I continue to love the sector Wall Street seems to hate: energy. Analysts are saying oil has peaked and bad times are directly ahead for the sector. I believe that oil markets are more fragile than the recent price decline might signal. The same factors that sent energy prices higher over the past year remain […]

Author: Tony Daltorio

An Oil Stock to Ride Out the Looming Recession

At the moment the oil market at the moment is much like the famous quote from the beginning of “A Tale of Two Cities.” It is a tale of two markets: the futures market for oil (controlled by Wall Street) and the physical market, which reflects the real-world demand for oil. Both factor in many […]

Recession-Proof Stock of the Week: Eli Lilly

Few sectors can withstand the economic headwinds that come during periods of economic upheaval, including recession and inflation. Recession stocks are sought out by retail and institutional investors alike. But one sector that can thrive is food—people will always need to eat. Another area largely insulated from market turmoil is the pharmaceutical sector. Prescription drugs […]

Recession-Proof Pepsi Is a Good Buy for an Inflationary Environment

Faced with the twin problems of inflation and recession, investors are looking for companies that fare well, no matter the economic climate. A typical recession tends to drive investors to certain sectors of the market to move their money so they can hunker down and ride it out. The consumer staples sector has been a […]

More Woes for Elon Musk as This Competitor Is Beating Tesla

Warren Buffett has done it again… Buffett’s Berkshire Hathaway (BRK.A, BRK.B) put $232 million into the Chinese battery and electric vehicle company BYD (BYDDY) in 2008. That stake is now worth a cool $7.7 billion, making it one of Berkshire’s most lucrative investments. Meanwhile, Elon Musk has heaped scorn on electric vehicle company BYD. Back […]

Here’s Where to Find Copper Mining Bargains

For thousands of years, the dual histories of humans and copper mining have intertwined. Copper is one of the few metals occurring in nature in a directly usable metallic form. This led to very early human use, beginning around 8000 BC. Thousands of years later, it was the first metal to be smelted from sulfide […]

Global Oil Shortage Drives The Re-fracking Boom

The ongoing global oil shortage has triggered President Joe Biden’s call to shale producers to spend more of their profits on increasing output. But shale firms have been under pressure from shareholders for many years to focus on returns rather than production growth, this has been one of many contributors to the global oil shortage. […]

An Energy Stock With Growth

There has been only one bright spot in what’s turning out to be an annus horribilis for U.S. stocks – the energy sector. The S&P 500 has fallen into a bear market, down more than 20% this year. The benchmark index is on pace for one its worst opening six months since 1970. Historically, there […]

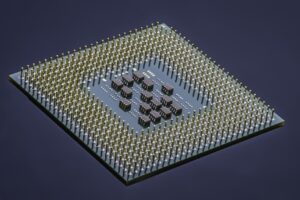

Semiconductor Industry Face Inflation and Shortages

The current state of the global semiconductor industry can be described by the famous opening words of Charles Dickens’s A Tale of Two Cities: “It was the best of times, it was the worst of times…” The global chip supply crunch triggered by the pandemic is likely to be drag on for the next two […]

Why Footwear Adidas Will Outperform Nike

Athletic footwear has come a long way from the humble “tennis shoes” of decades ago. Now, this footwear has become the norm, with the enduring popularity of athleisure. That’s why the Kantar BrandZ Most Valuable Global Brands 2021 ranking showed that apparel brands saw some of their fastest brand value growth in 2021, as shoppers […]