I take most predictions concerning future business conditions with a grain of sand. Every investor and every pundit in the investing world tries to guess what will be the “next big thing.” The hot idea of 2018, cannabis investing, has crashed and burned. I don’t see 5G as coming through for investors looking for the small-cap 5G stock that will steal the thunder of big names like AT&T (T) and Verizon (VZ).

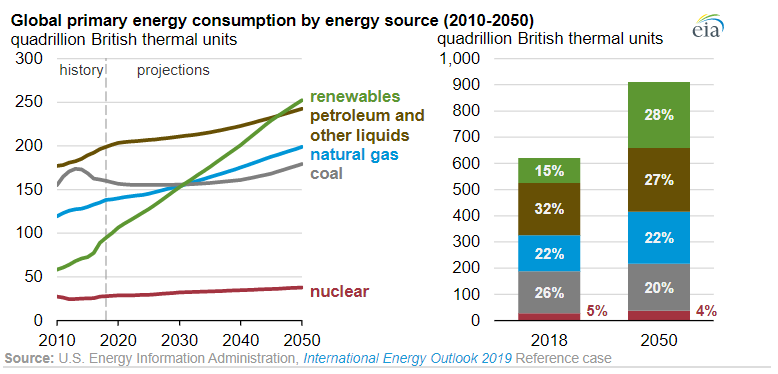

However, one future tech trend that investors can safely count on will be the steady transition to higher renewable energy sourcing. Each year the amount of energy consumed on planet earth continues to grow. As of September 2019, the U.S. Energy Information Agency (EIA) projected a 50% increase in world energy usage by 2050. The COVID-19 pandemic effect of reducing energy consumption will be very short-lived.

A large portion of the new energy production to meet demand growth will come from renewable sources. Governments and businesses around the world remain committed to developing and acquiring energy from renewable sources. These charts from the EIA show how renewable energy production growth (green line and bar) will significantly exceed the growth of traditional sources.

Many companies participate in the development of renewable energy projects and the distribution of power to end-users. Here are three dividend-focused stocks with strong renewable energy creds.

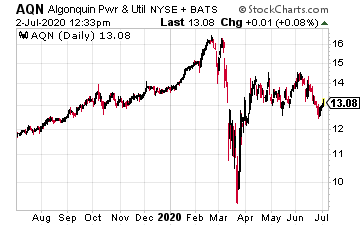

Algonquin Power & Utilities Corp (AQN) is a Canadian renewable energy and regulated utility company. Algonquin actively invests in hydroelectric, wind and solar power facilities, and utility businesses, through its two operating subsidiaries: Liberty Power and Liberty Utilities.

Liberty Power owns direct or indirect interests in more than 35 clean energy projects developing power from wind, solar, hydroelectric, and thermal. There are natural synergies for Liberty Power to sell energy to Liberty Utilities.

In May, Algonquin announced a 10% dividend increase. The increase marked the tenth straight yield of dividend growth, with an average annual compound growth rate at the 10% level.

AQN currently yields 4.8%.

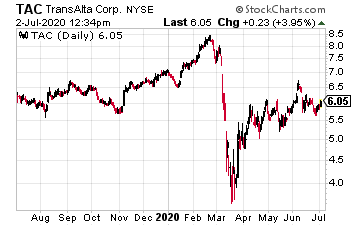

TransAlta Corporation (TAC) is Canada’s largest clean energy provider. The company operates 907 wind turbines at 20 wind farms. This is the largest wind fleet in Canada. The first solar project, located in Massachusetts, includes over 73,000 solar panels.

TransAlta is a 109-year-old company, so it still owns significant coal and gas-fueled energy production assets. Future growth will come from added renewable energy projects.

The TransAlta policy is to pay out 10% to 15% of deconsolidated funds from operations (FFO) as common stock dividends. The dividend rate increased by 6% in January.

The current yield is 2.1%.

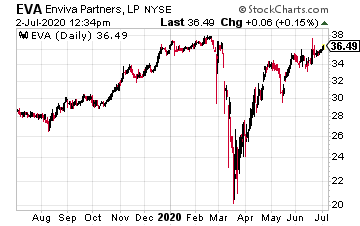

Enviva Partners, LP (EVA) takes a very different approach to the production of renewable energy. Enviva is the world’s largest producer of sustainable wood pellets. The pellets are marketed as a renewable alternative to coal. The company owns eight pellet manufacturing facilities located in five U.S. states. Enviva owns and operates four deep-water export terminals to facilitate the delivery of pellets to worldwide customers.

Wood pellets are sold on long term contracts primarily to energy producers in Europe and Asia. In these regions, government mandates to reduce coal burning naturally lead to using Enviva’s pellet products as a ready to go replacement for coal. Current contracts carry a weighted-average remaining term of 11.4 years and a product sales backlog of $10.2 billion.

Enviva Partners has paid a steadily growing dividend since the 2015 IPO.

The dividend is increasing by about one percent every quarter. The current yield is 7.5%.