Renewable energy companies have been hit hard by the recent increases in interest rates. Many of these companies borrowed a lot of money to build out their energy projects, with debt at very low-interest rates.

Higher interest rates put the business models at risk, as they are forced to refinance when the debt matures.

But for one of them in particular, things are looking much better than the headlines would make you think. And it’s created a great income investing opportunity…

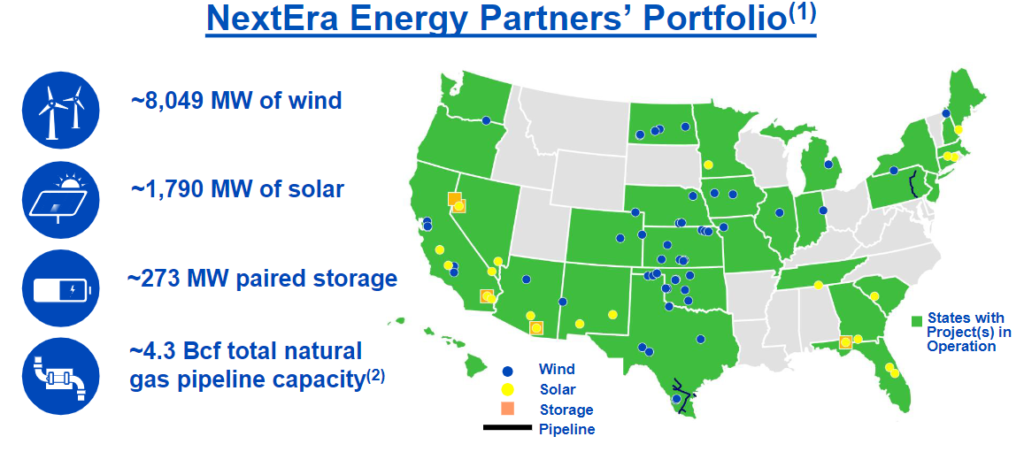

In September of last year, the share price of NextEra Energy Partners (NEP) collapsed by more than 50% when the company announced a significant change to its dividend policy and expected future payments. Before that announcement, NEP had been one of the best dividend growth stocks. The company increased its dividend every quarter to achieve about 15% annual dividend growth. The NEP dividend had been growing at that rate for almost a decade.According to the NextEra Energy (NEE) December investor presentation, NEP is the world’s seventh-largest wind and solar power generator.

NextEra Energy uses NextEra Energy Partners as a vehicle to monetize the renewable assets developed by its Energy Resources division. It is essential to understand that NextEra Energy has complete control over NEP. NextEra Energy is a large-cap ($126 billion) investment-grade utility with a long track record of superior results.

Also, investors misinterpreted what the company did in September. At that time, NextEra announced that the dividend growth rate for NEP would be reduced from the 15% annual target to 5% to 8% per year. It seems investors jumped to the conclusion that the dividend itself would be cut, which is not the case. The dividend growth rate was reduced, not the dividend rate.

Currently, at $30.00 per share, NEP yields over 11%. The company increased the dividend rate by 1.5% in October, meeting the target growth rate. The next dividend will be announced later this month and will likely include another increase of about 1.5%.

NEP yields 11% and is growing the dividend by 6% annually. That gives an excellent combination for high teens total returns. Once investors see the dividend continuing to increase, I expect them to jump back into NEP. This stock could produce a 30% to 40% total return this year.