Livent (LTHM) is a pure play and vertically integrated producer of high-quality lithium products, most notably in the energy storage and electric vehicle markets. Along with lithium compounds and metals, LTHM produces lithium-ion batteries, which play a major role in the mobile phone and electric vehicle industries. Given its array of products, LTHM is a […]

Author: Rick Rouse

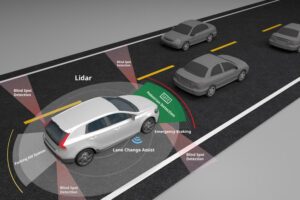

Luminar Technologies Remains Laser Focused Despite Steep Selloff

Luminar Technologies (LAZR) became a publicly traded company in November 2020 through a special purpose acquisition company (SPAC), and rose more than 30% in its debut. Shares eventually surged to a high of $47.80 just 13 trading days after going public, but are now trading in the high teens. Although it might be too early […]

GME, COIN, PG, or V? What’s the Best Pick for Traders Right Now?

While volatile stocks may be more exciting to trade, most investors are looking for consistency in their portfolios. Whether the goal is steady growth or consistent income, boring may be better in the long term. As fun as it may be to trade stocks like GameStop (GME) or the latest buzzworthy IPO like Coinbase (COIN), […]

ChargePoint Holdings (CHPT) Leads the Charging Revolution

ChargePoint Holdings (CHPT) is an established U.S. electric vehicle charging leader with a recognizable brand and strong customer relationships. Founded in 2007, the company started publicly trading on the New York Stock Exchange following the completion of its previously announced business combination with Switchback Energy Acquisition Corporation. Special purpose acquisition companies (SPACs) were big news […]

Tencent Music Entertainment Group (TME) Selloff Creates Buying Opportunity

Shares of Tencent Music Entertainment Group (TME) recently plunged 50% from their all-time high of $32.25, to an intraday low of $16.31 following liquidation by a major hedge fund. Specifically, Archegos Capital Management was forced to unload a number of the positions it held following a margin call. Goldman Sachs, Morgan Stanley, Credit Suisse, and […]

This Schlumberger Trade Could Deliver Triple Digits Following The Recent Pullback

Schlumberger (SLB) is the largest oilfield services industry in the world, with a presence in every energy market through its four main business segments: Reservoir Characterization, Drilling, Production, and Cameron. The company prioritizes providing top-notch services to its customers by being a global driver in technological innovation and is better positioned than most of its […]

NGVT Stock Price Pushing 52-Week Highs

Ingevity (NGVT) has been on the verge of making fresh 52-week highs as shares flirt with key resistance at the $80 level and the stock’s early January peak at $79.68. The company, which produces a variety of carbon materials and specialty chemicals, was spun out of WestRock (WRK) in 2016 at $25 a share. NGVT […]

IGT Stock Price Poised for a Breakout

Gambling stocks struggled in 2020 as companies with large physical casinos experienced dramatic declines in revenue and earnings due to the coronavirus pandemic. However, the sector has shown strength throughout 2021 so far, as a number of positive developments are coming into play. While the advancements in coronavirus vaccine development have been a welcome relief […]

This Stock Is The Latest Short Squeeze From r/WallStreetBets

Shares of Rocket Companies (RKT) recently zoomed to a high of $43 without any apparent new news from the company. However, the stock currently has large short bets placed against it by hedge funds and appears to have garnered some bullish interest from day traders on Reddit’s infamous r/WallStreetBets forum. Roughly 45% of RKT’s available […]

FuelCell Energy Still Looks Overvalued

Hydrogen pure-play stocks outperformed the overall market in 2020 and continue to do well in 2021. Hydrogen-related investments have attracted investor interest, as bullish sentiment believe the element — which emits no greenhouse gas when burned or used in fuel cells — may be a viable option to help the world meet its climate goals. […]