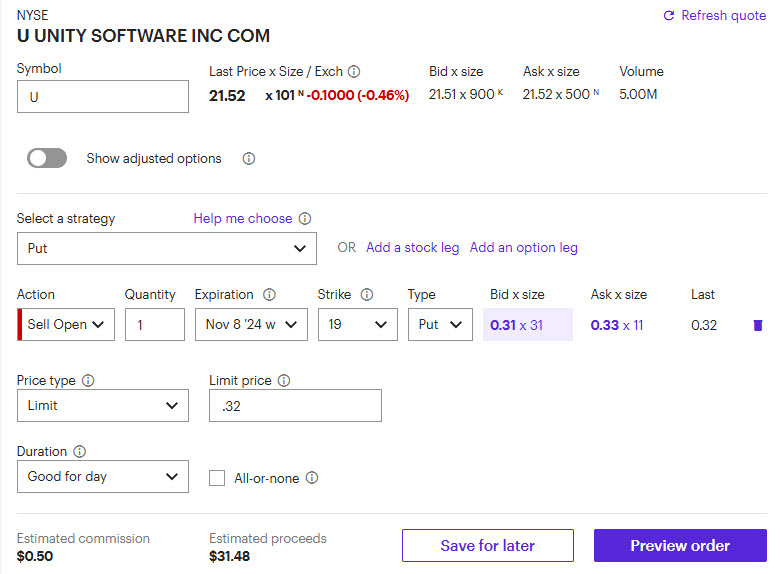

Our U puts are well out of the money. You can let them expire for zero and collect the full premium. No action needed.

November 6, 2024 - 1:54 pm

In the live session today, we sold to open the U November 8th 19 put for around 32 cents. You’ll need 1,900 per put sold in a cash account to make the trade. I’ll send out closing instructions on Friday.

November 1, 2024 - 2:18 pm

Our short put on HIMS is well out of the money. No action is needed as it will expire for zero and we’ll collect the full premium amount.

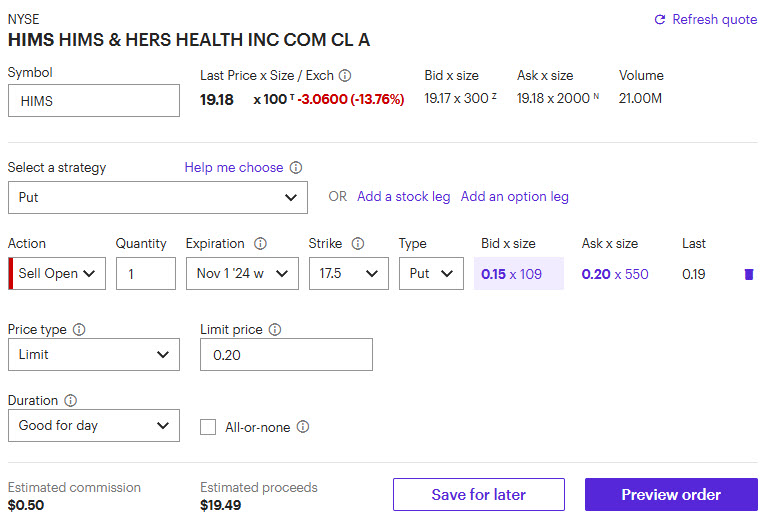

October 30, 2024 - 2:14 pm

In the live session today, we sold to open the HIMS 11/1 17.5 puts for around 20-25 cents. The stock has ticked up a bit so the 17.5 put is currently out of our price range (not enough premium), but that could certainly change by the end of the day. You’ll need 1,750 per put to make the trade in a cash account. I’ll send out closing instructions on Friday.

October 25, 2024 - 2:18 pm

ASTS is well above our strike price. No action needed as we can let our put expire for zero and collect the full premium.

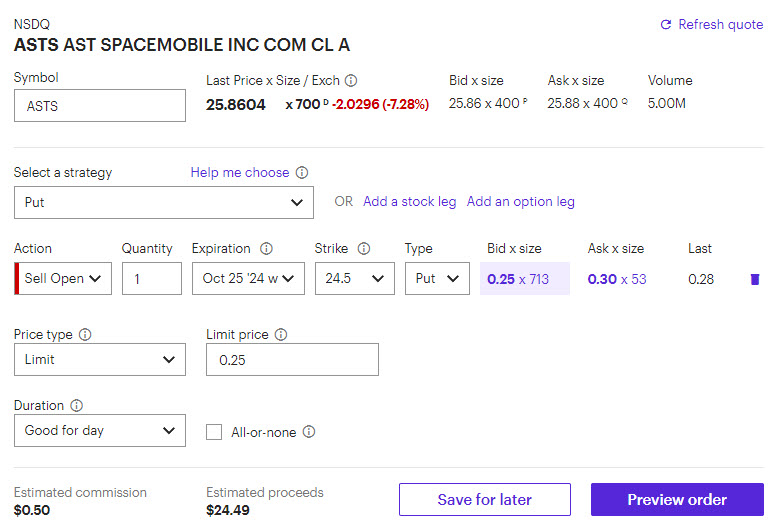

October 23, 2024 - 2:08 pm

In the live session today we sold the ASTS 24.5 puts (10/25 expiration) for around 25-30 cents. You’ll need 2,450 per put in your cash account to make the trade. I’ll send out closing instructions on Friday.

October 18, 2024 - 2:50 pm

WOLF is far enough from our short strike that we should be in good shape to let it expire for zero. No action needed.

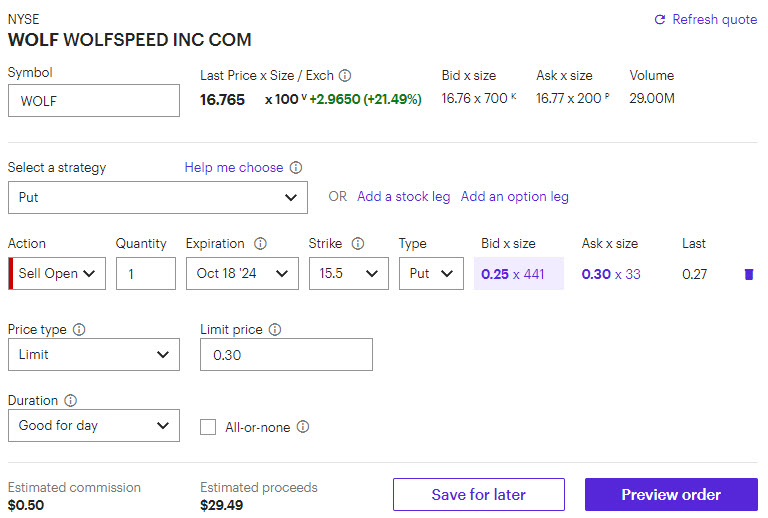

October 16, 2024 - 1:59 pm

In the live session today, we sold to open the WOLF October 18th 15.5 puts for a credit of around 25-30 cents. You’ll need 1,550 per put sold in a cash account to make the trade. I’ll send out closing information on Friday.

October 11, 2024 - 3:41 pm

Sorry the for late notice. No action needed on SAVA as we are well out of the money. You can let it expire for zero and collect the full premium!

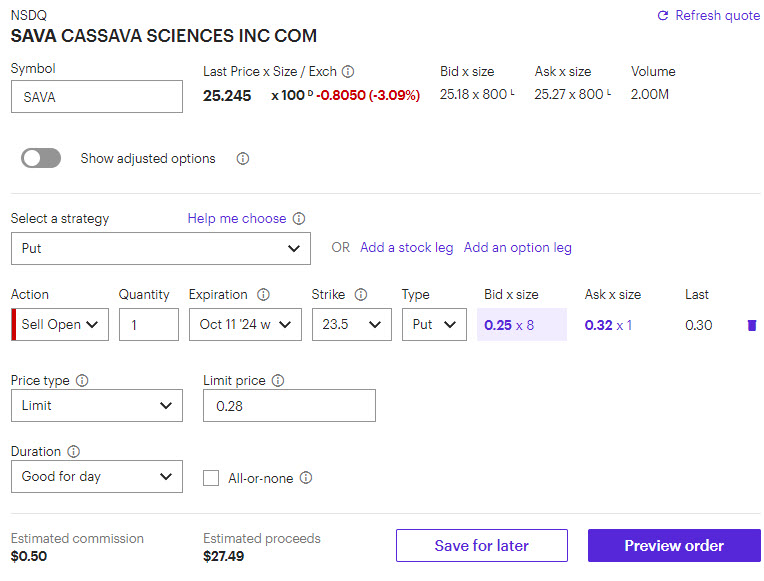

October 9, 2024 - 1:54 pm

In the live session today we started off by selling to open the SAVA Oct 11th 23 puts for 25-30 cents. The premium dropped quite a bit after we started selling and the stock price moved up, so the 23.5 strike is probably the better choice now. It can be sold for around 28 cents as of this writing. You’ll need 2,350 in a cash account per put sold. I’ll send out closing information on Friday.

October 4, 2024 - 12:47 pm

Our SAVA trade is in great shape. We are well above our short strike, so we can let the put expire for zero and collect the full premium. No action needed.

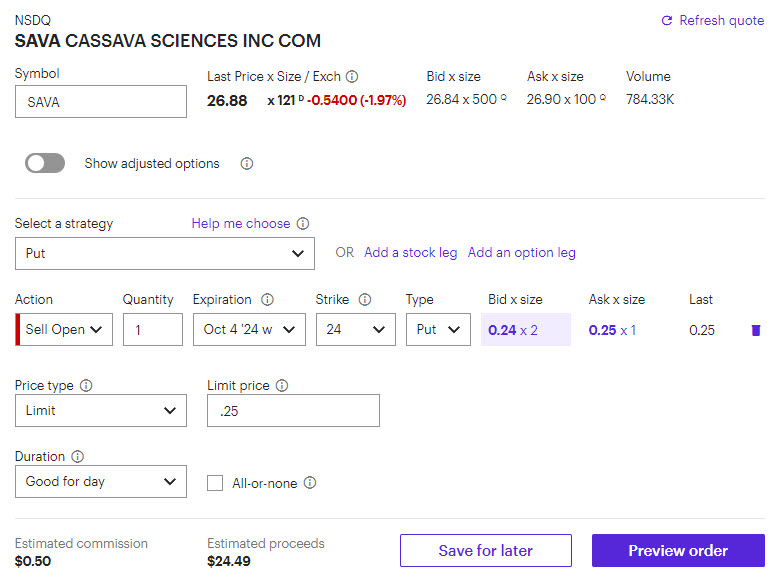

October 2, 2024 - 2:02 pm

In the live session today we sold puts on SAVA. More specifically we sold the October 4th 24 puts for around 30-35 cents. The price has now dropped to 25 cents. It’s still a reasonable trade here, but you could also wait a bit to see if the price comes back up a bit. You’ll need 2,400 in a cash account per put to make the trade.

October 1, 2024 - 10:47 am

We’re working on some patches to the texting system for 48-Hour Income. Recently there were a couple of unrelated problems that prevented us from being able to send text messages. This is a test send.

I hope to see you at tomorrow’s live trading room at 1:30 p.m. ET at https://us02web.zoom.us/j/83182381108

September 25, 2024 - 5:33 pm

Apologies for the delay. There was no trade today for 48 Hour Income. It was very sparse today. Things should pick up a bit next week.

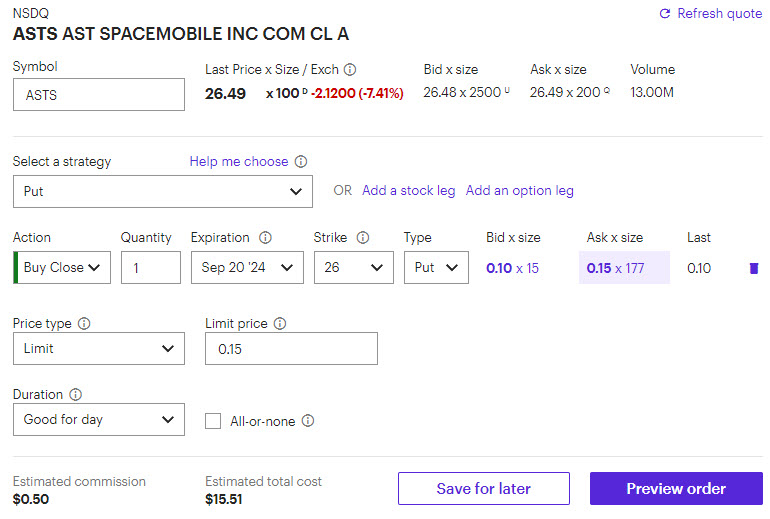

September 20, 2024 - 2:51 pm

ASTS pulled back today and is pretty close to our strike. Let’s be safe and close it a bit early. Remember, you are buying to close the puts. Let’s close here between 10-15 cents.

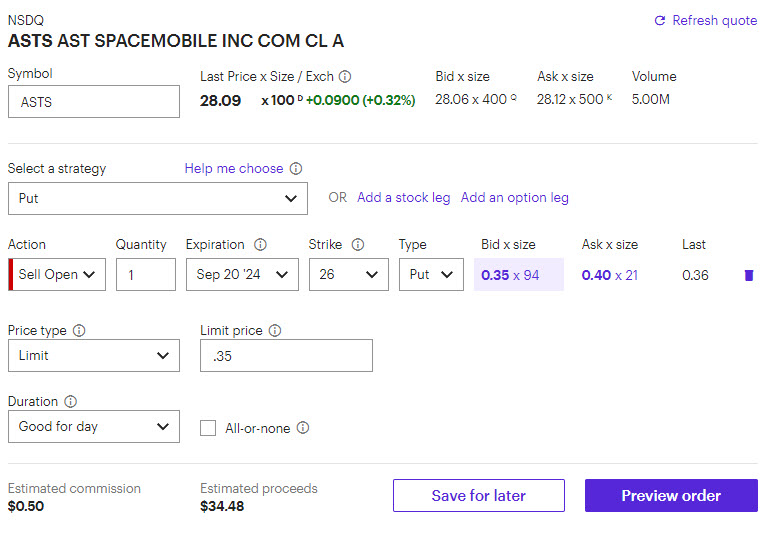

September 18, 2024 - 2:10 pm

In the live session today we sold the ASTS 26 puts for 35-40 cents. The price is moving around a lot due to the Fed announcement, so it may be challenging to get in to the trade if you haven’t done so already. You’ll need 2,600 for every put sold in a cash account. I’ll send out closing info on Friday.

September 13, 2024 - 11:01 am

I’ll be on the road today so I won’t get another chance to send a text… but no worries because ASTS is about 7 dollars above our short strike. No action necessary. You can let it expire and collect the full premium.

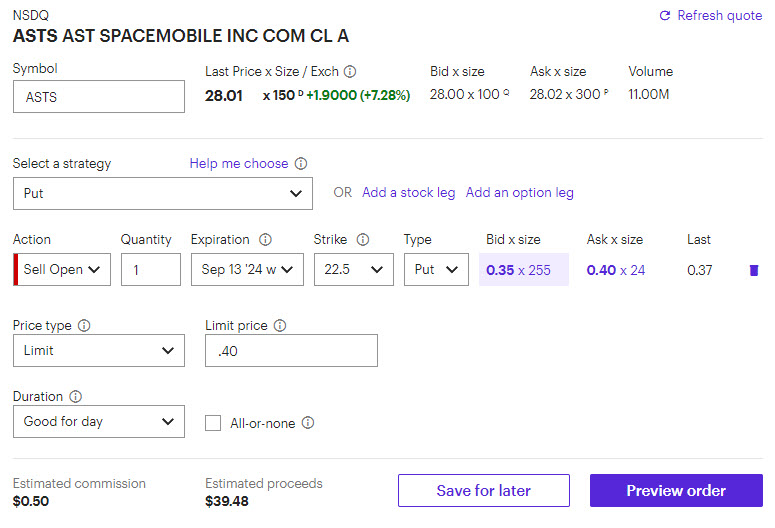

September 11, 2024 - 1:51 pm

In the live session today we sold the 22.5 puts in ASTS for around 40 cents. You’ll need 2,250 in a cash account for every put you want to sell to make the trade. There will be a satellite launch as early as tomorrow which is the big event for this stock. I’ll send out an update on Friday with closing info.

September 6, 2024 - 3:28 pm

We are in the clear on our AI puts. No action needed as we can let the puts expire for zero and collect the full premium.

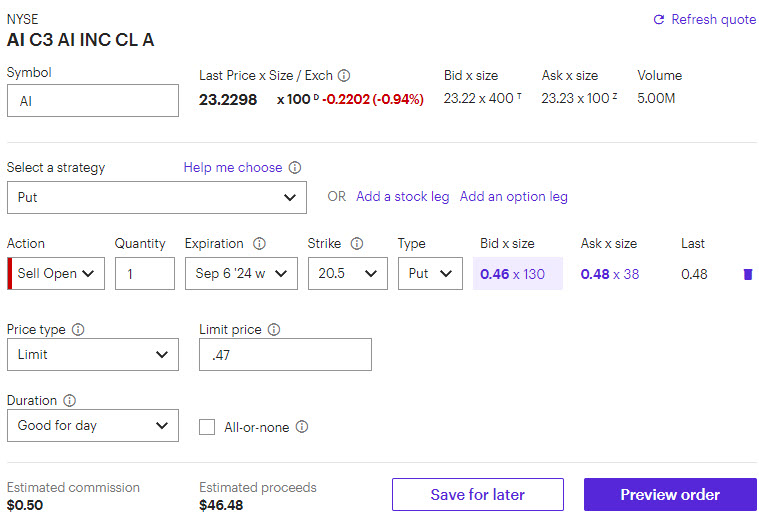

September 4, 2024 - 2:01 pm

In the live session today we sold to open the 20.5 put in AI. Earnings are today after close. The 20 put is also a reasonable alternative (or the 20.5-19.5 put spread). You’ll need 2,050 per put sold in a cash account to make the trade. I’ll update everyone by Friday on closing details.

August 30, 2024 - 3:03 pm

Our SYM trade is looking good. We can let the put expire and collect the full premium. No action is needed.

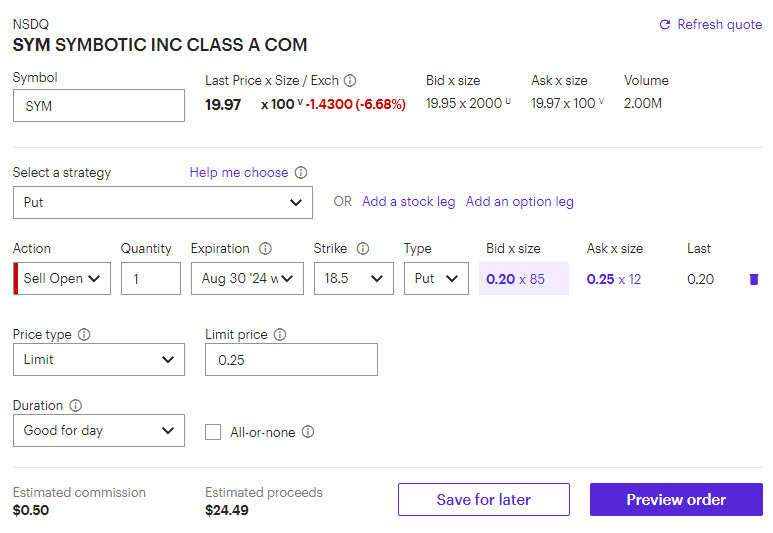

August 28, 2024 - 2:00 pm

In the live session today we sold to open the SYM 18.5 put for around 25 cents. You’ll need 1,850 per put sold in your account (if you have a cash account). I’ll send out closing info on Friday.

August 23, 2024 - 3:40 pm

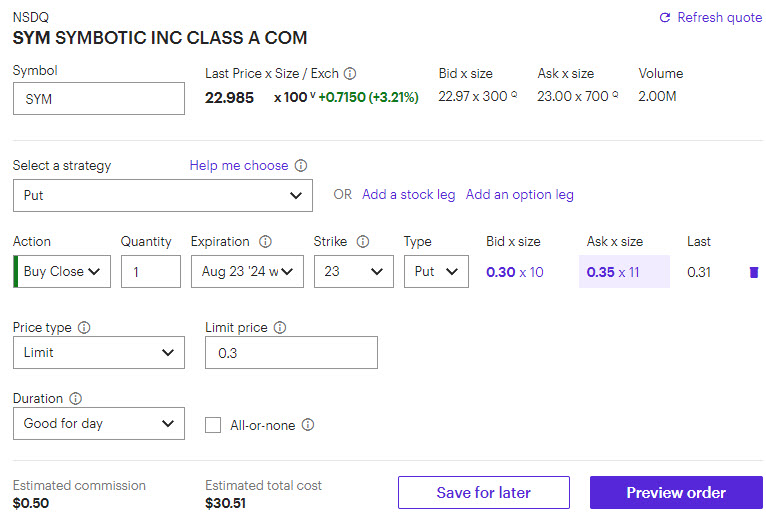

SYM is hanging out around right 23 so the option is still worth around 30 cents (what we paid for it). Keep in mind, anything above 22.70 in the stock at expiration is roughly profitable. However, we don’t want to get assigned on the shares, so you’ll definitely want to close the put (buy to close) before the end of day. At this point, the option probably won’t start to really lose value until about 10 minutes to close. That’s not enough time for me to get a closing text out, so I’m sending this now. Once the 23 put starts to lose premium value, it’s a good time to close. Just remember you are buying to close the put as seen below.

August 23, 2024 - 1:19 pm

SYM is back above 23 and the premium should start to melt in the next hour or so. I’ll send out another closing alert, but I’d wait for the premium to get to 10 cents or lower if possible.

August 22, 2024 - 4:09 pm

SYM closed today around 22.25. Our breakeven point is about 22.70. The lawsuit against SYM announcement today may have been the catalyst for the drop. Those lawsuits are, generally speaking, garbage. If the market is back up tomorrow, SYM should also move higher. I believe we have a very reasonable chance of closing this trade for a profit (as long as the market doesn’t have a big down day). Stay tuned for more info tomorrow. By the way, those of you who pulled the trigger on WOLF, good job! I was a bit scared of it, but it ended up working out so far.

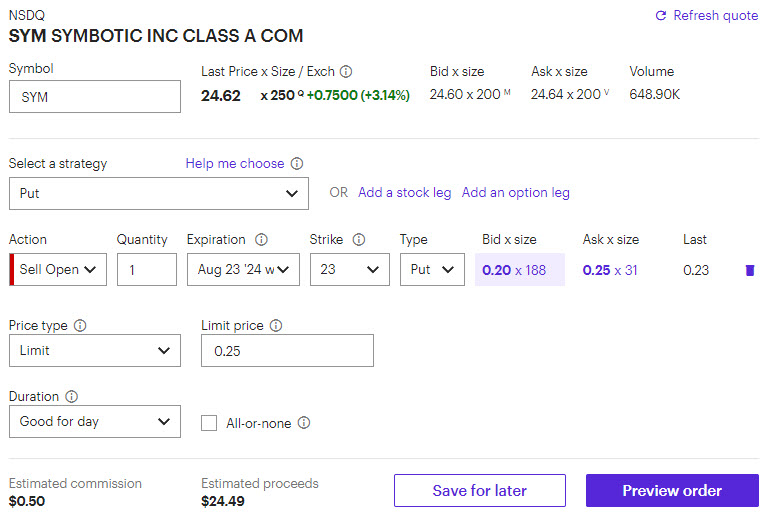

August 21, 2024 - 2:00 pm

In the live session today, we sold to open the SYM 23 put for 25-30 cents. I wouldn’t go lower than 25 cents if possible. You’ll need 2300 in your account per every put sold. I’ll send out closing info on Friday.

