Covered calls are popular and powerful trading strategies for many reasons. Above all else, an overwriting system can work in just about any type of market. There aren’t many strategies that offer a benefit in most market environments.

As a reminder, investors make covered calls when they buy a stock (in blocks of 100 shares) and sell one call for every block. The call sale provides a cash flow component to the trade, while the remaining shares serve as collateral. Depending on where the call is sold, there also may be share appreciation potential with the trade.

Most of the time, out-of-the-money (OTM) or at-the-money (ATM) calls are sold, versus shares of the stock. OTM calls provide the investor the opportunity to gain more on stock price appreciation. However, they offer less premium (cash flow). ATM options basically don’t allow for stock appreciation but can provide higher returns from the premium collected.

One strategy with covered calls that is not seen as often is selling an in-the-money (ITM) call against the stock. An ITM call will have a strike price below the actual share price.

Why would someone trade an ITM covered call? First off, it’s generally safer. The stock would have to drop further to lose money (versus an ATM or OTM strategy). What’s more, the returns can be higher than other covered call trades, depending on the stock and the option.

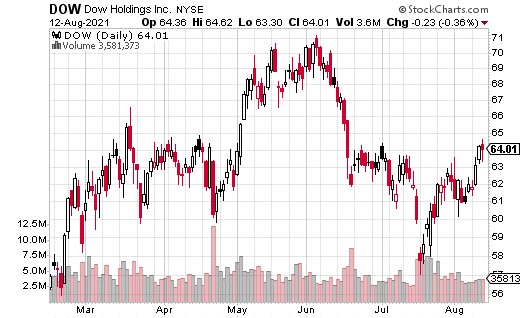

For a good example, let’s look at an actual ITM covered call trade that happened last week with Dow (DOW). DOW is a $47 billion chemicals company. Its stock price is up more than 15% this year to date, but it has gone mostly sideways since March. DOW also pays a solid 4.4% dividend.

With a covered call, DOW can become a much more interesting stock to own. With an ITM call, it can generate an even bigger return with less risk.

Here’s how…

The trade from last week involved 300,000 shares of DOW purchased for $63.90, while 3,000 of the January 62.50 calls were sold simultaneously for $5.05. Because it’s an ITM call, we need to subtract out the intrinsic value before analyzing. That’s the difference between the stock price and call price at the time of the trade. In this case, that’s $1.40.

If we take out the $1.40 from the call premium of $5.05, we get $3.65. That’s our time premium. It’s also how far the stock can fall below the strike price before any money is lost on the trade. So, that means this trade is protected down to $58.85. That’s what makes it safer than a more traditional ATM or OTM covered call.

The $3.65 in premium is also how we can calculate the return on cash. By dividing the time value by the stock price, we get a return of 5.7%. That’s a five-month return; annualized, we’d be looking at around a 13.5% return. Add in the DOW dividend, and making a trade like this for a year would result in nearly 18%.

For a relatively safe company like DOW, it’s easy to see the appeal of the ITM covered call trade. The downside risk is reasonable, while the returns are still fairly robust.