Video games are still thriving in the spotlight.

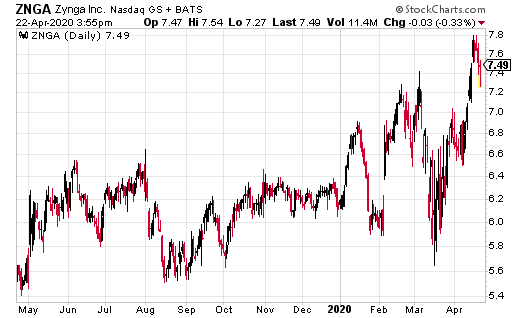

One of the top ones has been Zynga (ZNGA), which ran from a low of $5.80 to $7.80. All on the heels of the coronavirus and a World Health Organization note to play more video games.

“We’re at a crucial moment in defining outcomes of this pandemic. Games industry companies have a global audience – we encourage all to #PlayApartTogether. More physical distancing + other measures will help to flatten the curve + save lives,” tweeted Ray Chambers, U.S. ambassador to WHO. In fact, with millions of us staying at home, it could translate into higher sales for the company.

KeyBanc Capital Markets’ Tyler Parker for example said “guidance for bookings growth appears conservative and the company has beaten initial guidance over the past three years” back in Feb. 2020, as we noted on April 16, 2020.

SunTrust Robinson Humphrey analyst Matthew Thornton is bullish on the stock as well with a price target of $7.50. “The maker of mobile and social games is likely to hold up or perhaps benefit from the coronavirus outbreak,” as quoted by Investor’s Business Daily.

However, it appears one firm thinks the stock may have gotten ahead of itself. Just days ahead of ZNGA earnings on May 6, 2020, Bank of America downgraded the stock from a Neutral rating to Underperform with a target price of $7.50.

In its previous earnings report, Zynga posted a loss of $3.5 million, or break-even per share, compared with net income of $559,000, or break-even year over year. Analysts were looking for a loss of three cents. Adjusted revenue came in at $433 million, which was better than expectations for $418 million.

“Our momentum in 2019 has positioned us for continued growth in 2020,” he said. “We expect to increase our live services portfolio from five to six forever franchises and have the potential to launch new titles in the second half of this year,” said ZNGA CEO Frank Gibeau.

Shares of ZNGA last traded at $7.40 a share.

As of this writing, Ian Cooper does not have a position in shares of ZNGA.