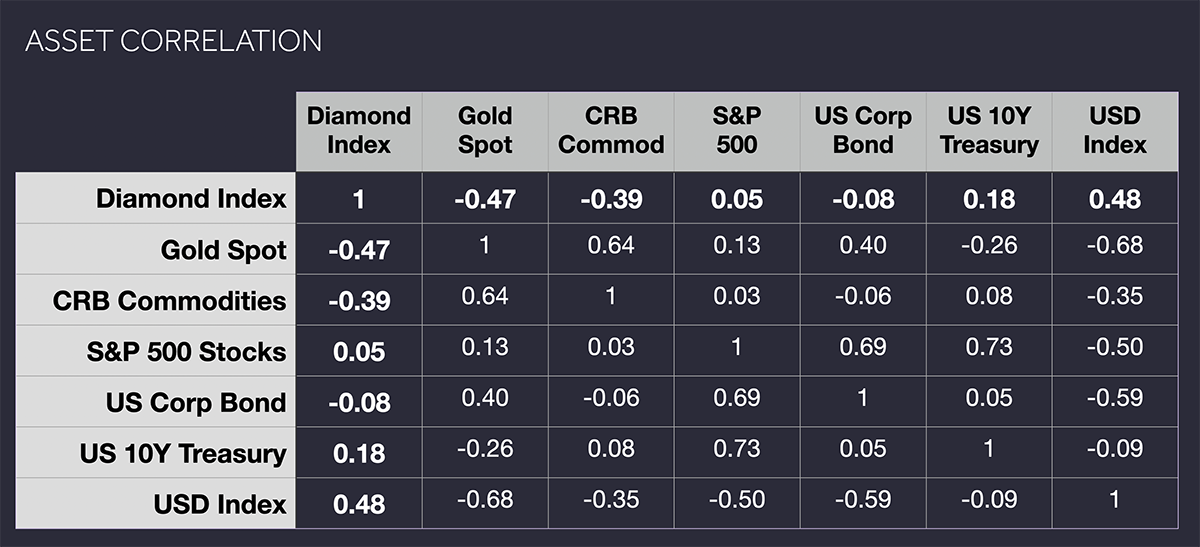

Diamonds are a $1.2 trillion natural resource, uncorrelated to stocks and negatively correlated to gold and silver with significantly less volatility than these asset classes.

Diversification is essential for asset preservation, risk management, and consistent returns. Investors seek to combine uncorrelated assets, and for this reason, diamonds are an extremely attractive asset. They often produce returns when other assets fall.

Uncorrelated Stability & Opportunity

Historically, diamonds had a negative correlation to other commodities including gold and silver, and no correlation to stocks or bonds. Now that diamonds can be priced via Diamond Standard’s technology, and traded with lower friction, the diamond commodity provides effective diversification for any portfolio.

Interestingly, diamonds have a mild negative correlation against those assets whereas gold has a mild positive correlation with the USD Index, commodities overall, and non-US equities. So diamonds are an effective diversification in portfolios that already hold gold.

Diamonds provide exceptional and essential protection against inflation. Since the advent of fiat money, inflation has been a constant tax on investments. The supply of money grows over time, reducing its purchasing power. Since 1913, that decline is 96% for the U.S. Dollar.

Precious metals have intrinsic value. They cannot be printed like fiat currencies, issued like stock certificates or bonds, and they are not a liability on another entity’s balance sheet, subject to an insolvency crisis. There are drawbacks, such as storage costs, and the lack of investment income.

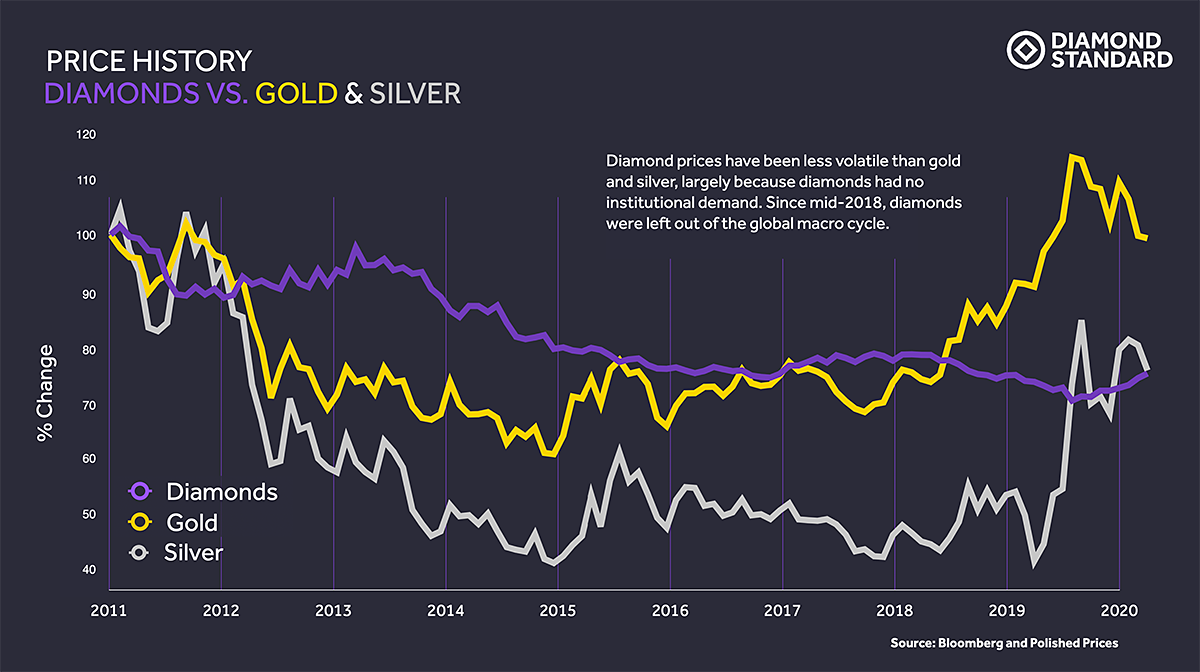

Diamonds at Multi-Year Low

Diamonds are at a multi-year low price, vs. gold and silver near multi-year highs—while investors increasingly seek hard assets, due to the macro environment.

However, the negative correlation to gold may not be long lived, once diamonds are available as a liquid commodity and via securities. Previously, during past economic downturns, investors were less likely to demand more gold, while consumers might demand less jewelry.

But for the next five to fifteen years, as investors build positions in diamonds for the first time, the one-way demand is likely to outweigh short-term economic trends.

Want to Know More?

Find out more about investing in diamonds for long term grown, asset diversification, and wealth protection. Join Tim Plaehn and Jay Soloff as they host a live informational webinar with Diamond Standard on October 26th. Click here for details and registration.