August 16, 2024 - 3:16 pm

I thought I sent this out earlier, but I may have missed the SEND button. Probably not enough coffee at that time:

This probably goes without saying, but there’s no action necessary on our ASTS puts. The stock is nowhere near our strike. We can let it expire and collect the full amount of premium. from our short puts.

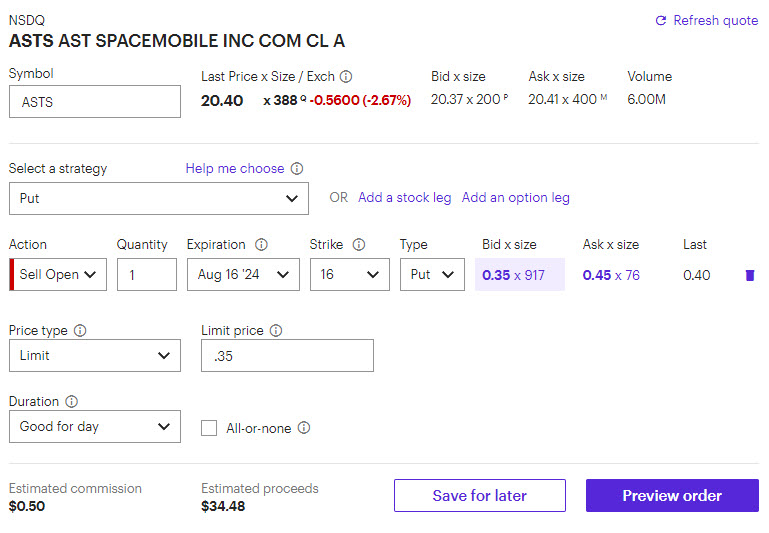

August 14, 2024 - 2:06 pm

In the live session today we sold the 16 put in ASTS for around 35 cents. Earnings are today after close. You’ll need 1,600 per put sold in a cash account to make the trade. I’ll send out a closing update on Friday.

August 9, 2024 - 2:10 pm

U is up quite a bit today and nowhere near our strike. We are in the clear to let it expire for zero. No action needed as we’ll collect the full premium.

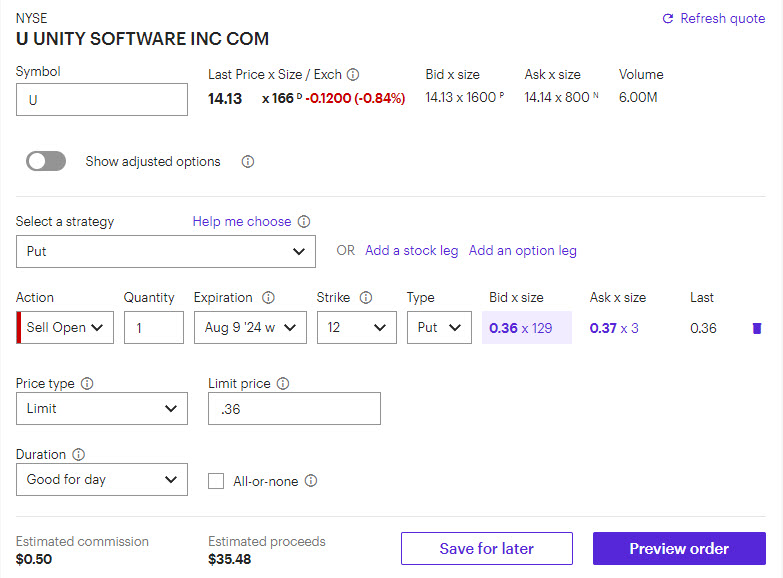

August 7, 2024 - 2:02 pm

In the live session today we sold the U 12 puts for 35 cents or the U 11.5 puts for 24 cents. Either strike is a reasonable choice. Earnings are tomorrow. You’ll need either 1,200 or 1,150 in your account per put sold (depending on which strike you choose). I’ll update the trade situation on Friday.

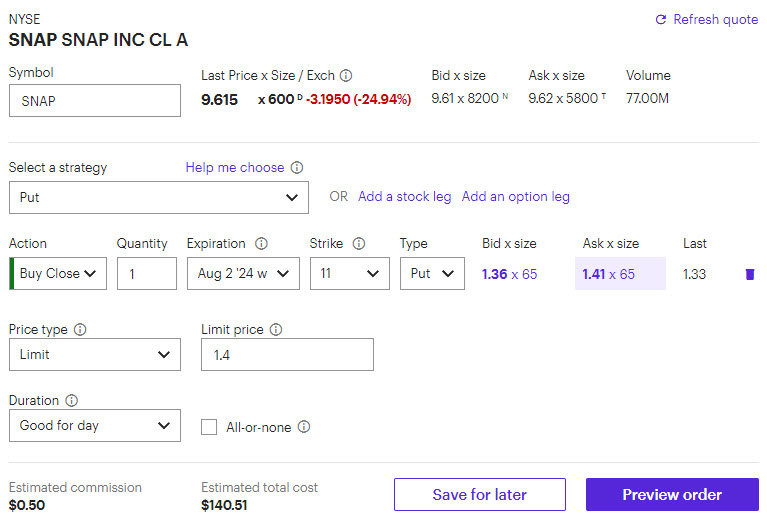

August 2, 2024 - 2:29 pm

It doesn’t look like SNAP will move much from this level. I think we would have been around 10.50-11 based on earnings alone, so the big selloff has probably pushed the stock down another buck or so. No reason to chase this one as we should have some good opportunities for put selling next week. Let’s close here and we’ll take around a dollar loss. Remember, you are buying to close the put.

August 2, 2024 - 11:09 am

SNAP was set to open up right around our strike price, maybe a bit lower, but the jobs report torpedoed the market. The VIX is around 30, which is nearly (but not quite) panic selling. I think this move is way overdone at this point, and the market is likely to rebound to some extent when investors realize it just means rate cuts are guaranteed for this year. For now, I’d wait to close the SNAP puts as we may see a reversal later in the day. I’ll send something out after we get a better idea how the market is going to behave.

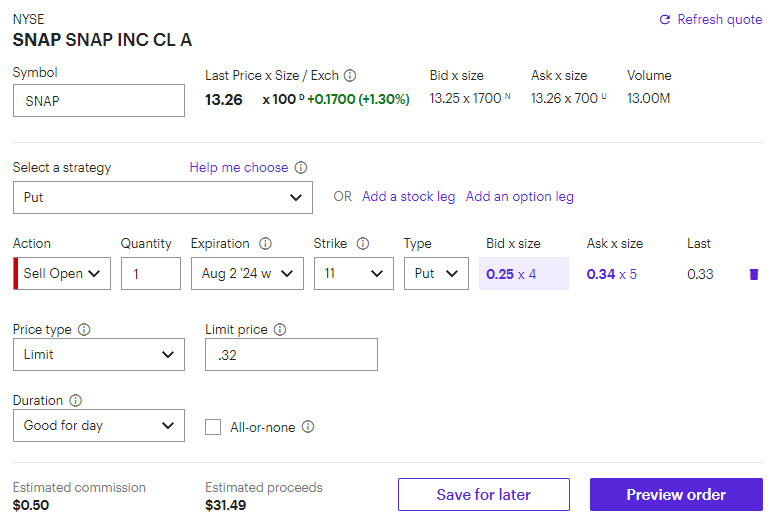

July 31, 2024 - 2:02 pm

In the live session today, we sold the SNAP 11 puts for around 32 cents. The price is still right around that level if you haven’t yet gotten in. Earnings are tomorrow. You’ll need 1,100 in cash in your account (for a cash account) for every put you sell. I’ll send out closing instructions on Friday.

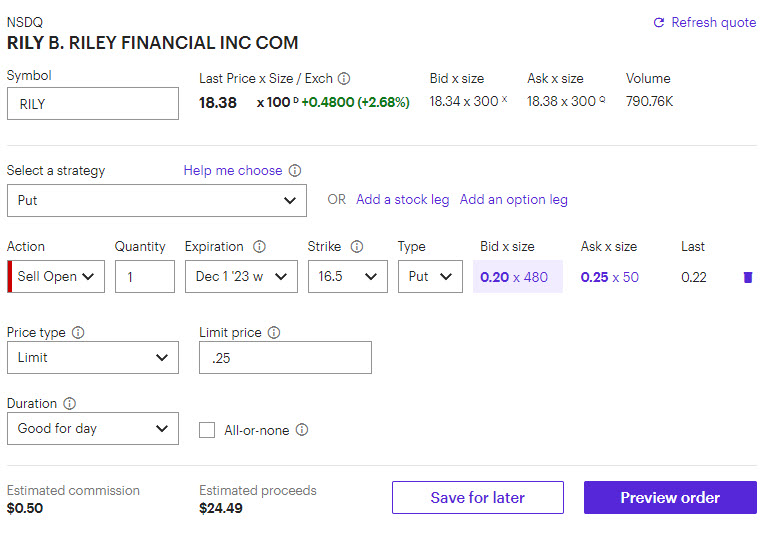

July 26, 2024 - 2:52 pm

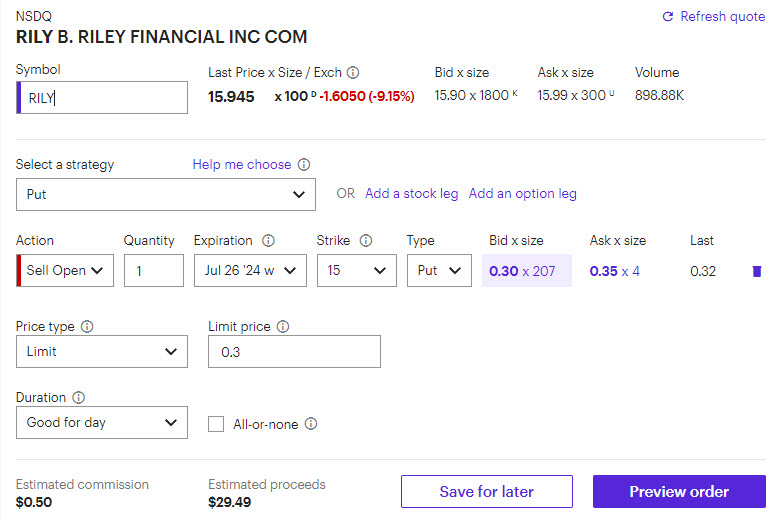

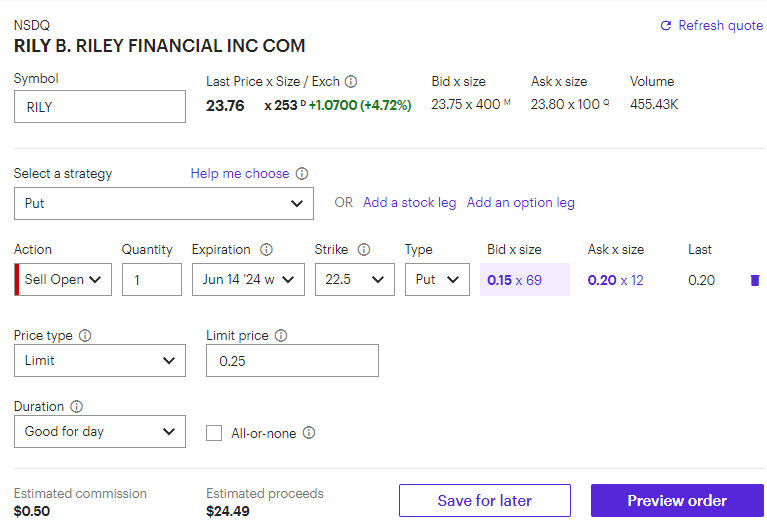

RILY has shot up well above our short strike. No action needed as we can let our puts expire for zero and collect the full amount of premium.

July 24, 2024 - 1:54 pm

In the live session today we sold to open the RILY 15 puts for around 30 cents. You’ll need 1,500 in your account per put to make this trade (for a cash account). I’ll send out closing instructions on Friday.

July 19, 2024 - 11:21 am

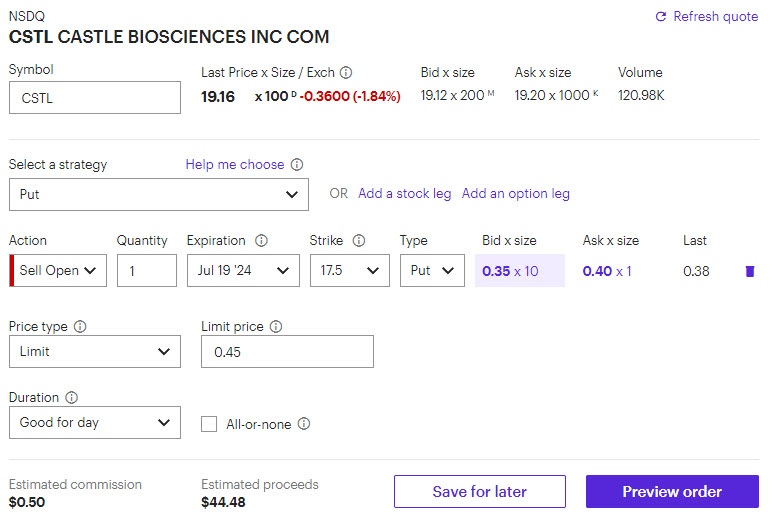

CSTL is above 19, so well above our short strike of 17.50. We are in good shape here and can let it expire for zero at the end of the day. No action needed as we are set to collect the full premium.

July 17, 2024 - 1:57 pm

In the live session today we sold to open the 17.5 puts in CSTL for around 45 cents (or higher). It’s not a very liquid options chain, so it may take a bit of time to get filled at 45 cents. I will send out closing info on Friday.

July 12, 2024 - 11:58 am

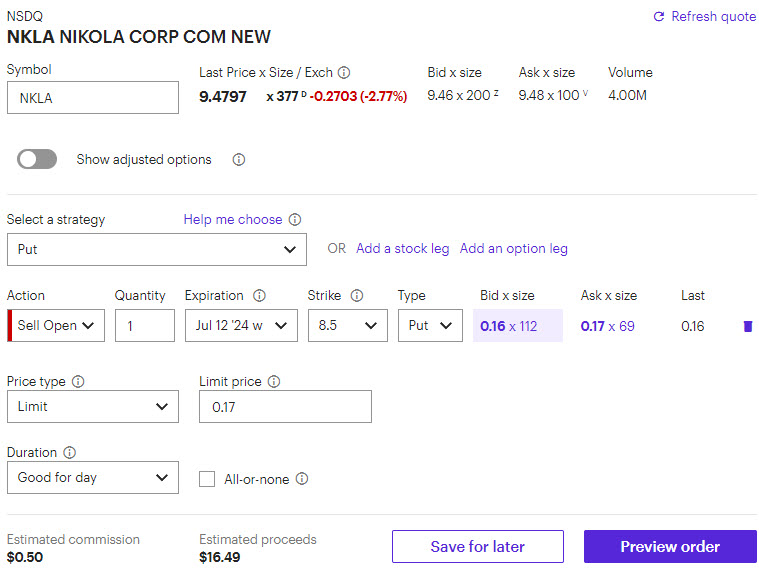

NKLA is safely above our short put strike, so we can let it expire for zero. No action needed.

July 10, 2024 - 2:08 pm

In the live session today we sold a put on NKLA and covered RILY (for those who own shares). For NKLA, we sold the 8.5 puts for Friday for at least 17 cents. You’ll need 850 in your account for each put sold. I will send out closing details on Friday.

For RILY, if you own shares, we are selling the August 9th 20 calls for 1.25-1.50 (the market is moving around a lot).

July 10, 2024 - 9:12 am

June 28, 2024 - 2:16 pm

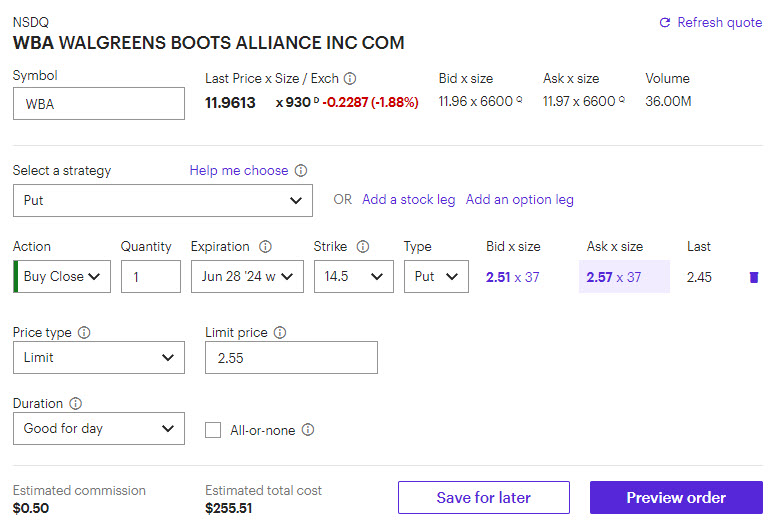

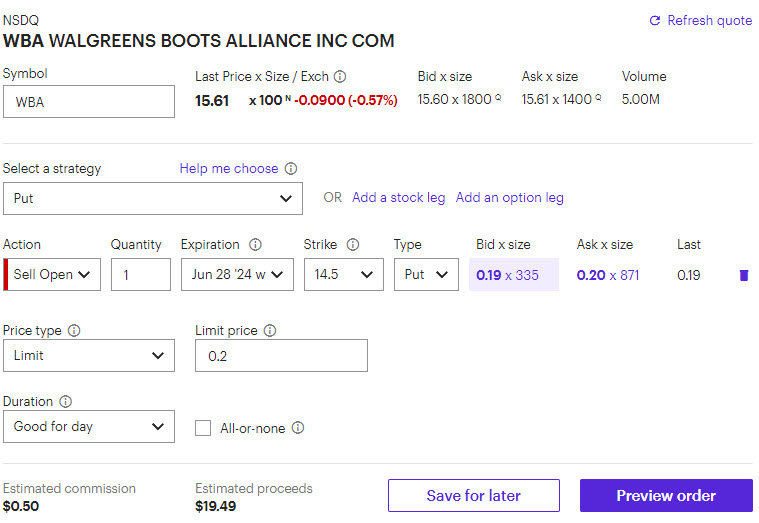

Judging by my email inbox, many of you have gotten assigned on WBA shares. I still think the best path forward is to close the trade, but those of you who regularly trade covered calls may wish to sell calls against the shares to help offset the loss on the share price drop. For everyone else, I believe selling the shares and taking the loss makes the most sense. If you didn’t get assigned yet, you can buy to close the put (as seen in the screenshot below). WBA isn’t likely to recovery quickly and the call premiums are minimal, so moving on from this trade is likely the best solution (rather than tying up capital).

June 27, 2024 - 5:04 pm

I don’t want to say the planets are aligned against us, because the responsibility for losses on any of our trades falls on me. That being said, I picked WBA very specifically for its lack of volatility on earnings days. Despite that, the stock quite literally had its worst day in over 40 years (40!). At this point, I can only shake my head.

We will close it out tomorrow for a loss. Even for those who normally take assignment on shares and sell calls, WBA probably won’t be a great covered call stock due to its lower premiums. I’ll send a text tomorrow during the trading day for closing instructions.

In the meantime, I have a lot of thinking to do as to how to modify our strategy while the deck is apparently stacked against us. We may avoid earnings for a while and stick to the RILYs of the world while they are paying a decent premium. More to come on this topic next week.

June 26, 2024 - 1:54 pm

In the the live session today we sold to open the WBA 14.5 puts for around 20 cents. Spread traders can look at the 14.5-13.5 put spread. Earnings are tomorrow before the market opens. I’ll send out instructions on Friday for next steps.

June 21, 2024 - 2:30 pm

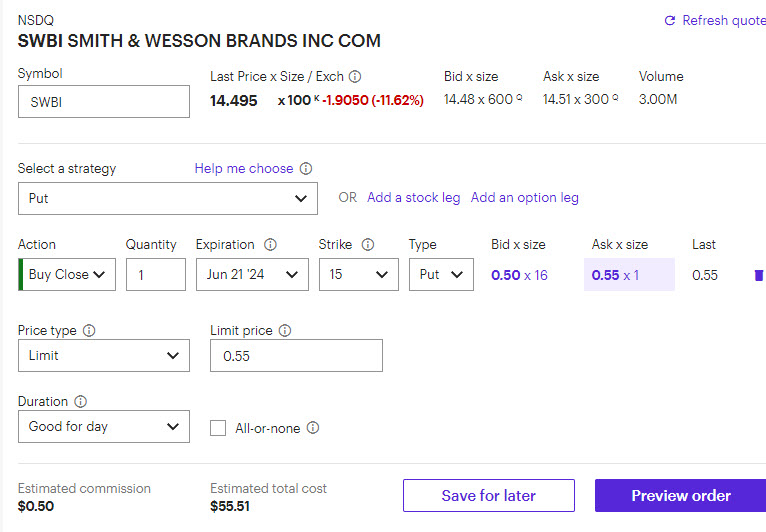

We haven’t been able to catch a break lately, but at least this week’s trade is likely to be a just a small loss. SWBI jumped in afterhours trade, and it seemed like we would be safe. Alas, the market gods had different plans for us. The stock is right at 14.50 and has been there most of the day. Closing now will result in roughly a 10-15 cent loss. The loss itself is minor, but I was certainly hoping for a big win this week. Regardless, we’ll keep plugging away and figure out how best to proceed in this low volatility market.

We need to close SWBI so as not to be assigned on the shares, so let’s buy to close our 15 puts here for 55 cents.

June 18, 2024 - 12:55 pm

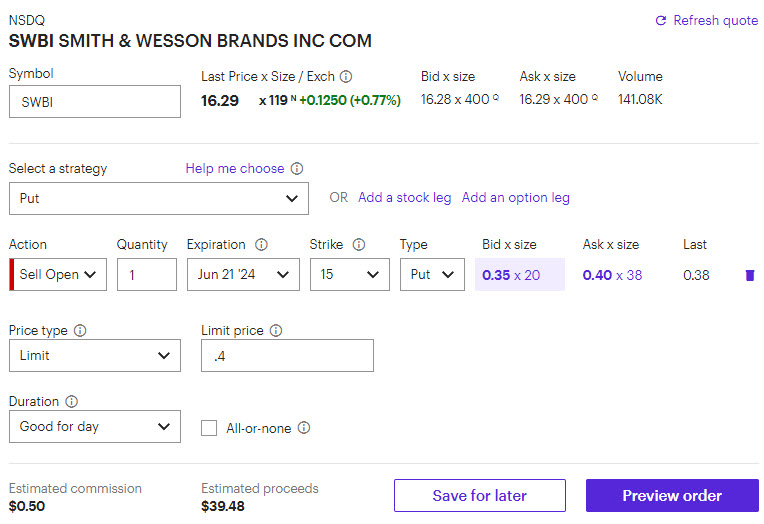

In the live session today we made a trade in SWBI and discussed covering FSLY and RILY shares. For SWBI, we sold the 15 call for around 40 cents. Earnings are on Thursday. Spread traders can do the 15-12.5 put spread. You’ll need 1,500 in your account to make this trade.

For FSLY, if you own the shares, one thing you can do is sell the July 26th 8 calls for around 20 cents. It’s a way to generate 3% returns on premium while we wait for earnings in late July/early August. For RILY, we are selling the July 5th 22 calls for around 35-40 cents. Again, you’ll have to own the shares to make this trade. For FSLY and RILY, if you don’t own the shares, you can ignore the trade.

June 17, 2024 - 1:30 pm

We are going to hold off today on selling calls on RILY and FSLY since they are both down today. I prefer to sell calls on up days, if possible. We can cover both of these stocks tomorrow during the 48-Hour Income live session. BTW, the session will be at 12 PM ET tomorrow since the market is closed on Wednesday. You should have received an email, but it’s the same link as the usual one.

