According to NVIDIA CEO Jensen Huang, for example, demand could exceed supply through 2022. Intel CEO Pat Gelsinger says the shortage won’t end until 2023. “We’re in the worst of it now, every quarter, next year we’ll get incrementally better, but they’re not going to have supply-demand balance until 2023,” he told The Independent.

STMicro CEO Jean-Marc Chery doesn’t see an end to the shortage before the first half of 2023.

The list goes on.

While it’s terrible news for companies that make cars, gaming consoles, medical devices, and hundreds of other products, it’s good news for chip stocks, like NXP Semiconductor (NXPI).

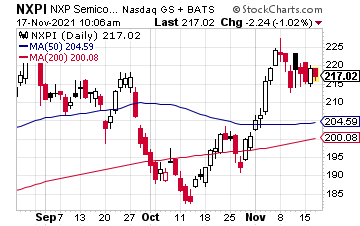

Since bottoming out around $60, NXPI ran to a recent high of about $216. Until we see a supply-demand balance with chips, the NXPI could push to highs.

In fact, we can see just how beneficial the shortage has been with earnings, explained Kurt Sievers, NXP president and CEO: “NXP delivered third-quarter revenue of $2.9 billion, an increase of 26 percent versus the year-ago period, and better than the mid-point of our guidance. Overall, customer adoption of our latest products as well as long-term demand trends across our end markets remain at unprecedented levels. We continue to take additional actions to assure supply to our customers, which underpins our continued confidence in robust growth in the remainder of 2021 and through 2022.”

Moving forward, the company expects for operating income to fall in a range of $967 million and $1.06 billion. Revenue is expected to fall in a range of $2.93 billion and $3.01 billion.

Analysts seem to like the NXPI stock, too.

Deutsche Bank recently raised its price target to $245 from $235. Raymond James raised its target to $250 from $230. KeyBanc raised its target to $255 from $250.

Again, until we begin to see a supply-demand balance, chip prices and related stocks, like NXPI could easily push to higher highs.