Options can make even the most mundane trade more exciting. The flexibility of options, especially when using spreads (combinations of buying or selling calls and puts), can allow for all kinds of creativity when designing strategies. Plus, the leverage inherent in options can quickly make the return (or loss) potential of a trading strategy a lot more interesting.[insert image

For example, investing in sector ETFs doesn’t tend to be all that exciting. Sure, some sectors move around more than others; however, one benefit of investing in entire sectors is that they aren’t as volatile as individual stocks (or individual industries).

Of course, that safety comes at a price. Like anything else in investing, you get paid for taking risks. By choosing, say, a tech sector ETF over a tech stock, your chance for higher returns is far less likely. Conversely, though, your chance for an outsized loss is also less likely.

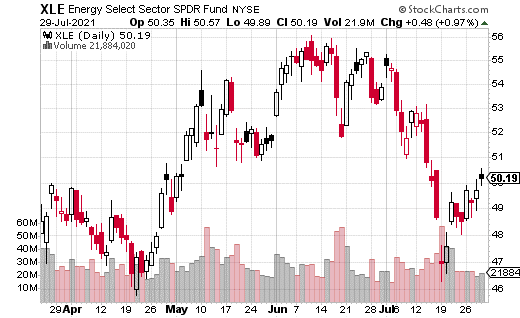

One of the most volatile sector ETFs this year has been Energy Select Sector SPDR ETF (XLE). The energy sector has moved around a lot with big changes in both oil and natural gas. Yet even XLE has been range-bound for the last five months.

As you can see in the chart, since March, XLE has basically been between $47 and $55. At the current price of around $50, how much upside potential can one expect if they want to have energy sector exposure in August?

That’s where options come in. An institution or fund put on a massive XLE options spread using both calls and puts that gives bullish exposure to energy through most of August.

More specifically, the trader used a strategy where a call spread was partially financed by selling a put. With XLE at $50.39, the August 20 52-55 call spread was purchased (buying the 52 call and selling the 55 call). At the same time, the August 20 46 put was sold. The entire cost of the trade was $0.25.

The strategist who designed this trade is betting on XLE getting back to the top of its recent range by August expiration (August 20). By selling the put at the 46 strike, the expectation is that XLE will not drop below that level. By selling the 55 strike, the cap is assumed to be $55. Both of the options were sold to help finance the purchase of the 52 call.

At a total cost of $0.25, the position can generate $2.75 in profit if XLE goes to $55 or above by August expiration—a return of 1,100%. The trade was made a whopping 27,500 times, making max gain $7.5 million.

If XLE ends up below $52 but above $46, only $0.25 per spread is at risk. Below $46 is where most of the risk is because there’s no downside protection if the energy sector were to crash. That’s why this isn’t the sort of trade you should do at home. However, using a sector ETF means less risk of a big selloff than from an individual stock.