Here’s that link, just in case:

https://yn345.keap-link012.com/v2/click/c7418337eebb4d37822eb9d3ee61a017/eJyNkEsLgkAUhf_LXYs6PnJyJxEiVouodVheaErHYbwWFv73pgeuClp_53yXc-9AKAtJWQkx9NIPQrBA40EogZJmjaTi8ILMIJdPLKiEPKe66RTE92_lkb9aQRRGUwuoV2gym3Uyy7NVultkq9xkVaHNlX9EHo9Y4EWjab5MsgUMw0811oLmF2NvISbd4XNVKcwy2urK5I9Eqo0dp2td74p7-9Y0td21zsnhPuOezxlzufEUSqEsP4_IsX_bhge_RmKK

June 14, 2024 - 2:46 pm

Okay, doesn’t look like we’re getting much of a rally. Once again, my personal strategy is to take assignment of the shares because I think RILY is a great covered call stock. I’ll send out a suggested strike for RILY and FSLY on Monday. For those capital constrained, you’ll need to buy back the short put in order to avoid assignment. It should cost around 1.50-1.70 depending on how the market is moving. Subtract 25 cents from that to get your loss per contract. However, I definitely feel that this will be a solid trade as a covered call as long as capital isn’t an issue.

June 14, 2024 - 1:31 pm

RILY is well under our strike at the moment (21.10 stock price versus 22.50 strike price). I strongly believe that RILY makes for a great covered call stock. If capital is available, I’d personally take assignment and sell a call next week (using the 22 or 22.5 strike expiring in a week – but it depends on where the stock closes). If capital isn’t available, you’ll have to buy back the put for around 1.40 (which is a loss of 1.15 or 115 per option). That doesn’t have to happen right now (I’ll send another update), just sometime before close (so we can see if the stock rallies before the end of day). For spread traders, you can let the spread expire if the stock is below 21.50, otherwise you’ll need to buy back the short put and sell the long put. I’ll send another update in an hour or so, but again, my personal preference is to take assignment of the shares and sell a call next week.

June 13, 2024 - 2:54 pm

This isn’t a trader alert but rather another opportunity to join me live… it just kind of came together quickly so I apologize for the last minute notice…

Last chance to get a free seat to watch two top options traders share everything

This afternoon, at 4:15 p.m. eastern, I’m going LIVE with Adam Mesh… an all-star options trader.

I’ve been trading for 25+ years and featured in every trading show imaginable… plus going mainstream with appearances with Jay Leno and Ellen Degeneres.

We’ve done this LIVE call once before this year… and made k on an options trade on IWM while we were on the call.

You’ll hear about our thoughts on the summer markets, our favorite options trades right now and more.

It’s 100% free. Click here to register.

June 12, 2024 - 2:02 pm

In the live session today, we sold the 22.5 put on RILY. However, the market moved pretty quickly when we started selling so the price is currently out of our range. Personally, I’d put in my limit sell (to open) order at 25 cents and wait to see if it gets filled. If it doesn’t, it may be best to sit this one out. You’ll need 2,250 in your account per one lot to make this trade as a cash secured put. A reasonable spread would be the 22.5-21.5 put spread, for those of you who prefer spreads.

May 31, 2024 - 2:00 pm

It was certainly nice to have a low stress week, especially with two trades on. Both GPS and ASAN are well above our strike prices, so we can just let them expire for zero (no action needed). We will collect full premiums on both trades. We’re off next week, but back on the week after that. See you then!

May 29, 2024 - 2:01 pm

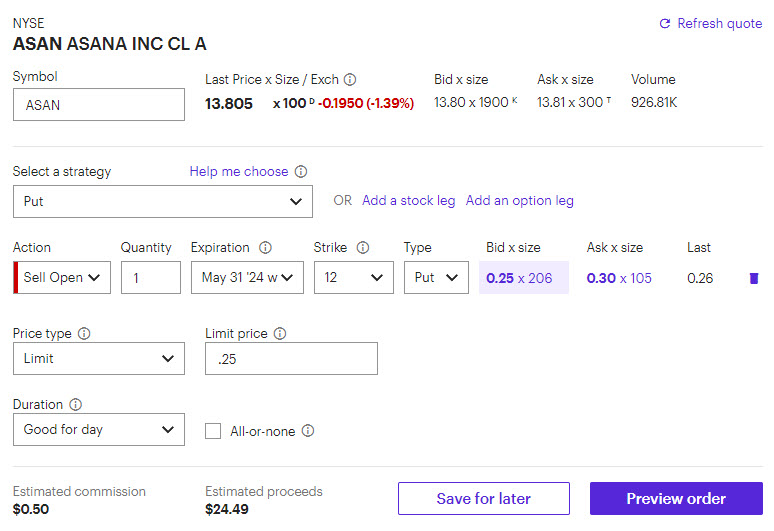

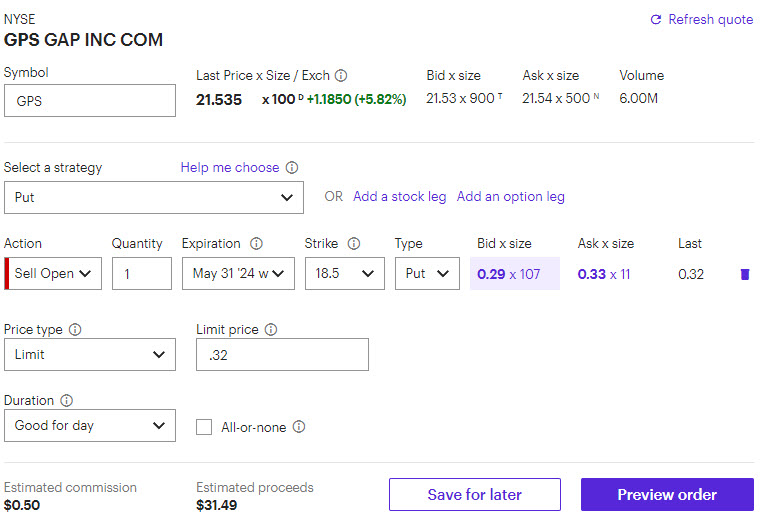

We made two trades today in the live session. We are selling puts on both GPS and ASAN. If I can only pick one, I’d probably do ASAN (but I think they are both strong choices). For ASAN, we are selling the 12 puts for around 25 cents (with the 12-11 put spread for the spread traders). For GPS, we’re looking at the 18.5 puts for around 32 cents (18.5-17.5 or 19-18 for the spread traders). Both stocks have earnings tomorrow. I’ll send out updates on closing/expiration on Friday.

May 24, 2024 - 3:14 pm

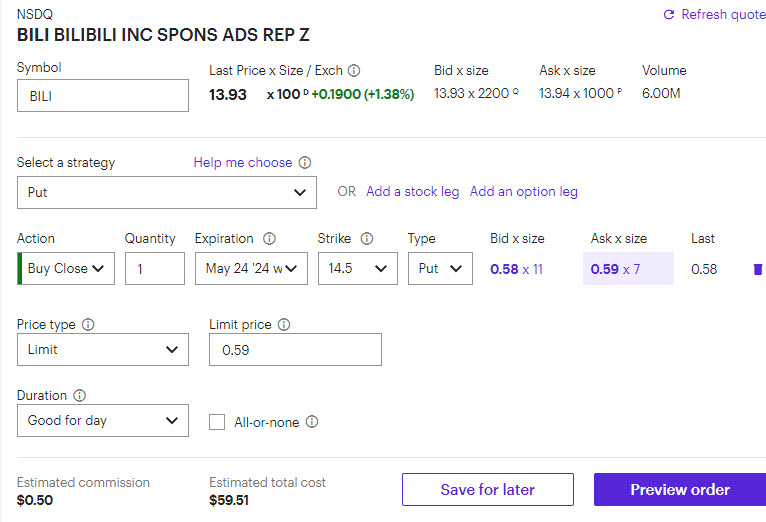

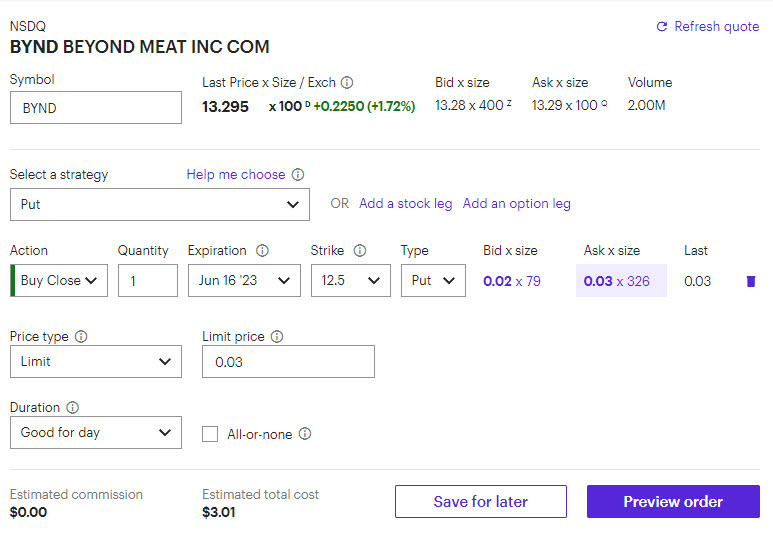

Looks like BILI is going to sit around 14. We need to close so we don’t get assigned on the stock, so let’s do that now (if you haven’t already). We’re looking to close anywhere between 50 and 60 cents. We collected a premium of about 30 cents, so we’re looking at a 20-30 cent loss on the trade. While we obviously prefer gains, this is the sort of loss that is in line with expectations for this strategy (compared to FSLY, which was much more of a fluke), and one we can easily recover from (basically one week of gains). Remember, we are buying to close the puts (as can be seen in the example below).

May 24, 2024 - 1:22 pm

Our BILI puts are trading for around 45 cents right now, or roughly a 15 cent loss. We’re going to give it another hour or so and let time decay do its thing before closing. Stay tuned.

May 23, 2024 - 3:10 pm

As I write this, BILI is at 13.70, so we’re down about 50 cents (assuming you collected 30 cents in premium). The silver lining is that the event risk is out of the way and we still have a full day left for it to recover. What’s more, tomorrow should be a light trading day because it’s the Friday before a 3-day weekend. I think there’s a reasonable chance the share price could drift higher. My plan is to hold until tomorrow before making a closing decision. I’ll keep you posted tomorrow.

May 22, 2024 - 2:24 pm

Hey everyone, we have a couple items to discuss from today’s session below. We have the trade in BILI and I have the link to the waitlist for Trevor’s software (and the promo code), which should be available for purchase in about a week.

First off, the link for the software waitlist:

https://www.jtncgroup.com/quantum-flo-waitlist

Also, the promo code to use is: IAPromo

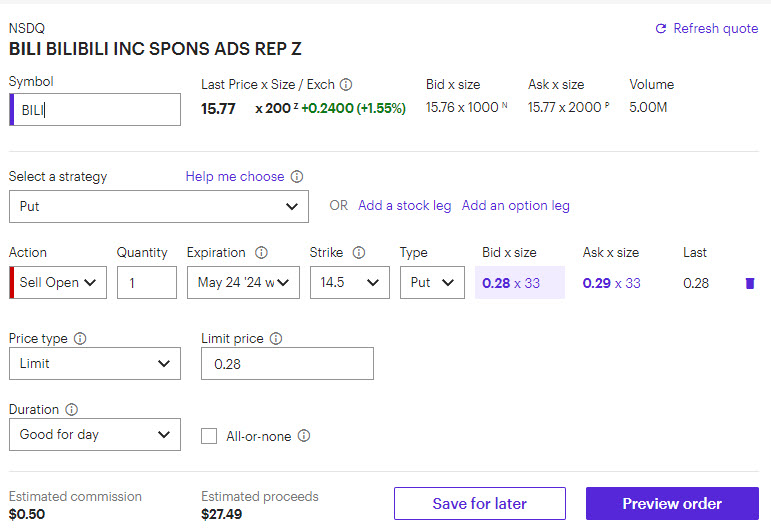

The trade from today is BILI 14.5 puts for around 30 cents. Earnings are before market open tomorrow. You’ll need 1,450 in your account to make the trade (per put sold). As always, I’ll let you know by Friday close if we’ll close or let the trade expire for zero.

May 17, 2024 - 7:22 pm

I’m doing a webinar next week with Adam Mesh called the “All-Star Options Event” where we’ll be talking about his options strategies and core trading philosophy. If you’re interested in signing up, here’s the link:

https://webinar.adammesh.com/individual-investors-event/

May 17, 2024 - 3:08 pm

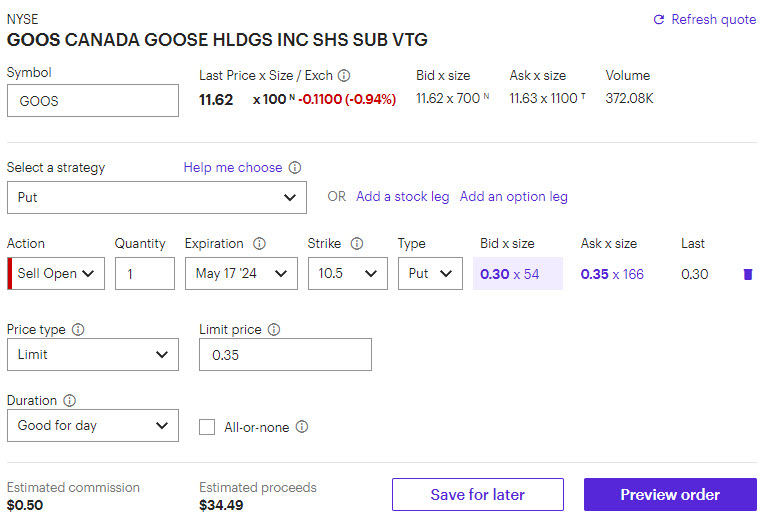

GOOS jumped after earnings yesterday and is still well above our short put strike. We can safely let the puts expire for zero (no action needed) and collect the full premium amount.

May 15, 2024 - 2:00 pm

In the live session today we sold a put on GOOS. Specifically, we sold the 10.5 put for around 35 cents (down to 30 cents is reasonable). For spread traders, the 10.5-9.5 put spread is a good choice. Earnings are before market open tomorrow. I’ll send out closing/expiration instructions on Friday.

May 10, 2024 - 2:09 pm

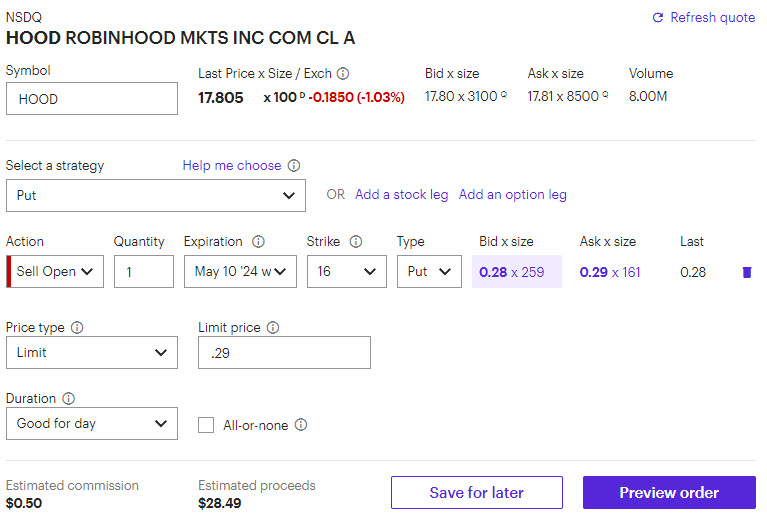

We are in good shape with HOOD. Our 16 puts are set to expire for zero (so no action is needed) and we’ll collect the full premium.

May 8, 2024 - 2:09 pm

In the live session today in 48 Hour Income, we sold the 16 puts in HOOD for about 28-30 cents (the 16-15 put spread is a reasonable alternative). HOOD earnings are today after close. I’ll send out closing/expiration instructions on Friday.

May 8, 2024 - 1:00 pm

Please ignore that last text about FSLY. It was meant to go to the Weekly Income Accelerator subscribers. Sorry for the confusion.

May 6, 2024 - 2:00 pm

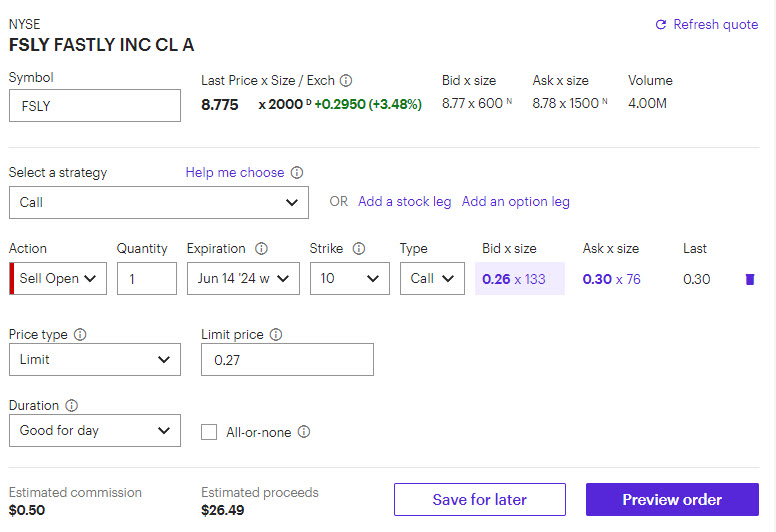

Many of you should now own FSLY shares. Either you were assigned early or took assignment at expiration. For those holding the shares, we’re going to sell calls now. Covered calls are normally outside the scope of this service, but this is an extenuating circumstance. I will discuss the reasoning behind selling these calls on Wednesday, during our normal webinar. But, in a nutshell, premiums aren’t very high in FSLY calls so we’re going to go out 40 days to June 14th to sell the 10 calls for around 27 cents. If we get called away at 10, we will have made back most of our losses from selling the 11 puts (and collecting premium from both the puts and the calls). Since you already own the shares, you can sell to open a call without any issues in your brokerage. They know the call isn’t “naked” if you have shares in your account. We can sell 1 call for every 100 shares we own.

May 3, 2024 - 2:25 pm

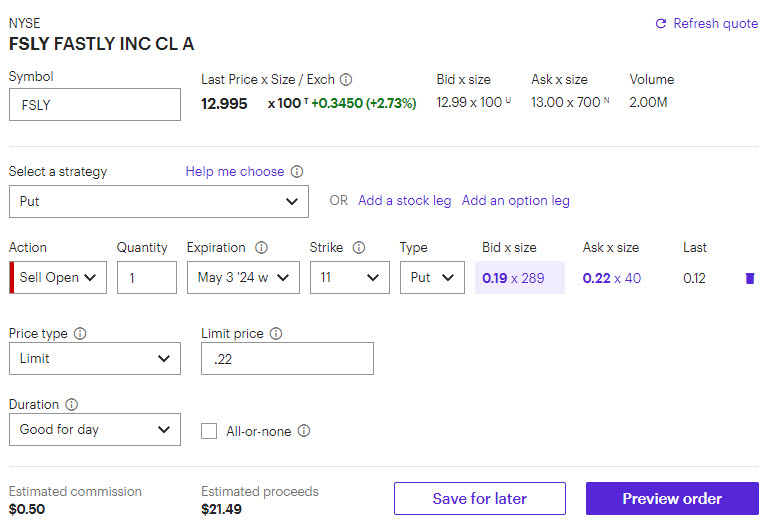

Typically, our rule in 48 Hour Income is to never take assignment on shares. However, since many of you have already gotten assigned early on FSLY, we’re going to make an exception in this case. If you haven’t gotten assigned, my preference in this case is to let the options expire and take ownership of the shares. On Monday, I will send out a note with what call to sell if you want to turn the position into a covered call (which again, is what I personally would do in this scenario). On Wednesday, I will discuss the situation in more depth and talk about how I look for calls to sell in these types of scenarios.

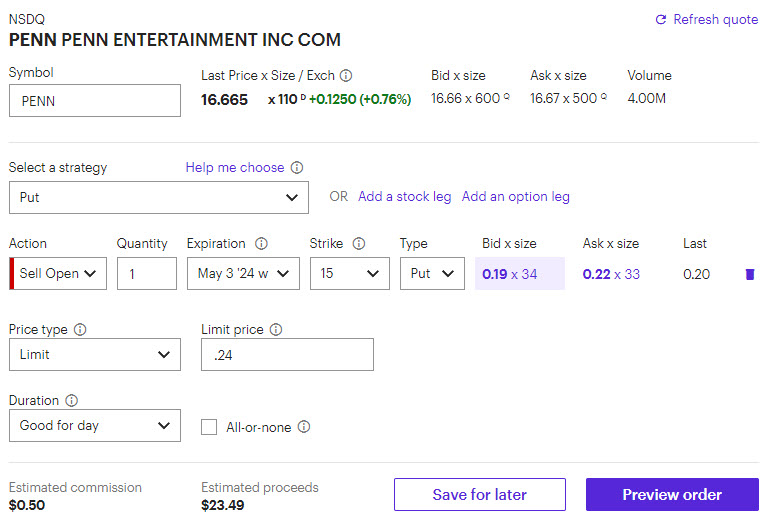

For PENN, it looks like we’re in the clear so we can let the option expire for zero (no action) and collect the entire premium.

May 2, 2024 - 2:46 pm

Plenty of questions coming in about FSLY as expected. The options implied a move of about 2.25. Instead, it dropped 4.50 or so. FSLY actually beat on revenues and earnings but lowered guidance for the coming year. It was bad, but nowhere near down 35% bad. That being said, we can’t control the market reaction, so we have to work with what we have.

First off, we’ll wait until tomorrow to close. The bad news is out there already, so we may as well give it as much time as possible to recover. For those of you who are comfortable taking assignment (getting assigned the shares), there likely will be good premiums in the calls for covered call trading. I’ll send a note tomorrow when it’s time to close for those that want to take the losses and move on.

PENN is right at our short strike, so I’ll address that tomorrow as well.

May 1, 2024 - 2:09 pm

In the live session today in 48 Hour Income, we made two trades. We sold the 11 puts in FSLY for about 25 cents (minimum is about 22 cents and the 11-10 put spread is a reasonable alternative). We sold the 15 puts in PENN for around 26 cents (23-24 cents is the minimum for that one and the 15-14 put spread is the alternative there). If I could only pick one, I’d stick with FSLY over PENN. FSLY earnings are today after close and PENN earnings are tomorrow. I’ll send out closing/expiration instructions on Friday.

April 26, 2024 - 2:56 pm

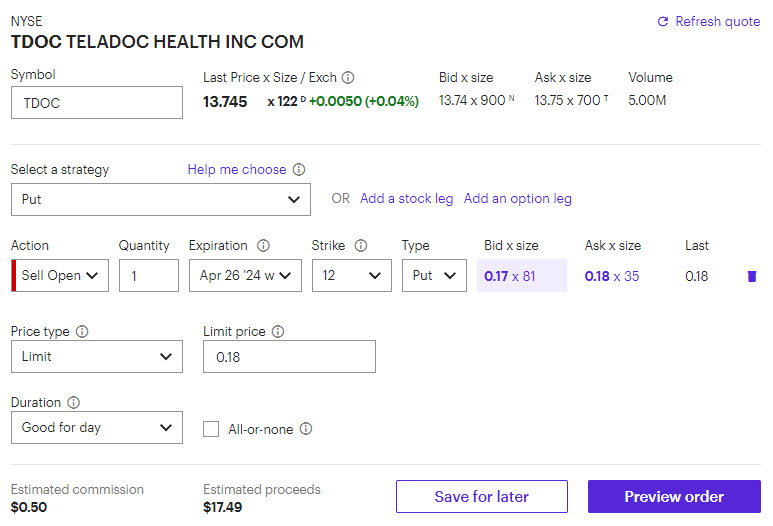

We should be in the clear on the TDOC trade. We are short the 12 puts and the stock is over 13. We can let the puts expire for zero (no action needed). Depending on where you got filled, we’re looking at 1.5%-2% returns on the trade.

