Outside of a personal residence, real estate is an asset class that often is underrepresented in investor portfolios. One reason is that it takes a lot of capital or taking on a lot of debt to buy an apartment building, office building, or a farm.

Real estate investment trusts (REITs) offer a stock exchange-traded way to get real estate exposure into your portfolio. Structured as pass-through entities, REITs are companies that own real estate or real estate finance assets. A pass-through structure allows a company not to pay corporate income taxes as long as at least 90% of net income is paid to investors as dividends. REITs are one just a few asset types that have been allowed to use the pass-through feature.

If you are familiar with REITs, your thoughts will likely go to the more visible classes of commercial property. Most REITs own a single type of real estate, such as shopping centers, office buildings, healthcare facilities, or warehouses.

Here’s How to Make $3,790 in Extra Income. Critical Date Approaching: July 31 [ad]

However, specialty REITs provide investment exposure to some types of real estate you may not know you can own through an REIT. Here are five investment ideas to consider:

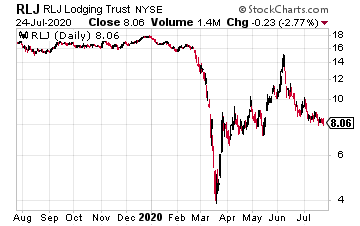

Lodging REITs, which own hotels, have been decimated by the pandemic. While most REITs have fixed revenue streams from rent or lease payments, hotel REITs are different.

A hotel REIT participates in the profits of its portfolio of hotels. That means when the hotel business is good, an REIT in this category can do very well, with growing dividends and an appreciating share price. Most hotel REITs have suspended dividends. The time to buy into this group will be when they announce the restart of common stock dividends. RLJ Lodging Trust (RLJ) owns 103 premium-branded hotels in 23 states and Washington, D.C. RLJ was an $18 stock with a 7% dividend yield before COVID shutdown the hotel industry.

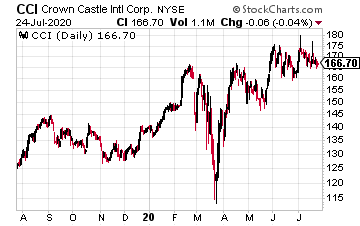

Crown Castle International (CCI) is a REIT that owns cell phone towers. Cell towers are a great business: you build one tower and then grow its revenue by adding more transmitter leases.

The Crown Castle International portfolio consists of more than 40,000 cell towers, approximately 70,000 on-air or under-contract small cell nodes, and about 80,000 route miles of fiber.

For investors, Crown Castle has been a solid dividend growth stock.

The company targets 7% to 8% long-term growth of the dividends per share.

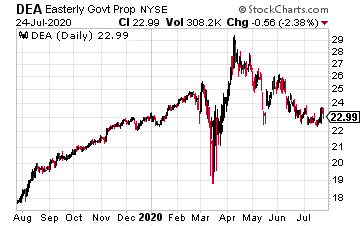

Easterly Government Properties (DEA) is exclusive in its niche, with a portfolio 100% dedicated to U.S. Government Agencies through the General Services Administration.

Easterly currently owns 74 properties and adds a few each year to the portfolio. Management projects the REIT will double its portfolio over the next decade.

Easterly’s appeal is that it has a tenant that will always make lease payments. Dividend growth has been slow since the 2015 IPO. Again, the focus here is on the strength of having the U.S. government as your primary tenant.

Currently, the shares yield 4.4%.

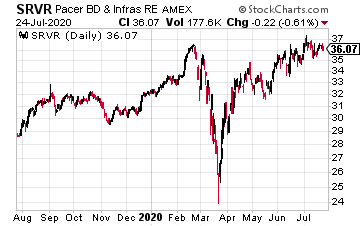

The Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (SRVR) owns a portfolio of data center and telecom infrastructure REITs. Crown Castle International, discussed above, is its third-largest holding. This fund is the REIT equivalent of a tech stock ETF.

While many REIT groups crashed early in 2020 as the economy shut down, SRVR returned 22.37% for the 12 months ending on June 30, 2020.

The ETF has $800 million of assets. The weighted average market cap of the portfolio is $41 billion.

The current yield is 2.8%.

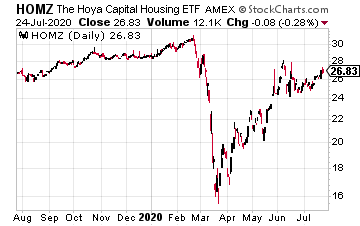

The Hoya Capital Housing ETF (HOMZ) covers all aspects of homeownership or rental.

The portfolio breaks down to 30% in residential REITs and real estate operators, 30% in homebuilders and home building products, 20% in home improvement and furniture retailers, and 20% in mortgage lenders, title and mortgage insurance companies, and real estate technology companies. I think they have the housing universe covered.

The ETF is relatively new, with an IPO in March 2019. HOMZ pays monthly dividends, but the yield of 2% is just icing on the cake to have the housing sector covered with a single investment.