Diamonds are a $1.2 trillion natural resource, more than silver and platinum combined. As a durable hard-asset, diamonds are just like precious metals and a reliable store of wealth. In the first part of our “Why Diamonds?” series, we shared insights on diamonds as an important feature for portfolio diversification as an uncorrelated asset. In this installment, we examine current investor sentiment and see how it will dramatically evolve over time.

To set the context, we must compare diamonds to other precious metals. Today, virtually all pensions, endowments, sovereign wealth funds, asset managers, and family offices allocate a portfolio of their portfolios to gold. A frequently cited recommendation is 5 to 10%.

Allocate Early in the Position-Building Phase

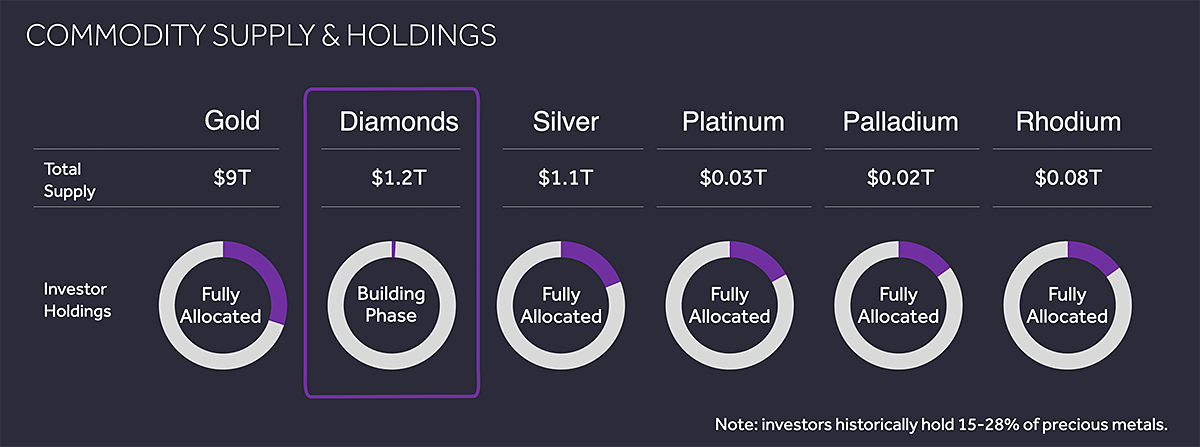

Reviewing investor holdings across commodities, a startling statistic jumps out — just 1% of diamond supply is held by investors. Yet investors hold approximately 30% of the world’s gold, 19% of silver, 17% of platinum and 15% of both palladium and rhodium.

If 15% of pent-up demand is unlocked by a market-traded diamond commodity, investor allocation could amount to $180 billion at current values from $12 billion today. Could this pent-up demand be addressed by new supply? We noticed a diminishing in global supply while prices are near an all-time low. There have been no new major mines in 20 years, and others are depleted. De Beers estimates a 1%-2% supply decline annually until 2030. Some analysts project a drop of up to 5%.

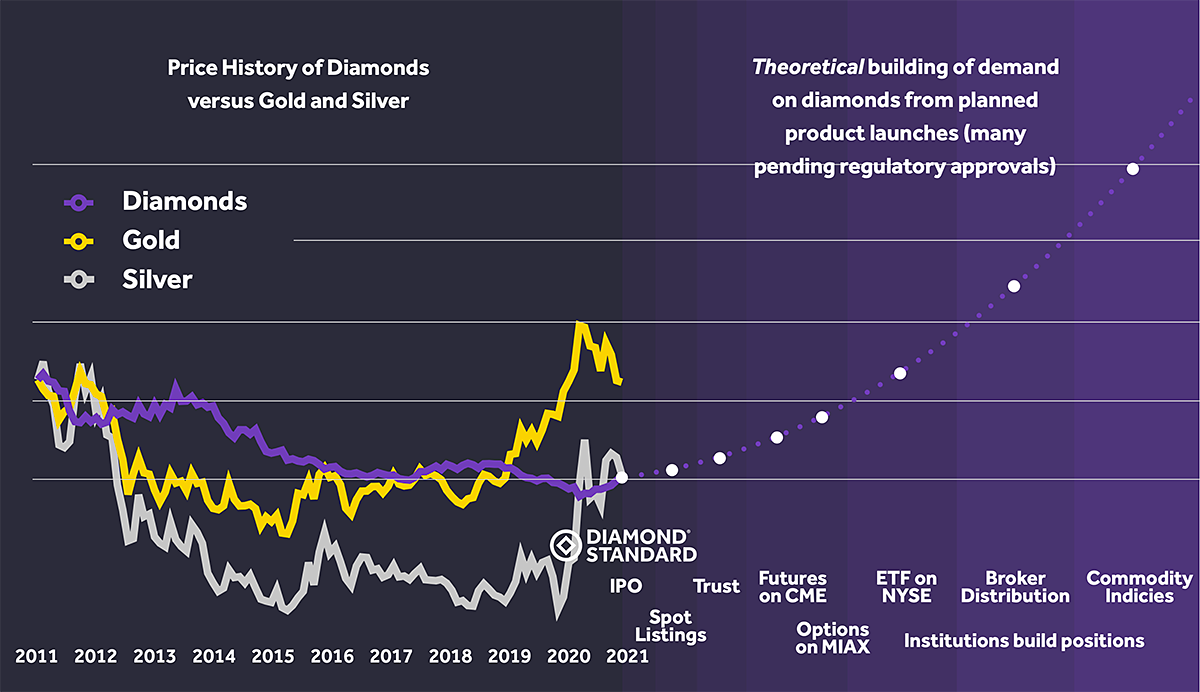

While treasured for hundreds of years, diamonds are the only top-ranked precious metal resource not commonly held by investors. Diamond Standard is unlocking the value of diamonds as an asset for the first time in the form of a secure, deliverable and easily traded product — just like gold bars. Diamond demand will build as the asset is unlocked by spot trading and new securities; increasing transparency and liquidity for institutions. Today, Diamond Standard is making the diamond market and introducing coins through an initial offering. We are purchasing diamonds through a transparent bidding process on the Diamond Standard Exchange (DSE), the first-ever loose diamond market maker. The DSE bids on millions of varieties of diamonds using an automated market-making system, adjusting bids until a statistically valid sample of diamonds can be purchased. The geological yield of this sample will be the permanent benchmark for all Diamond Standard Coins. Against this standard, anyone can verify the validity of any sample or Coin.

After the initial sale, the market price of the Coin will be established by independent trading on various digital exchanges. Like gold, there will be a daily fix, used to settle the forthcoming futures on CME Globex and options on MIAX, and to report the net-asset-value for any securities or institutional funds. As an uncorrelated and under-allocated asset, diamonds will play an important role in investor portfolios.

Join Tim Plaehn and Jay Soloff on October 26th as they’re joined by the founder of Diamond Standard who will share how you can get started in this exciting, new alternative investment. Click here for details and to register.