April 24, 2024 - 2:09 pm

Really quick before I get to the trade, I forgot to mention during today’s webinar that we have a bonus webinar tomorrow night that you’re all invited to (for free of course) talking about a really neat ETF, HTUS. It’s being presented by Euan Sinclair who has written 3 books on options trading that are pretty much required reading for professionals. If you register at the link below, even if you can’t make it live, you can watch the replay. Here’s the link:

https://us02web.zoom.us/webinar/register/WN_y-WJ3bU4Qs-viJ0iSFmFHg?inf_contact_key=f5b84d87a651bbd72caeef0ae0e628506303c23d34f0b6ec81d0174425c11f9a#/registration

Regarding the trade we made, we sold the 12 puts in TDOC for around 20-24 cents. It’s dropped to about 18 cents now, but you could get another shot at 20 cents before close today. Earnings are tomorrow. I’ll send out info on closing/expiration on Friday.

April 19, 2024 - 2:57 pm

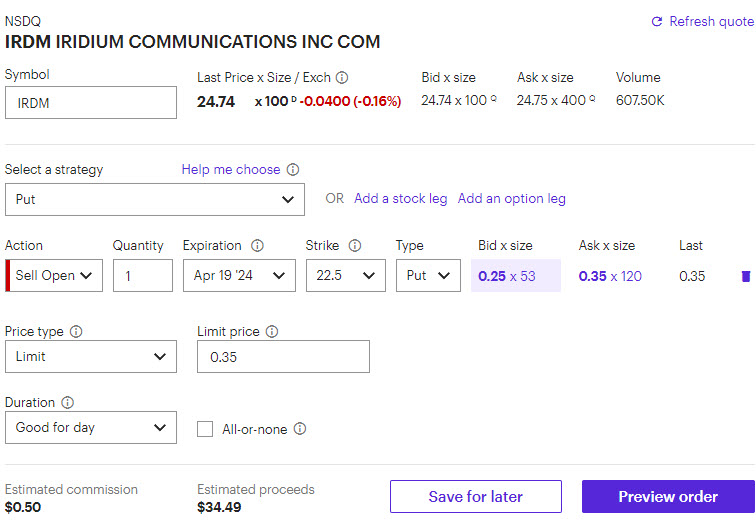

Well, despite the volatility in the market this week, IRDM turning out to be an easy win. The stock price went up after earnings and our puts were never close to the stock price. You can let the trade expire for zero (no action needed).

April 17, 2024 - 2:05 pm

In the live session today we sold to open the April 19th 22.5 put in IRDM. We started selling at 45 cents and then 40 cents. It’s currently around 35 cents. Personally, I would try to get 40 cents first and if there’s no action for the next hour or so, then 35 cents is still reasonable. Earnings are before open tomorrow, so if you don’t get filled today, there won’t be a chance tomorrow. I’ll send out a text on Friday regarding expiration/closing.

April 10, 2024 - 1:54 pm

We’re going to sit on our hands this week in 48 Hour Income. There were no trades worth doing. We’ll try again next week!

April 5, 2024 - 3:22 pm

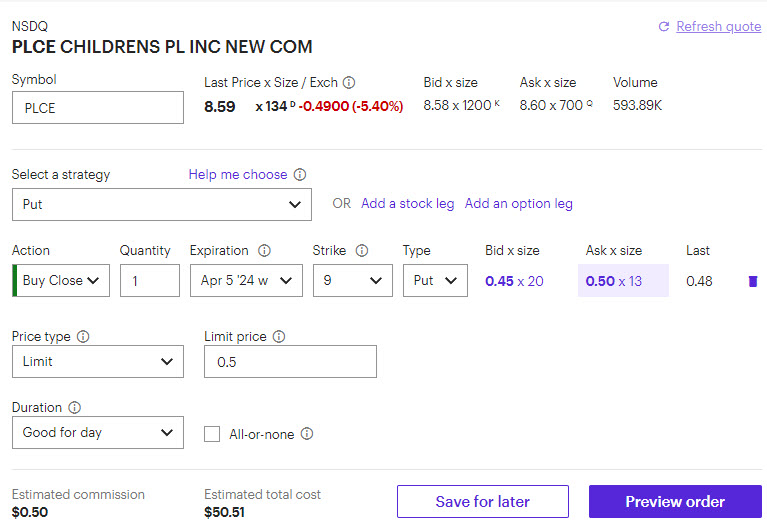

Okay, it doesn’t appear that we’re going to get a rally in PLCE. I didn’t mind waiting this long because the stock hasn’t really dropped below 8.50 or so today, so it made sense to give it a chance to recover. We don’t want to own the shares, so we’re going to close the position for a small loss. If we buy to close for 50 cents, that’s a 25-30 cent loss depending on where you got filled. Not great, but far from terrible. Keep in mind, most of our best trade are available during earnings season, and we’re just a couple weeks away from a fresh start to Q2 earnings.

April 5, 2024 - 2:39 pm

PLCE has been stuck below our strike today. I’ve been waiting to see if we can close for under 20 cents, but the stock has bounced around a little too much so far. I’m going to give it another 30-45 minutes to see if there’s a last minute rally in the share price. Either way, I’ll send out another text with closing instructions before the end of the market day.

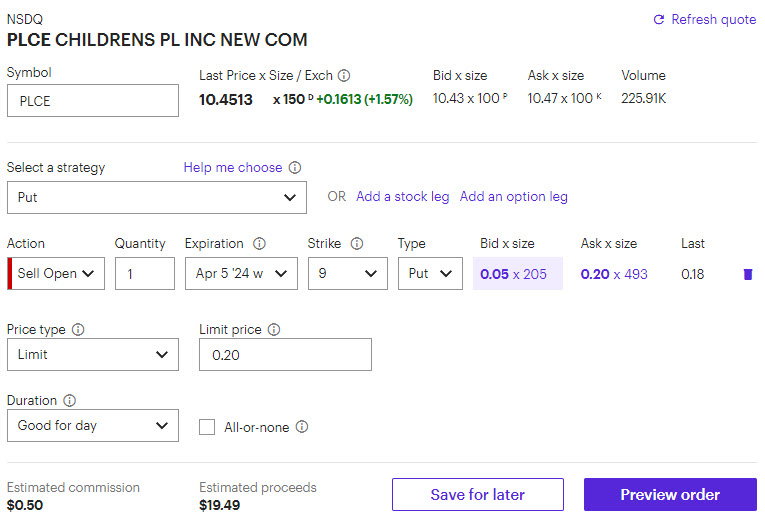

April 3, 2024 - 2:08 pm

In the live session today we sold to open the April 5th PLCE 9 puts for around 20-25 cents. The company is supposed to announce earnings tomorrow. A reasonable spread is the 9-8 put spread (selling the 9, buying the 8). I’ll send out closing instructions on Friday.

March 28, 2024 - 2:42 pm

WBA will finish well above our strike price, so no action necessary on our puts. You can let them expire for zero. We’ll make about 1.25% for the one day trade.

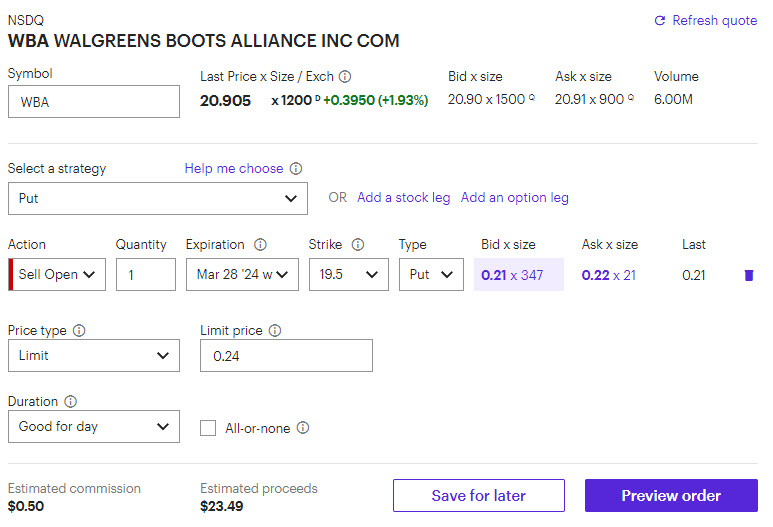

March 27, 2024 - 1:57 pm

In the live session today we sold (to open) the WBA 19.50 put for around 24 cents. WBA has earnings tonight after close. For spread traders, I like the 19.5-18.5 or 19.5-18 put spread. Remember, the market is closed Friday so the options will expire tomorrow after close. I will send out a text regarding our exit strategy during trading hours tomorrow. Trade details below.

March 22, 2024 - 1:27 pm

We should be fine at this point letting CHWY expire. I assume Fridays after close will continue to be non-events (RILY notwithstanding). No action needed as we can let the 15 puts expire for zero.

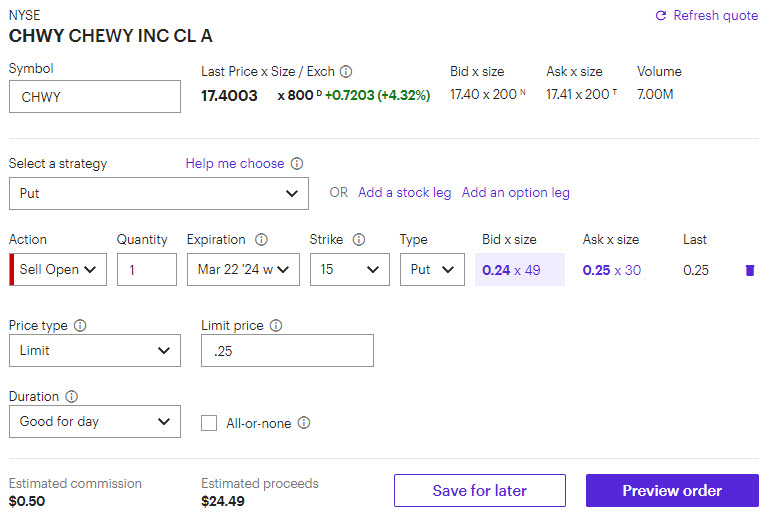

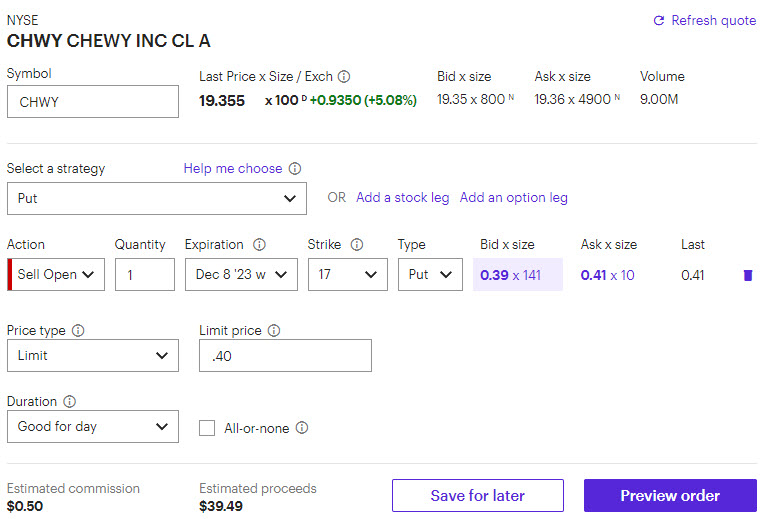

March 20, 2024 - 2:11 pm

In the live session today we sold a 15 put on CHWY. CHWY has earnings after close today. The market has spiked a bit on bullish news from the Fed, so I think it’s reasonable to use the 15.5 strike instead of the 15 strike. We sold the 15 strike during the session at around 30 cents. It’s about 25 cents now. the 15.5 is about 38 cents. I think either strike is fine (although the 15 put is the safer trade). For the spread traders, the 15-14 or 15-13.5 put spreads are both reasonable choices.

March 18, 2024 - 2:37 pm

Okay, so we caught a break and RILY is up above our short strike (16.5). As of this writing, it’s up to about 16.80 – so if we sell the shares now, you can tack on another 30 cent or so to our profit. While this was far from an ideal scenario, we are fortunate that we can get out with additional gains. For those of you who sold covered calls, you should also be in good shape as it no longer appears that RILY is in danger of falling off a cliff. Bottom line, I think is a good time to sell the shares and take profits.

March 18, 2024 - 9:05 am

As many of you have now seen, RILY tanked on news in after hours trading last week and I imagine most, if not all of you, got assigned on the shares. Our short put was at 16.5 (for most of you) and the stock is around 15.70. I’m livid that this happened for a couple reasons which I’ll get back to, but first here’s what happened.

Earlier this year, RILY had delayed the submission of their annual report to review the transactions involving their client who is in trouble with the SEC. They had a grace period for getting the financial submitted, which they just missed. That’s the news that came out after close on Friday, causing the stock to drop about 10% in after hours trading. The company has said they are still working with auditors and the submission will be done as soon as reasonably possible. Last month, RILY also said they didn’t expect significant changes to their financials because of the legal situation (for which they also claim to have no knowledge of any wrongdoing).

There is a brief window after market close on Friday that stocks still trade in after hours. I’ve never seen it happen that options so far out of the money end up in the money during this period – but that’s exactly what happened to us.

It’s hard to say how the stock will react on Monday, but we basically have two choices.

1) Sell the stock on Monday when the market opens (or any time after). If the stock is back up above 16.50, this is the easy choice as you’ll make a profit from the premium and the stock price.

2) Sell covered calls against the shares. RILY call premiums are really juicy so this could also be a good way to generate profits, but will require more time. If the stock is below 16 on Monday, this is probably what I prefer.

Of course if the stock is down, you could also sell and take a loss on the shares. I don’t expect significantly more downside than the 10% the stock already dropped on Friday, but there’s always a risk that the short sellers will push the stock even lower.

Finally, I have to say that I’m really irritated at this whole situation. First off, there’s kind of an unwritten rule that company news is not released on Friday afternoon. It rarely happens and usually angers a lot of people when it does. More importantly, the fact that options can be assigned/exercised after hours on Friday is a joke. Most people (especially retail traders) have no way to trade out of the situation once markets close on Friday. It’s completely unfair (in my opinion) that this can happen. I intend to write a letter to the SEC about this, although I’m sure it means nothing to them.

In the meantime, hang tight. We’ll see where things are on Monday and go from there. My preference is that the stock is around 16.50 or higher and we simply sell the shares out. I’ll likely be contacting you via email since the texting system is still not working properly.

March 15, 2024 - 2:27 pm

We are safe to let both the RILY and CSIQ puts expire for zero. No action is necessary as we will collect full premiums on both trades.

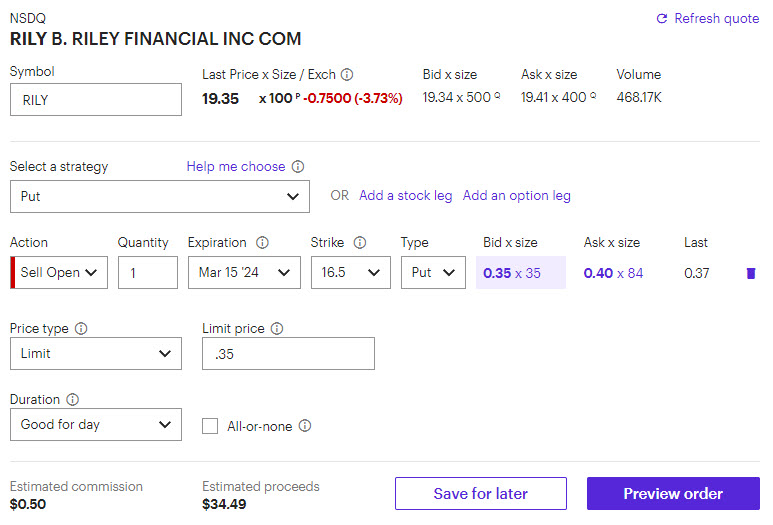

March 13, 2024 - 2:05 pm

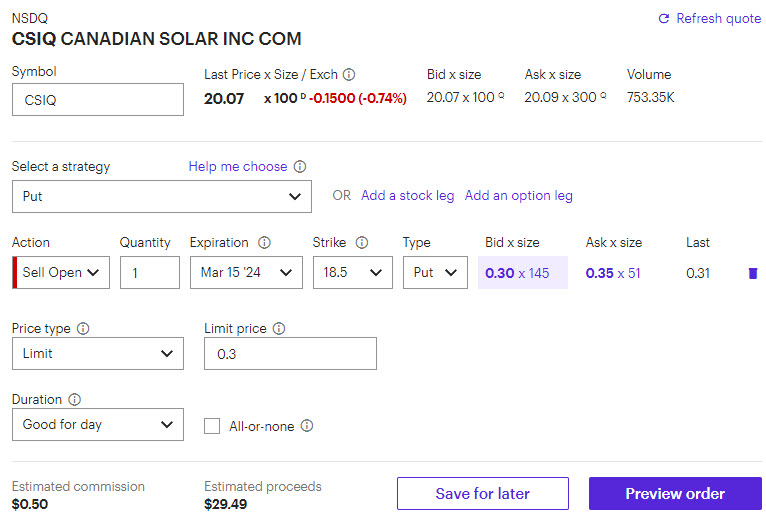

We made two trades today in the live session. We sold the 16.5 puts in RILY and the 18.5 puts in CSIQ (both expiring on Friday). CSIQ has earnings tomorrow. If you can only do one, I prefer the RILY trade. For spreads, I like the 16.5-15 put spreads for RILY (selling the higher strike, buying the lower strike) and the 18.5-17.5 put spread in CSIQ. Details can be found below for the cash secured put trades. I’ll text with instructions prior to Friday expiration.

March 8, 2024 - 12:50 pm

Both GPS and RILY are nowhere near our strikes, so barring some monumental collapse in the market, we can let both expire for zero. No action is necessary as we’ll collect full premium. Cheers to a non-stressful week of premium collection.

March 6, 2024 - 2:21 pm

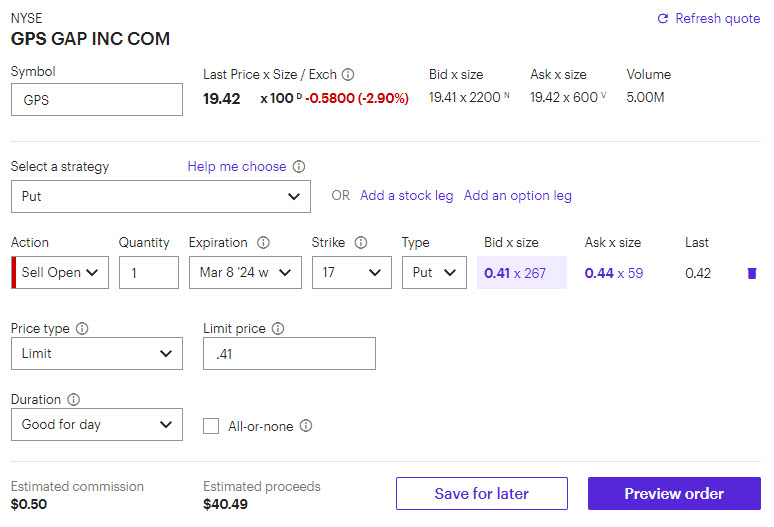

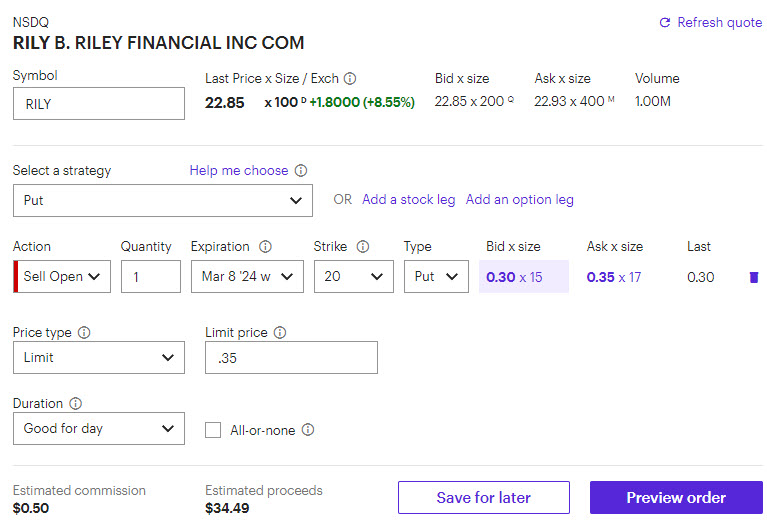

We made two trades today in the live session. We sold the 20 puts in RILY and the 17 puts in GPS (both expiring on Friday). RILY has an ex-dividend date on Friday and GPS has earnings after close tomorrow. If you can only do one, I prefer the GPS trade. For spreads, I like the 20-19 put spreads for RILY (selling the higher strike, buying the lower strike) and the 17-16 put spread in GPS. Details can be found below for the cash secured put trades. I’ll text with instructions prior to Friday expiration.

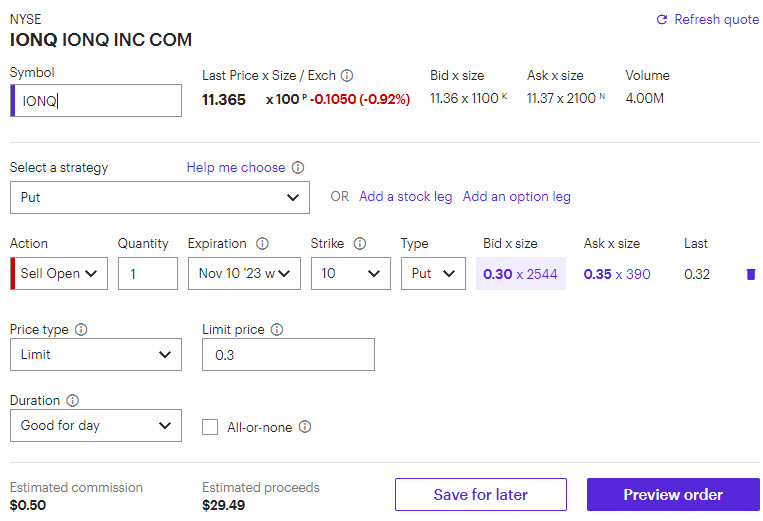

March 1, 2024 - 12:40 pm

We are in good shape on both of our positions (RILY and IONQ). As it stands now, we can let both expire for zero (no action needed). I’ll text if there’s a change before market close, but it looks like we’ll collect the full premium on both trades.

