We’re in the heart of earnings season, with some of the biggest companies in the world reporting this week. Yet, almost all the focus in the investment world is on gold and silver. After a long hiatus, it seems precious metals are back in the limelight. With the top Nasdaq-100 stocks like Apple (AAPL) and […]

Author: Jay Soloff

Trade of the Week: INTC

The big earnings loser last week was Intel (INTC), the semiconductor giant. INTC badly missed earnings with a delay in production of their next-gen chip. The stock price dropped over 16% on the day after earnings were announced. As you’d expect, options volume was very high during the move, with a surprising amount of action […]

Earn 555% If SPY Sells Off In the Next Month

The S&P 500, and its ETF analogue SPY, is roughly breakeven for the year, which is crazy if you think about it. We had a full market crash in March due to the coronavirus pandemic. For the most part, the concerns that arose in March haven’t come close to being resolved; yet the stock market […]

Trade of the Week: NIO

Electric vehicles have been all the rage lately in the stock and options market. NIO (NIO) has been no exception to this. The company is sometimes called the “Tesla of China” and actually has $1 billion worth of sales already. However, the huge run up in the stock price gave NIO an extremely high valuation, […]

Trading Options On The “Next Tesla”

In a year of unpredictable market action, perhaps the most eye-opening moves are occurring in electric vehicle (EV) stocks. EV companies like TSLA are all the rage right now. Just about any stock that has some relationship to electric vehicles sees a ton of action (in the stock and the options). Just look at what […]

Trade of the Week: TSLA

Another week, another record high for Tesla (TSLA), which continues to be on a tear. Electric vehicle companies have been the most popular picks for investors lately, led by TSLA. The electric vehicle powerhouse has gone from $1,000 per share to over $1,500 in just a few weeks. The euphoria surrounding the industry is partly […]

SLV Price Trending Higher: Here’s How To Earn 8.5% On It

When uncertainty grips the market, investors often turn to precious metals for safety. Well, at least they used to. These days, most of the action in precious metals is in gold. The price of gold has climbed nearly 19% in 2020 to date. Silver has been okay, up 4% so far this year. Platinum, on […]

Trade of the Week: XLF

There was a fair amount of options action ahead of the long holiday weekend. A massive amount of puts traded in the financial sector, more specifically, on the Financial Select Sector SPDR ETF (XLF). Some of the large trades could be setting up a hedge against downside risk through August. One interesting trade in XLF […]

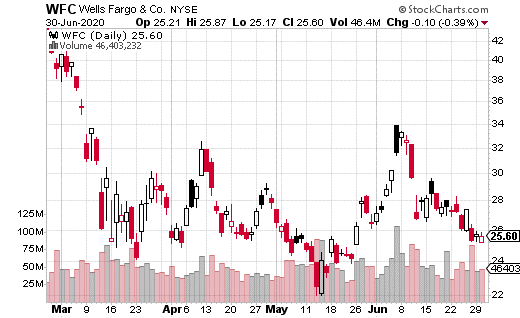

Make 9.7% On America’s Most Notorious Bank

Despite plenty of volatility in the market, it hasn’t been any easier to generate income for your portfolio. Yields are still ultra-low for most fixed income instruments. Moreover, many high-yield dividend stocks have slashed their dividend payments. Regarding dividend stocks, buying and holding them is certainly not an unreasonable way to generate yield. The best […]

Trade of the Week: Facebook

The market is experiencing a resurgence of volatility, adding to the already very active options market. Last week, the bears finally caught up to Facebook (FB). The social media platform’s share price dropped 8% in one day, with options trading over 1 million contracts. The selloff came courtesy of Verizon (VZ), which decided to pull […]