The financial markets got something of a shock last week, with a higher-than-expected consumer price index (CPI) print. The CPI is a popular measure of consumer prices, so a spike in CPI suggests inflation. On the day of the CPI print, stocks sold off sharply. Clearly, investors were spooked by the specter of looming inflation.

Yet stocks quickly recovered the next day. Maybe inflation is not so imminent? The Fed doesn’t seem overly concerned, calling the spike in CPI “transitory inflation,” meaning they expect it to be temporary.

Here’s the thing: inflation does tend to spike on the way out of a recession. With COVID infection numbers rapidly dropping, many U.S. businesses hit hard during the pandemic are experiencing a resurgence. What’s more, supply issues may exacerbate the problem in certain areas (lumber, used cars, gas, to name a few).

It’s possible that inflation will return to normal levels this year or next. Perhaps that’s why the Federal Reserve is in no hurry to raise rates. Meanwhile, the economy is benefiting from consumer spending.

One beneficiary of increasing consumer spending is the gambling industry. As expected, gambling took a back seat during the heart of the pandemic (well, at least in-person gambling did). Undoubtedly, casino companies are thrilled to see the U.S. return to some level of normalcy.

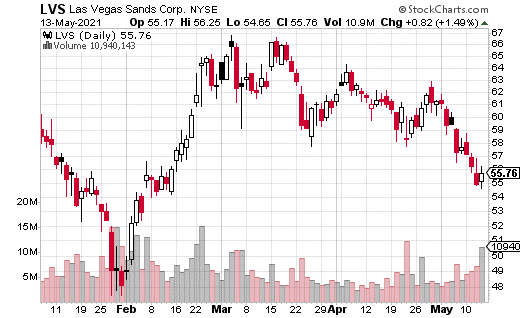

For example, let’s look at Las Vegas Sands (LVS). The casino operator dropped below $40 per share after the pandemic hit. The stock has since climbed to around $55 after briefly touching $65. Investors seem to be expecting a strong recovery.

Looking at some of the options action in LVS supports the bullish thesis. In fact, a fund or institution placed what looks like a massive trade that hits max gain if LVS hit $60 or above by the first week of June.

With the stock at $55.80, a trader sold LVS 50 puts while buying the 57-60 call spread (buying the 57 call, selling the 60 call), all expiring on June 4. This trade was put on a whopping 17,500 times for a total cost of $0.54.

The 50 puts were sold to help finance the call spread (reduce the cost). It also implies that the strategists who made the trade doesn’t think LVS will drop below $50 prior to June 4. (The position starts to lose money below $50.) In addition, if the stock doesn’t climb above $57, the premium paid ($0.54) can be lost.

The trade makes money from a stock price of $57.54 up to $60 at expiration. Max gain is $2.46 if LVS closes north of $60 on expiration day. That works out to 456% gains. In total dollar terms, the trader spent $945,000 with a chance to make $4.3 million max.

While the upside is clearly attractive, the downside risk of this trade can be extreme if the stock plunges. This isn’t the sort of trade you want to make if you’re not an experienced trader. Instead, sticking to the 57-60 call spread is a perfectly reasonable replacement, with far lower risk.