February 28, 2024 - 2:08 pm

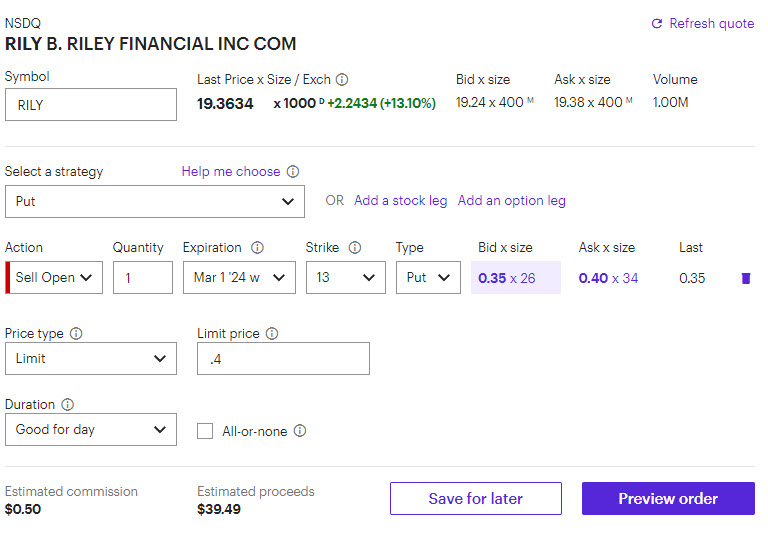

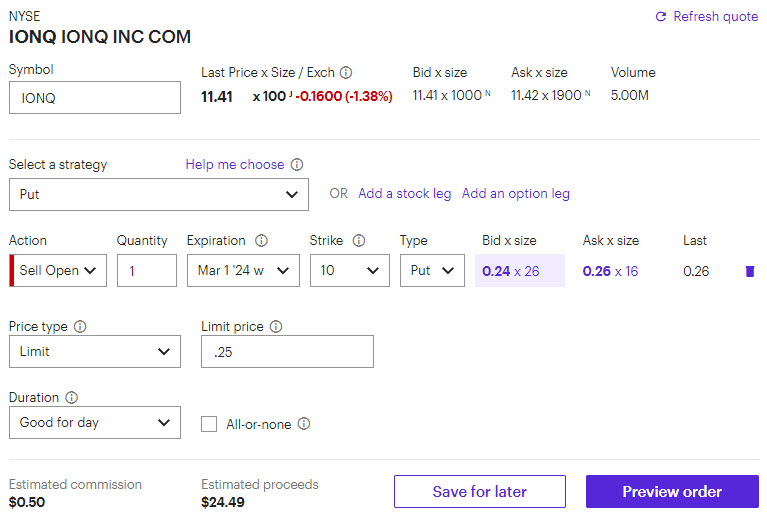

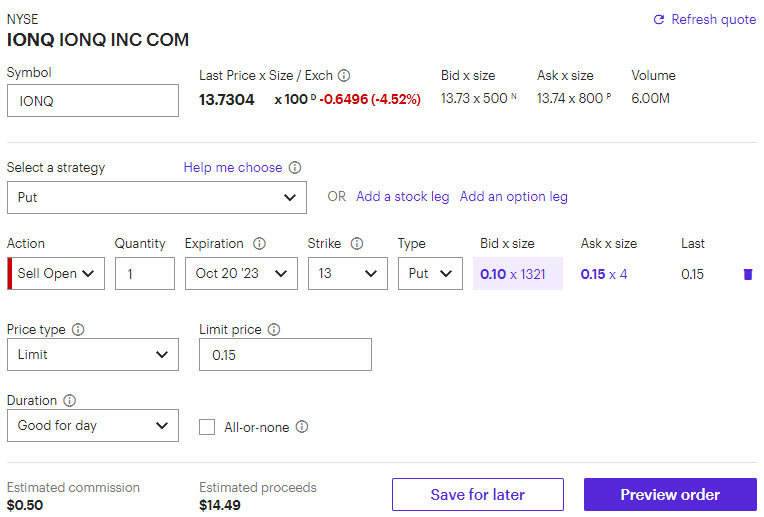

We made two trades today in the live session. We sold the 13 puts in RILY and the 10 puts in IONQ (both expiring on Friday). RILY has earnings tomorrow and IONQ has earnings after close today. For spreads, I like the 13.5-12.5 for RILY (selling the higher strike, buying the lower strike) and the 10.5-9.5 put spread in IONQ. Details can be found below for the cash secured put trades. I’ll text with instructions prior to Friday expiration.

February 26, 2024 - 5:51 pm

Test of the 48-Hour Income trade alert system.

February 16, 2024 - 2:34 pm

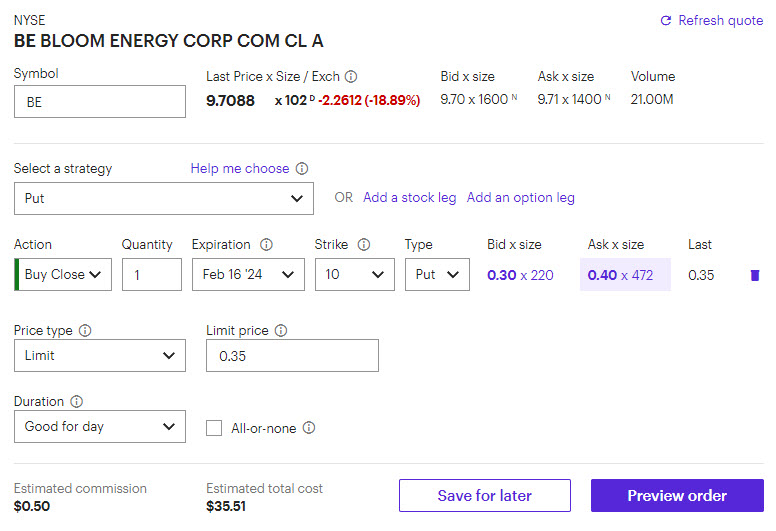

We have mixed results again this week. ABR worked like a charm and we can let that put expire for zero (no action is necessary), which means our profits are about 2.7% (depending on where you got in). BE, on the other hand, missed earnings and the reaction has been extreme. Fortunately, the stock had run up a bit before last night so it’s dropped just below our strike. If we close here (buy to close) then we can get around 35 cents, which is only a 1% loss. Closing trade details are below.

February 14, 2024 - 2:16 pm

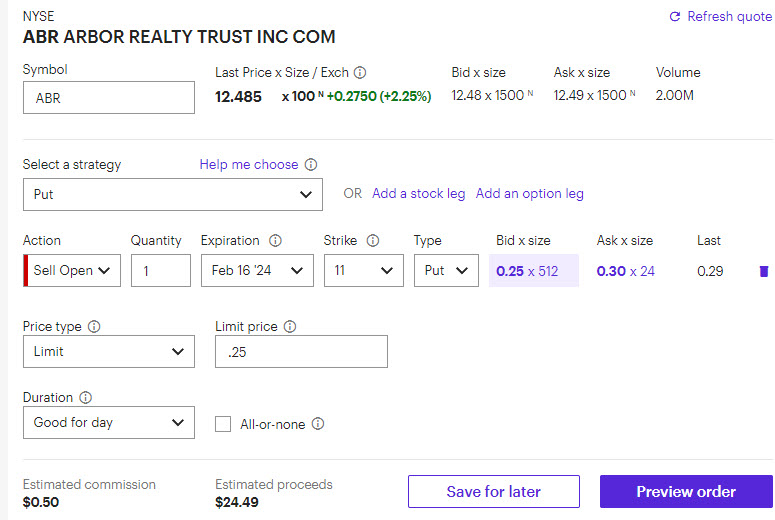

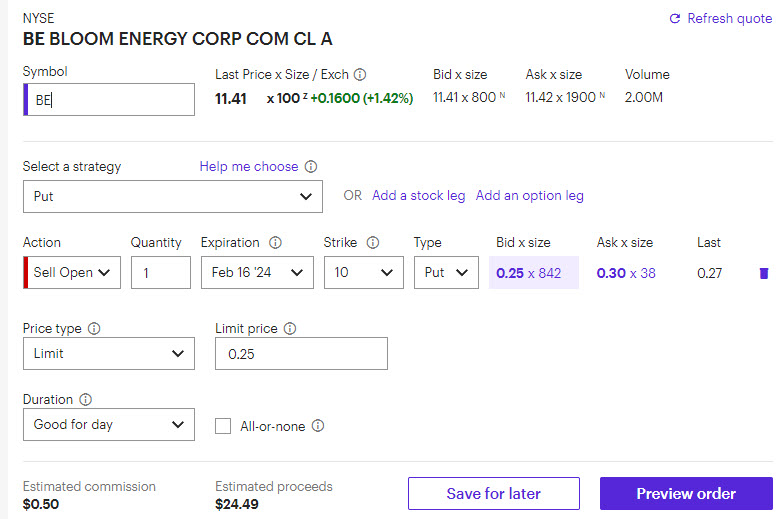

In the live session today we made two trades: selling puts on ABR and BE. For ABR, we’re selling the 11 puts for around 25-30 cents (or the 11.5-10.5 spread – selling the 11.5, buying the 10.5). For BE we’re selling the 10 puts for 25-30 cents (or the 10-9 put spread – selling the 10, buying the 9). Trade details can be found below. I’ll send out an update on expiration/closing on Friday.

February 9, 2024 - 3:00 pm

Regarding our open trades in 48 Hour Income:

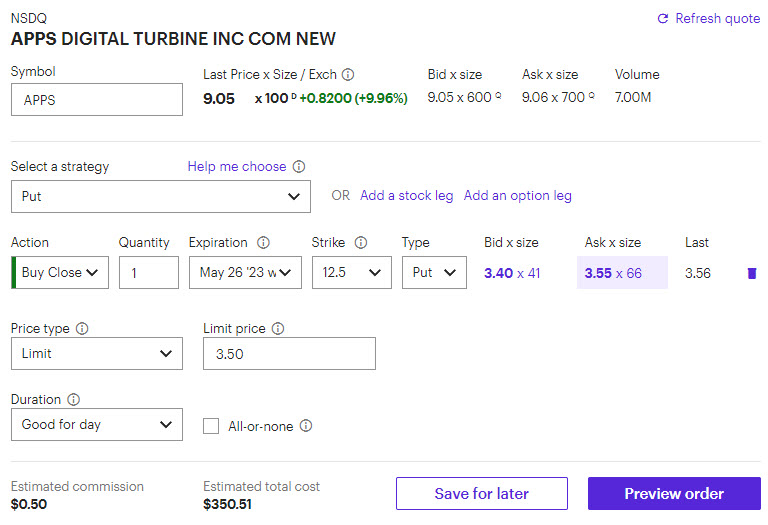

- RILY is in good shape and we can let it expire for zero (no action necessary)

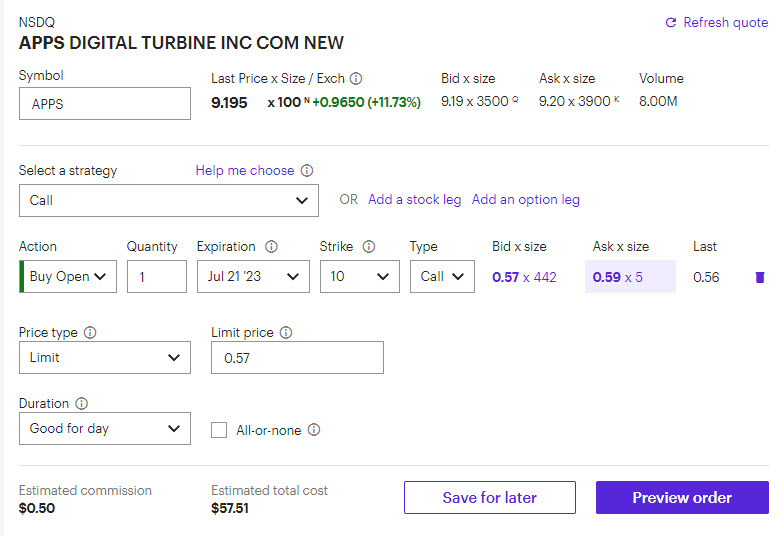

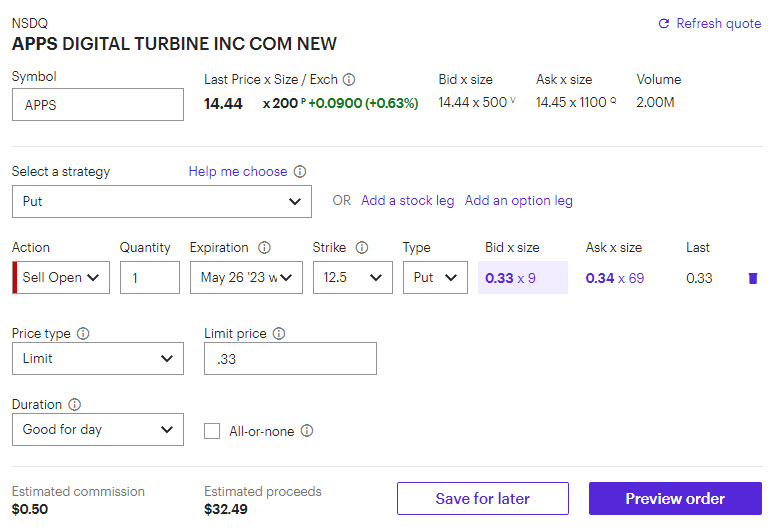

- APPS will need to be closed if you haven’t already gotten assigned on the shares (unless you want to accept assignment). For those who own the shares already due to early assignment, you can sell them out at any time (or hold as long as you want – or even sell calls against those shares).

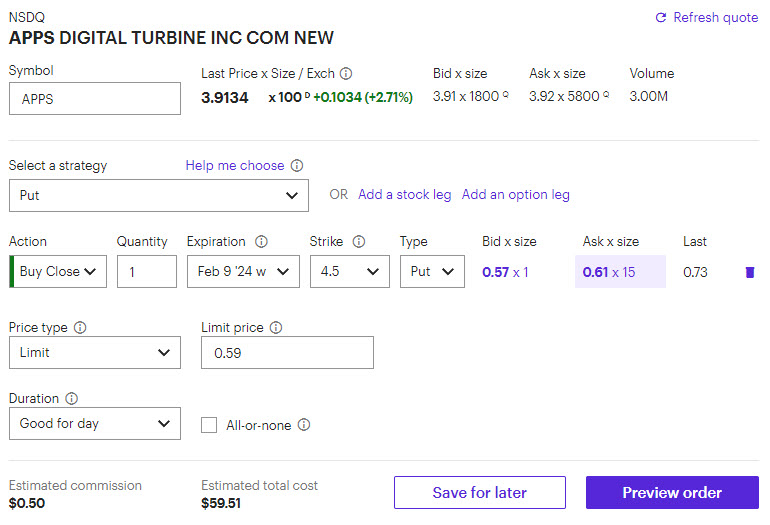

- For those with APPS still open that don’t want to take a assignment, closing trade details are below. We’re looking at around a 10% loser given current levels (just for APPS, that doesn’t include any gains from RILY).

February 8, 2024 - 2:08 pm

APPS missed earnings is down below 4 at the moment. I think the selling is way overdone and we’ll definitely give this trade as long as possible before closing. There’s definitely rebound potential before expiration (we only need to get back to 4.35 or so to break even). Keep an eye out tomorrow for a closing email regardless. RILY is in good shape and we’ll likely be able to let that one expire for zero.

February 8, 2024 - 11:16 am

Test of the SMS Alert system

February 7, 2024 - 2:19 pm

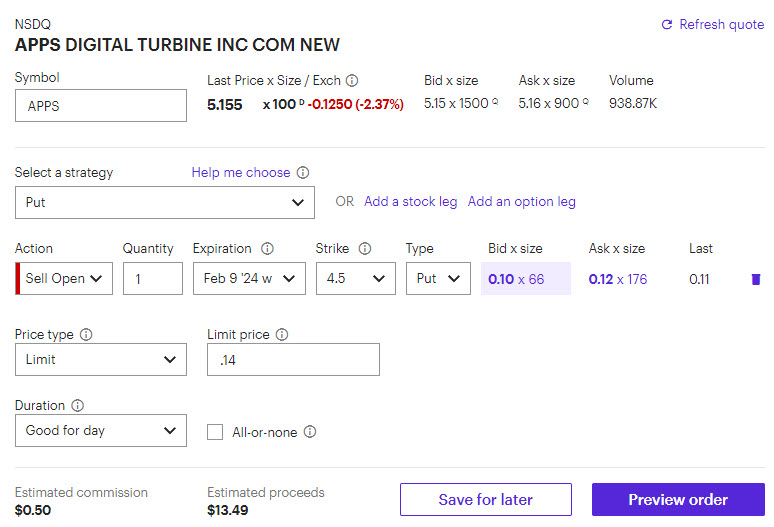

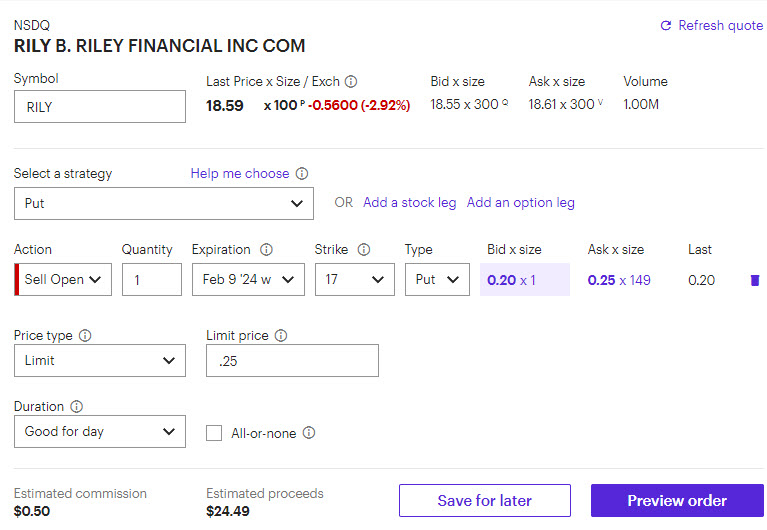

We made two trades in the live session today, APPS and RILY. Both are below the minimum entry point at the moment, but I expect them to bounce back to some extent. If the puts can get back to a reasonable selling level, I like them both fairly equally. For APPS, we sold the Feb 9th 4.5 puts for around 15 cents (with a minimum of 14 cents). The 4.5-4 spread is a good alternative for spread traders. For RILY, we sold the Feb 9th 17 puts for around 30 cents (minimum 25 cents) with the 17-16 spread as a good choice for spread traders.

I’ll send texts for these trades on Friday to explain next steps (closing or letting expire).

February 6, 2024 - 1:51 pm

This is a test of the 48-Hour Income text alert system. No action required.

February 2, 2024 - 1:24 pm

Our GOOS is golden, so we are good to let it expire for zero (no action necessary). If you sold the 11 puts for 30 cents, it’s a 2.7% gain, while the 10.5 puts for 20 cents is a 1.9% gain.

January 31, 2024 - 5:46 pm

It seems like there may have been an error when sending out this text after the 48 Hour Income live session, so I’m resending it now.

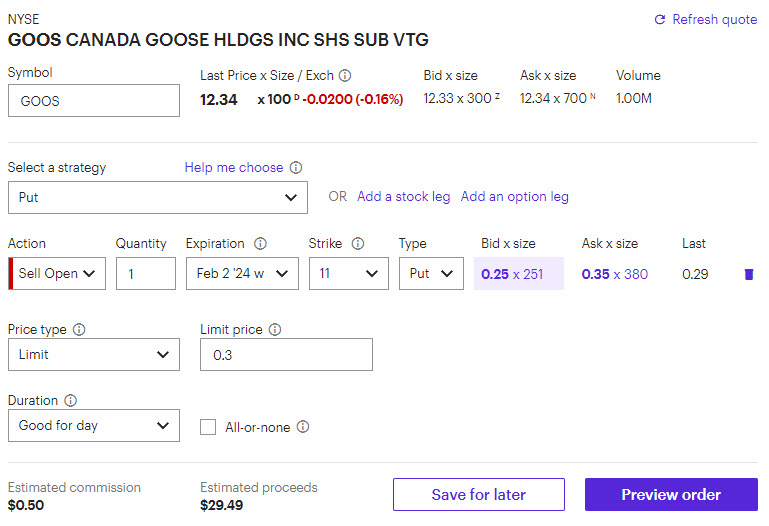

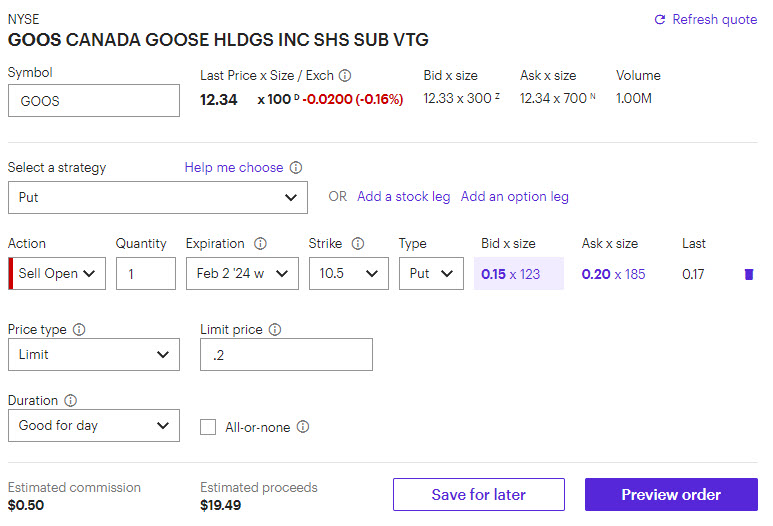

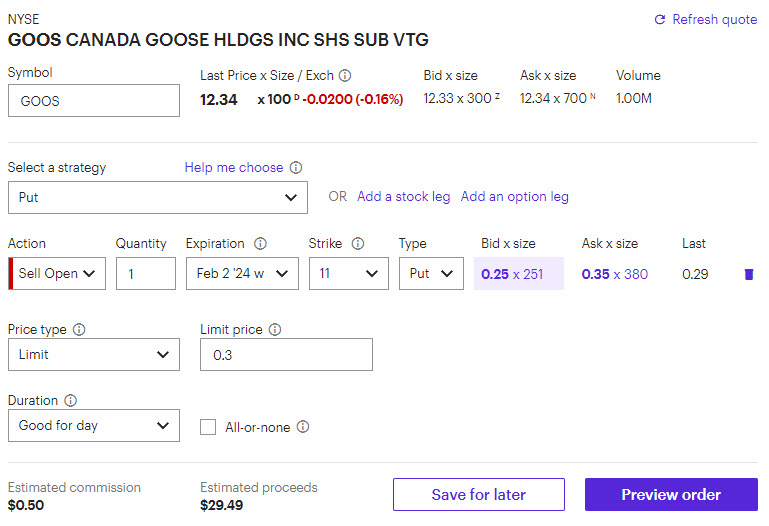

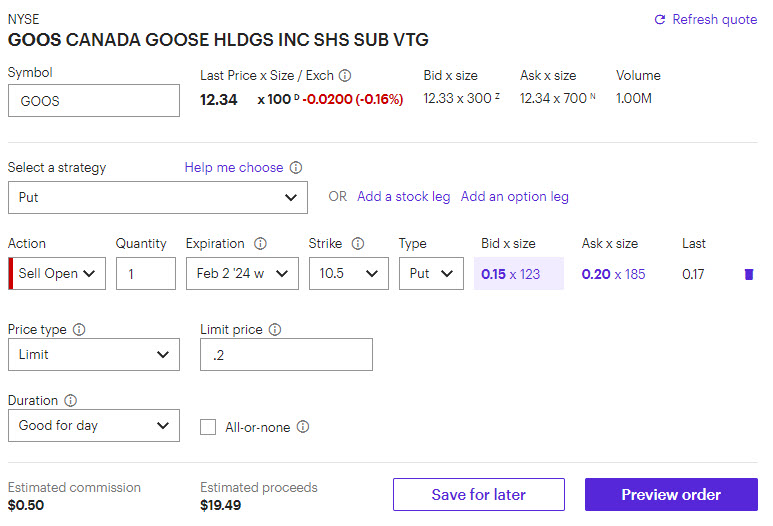

In the live session today we sold a put on GOOS, with earnings coming out tomorrow. Either the 10.5 or 11 put are viable. Originally I liked the 11 put for 30 cents a bit better, but many of you were getting filled on the 10.5 put for 18-20 cents, which is also really good. I’ve included screenshots of both below, so you can choose one or the other (or both!). The spread I like in this scenario is the 11-10 for 15-20 cents. I’ll text out closing info on Friday, even if it’s just to say that we’ll let the option expire.

