Most of you are surely aware of the headlines blaring that retail gasoline prices in the United States rose again and hit another all-time record, surpassing one set in March. On May 10, the average cost of a retail gallon of gasoline hit $4.374, according to the American Automobile Association, surpassing the former record of […]

Author: Tony Daltorio

Europe’s Almost Unknown Gas Play

Some of the best investments come from digging a little deeper beyond the headlines. For example, we have all heard by now about Europe’s woes regarding natural gas and its dependency on Russian gas supplies. But do you know what company is the second-biggest provider of natural gas to Europe, behind only Russia’s Gazprom? It […]

Floating Your Way to Easy Profits in Europe

On May 4, the European Union proposed a phased-in ban on imports of all Russian oil. The ban will cover all Russian oil, seaborne and pipeline, crude and refined. The goal is to phase out Russian oil supplies in an “orderly fashion” within six months and refined products by the end of the year. The […]

Sony’s Epic Hopes

In early March, I told you how Sony (SONY) has had one ambition for literally decades: to become the world’s most fully integrated entertainment company. Over the years, Sony has put together an outstanding array of assets: world-class music catalogs (Sony Music), Hollywood film and television studios, plus PlayStation, the leading video game hardware. But […]

The Only Tech Sector to Invest in and One Stock to Own in It

The Russian invasion of Ukraine has brought to the fore the importance of many sectors, especially in the commodities space. But it has also reinforced the importance of one tech sector in particular: cybersecurity. In early April, news broke that Russian hackers had launched a cyberattack on the Ukrainian power grid, along with parallel attempts […]

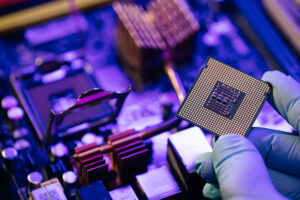

This Semiconductor Stock is a Buy as Equipment Delays Lengthen

Despite the view from Wall Street analysts and their rose-colored glasses, the woes of the semiconductor industry continue. Last month, a warning came from Peter Wennick, CEO of ASML Holding (ASML), a manufacturer of chip-making equipment. In an interview with the Financial Times, Wennick said: “Next year and the year after, there will be shortages. […]

Russia Sanctions Mean Hidden Opportunities for Metals

Russia’s invasion of Ukraine and the resultant sanctions against Russia are creating many profitable opportunities for investors. However, many of these opportunities have been passing by unnoticed because they occur in a sector that Wall Street routinely ignores: commodities. A major piece of news on March 21 has led to one of these under-the-radar opportunities: […]

Russia, Europe, and LNG Investing Opportunities

In recent years, the epicenter of demand for liquefied natural gas (LNG) has been Asia. The world’s three largest buyers of liquified natural gas are located there: China, Japan, and South Korea. China’s imports of LNG alone are expected to increase by 8.0 to 8.5 million tons year-on-year in 2022, accounting for about 45% of […]

One Semiconductor Stock You Need to Own

When choosing a company to invest in, I always like to look for what Warren Buffett called a “moat” protecting it—a competitive advantage that allows the company to maintain pricing power and better than average profit margins. When I’m considering an investment in the technology sector too, particularly in the semiconductor space, I am especially […]

Is Warren Buffett’s Value Investing Still Relevant?

I have no doubt that one of the very best investors over the long-term is Warren Buffett. The real proof to me is how he especially shines in times of crisis, as in the current environment. Over two decades, his Berkshire Hathaway (BRK.A & BRK.B) stock has outperformed the S&P 500, 570% versus 465%. This […]