One of the great things about options is that there are so many ways they can be used. There are endless iterations when it comes to implementing options trades. This flexibility is one of the primary reasons why options have become so popular in recent years.

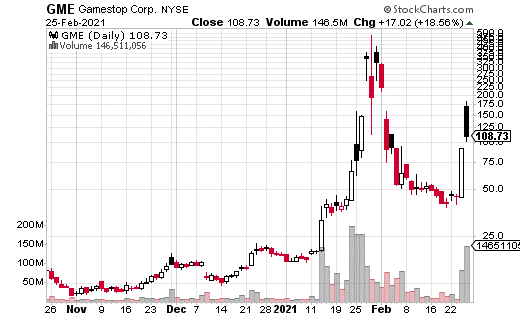

GameStop (GME) has been in the news a lot lately, as the stock’s rollercoaster ride continues. GME volatility continues at absurd levels.

The implied volatility (forward-looking volatility that is based on the price of the options) was under 50 before the pandemic. As I write this, it’s about 500!

Ridiculously high implied volatility also means crazy-high options prices. For instance, if you wanted to buy an at-the-money call in GME with two weeks to expiration, it will cost you about $5,700 for one contact. In comparison, the equivalent call in Apple (AAPL) costs about $435.

So how do you trade something like GME with options when there’s this level of extreme volatility?

First off, you may not want to go anywhere near this type of trading. I certainly don’t blame you if that’s the case. There’s not a lot of analysis involved when the action is so intense.

However, if you like the adrenaline rush of extreme stock moves, then GME could be for you. In that case, it may take some creative options trading in order to get involved at an affordable level.

In fact, I came across a fascinating trade last week in GME, which I felt was a brilliant way to take advantage of the extreme volatility in the options. The trade used a strategy called a “butterfly.” In this case, it was an ultra-wide, very short-term call butterfly.

Specifically, a trader purchased a 500 x 1000 x 500 call butterfly at the 130-200-270 strikes expiring on February 26. This trade was executed at a price of $4 ($400 for each butterfly), while the stock was sitting around $133.

Typically, a butterfly like this is used when the trader expects the underlying stock to stay in a certain range. However, in this case, the trade was likely a cheap way to get upside exposure. You see, the trade would be profitable anywhere between $134 and $266 by Friday expiration. That’s not a lot of money to spend to get access to that huge of a range.

The most that can be lost on this trade is the $4 spent in premium. For 500 spreads, that’s $20,000. On the other hand, max gain is at the center of the range, the stock at $200, at expiration. In this case, the payoff would be $66 or $3.3 million.

Now, I doubt the trader is expecting GME to close exactly at $200 but expecting a quick double or triple on this trade is not an unreasonable expectation. As I write this, GME is down to $108 (but it also traded in over an $80 range during the day).

By the time you read this, this trade will have expired. However, there’s no reason a strategy like this can’t be used again as long as the volatility continues in GME. The risk versus reward profile of the butterfly is undoubtedly attractive.