January 31, 2024 - 2:04 pm

In the live session today we sold a put on GOOS, with earnings coming out tomorrow. Either the 10.5 or 11 put are viable. Originally I liked the 11 put for 30 cents a bit better, but many of you were getting filled on the 10.5 put for 18-20 cents, which is also really good. I’ve included screenshots of both below, so you can choose one or the other (or both!). The spread I like in this scenario is the 11-10 for 15-20 cents. I’ll text out closing info on Friday, even if it’s just to say that we’ll let the option expire.

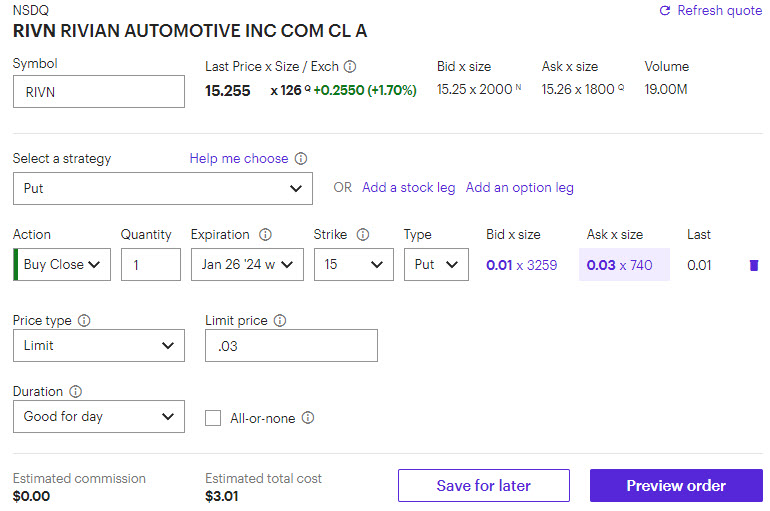

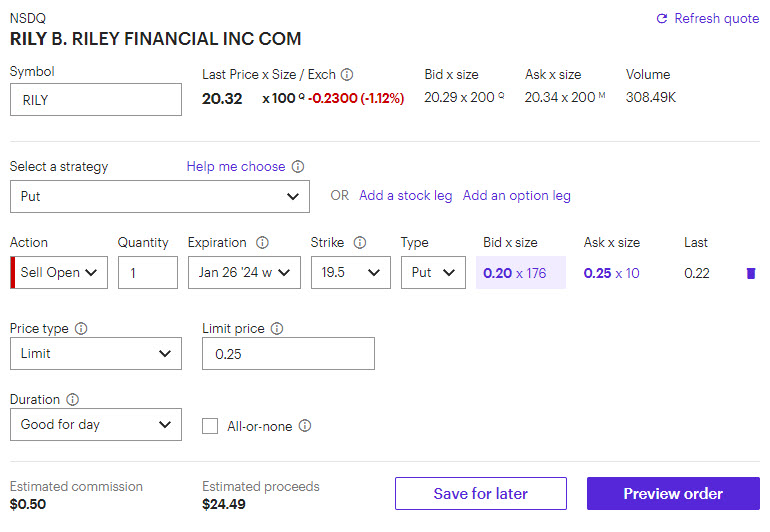

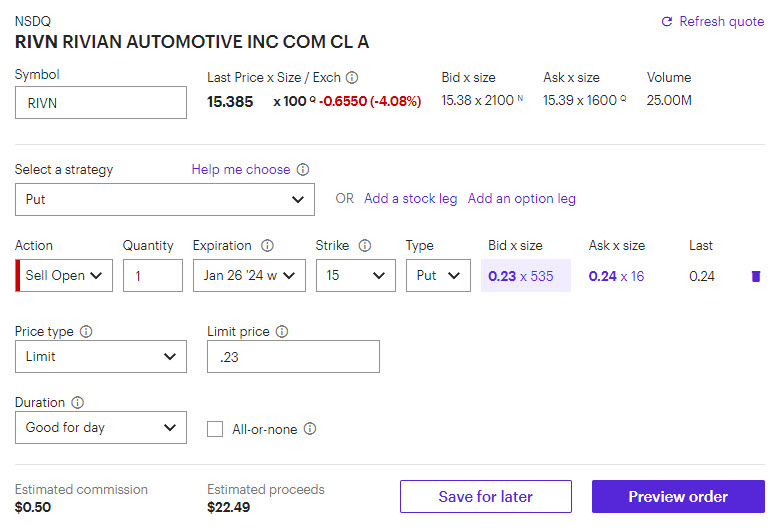

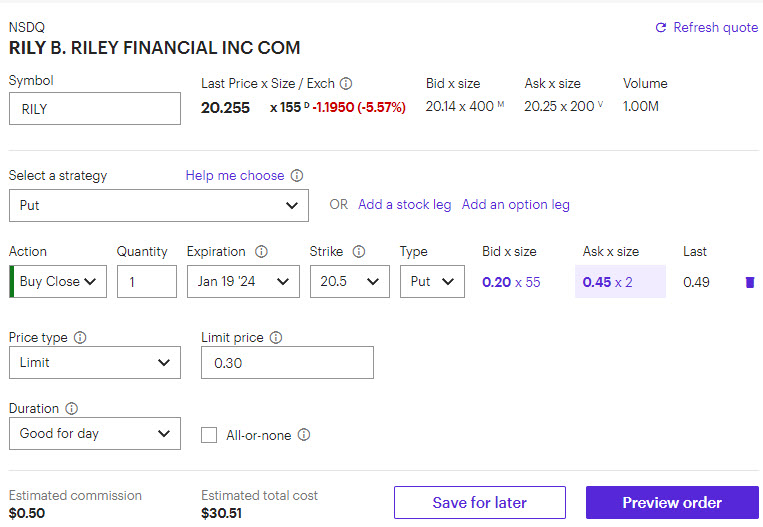

January 26, 2024 - 2:04 pm

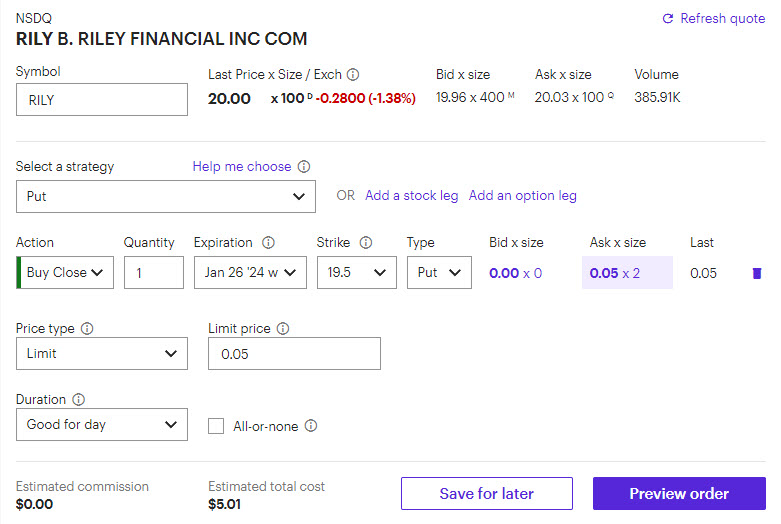

We are probably fine to let our options expire for zero – however, after the close call last week that turned out to be a small loss, I think we should pull the trigger early and close both trades. We can close RIVN for 3 cents and RILY for 5 cents (or less). Since we went a bit more aggressive on the trades this week, we’ll go a bit more conservative on the closing. Details can be found below. We’re looking at around 1% gains for each trade.

January 24, 2024 - 2:13 pm

We made two trades today in the live session for 48 Hour Income. They are both a bit more aggressive than usual. If you can only do one, I’ll say RILY just because it’s a bit further away from the stock price.

For RILY we’re selling the 19.5 put for around 25 cents (I wouldn’t go any lower than that). For a put spread, the 19.5-18.5 spread is what I like in RILY.

For RIVN, we’re selling the 15 put for around 23 cents (and I wouldn’t go below 20). The 15-14 put spread is a reasonable choice for RIVN.

Details can be found below. I’ll text out closing instructions (probably on Friday) even if I’m just saying to let the puts expire.

January 19, 2024 - 3:36 pm

Looks like RILY is not going to cooperate. Our rule is we never take assignment on shares (but for those comfortable trading covered calls on your own, RILY does have attractive call premiums), so we’re going to buy to close our puts here for a small loss. If we close for 30-35 cents, then we have a 10-15 cent loss (assuming you collected 25 cents in premium on the opening). That works out to less than a 1% loss. Obviously, we don’t want to have losers, but these are the type of losses we can definitely handle. Trade details can be found below.

January 19, 2024 - 1:27 pm

RILY is down around our strike price so we’re going to look at closing the put for 10 cents (or less). It’s not quite there yet, but I’ll send out another text when it looks like that price is good. Stay tuned.

January 17, 2024 - 2:17 pm

In the live session today we sold the RILY Jan 19th 20.50 put for around 25 cents – details below. The price is moving around quite a bit but we’d like to get at least 25 cents on this trade (but probably no higher than 35 cents – in that case, I’d drop to a lower strike). For spread traders, the 21-20 put spread looks reasonable as well.

I’ll send out a text on Friday on next steps (either close or let expire).

January 10, 2024 - 3:55 pm

There was no 48 Hour Income trade today. There has been a lack of volatility in the market this year, but things will pick up with earnings next week. We’ll try to do multiple trades per week during earnings season to make up for the lack of action so far.

January 3, 2024 - 2:17 pm

No trade today in 48 Hour Income. Everything was either too risky or didn’t provide enough premium. Don’t worry though, earnings season is coming soon and there will be weeks we can do more than one trade to make up for these slow periods.

December 29, 2023 - 12:08 pm

Just a quick reminder that we didn’t have a trade this week in 48-Hour Income. We’ll be back at it next week after the calendar flips to 2024. See you then!

December 22, 2023 - 1:04 pm

We should be good to go with RILY sitting around 20. Our puts are set to expire for zero, which means no action is needed. We will collect the 30-35 cents (roughly) for our 18 puts (or whatever puts you ended up using).

As a reminder, there will be a live session next week, although I can’t make any promises that there will be anything worth trading. Happy holidays!

December 20, 2023 - 2:08 pm

In the live session today we sold to open the December 22nd 18 puts in RILY for around 30 cents (starting at around 35 cents). The bid/ask spread has fluctuated quite a bit, so this trade may require a limit order at 30 sitting in the market for a while to get filled. I also think the 17.5 and 18.5 strikes are both viable trades as well (depending on your risk tolerance level). The lack of liquidity means it may take some time to get your price. The 19/18 and 18.5/17 are both reasonable credit spread trades for you spread traders out there.

I’ll send texts out regarding closing instructions (or just saying we’ll let it expire for zero).

December 15, 2023 - 2:25 pm

The put we sold on CHWY is far out of the money, so we can safely let it expire for zero. No action is necessary. It wasn’t a huge payout, but we’ll take the low stress wins whenever we can get them. If you sold the 18 put for around 23 cents, it was a 1.3% winner for the week.

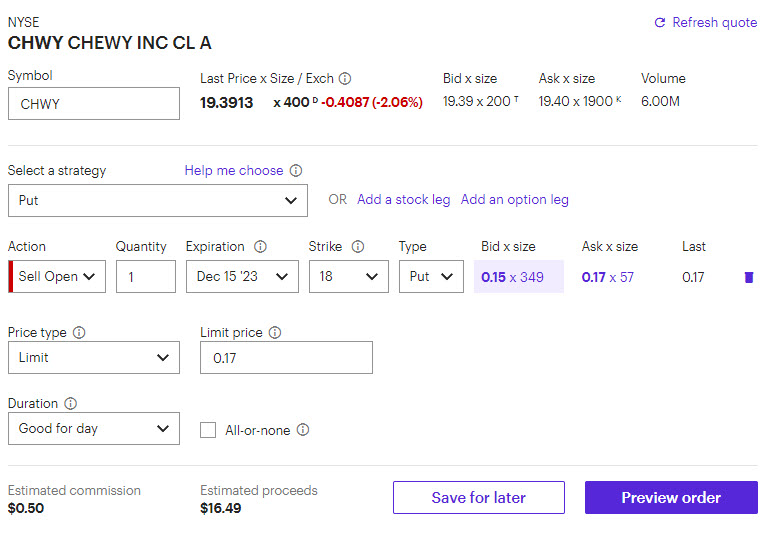

December 13, 2023 - 2:10 pm

In the live session today we sold a put in CHWY (again), specifically the December 15th 18 put for around 17-19 cents (using the current price). I wouldn’t go lower than 17 cents or so as that’s only about a 1% return. As always, I’ll send out a text about closing, even if it just says we’re going to let it expire.

December 8, 2023 - 1:37 pm

We’re in the clear on CHWY. The stock price is well above our put strike, so no action is necessary. We’ll let it expire for zero. Depending on where you got filled, we generated a return of 2.4% to 3% on the trade.

December 6, 2023 - 2:12 pm

In the live session today we sold a put in CHWY, specifically the December 8th 17 put for around 40 cents (using the current price). Earnings are after close today. I probably wouldn’t go much lower than 40 cents for this trade, which is around a 2.5% return. As always, I’ll send out a text about closing, even if it just says we’re going to let it expire.

December 1, 2023 - 1:15 pm

RILY will finish well above our put strike, so no action will be necessary. We can let it expire for zero. If you sold the put for 30 cents, that works out to 1.8% gains in just over 2 days.

November 29, 2023 - 2:06 pm

In the live session today we sold a put in RILY. Specifically we sold the December 1st 16.50 put for around 30 cents. The bid/ask is currently .20/.25 so you may have to leave the .25 (or higher) in there as a limit order for a bit to get it filled. I personally would not go lower than 25 cents on this trade, and it may even make sense to wait to see if it gets back up to 30 cents. I’ll send out closing instructions (which may just be to let it expire) later in the week.

November 22, 2023 - 2:04 pm

We didn’t make a trade in the live session today – with the market closed tomorrow and a half day Friday, there was very little premium in any options to be found. We’ll get back at it next week. Happy Thanksgiving!

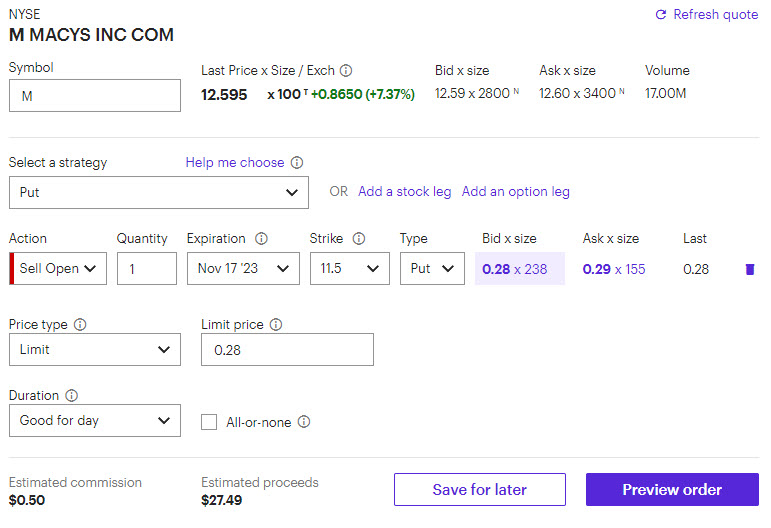

November 17, 2023 - 2:52 pm

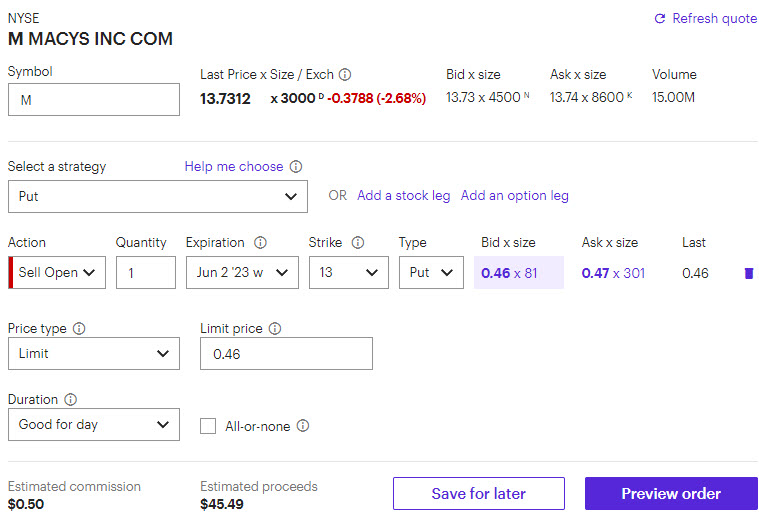

Our M put will expire well out of the money, so no action is necessary. We’ll collect the full premium on the trade, which equates to roughly 2.6% gains in a bit over 2 days.

November 15, 2023 - 2:03 pm

In the live session today, we sold to open the M November 17th 11.5 puts for around 28-31 cents. For those who prefer spreads, the 10.5-11.5 put spread is a good proxy (buying the 10.5, selling the 11.5). Earnings are tomorrow morning. You need $ 1,150 in you account to make this trade if you are using cash secured puts. Details can be found below.

As always, I will send out a closing text, even if those instructions are to just let the put expire for zero. If the stock is too close to our strikes on Friday, I’ll likely try to close for 5 or 10 cents.

November 10, 2023 - 1:56 pm

Looks like we’re in the clear on IONQ. The stock will end up above our strike price, so no action is necessary. We’ll let the 10 put expire for zero and collect around 3.5% in just over two days.

November 8, 2023 - 2:07 pm

In the live session today, we sold to open the IONQ November 10th 10 puts for 30-35 cents, which is where the price is now (at the time of hitting send on this text). For those who prefer spreads, the 9-10 put spread is a good proxy (buying the 9, selling the 10). Details can be found below.

As always, I will send out a closing text, even if those instructions are to just let the put expire for zero. If the stock is too close to our strikes on Friday, I’ll likely try to close for 5 or 10 cents.

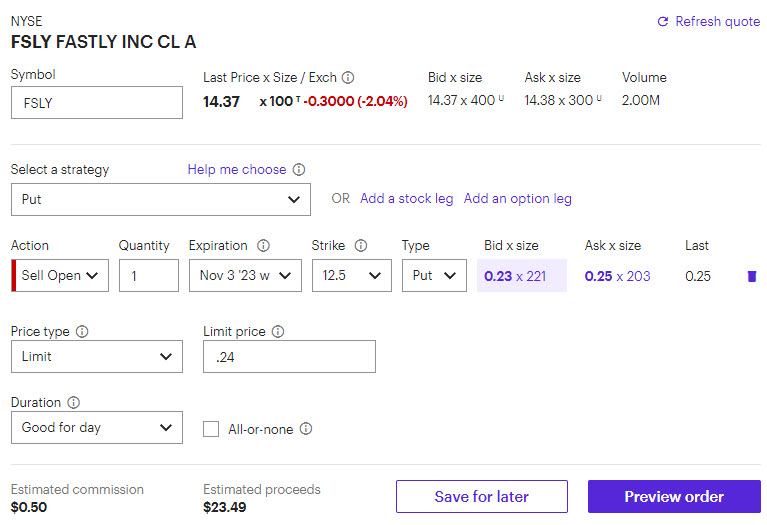

November 3, 2023 - 10:25 am

It’s been a nice low stress week for us. Both FSLY and PLTR are well above their strike prices. That means no action is necessary and we can let our puts expire for zero, collecting the full premium for both trades.

November 1, 2023 - 2:17 pm

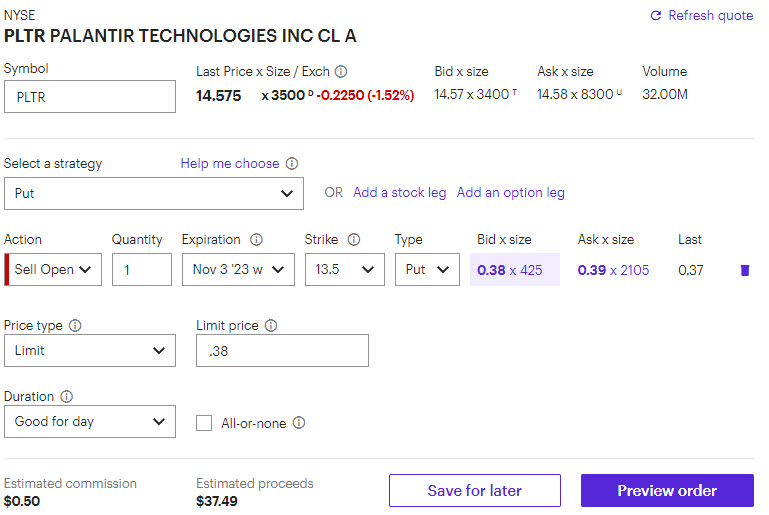

Trade Alert:

In the live session today, we made trades in both FSLY and PLTR (but if you can only pick one, I like FSLY a little better). We sold the FSLY November 1st 12.5 puts for around 30 cents – it’s around 25 cents now, which is still okay for a put sale (and the 11.5-12.5 put spread is reasonable here too). For PLTR, we sold the Nov 1st 13.5 puts for 34 cents and it’s slightly higher than that now (the 12.5-13.5 put spread is a good proxy). Details can be found below.

As always, I will send out a closing text, even if those instructions are to just let the put expire for zero. If the stock is too close to our strikes on Friday, I’ll likely try to close for 5 or 10 cents each.

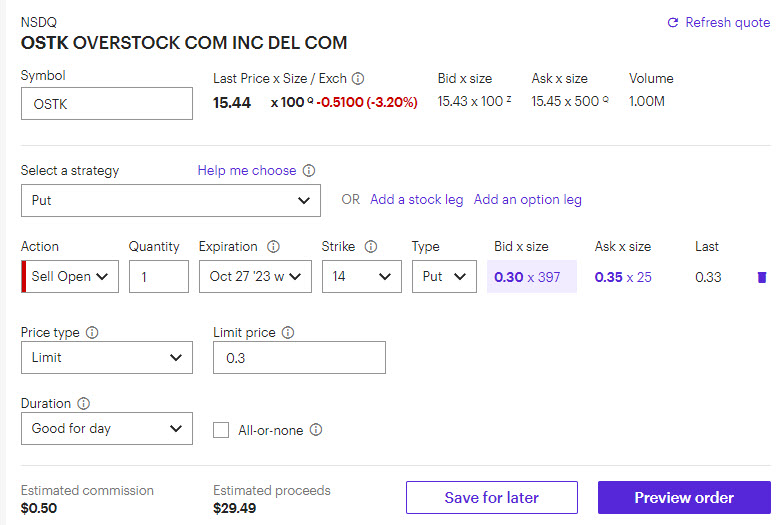

October 27, 2023 - 3:01 pm

Okay, so the market is selling off and I think it’s best if we close OSTK here. We sold the put for around 35 cents, and we’ll close it here for 15 cents. So we’ll make 20 cents despite the stock dropping all the way to our strike price. Closing details are below (remember you are buying to close).

October 27, 2023 - 2:20 pm

OSTK is right around our strike, so we’re going to close it (if you haven’t done so already). Let’s wait a bit to see if we can get under 10 cents. I’ll send out another text when it’s time to close.

