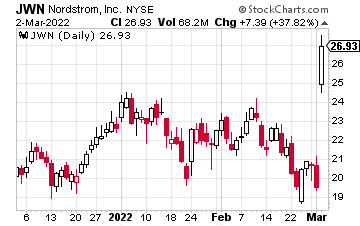

Pay close attention to Nordstrom (JWN).

After diving from a November high of $34.65 to a low of $19.39, the retailer is once again skyrocketing—so much so, it could refill its bearish gap around $32.50 a share, near-term.

This is all thanks to blowout earnings and a strong outlook.

For its fourth quarter, Nordstrom posted earnings per share of $1.23 on sales of $4.38 billion. Analysts were only looking for EPS of $1 on sales of $4.36 billion. Going forward, Nordstrom expects to earn between $3.15 and $3.20 for the entirety of 2022, which is higher than the expectations for $2 a share.

Even better, the company says it could be in a position to again return cash to shareholders in the first quarter of fiscal 2022.

As reported by CNBC: “According to Evercore ISI analyst Omar Saad, [the upswing is] because Nordstrom has been drowned in negative sentiment in recent months. That was due in large part to poor performance at its off-price Rack business… And so, in the latest quarter, Nordstorm made ‘baby steps,’ which was more than enough to give shares of the retailer a massive lift.”

Helping this, analysts at BMO Capital raised their price target on JWN from $23 to $30. Deutsche Bank raised its target from $22 to $31. Citi raised its from $25 to $27.

While that’s all great news, some analysts aren’t on board just yet.

UBS analysts, for example, say the latest guidance assumes gross margin improvement and stronger selling, general, and administrative expenses (SG&A) year over year. That could be difficult for the company to achieve, they added, with the company facing macro headwinds and inflationary issues in 2022. With that, UBS has put a sell rating on Nordstrom stock, with a price target of $12 a share.

In my opinion, with the worst circumstances fully priced into the stock, it may be time to go long.

As added by CNBC: “In the coming months, Nordstrom is hoping—like other retailers—that consumers head back to offices, parties, concerts and other social venues. Its business is poised to benefit as shoppers spend money on refreshing their wardrobes.” That could happen, especially with the pandemic starting to cool off a bit.