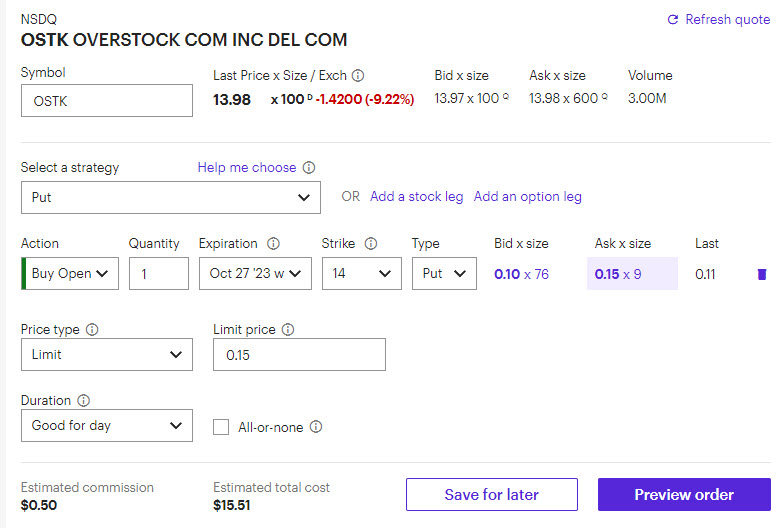

October 25, 2023 - 2:05 pm

During the live session today, we sold the OSTK October 27th 14 put for around 35 cents. The market is right around that area, so you still should be able to get filled for 30-35 cents. I’ll send out closing instructions on Friday (or instructions to let the put expire if that’s the case). For spread traders, the 13-14 put spread looks good to me (Selling the 14, buying the 13). Earnings come out tomorrow before market open.

October 20, 2023 - 3:16 pm

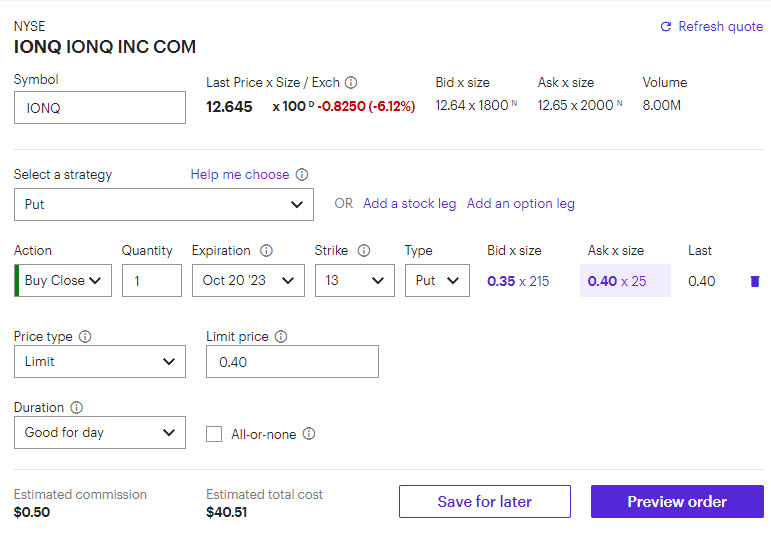

IONQ doesn’t look like it will rally above 13, so we need to close our puts so as not to get assigned on the stock. We sold the put for around 15-20 cents and we’ll close it for about 40 cents. That means we are going to take a small loss on this trade (roughly -2%). This is the sort of reasonable loss that I assume will happen now and then and we can easily recover from (especially with earnings season in full swing for our next trade). Here are the closing details (remember, it’s buy to close):

October 20, 2023 - 2:02 pm

IONQ is right at our strike, so let’s give it a little longer before closing. I’ll send another text out in the next hour, but I prefer to close it for 5 cents (or less).

October 18, 2023 - 2:13 pm

In the live session today we sold the IONQ 13 put (for this Friday) for 15-20 cents. The current market is only 10-15. I don’t think I’d do this trade under 15 cents or so, so you may need to be patient to get filled at 15 (or higher) or wait to see if the stock ticks back down a bit. A potential spread trade here is the 12-13 put spread or (STO the 13, BTO the 12).

October 13, 2023 - 2:24 pm

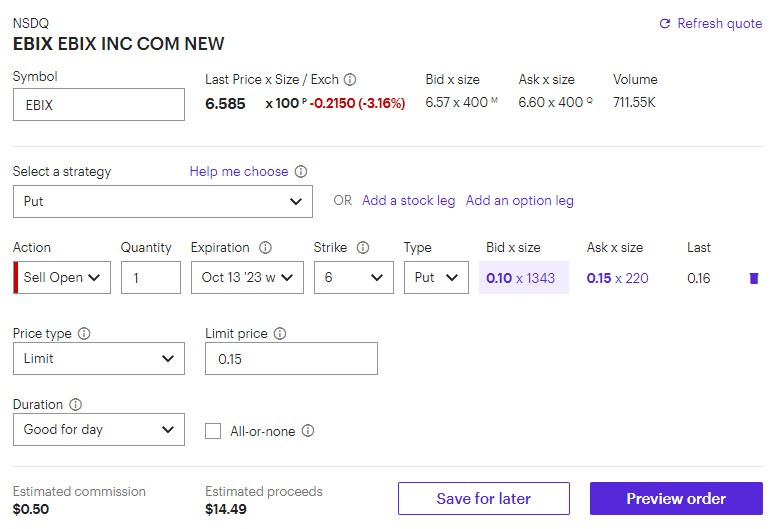

Our EBIX 6 puts look to be in good shape to expire for zero. No action is necessary since they should expire out of the money. We sold for 15-20 cents so we’ll earn roughly 3% in a little over two days.

October 11, 2023 - 2:15 pm

In the live session today we sold the EBIX 6 put (for this Friday) for 15-20 cents. The stock has ticked up about 10 cents since the trade came out, so the current market is only 10-15. I don’t think I’d do this trade under 15 cents or so, so you may need to be patient to get filled or wait to see if the stock ticks back down. A potential spread trade here is the 5-6 put spread or (STO the 6, BTO the 5).

October 11, 2023 - 10:32 am

Ignore the confusing email title from earlier – there will be a live session today for 48 Hour Income. I’m going to be about 5 minutes late due to a MoneyShow presentation I’m giving at 1 ET, but the session will definitely happen.

October 4, 2023 - 2:08 pm

We have no trades this week. We looked at a few opportunities but nothing was worth the risk. As we get closer to earnings season, we will see more viable choices. Moreover, we can certainly do two trades in some weeks during earnings season if there are enough attractive possibilities.

October 4, 2023 - 12:27 pm

One last test before our Live Trading Room. Thanks again for your patience.

October 4, 2023 - 11:19 am

One more test to verify that messages are being received. Sorry for the inconvenience. Hope to see you at today’s Live Trading Room at 1:30 p.m. eastern. Here’s the link to attend: https://us02web.zoom.us/j/83182381108

October 4, 2023 - 10:46 am

A number of 48-Hour Income subscribers have told us they’ve not been receiving text alerts. Today the team is working on some major changes to the coding that’s used for our texting service. This means you may see several test texts from me today. I apologize for any confusion this may cause. It’s our hope that this resolves the issue. Thank you for your understanding and patience.

October 4, 2023 - 10:40 am

A number of 48-Hour Income subscribers have told us they’ve not been receiving text alerts. Today the team is working on some major changes to the coding that’s used for our texting service. This means you may see several test texts from me today. I apologize for any confusion this may cause. It’s our hope that this resolves the issue. Thank you for your understanding and patience.

September 29, 2023 - 2:22 pm

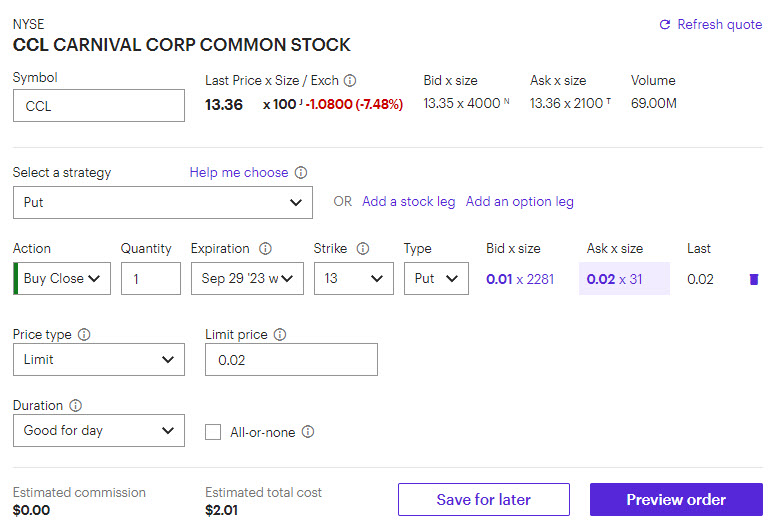

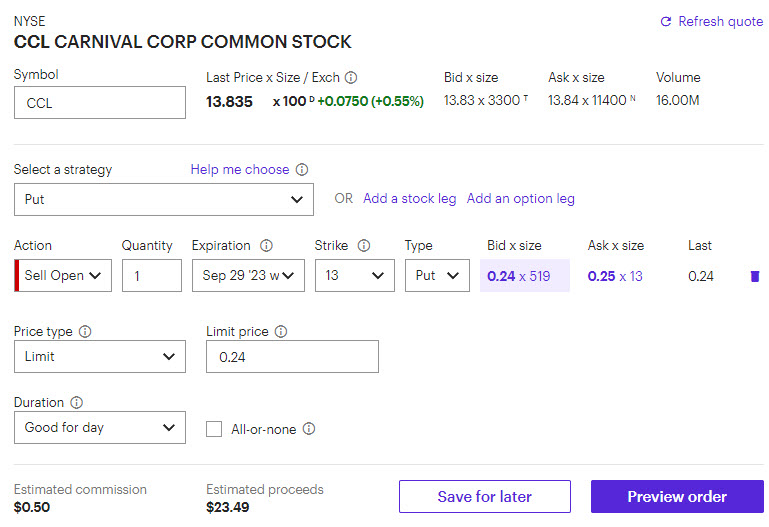

Because it’s the end of the quarter, it’s hard to say what the last hour of the trading day is going to bring. As such, let’s go ahead and close our CCL put since we can buy it back for 2 cents.

Closing details are below, but you will simply be buying to close the 13 put for 2 cents. That gives us about 25 cents in profit or right around 2% gains for this trade.

September 27, 2023 - 2:06 pm

Trade Alert:

In the live session today, we sold the CCL September 29th 13 puts for around 27-28 cents. The stock has moved higher since then, and now the market is showing 24-25 for the put. I’m okay with doing this trade at these levels, but I wouldn’t go much lower. (For the put spread traders, the 13-12 put spread is the spread I’d use, STO 13 and BTO 12 for .18-.20 net credit.) Earnings for CCL come out on Friday.

As always, I will send out a closing text, even if those instructions are to just let the put expire for zero. If the stock is too close to our strikes on Friday, I’ll likely try to close for 5 or 10 cents.

September 20, 2023 - 2:49 pm

We didn’t make any trades today in the 48-Hour Income live session, with volatility being essentially non-existent this week. We’ll make it up with two trades at a future date when there are better choices to be found.

September 15, 2023 - 2:22 pm

EBIX is trading over 14, so our puts are in good shape to expire for zero. No action is necessary, and we’ll collect the full 15-20 cents in premiums. That’s roughly 1.3% gains in about 2 days.

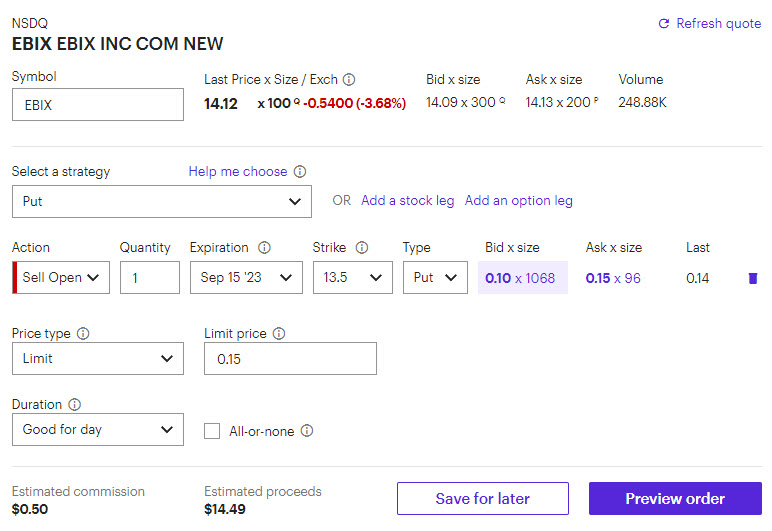

September 13, 2023 - 2:32 pm

Trade Alert:

In the live session today, we sold the September 15th 13.5 put in EBIX for around 20 cents. However, the stock moved higher right after the trade, and now the market is showing 10 cents bid at 15 cents offered. I’m okay with doing this trade for 15 cents, but not for a penny less. If you can’t get filled at 15 cents, it’s fine to sit this one out. There weren’t any great trades this week to speak of, which will happen now and then. (For the put spread traders, the 13.5 – 12 put spread is probably the put spread I’d use, but you may not even be able to get 10 cents for it, which may not be worthwhile.)

As always, I will send out a closing text, even if those instructions are to just let the put expire for zero. If the stock is too close to our strikes on Friday, I’ll likely try to close for 5 or 10 cents.

September 8, 2023 - 11:29 am

PATH is trading over 18, so our puts will easily expire out of the money (for zero). No action is necessary, and we’ll collect the full 25 cents or so in premiums. That’s roughly 1.7% gains in about 2 days.

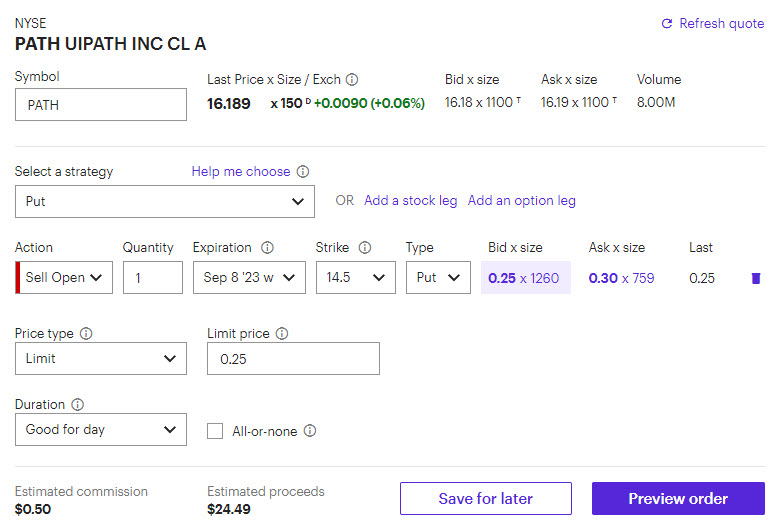

September 6, 2023 - 2:02 pm

Trade Alert:

Our cash secured put trade today is in PATH. We’re selling the 14.50 put for around 25 to 30 cents. Details can be found below. If you prefer the put spread, the 14.5-12.5 is a reasonable choice (selling the 14.5 and buying the 12.5). Earnings for PATH are after market close today.

As always, I will send out closing instructions, even if those instructions are to just let the put expire for zero. If the stock is too close to our strikes on Friday, I’ll likely try to close for 5 or 10 cents.

September 1, 2023 - 2:28 pm

S is up big today after earnings, so no action is necessary on the put. It will expire well out of the money, meaning we collect the entire premium. Depending on where you got filled, we’re looking at around 2% gains on this trade.

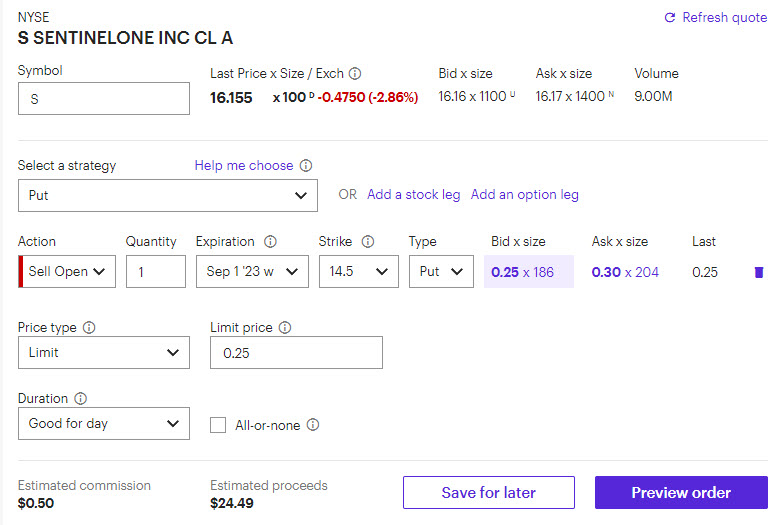

August 30, 2023 - 2:11 pm

Trade Alert:

Our cash secured put trade today is in S. We’re selling the 14.50 put for around 25 to 30 cents. Details can be found below. If you prefer the put spread, the 14.5-12.5 is a reasonable choice (selling the 14.5 and buying the 12.5).

As always, I will send out closing instructions, even if those instructions are to just let the put expire for zero. If the stock is too close to our strikes on Friday, I’ll likely try to close for 5 or 10 cents.

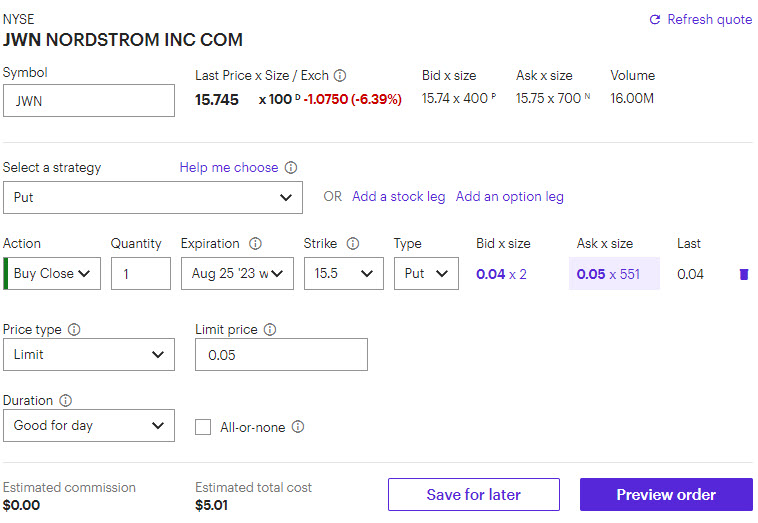

August 25, 2023 - 2:29 pm

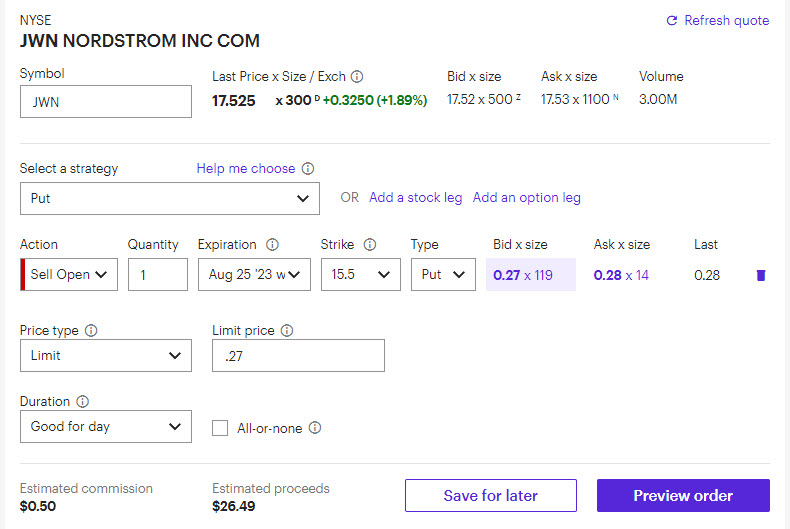

Okay – a little more nail biting than I prefer, but we got there. Let’s close our JWN put here for about 5 cents. If you got in for 30-35 cents we are looking at a 2 day profit of 1.6% to 1.9%. Remember, to close the trade you are buying to close the put, as seen below.

August 25, 2023 - 1:52 pm

Our JWN put is right around the breakeven point here. We’ll want to close it today so we don’t get assigned on the shares. However, I plan on giving it a bit more time to see if we can close for a profit. I’ll send out another text when it’s time to close. Stay tuned.

August 23, 2023 - 2:08 pm

Trade Alert:

Today our 2-day cash secured put trade is in JWN. We’re selling the 15.50 put for around 27 to 29 cents. The put price has dropped a bit, so you may need to leave your offer in there for a little while before it gets filled. Details can be found below.

As always, I will send out closing instructions, even if those instructions are to just let the put expire for zero. If the stock is too close to our strikes on Friday, I’ll likely try to close for 5 or 10 cents.

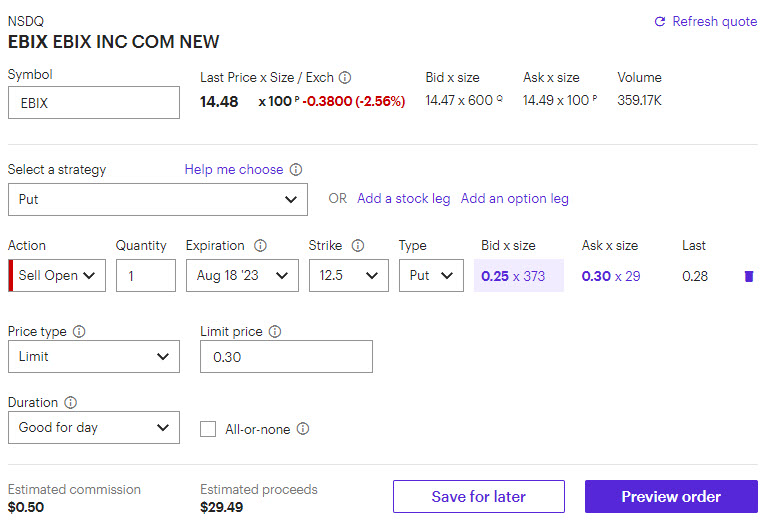

August 18, 2023 - 3:12 pm

No action necessary on the EBIX put. It will expire well out of the money, meaning we collect the entire premium. Depending on where you got filled, we’re looking at around 3% gains on this trade.

August 16, 2023 - 2:14 pm

Trade Alert:

Today our 2-day cash secured put trade is in EBIX. We’re selling the 12.50 put for around 30 cents. The put price has dropped a bit, so you may need to leave your 30 cent offer in there for a little while before it gets filled. Details can be found below.

As always, I will send out closing instructions, even if those instructions are to just let the put expire for zero. If the stock is too close to our strikes on Friday, I’ll likely try to close for 5 or 10 cents.

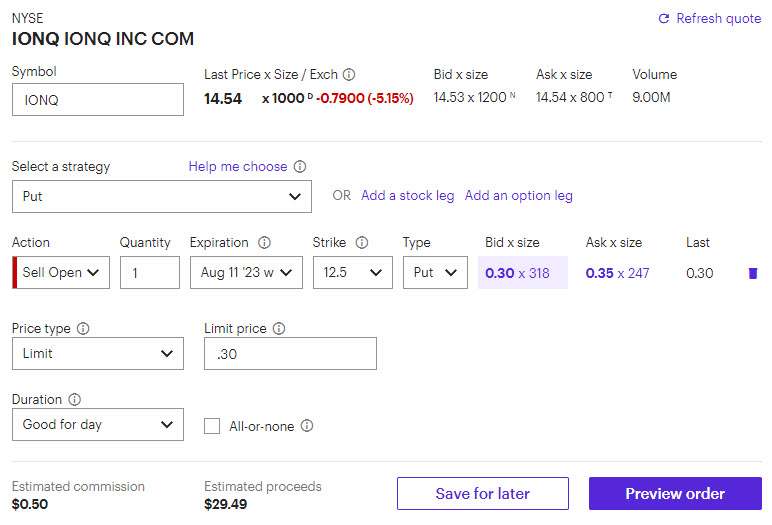

August 11, 2023 - 3:21 pm

IONQ reacted very positively to earnings, so we’re completely in the clear. No action is necessary, and we’ll let our puts expire for zero. At an average sale price around 32 cents, our return is approximately 2.6% in under two days.

August 9, 2023 - 2:03 pm

Trade Alert:

Our trade today is in IONQ. We’re selling the 12.50 put for around 30-35 cents. Details can be found below. Earnings in IONQ are tomorrow after close.

As always, I will send out closing instructions, even if those instructions are to just let the put expire for zero. If the stock is too close to our strikes on Friday, I’ll likely try to close for 5 or 10 cents.

August 4, 2023 - 2:46 pm

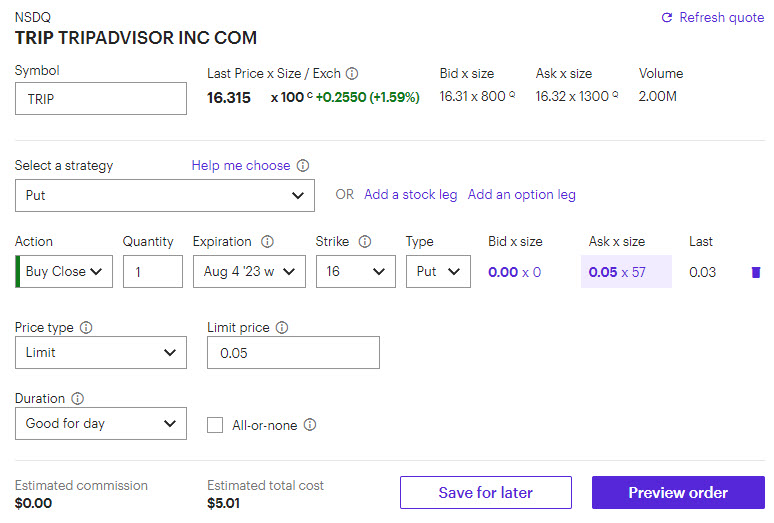

Closing Alert:

It’s been a relatively low stress week for our two trades. However, with the market selling off and TRIP getting a bit too close to our short strike, I think it makes sense to close the put in TRIP. For FSLY, we can just it expire for zero. We’ll buy to close the 16 put in TRIP for a limit of 5 cents (and you may get filled at a price lower than 5 cents). Details are below.

August 2, 2023 - 2:17 pm

Trade Alerts:

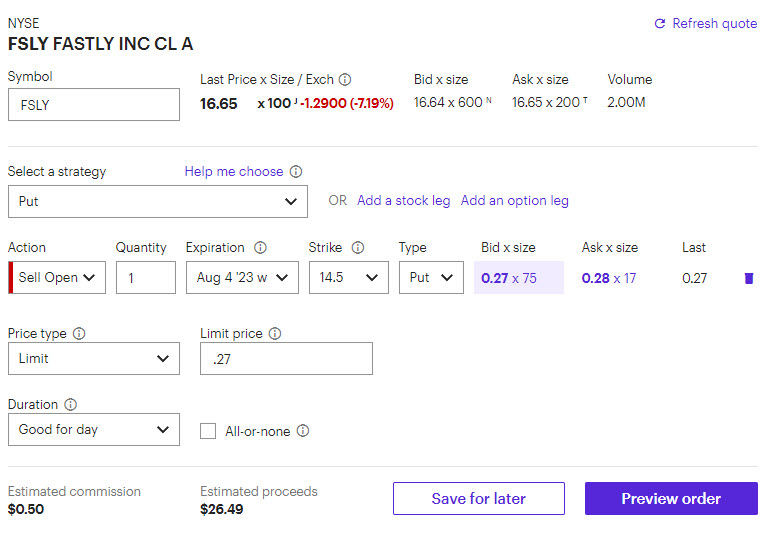

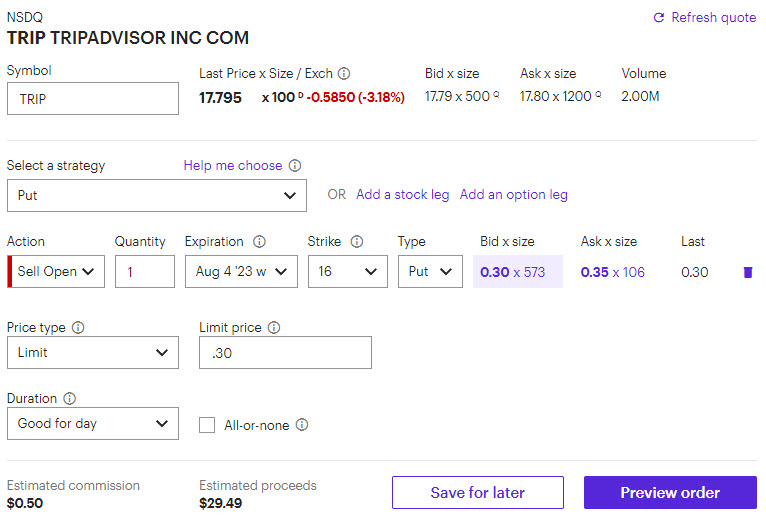

We have two trades today, FSLY and TRIP. In FSLY, we’re selling the 14.50 strike for around 27-30 cents. In TRIP, we’re selling the 16 strike for around 30-35 cents. Details can be found below.

In both cases, I will send out closing instructions, even if those instructions are to just let them expire for zero. If the stock is too close to our strikes on Friday, I’ll likely try to close for 5 or 10 cents. Both trades can be found below. Remember, we are selling to open the puts and these are cash secured. You need to have $ 1,450 in your account for FSLY and $ 1,600 for TRIP. (If I was only choosing one myself, I’d do FSLY, but either trade is reasonable if you don’t want to/don’t have the capital to do both.)

Trade Details:

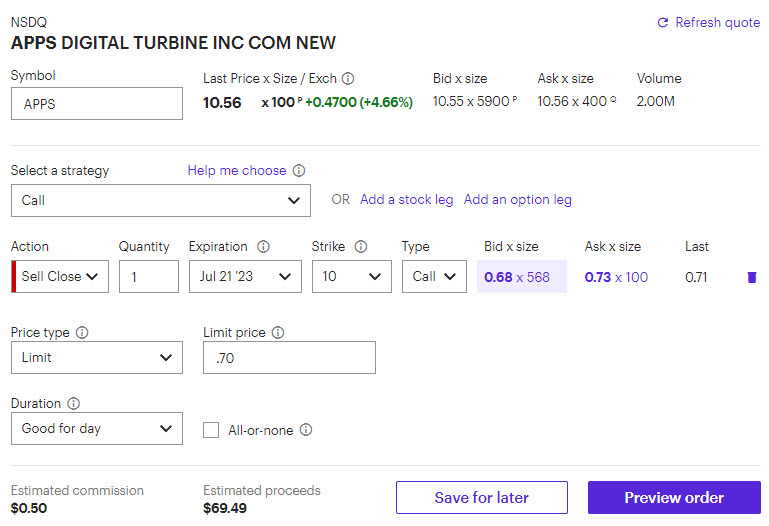

July 28, 2023 - 3:02 pm

Closing Alert:

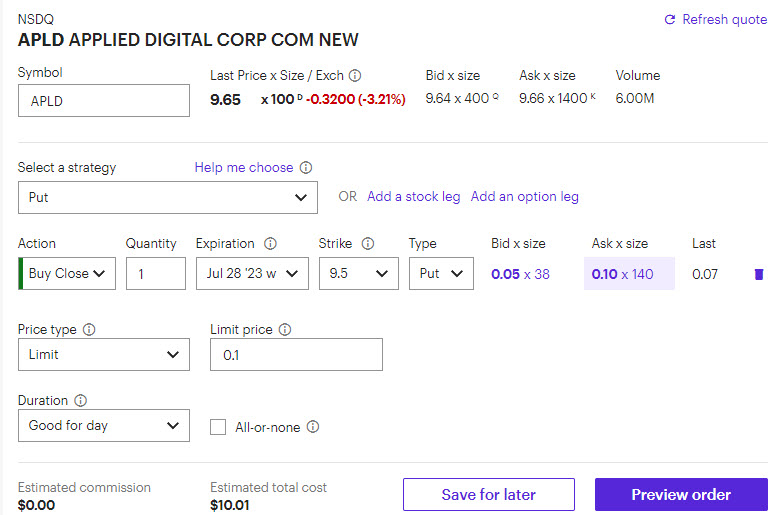

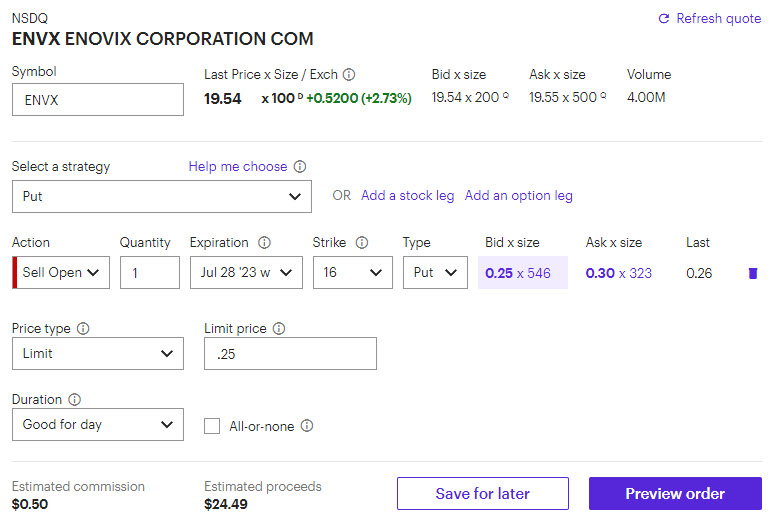

Okay, so we can let ENVX expire for zero which means we’ll earn 1.6% on that trade (about 25 cents). For APLD, we’ll close here to be safe. We’ll place a buy to close limit order for 10 cents (as seen below), but you should get filled for about 7 cents. If so, we’ll make about 13 cents on the trade or a return of 1.4%.

July 28, 2023 - 1:10 pm

ENVX is way above our strike so we can just let it expire for zero. APLD is sitting just above our strike, so we’ll probably close it – but, I want to wait to see if we can close it at 5 cents or under. For now, let’s give it a bit more time.

July 26, 2023 - 2:28 pm

Trade Alerts:

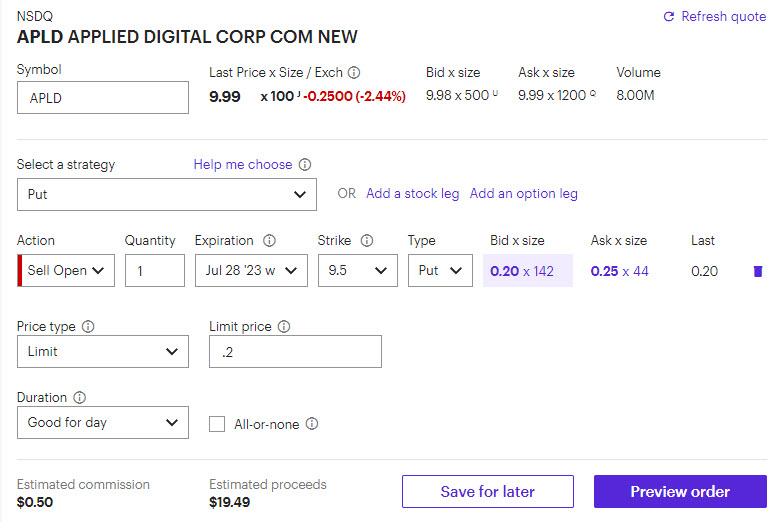

We have two trades today, APLD and ENVX. In ENVX, we’re selling the 16 strike for around 25 cents and it’s about 18% away from the stock price. The company does have earnings tonight, so it’s likely to gap one direction or the other. On the other hand, APLD doesn’t have earnings and selling the 9.5 put for around 20 cents produces a higher potential return than ENVX. However, the stock is around 10, so the put is much closer to the money.

In both cases, I will send out closing instructions, even if those instructions are to just let them expire for zero. If the stock is too close to our strikes on Friday, I’ll likely try to close for 5 or 10 cents. Both trades can be found below. Remember, we are selling to open the puts and these are cash secured. You need to have $ 1,600 in your account for ENVX and $ 950 for APLD. (If I was only choosing one myself, I’d do ENVX, but either trade is reasonable if you don’t want to/don’t have the capital to do both.)

Trade Details:

July 14, 2023 - 2:56 pm

We’re a bit too close for comfort here, so let’s close our IONQ puts for 5 cents. It’s a buy to close order as seen below in the screenshot. Assuming a sell price of 20 cents and closing price of 5 cents, our return is 1.1% in about 2 days.

July 14, 2023 - 1:59 pm

The plan is still to hold IONQ to expiration, but since the stock price has come down, there’s a possibility we may try to close it for 5 cents as we approach market close. I’ll send another text out either way.

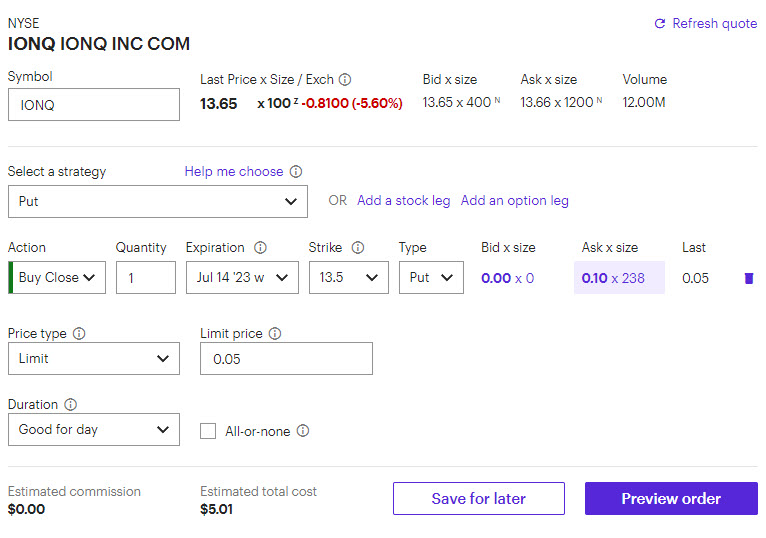

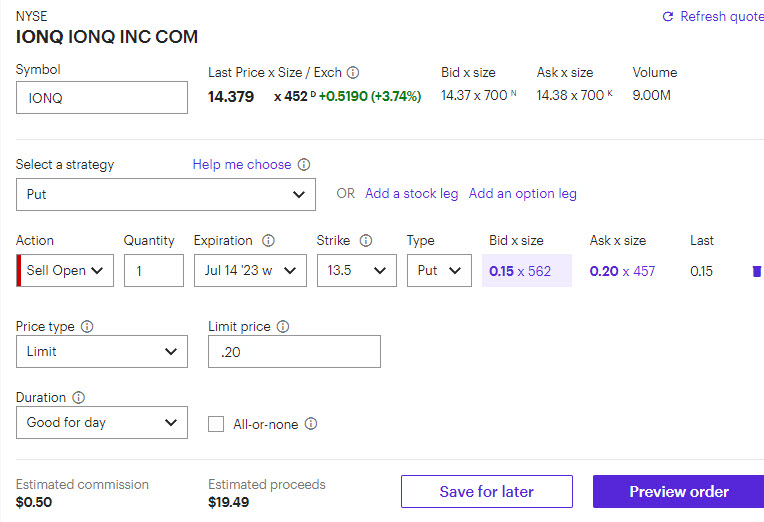

July 12, 2023 - 2:29 pm

Trade Alert:

We have two potential trades today, one new one in IONQ, and one closing our calls in APPS. The APPS trade is only if you already own the 10 calls. Otherwise, you can ignore that trade. For those of you who own APPS stock and have been selling covered calls, I think it makes sense to keep doing that. I’m getting out of the long call business for now since I think we can do well just selling puts moving forward. You are on you own in terms of management APPS, but you can email me with questions.

Okay, the new trade is in IONQ. It has moved a bunch since we started, so I’d only make this trade if you can 20 cents for the 13.5 puts. If not, skip the trade. We’ll have lots of opportunities for better trades during earnings season. Patience, as always, is a good thing. My intention is to hold this trade to expiration as long as the stock remains above the strike price, but I’ll send out a closing/commentary text regardless.

Trade Details:

July 7, 2023 - 1:38 pm

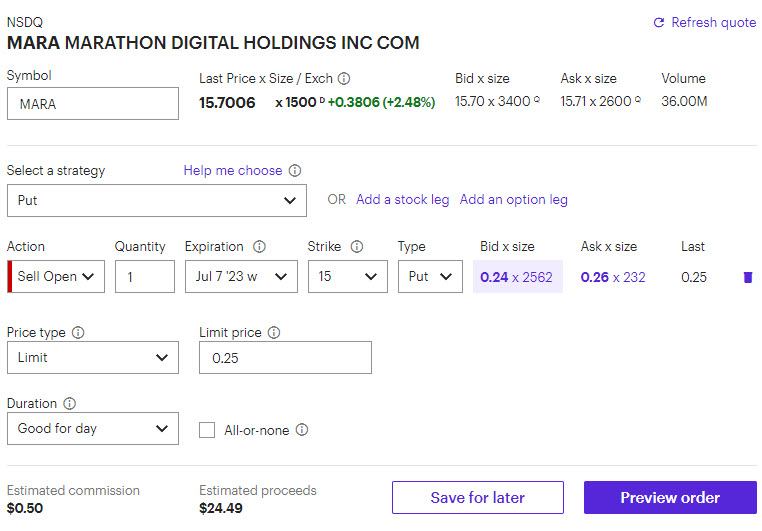

MARA has jumped today, so we can let our 15 puts expire for zero. No action is necessary. We sold the puts for around 26 cents, which works out to be a 1.7% gain in under 2 days.

July 5, 2023 - 2:07 pm

Trade Alert:

We’re selling (to open) the MARA July 7th 15 puts for around 25 cents. I prefer to let this one expire for zero if it’s away from our strike, but if you want to close, make sure it’s under 5 cents. I’ll send out a closing/expiration reminder text regardless.

Trade Details:

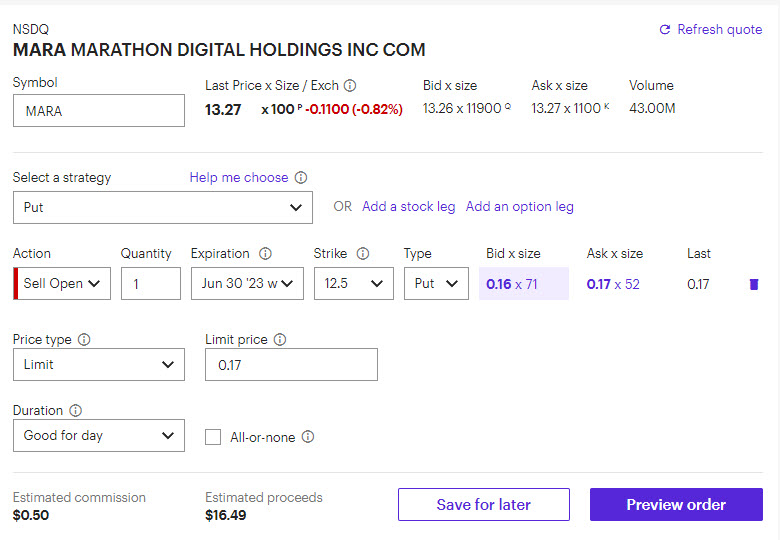

June 30, 2023 - 2:44 pm

Our MARA trade will expire well out of the money, so no need to close it (in other words, no action is necessary). We sold the 12.5 put for around 18 cents and it will expire for 0, which means we generate a profit of 1.4% in under 2 days.

June 29, 2023 - 2:45 pm

Our trade is working out nicely so far, so we’re in good shape to let it expire for zero. In the meantime, I strongly recommend checking out the webinar I’m hosting tomorrow with Cem Karsan concerning 0DTE options. Cem is a leading voice in the options industry and you won’t want to miss what he has to say. The link to register for the webinar is below (and don’t worry if you can’t make it, you’ll get a replay link).

https://us02web.zoom.us/webinar/register/WN_xXRPOv2GTein4x_W0YvLGQ#/registration

June 28, 2023 - 2:04 pm

Trade Alert:

We’re selling (to open) the MARA June 30th 12.5 puts for around 17 cents. I prefer to let this one expire for zero if it’s away from our strike, but if you want to close, make sure it’s under 5 cents. I’ll send out a closing/expiration reminder text regardless.

Trade Details:

June 16, 2023 - 3:00 pm

Closing Alert:

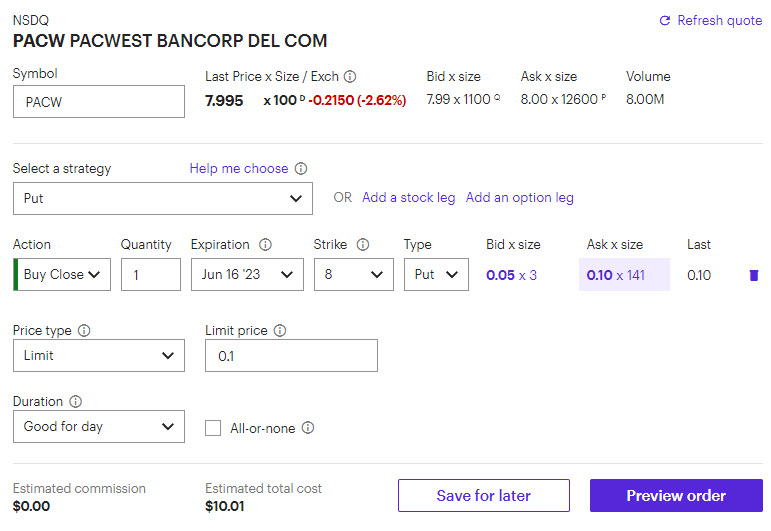

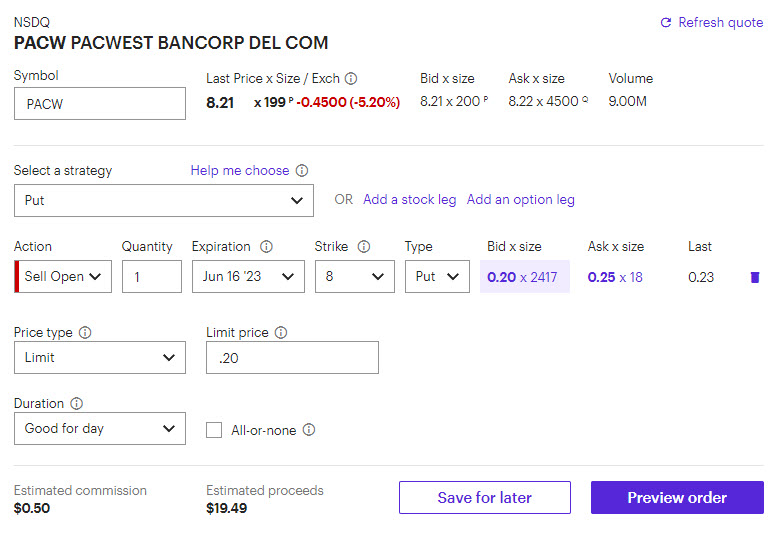

We don’t want to be assigned on PACW shares, so let’s close our trade. You’ll have to enter the buy to close limit order in at either 5 or 10 cents, but if you use 10 cents, you’ll likely get filled at a price lower than 10 cents (the last trade I saw was filled at 7 cents). We collected 15-20 cents for the 8 puts and if we close them here, we should get filled for around 7 cents. Let’s say we opened at 15 and closed at 7, that’s 8 cents collected, or 1% in profit in less than 2 days. See trade details below.

Trade Details:

June 16, 2023 - 1:12 pm

Closing Alert: